entity claiming this exemption must provide a statement to the PTE stating that it has diplomatic immunity from federal

income tax.

•Real estate investment trusts (REITs) except Captive REITs.

•Corporations that are exempt from Virginia income tax include:

•Certain banks, insurance companies, and public utilities that are subject to other taxes in lieu of Virginia income tax.

•Corporations that are exempt from federal income tax under IRC § 501.

If a nonresident owner claims to be exempt from the withholding tax, the

PTE is required to obtain documentation from the nonresident owner

setting forth the basis for the exemption. This documentation must be retained by the PTE with its records.

The determination of nonresident status will be based on the owner’s address of record for the PTE unless the PTE has other information

relating to the owner’s residence or commercial domicile by reason of the owner’s participation in management of the PTE. If an owner is also employed by the PTE, the information relating to withholding on wages

will also be considered.

The PTE must provide with its return of withholding tax a list of every

individual, corporation, and other entity claiming exemption from

the withholding tax. The list must contain the name, Social Security number, federal employer identification number (FEIN), or other taxpayer identification number and the address of each nonresident

owner claiming exemption, as well as a description of the basis for the claimed exemption.

Penalties

Extension Penalty – The PTE must pay at least 90% of the withholding tax due by the return due date to avoid a penalty. If the return is filed within the 6-month extension and less than 90% of the tax was paid by the original return due date, then the PTE owes an extension penalty. The penalty is 2% per month of the tax due with the return from the due date through the date that the return is filed, up to a maximum of 12%.

Late Filing Penalty – If the return is filed after the extended due date, the extension is not valid, and the entity is subject to the late filing penalty of 30% or $1,200, whichever is greater.

Late Payment Penalty – If the return is filed within the extended period

and full payment is not included with the return, the entity is subject to the late payment penalty of 6% per month from the date the return is filed through the date of payment, up to a maximum of 30%.

Interest – Interest is due on any unpaid tax at the underpayment rate under IRC § 6621, plus 2%, from the due date until paid.

Change of Address/Out-of-Business

If the PTE changes its business mailing address or discontinues the business, either send a completed Form R-3, Registration Change Request or a letter to the Virginia Department of Taxation,

P.O. Box 1114, Richmond, Virginia 23218-1114. A Form R-3 can be

obtained from the Department’s website, www.tax.virginia.gov, or by calling the Department at (804) 367-8037.

Questions

If you have any questions about this return, call (804) 367-8037 or write to the Virginia Department of Taxation, P.O. Box 1115, Richmond,

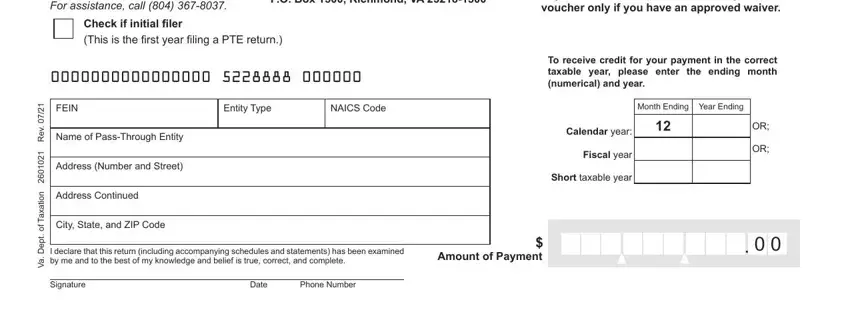

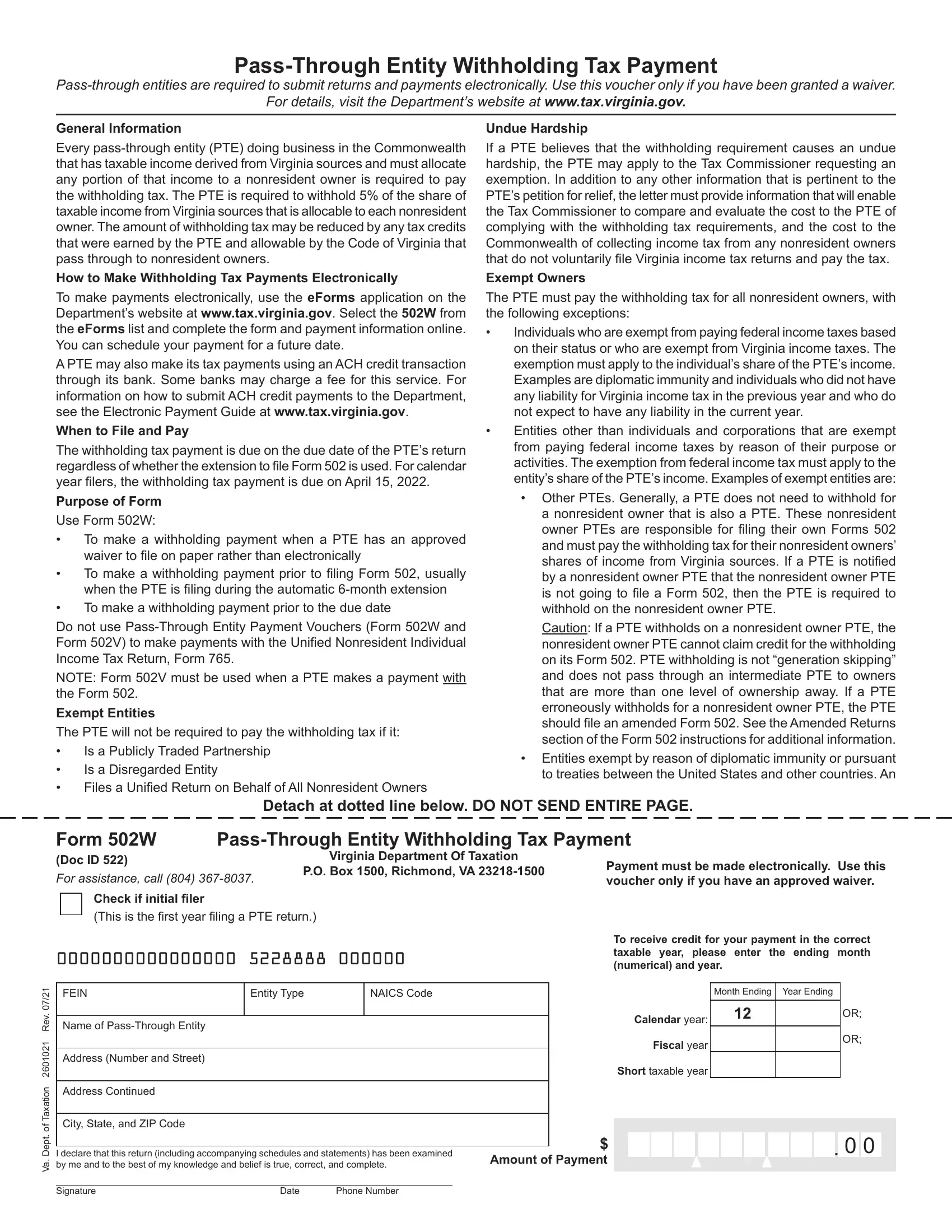

Virginia 23218-1115. Preparation of Payment Voucher

Complete the PTE’s FEIN, entity type, North American Industry Classification System (NAICS) code, ending month and year, and name

and address information.

Entity type: A proper entry in this field is required. Enter the code that corresponds to the type of entity that is filing this return.

Type |

Code |

S Corporation |

SC |

General Partnership |

PG |

Limited Partnership |

PL |

Limited Liability Company |

LL |

Limited Liability Partnership |

LP |

Nonprofit Organization |

NZ |

Other |

OB |

NAICS code: Enter the 6-digit NAICS code. You can access a list of

these codes by visiting the Businesses section on the Department’s website, www.tax.virginia.gov.

Determine the amount of withholding due by either:

(1)Computing the taxable income of the PTE and applying the pro rata

share of the nonresident owners. Multiply the nonresident income by 5% to calculate the tax liability. Then reduce the tax liability by the owner’s share of any tax credits.

(2)Computing the taxable income of the individual nonresident owners. Calculate the tax liability of each owner by multiplying taxable income by 5%. Reduce the tax liability by the owner’s share of tax credits.

Enter the total amount withheld for all nonresident owners in the block

indicating the amount of payment.

Declaration and Signature

Be sure to sign, date, and enter your phone number in the space

indicated.