Managing forms together with our PDF editor is easier compared to anything else. To update california offer and compromise form 4905be franchise tax board the form, there isn't anything you should do - basically keep to the steps listed below:

Step 1: Hit the orange "Get Form Now" button on the web page.

Step 2: You will discover each of the options that it's possible to take on your document once you've got entered the california offer and compromise form 4905be franchise tax board editing page.

For each segment, prepare the data asked by the platform.

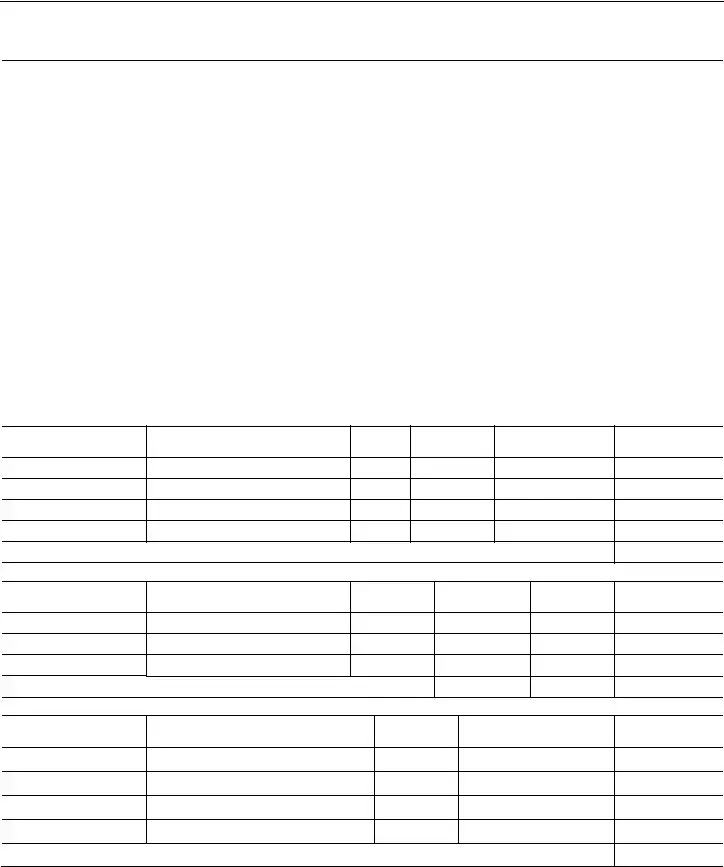

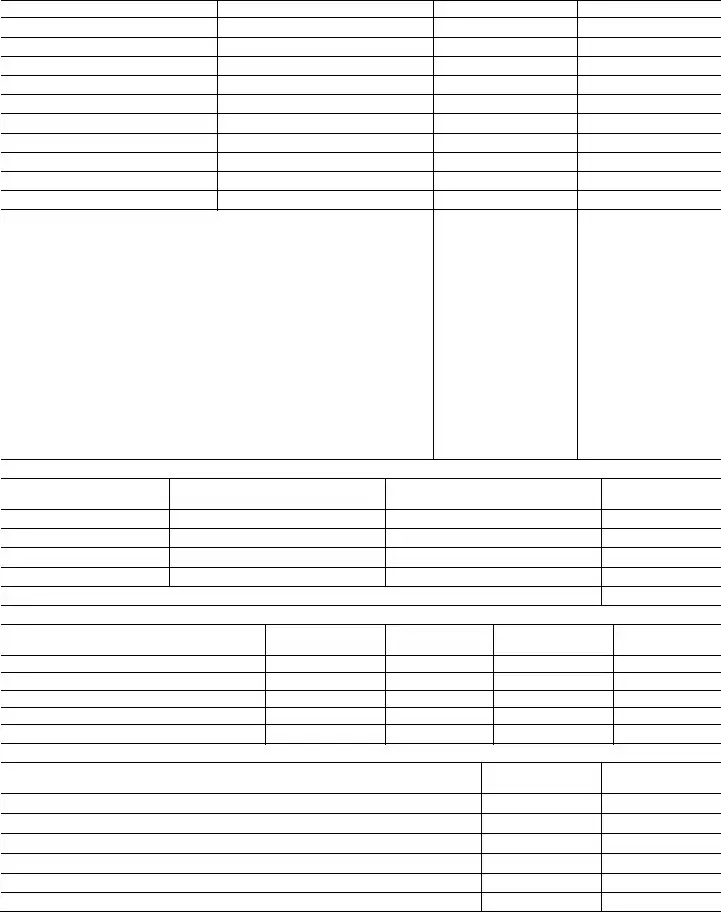

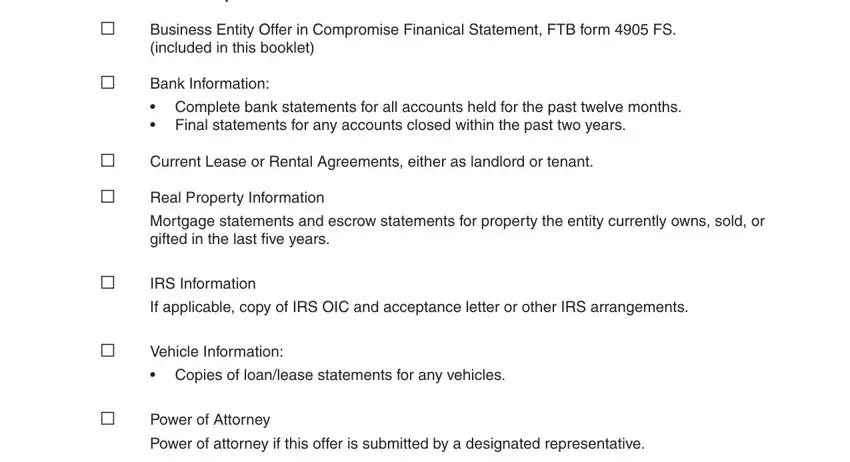

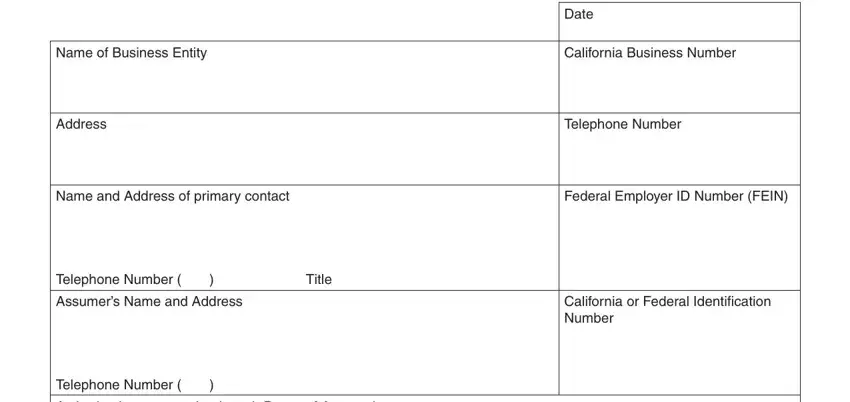

Put down the data in the Name of Business Entity, California Business Number, Date, Address, Telephone Number, Name and Address of primary contact, Federal Employer ID Number FEIN, Telephone Number, Title, Assumers Name and Address, California or Federal, Telephone Number, and Authorized representative attach area.

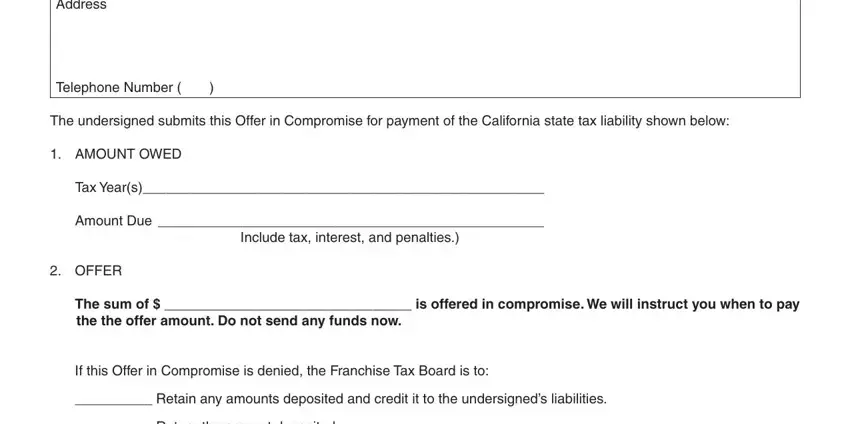

The software will request details to conveniently fill in the box Authorized representative attach, Telephone Number, The undersigned submits this Offer, AMOUNT OWED, Tax Years, Amount Due, Include tax interest and penalties, OFFER, The sum of is offered in, If this Offer in Compromise is, Retain any amounts deposited and, and Return the amount deposited.

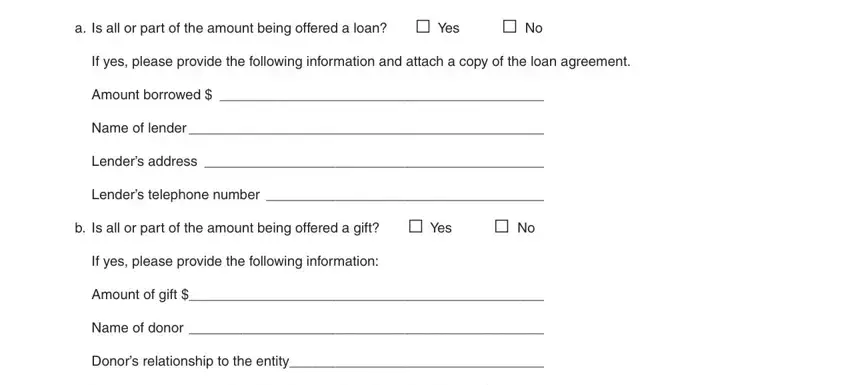

The SOURCE OF FUNDS, a Is all or part of the amount, If yes please provide the, Amount borrowed, Name of lender, Lenders address, Lenders telephone number, b Is all or part of the amount, If yes please provide the, Amount of gift, Name of donor, and Donors relationship to the entity area will be your place to put the rights and obligations of both sides.

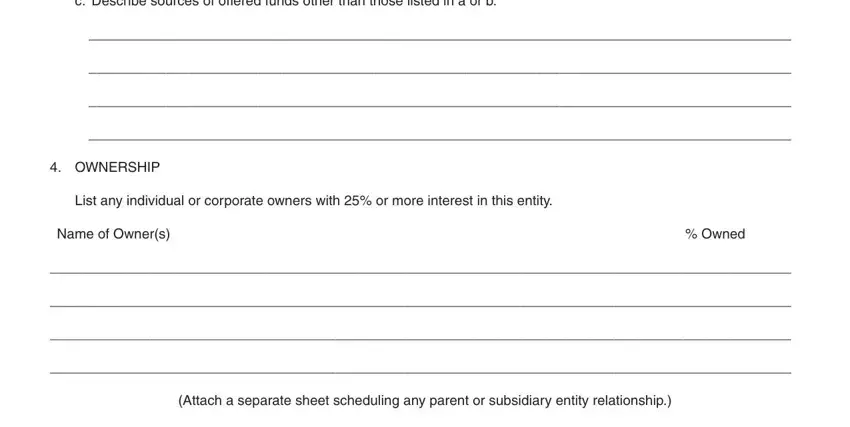

End by analyzing all of these sections and filling out the required data: c Describe sources of offered, OWNERSHIP, List any individual or corporate, Name of Owners, Owned, and Attach a separate sheet scheduling.

Step 3: Click the "Done" button. Now it's possible to export the PDF document to your gadget. As well as that, you can easily send it by means of electronic mail.

Step 4: In order to avoid any kind of headaches down the road, you will need to create minimally a few copies of your form.