We were building the PDF editor with the prospect of allowing it to be as easy to use as it can be. Therefore the entire process of typing in the letter of credit forms is going to be simple accomplish the following steps:

Step 1: Click the "Get Form Here" button.

Step 2: Once you have entered the letter of credit forms editing page you can discover the different actions you can use with regards to your file at the top menu.

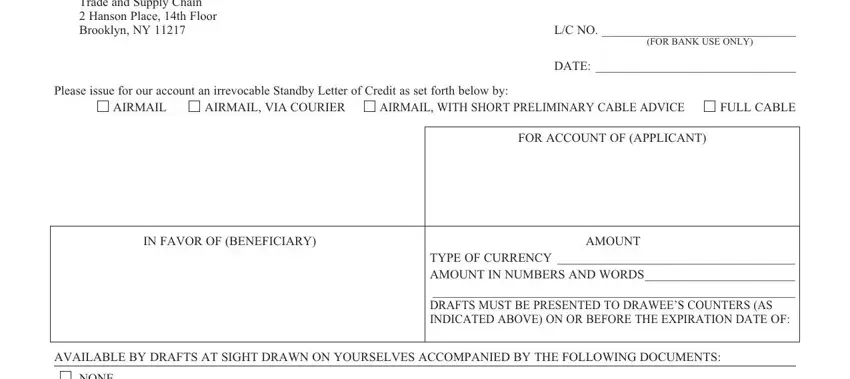

The next areas are what you will have to complete to obtain the ready PDF form.

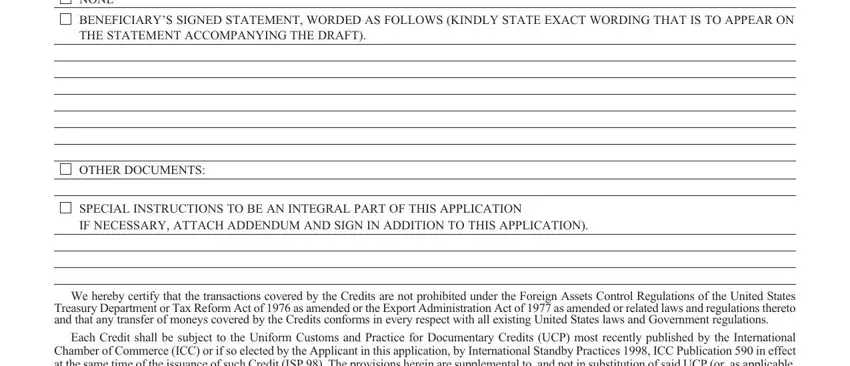

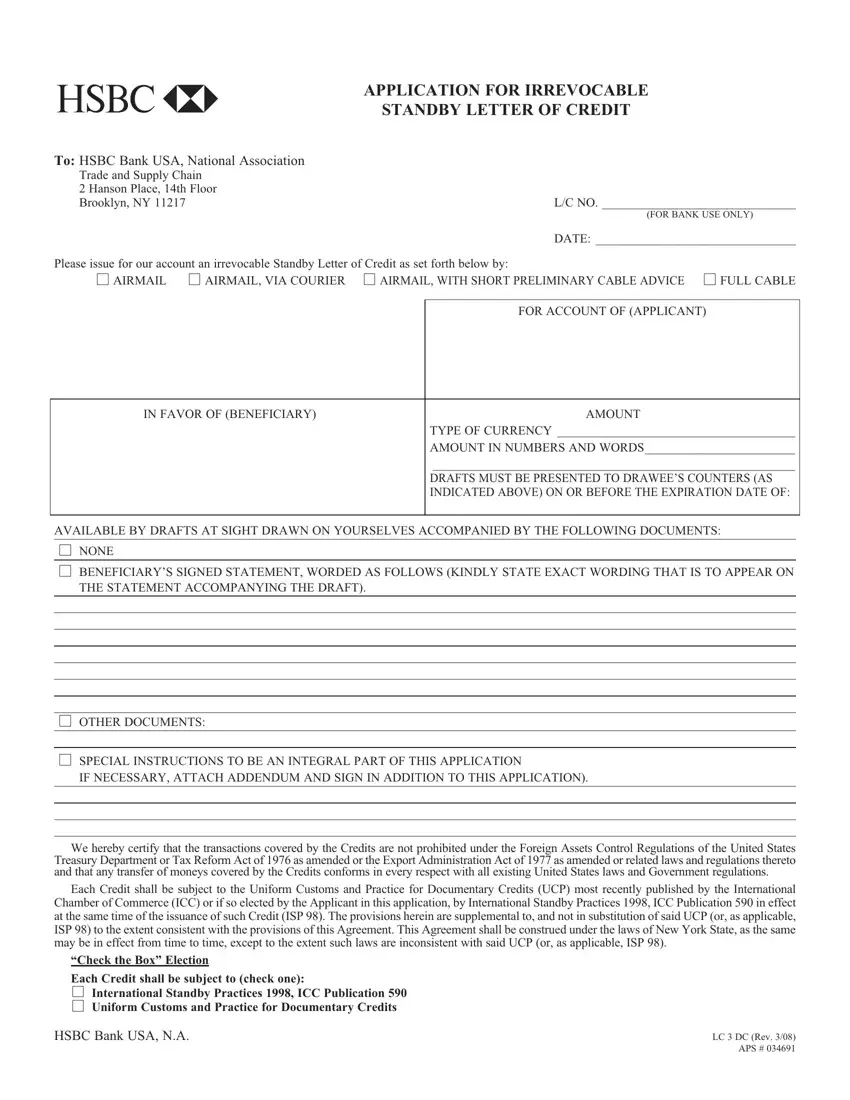

Provide the expected data in the section NONE, BENEFICIARYS SIGNED STATEMENT, OTHER DOCUMENTS, SPECIAL INSTRUCTIONS TO BE AN, We hereby certify that the, and Each Credit shall be subject to.

The system will ask for more information in order to automatically prepare the segment Check the Box Election Each Credit, International Standby Practices, HSBC Bank USA NA, and LC DC Rev APS.

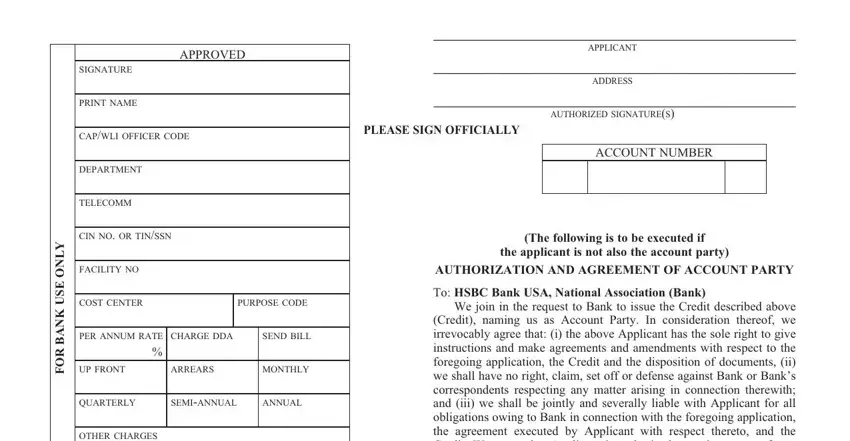

You'll need to identify the rights and obligations of all parties in paragraph APPROVED, SIGNATURE, PRINT NAME, CAPWLI OFFICER CODE, DEPARTMENT, TELECOMM, CIN NO OR TINSSN, FACILITY NO, COST CENTER, PURPOSE CODE, PER ANNUM RATE CHARGE DDA, SEND BILL, UP FRONT, ARREARS, and MONTHLY.

End by reviewing all these sections and preparing them correspondingly: OTHER CHARGES Issuance Fee, PARTICIPATION, Yes No, SIC CODE, PAYMENT COMMISSION, If Yes Attach Separate Memo, We join in the request to Bank to, Name, ACCOUNT PARTY AS INDICATED ON, Address, and PLEASE READ AGREEMENT CAREFULLY.

Step 3: Once you have clicked the Done button, your file is going to be readily available upload to any kind of electronic device or email you identify.

Step 4: In order to prevent any specific difficulties as time goes on, you should create up to several copies of the form.

NONE

NONE

BENEFICIARY’S SIGNED STATEMENT, WORDED AS FOLLOWS (KINDLY STATE EXACT WORDING THAT IS TO APPEAR ON THE STATEMENT ACCOMPANYING THE DRAFT).

BENEFICIARY’S SIGNED STATEMENT, WORDED AS FOLLOWS (KINDLY STATE EXACT WORDING THAT IS TO APPEAR ON THE STATEMENT ACCOMPANYING THE DRAFT).

OTHER DOCUMENTS:

OTHER DOCUMENTS:

SPECIAL INSTRUCTIONS TO BE AN INTEGRAL PART OF THIS APPLICATION

SPECIAL INSTRUCTIONS TO BE AN INTEGRAL PART OF THIS APPLICATION

International Standby Practices 1998, ICC Publication 590

International Standby Practices 1998, ICC Publication 590

Uniform Customs and Practice for Documentary Credits

Uniform Customs and Practice for Documentary Credits