By using the online PDF editor by FormsPal, you may fill out or change 500 Es Form right here and now. FormsPal team is continuously working to develop the tool and make it much faster for people with its many functions. Bring your experience one step further with continually improving and exciting options we provide! In case you are seeking to get started, this is what it will take:

Step 1: Access the PDF doc inside our editor by clicking the "Get Form Button" in the top area of this page.

Step 2: Using our state-of-the-art PDF file editor, you can actually accomplish more than just complete blank form fields. Try all of the functions and make your documents seem faultless with customized text added in, or optimize the file's original input to perfection - all supported by the capability to incorporate stunning images and sign the PDF off.

As a way to fill out this form, make sure you type in the necessary details in each and every field:

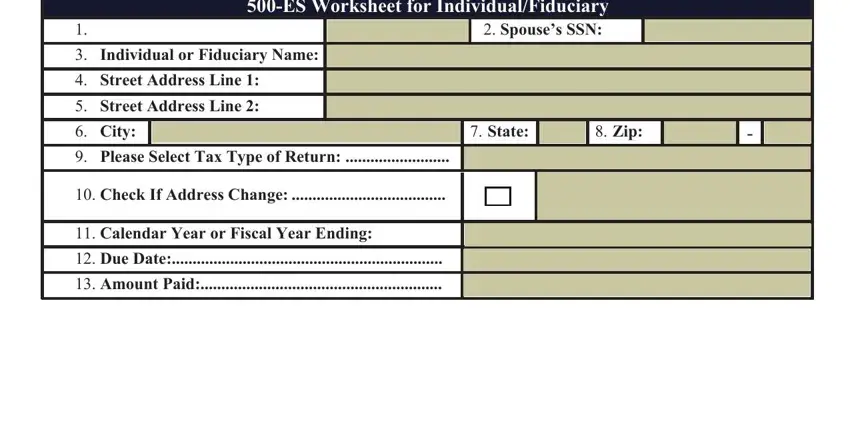

1. You will need to fill out the 500 Es Form correctly, therefore be careful while filling out the sections containing these blanks:

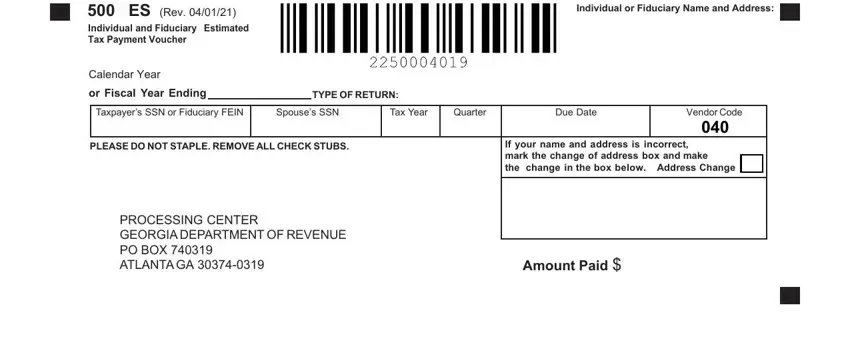

2. Now that the previous section is finished, you need to put in the needed specifics in ES Rev Individual and, Individual or Fiduciary Name and, Calendar Year, o r Fi scal Y ear Ending, TYPE OF RETURN, Taxpayers SSN or Fiduciary FEIN, Spouses SSN, Tax Year, Quarter, Due Date, Vendor Code, PLEASE DO NOT STAPLE REMOVE ALL, If your name and address is, PROCESSING CENTER GEORGIA, and Amount Paid so that you can move on to the 3rd stage.

Be extremely careful when filling out Quarter and If your name and address is, as this is where most people make a few mistakes.

Step 3: Prior to submitting this form, you should make sure that all blank fields have been filled in correctly. When you believe it's all good, click “Done." After setting up afree trial account here, you'll be able to download 500 Es Form or send it through email directly. The file will also be available from your personal account menu with your modifications. When you use FormsPal, you can easily fill out forms without stressing about information breaches or records being distributed. Our protected system makes sure that your personal information is stored safely.