BOE-277 (P1) REV. 05 (02-11)

CLAIM FOR ORGANIZATIONAL CLEARANCE CERTIFICATE - |

STATE OF CALIFORNIA |

WELFARE EXEMPTION |

BOARD OF EQUALIZATION |

|

www.boe.ca.gov |

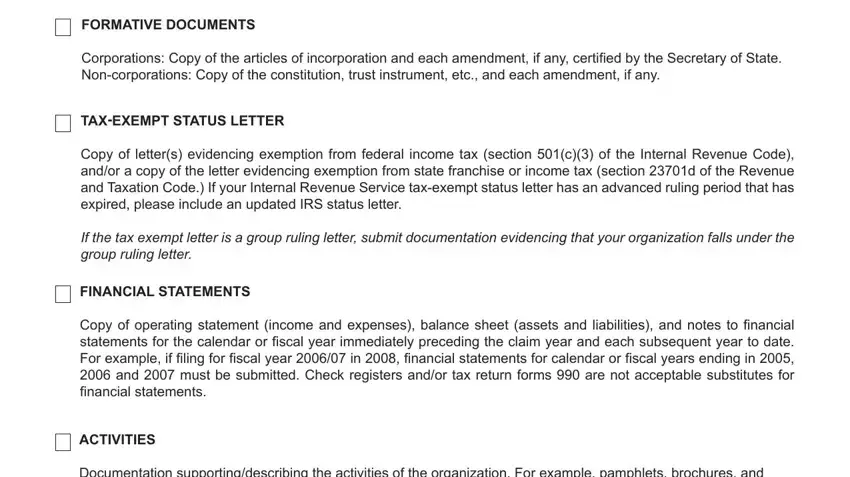

CHECKLIST FOR CLAIM

PTHE FOLLOWING DOCUMENTS MUST BE SUBMITTED WITH THE CLAIM FORM.

IF ALL DOCUMENTS ARE NOT SUBMITTED, YOUR CLAIM WILL BE RETURNED.

FORMATIVE DOCUMENTS

Corporations: Copy of the articles of incorporation and each amendment, if any, certiied by the Secretary of State.

Non-corporations: Copy of the constitution, trust instrument, etc., and each amendment, if any.

TAX-EXEMPT STATUS LETTER

Copy of letter(s) evidencing exemption from federal income tax (section 501(c)(3) of the Internal Revenue Code),

and/or a copy of the letter evidencing exemption from state franchise or income tax (section 23701d of the Revenue and Taxation Code.) If your Internal Revenue Service tax-exempt status letter has an advanced ruling period that has expired, please include an updated IRS status letter.

If the tax exempt letter is a group ruling letter, submit documentation evidencing that your organization falls under the group ruling letter.

FINANCIAL STATEMENTS

Copy of operating statement (income and expenses), balance sheet (assets and liabilities), and notes to inancial statements for the calendar or iscal year immediately preceding the claim year and each subsequent year to date. For example, if iling for iscal year 2006/07 in 2008, inancial statements for calendar or iscal years ending in 2005, 2006 and 2007 must be submitted. Check registers and/or tax return forms 990 are not acceptable substitutes for inancial statements.

ACTIVITIES

Documentation supporting/describing the activities of the organization. For example, pamphlets, brochures, and web pages are acceptable forms of documentation.

FOR ADDITIONAL INFORMATION

Additional information on OCC iling requirements is available at: http://www.boe.ca.gov/proptaxes/welfareorgreq.htm.

If the organization is a Veterans’ Organization, submit claim form BOE-279, Claim for Organizational Clearance Certiicate

– Veterans’ Organization Exemption.

If the organization is a Limited Liability Company, submit claim form BOE-277-LLC, Claim for Organizational Clearance

Certiicate – Welfare Exemption, Limited Liability Company.

BOE-277 (P2) REV. 05 (02-11)

INSTRUCTIONS FOR FILING A CLAIM |

STATE OF CALIFORNIA |

FOR AN ORGANIZATIONAL CLEARANCE CERTIFICATE - |

BOARD OF EQUALIZATION |

WELFARE EXEMPTION |

www.boe.ca.gov |

(Refer to section 254.6 of the Revenue and Taxation Code) |

|

ORGANIZATIONAL CLEARANCE CERTIFICATE

An organization that intends to claim the welfare exemption, shall ile with the State Board of Equalization (Board), County-Assessed Properties Division’s Exemption Section, at the address listed on page 3 of this claim package, a claim for an Organizational Clearance Certiicate. The Board shall review each claim to determine whether the organization meets the requirements of section 214 and shall issue a certiicate to a claimant that meets these requirements. The Assessor may not approve a property tax exemption claim until the claimant has been issued a valid Organizational Clearance Certiicate. If a welfare exemption claim is iled timely with the Assessor, the claim will be considered timely iled even if the claimant has not yet received the Organizational Clearance Certiicate from the Board.

Information on the welfare exemption is on the Board’s website (www.boe.ca.gov) and may be accessed by selecting 1) Property Tax, and 2) Welfare and Veterans’ Organization Exemptions. If you have any questions, you may contact the Board’s Exemption Section at 916-274-3430.

FILING OF CLAIM

FISCAL YEAR OF CLAIM

The initial iscal year for which the Organizational Clearance Certiicate is sought must be entered correctly. The proper iscal year follows the lien date (12:01 a.m., January 1) as of which the taxable or exempt status of the property is determined. For example, a person iling a claim for an Organizational Clearance Certiicate in February 2008 would enter “2008-2009” on the claim; a “2007-2008” entry on a claim iled in February 2008 would signify that a claim was being iled for the preceding iscal year. If the initial iscal year for which the Organizational Clearance Certiicate is sought is for a previous year, only one claim form is required. It is not necessary to ile a separate claim for each iscal year.

1. Formative Documents

An organization must attach a copy of the Articles of Incorporation and any amendments thereto certiied by the Secretary of State, or comparable instrument for unincorporated organizations.

2. Tax-Exempt Status Letter

An organization must attach a copy of the letter evidencing the exemption from federal income tax (section 501(c)(3) of the Internal Revenue Code) or a copy of the letter evidencing exemption from state franchise or income tax (section 23701d of the Revenue and

Taxation Code.) If the IRS tax exemption status letter has an advanced ruling period that ended prior to iling of this claim, please also include a copy of a current IRS tax-exempt status letter. If the letter provided has subsequently been revoked, attach a copy of the letter

stating that fact.

3. Financial Statements

An organization must attach a copy of certiied inancial statements. In submitting the inancial statements (balance sheet and operating statement and notes) of the organization, the complete inancial transactions of the organization should be included. If the nature of any item of income or disbursement is not clear from the account name, further explanation indicating the nature of the account should be appended. Please submit inancial statements for each year beginning with the year immediately preceding the irst iscal year that

exemption is claimed.

Other

4.If the answer is yes, please note that Revenue and Taxation Code section 214, welfare exemption statute, provides, in part, that “The owner is not organized or operated for proit.” (See section 214(a)(1))

5.If the answer is yes, please note that Revenue and Taxation Code section 214, welfare exemption statute, provides, in part, that “No part of the net earnings of the owner inures to the beneit of any private shareholder or individual.” (See section 214(a)(2))

6.If the answer is yes, give title of position (do not list names of position holders) and weekly or annual salary, commissions, or percentage payments.

7.If the answer is yes, list the type of obligations (such as bonds, notes, etc.), the amounts of the obligations, the payment terms, and names of creditors. Use a separate schedule if necessary.

8.and 9. Activities

An organization must attach documentation supporting/describing the activities of the organization. Please identify the purpose of your organization. In addition, please check the box that best describes the activities of your organization and state fully all activities in which the organization is engaged. If necessary, you may provide this information on a supplemental attachment.

If the corporation is a managing general partner of a Limited Partnership, please submit form BOE-277-L1, Claim for Supplemental Clearance Certiicate for Limited Partnership, Low-Income Housing Property – Welfare Exemption, for each limited partnership.

BOE-277 (P3) REV. 05 (02-11)

CLAIM FOR ORGANIZATIONAL CLEARANCE CERTIFICATE - WELFARE EXEMPTION

This form must be completed and iled with the Board of Equalization, County- Assessed Properties Division, PO Box 942879, Sacramento, CA 94279-0064

STATE OF CALIFORNIA BOARD OF EQUALIZATION

www.boe.ca.gov

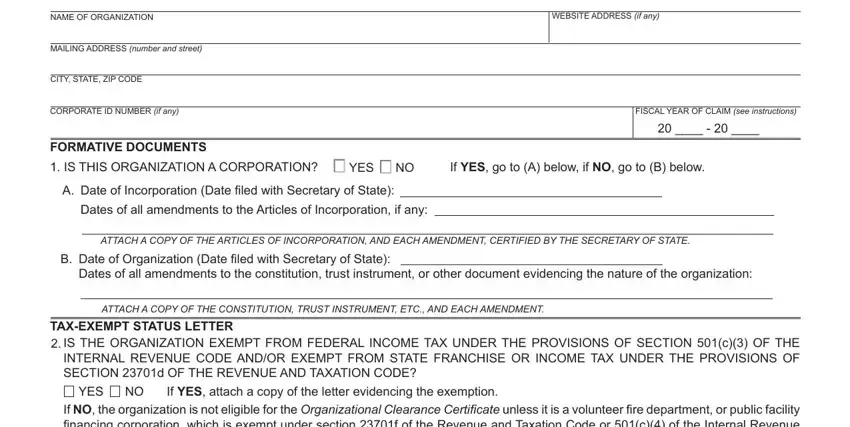

NAME OF ORGANIZATION

MAILING ADDRESS (number and street)

CITY, STATE, ZIP CODE

CORPORATE ID NUMBER (if any)

FORMATIVE DOCUMENTS

WEBSITE ADDRESS (if any)

FISCAL YEAR OF CLAIM (see instructions)

20 ____ - 20 ____

1. IS THIS ORGANIZATION A CORPORATION? |

YES NO |

A. Date of Incorporation (Date iled with Secretary of State):

If YES, go to (A) below, if NO, go to (B) below.

Dates of all amendments to the Articles of Incorporation, if any:

ATTACH A COPY OF THE ARTICLES OF INCORPORATION, AND EACH AMENDMENT, CERTIFIED BY THE SECRETARY OF STATE.

B.Date of Organization (Date iled with Secretary of State):

Dates of all amendments to the constitution, trust instrument, or other document evidencing the nature of the organization:

ATTACH A COPY OF THE CONSTITUTION, TRUST INSTRUMENT, ETC., AND EACH AMENDMENT.

TAX-EXEMPT STATUS LETTER

2.IS THE ORGANIZATION EXEMPT FROM FEDERAL INCOME TAX UNDER THE PROVISIONS OF SECTION 501(c)(3) OF THE INTERNAL REVENUE CODE AND/OR EXEMPT FROM STATE FRANCHISE OR INCOME TAX UNDER THE PROVISIONS OF SECTION 23701d OF THE REVENUE AND TAXATION CODE?

YES NO If YES, attach a copy of the letter evidencing the exemption.

If NO, the organization is not eligible for the Organizational Clearance Certiicate unless it is a volunteer ire department, or public facility inancing corporation, which is exempt under section 23701f of the Revenue and Taxation Code or 501(c)(4) of the Internal Revenue

Code.

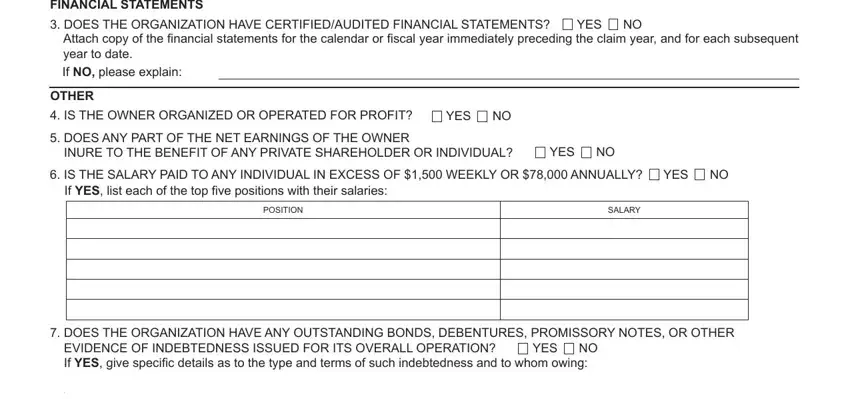

FINANCIAL STATEMENTS |

|

3. DOES THE ORGANIZATION HAVE CERTIFIED/AUDITED FINANCIAL STATEMENTS? |

YES NO |

Attach copy of the inancial statements for the calendar or iscal year immediately preceding the claim year, and for each subsequent year to date.

If NO, please explain:

OTHER |

|

|

4. IS THE OWNER ORGANIZED OR OPERATED FOR PROFIT? |

YES NO |

|

5. DOES ANY PART OF THE NET EARNINGS OF THE OWNER |

|

YES NO |

INURE TO THE BENEFIT OF ANY PRIVATE SHAREHOLDER OR INDIVIDUAL? |

6.IS THE SALARY PAID TO ANY INDIVIDUAL IN EXCESS OF $1,500 WEEKLY OR $78,000 ANNUALLY? YES NO If YES, list each of the top ive positions with their salaries:

7. DOES THE ORGANIZATION HAVE ANY OUTSTANDING BONDS, DEBENTURES, PROMISSORY NOTES, OR OTHER

EVIDENCE OF INDEBTEDNESS ISSUED FOR ITS OVERALL OPERATION? YES NO If YES, give speciic details as to the type and terms of such indebtedness and to whom owing:

BOE-277 (P4) REV. 05 (02-11)

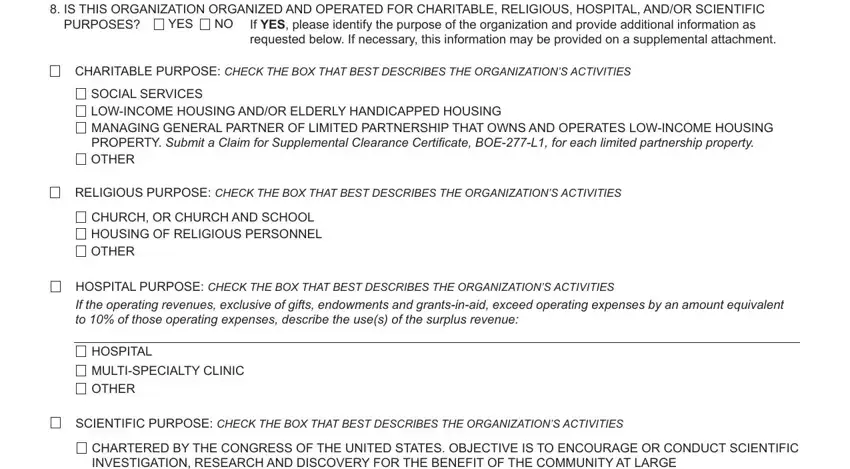

ACTIVITIES

8. IS THIS ORGANIZATION ORGANIZED AND OPERATED FOR CHARITABLE, RELIGIOUS, HOSPITAL, AND/OR SCIENTIFIC

PURPOSES? YES NO If YES, please identify the purpose of the organization and provide additional information as requested below. If necessary, this information may be provided on a supplemental attachment.

CHARITABLE PURPOSE: CHECK THE BOX THAT BEST DESCRIBES THE ORGANIZATION’S ACTIVITIES

SOCIAL SERVICES

LOW-INCOME HOUSING AND/OR ELDERLY HANDICAPPED HOUSING

MANAGING GENERAL PARTNER OF LIMITED PARTNERSHIP THAT OWNS AND OPERATES LOW-INCOME HOUSING

PROPERTY. Submit a Claim for Supplemental Clearance Certiicate, BOE-277-L1, for each limited partnership property.

OTHER

RELIGIOUS PURPOSE: CHECK THE BOX THAT BEST DESCRIBES THE ORGANIZATION’S ACTIVITIES

CHURCH, OR CHURCH AND SCHOOL

HOUSING OF RELIGIOUS PERSONNEL

OTHER

HOSPITAL PURPOSE: CHECK THE BOX THAT BEST DESCRIBES THE ORGANIZATION’S ACTIVITIES

If the operating revenues, exclusive of gifts, endowments and grants-in-aid, exceed operating expenses by an amount equivalent to 10% of those operating expenses, describe the use(s) of the surplus revenue:

HOSPITAL

MULTI-SPECIALTY CLINIC

OTHER

SCIENTIFIC PURPOSE: CHECK THE BOX THAT BEST DESCRIBES THE ORGANIZATION’S ACTIVITIES

CHARTERED BY THE CONGRESS OF THE UNITED STATES. OBJECTIVE IS TO ENCOURAGE OR CONDUCT SCIENTIFIC INVESTIGATION, RESEARCH AND DISCOVERY FOR THE BENEFIT OF THE COMMUNITY AT LARGE

MEDICAL RESEARCH OTHER

9.STATE FULLY ALL ACTIVITIES IN WHICH THE ORGANIZATION IS ENGAGED. INCLUDE ALL ACTIVITIES SINCE JANUARY 1 OF PRIOR YEAR, AND PROVIDE DOCUMENTATION DESCRIBING THE ACTIVITIES.

Whom should we contact for additional information?

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any accompanying statements or documents, is true, correct and complete to the best of my knowledge and belief.

NAME OF CLAIMANT

SIGNATURE OF CLAIMANT

t

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION.