You may complete ttb f 5120 17 form effortlessly in our online PDF editor. To keep our editor on the leading edge of convenience, we aim to integrate user-driven features and enhancements on a regular basis. We're routinely grateful for any feedback - join us in revolutionizing how we work with PDF forms. Getting underway is simple! All you should do is take the next basic steps below:

Step 1: First of all, open the pdf editor by clicking the "Get Form Button" in the top section of this site.

Step 2: When you open the PDF editor, you will see the document prepared to be filled in. Besides filling in various fields, you can also perform many other actions with the Document, that is adding your own text, modifying the initial text, adding illustrations or photos, signing the PDF, and a lot more.

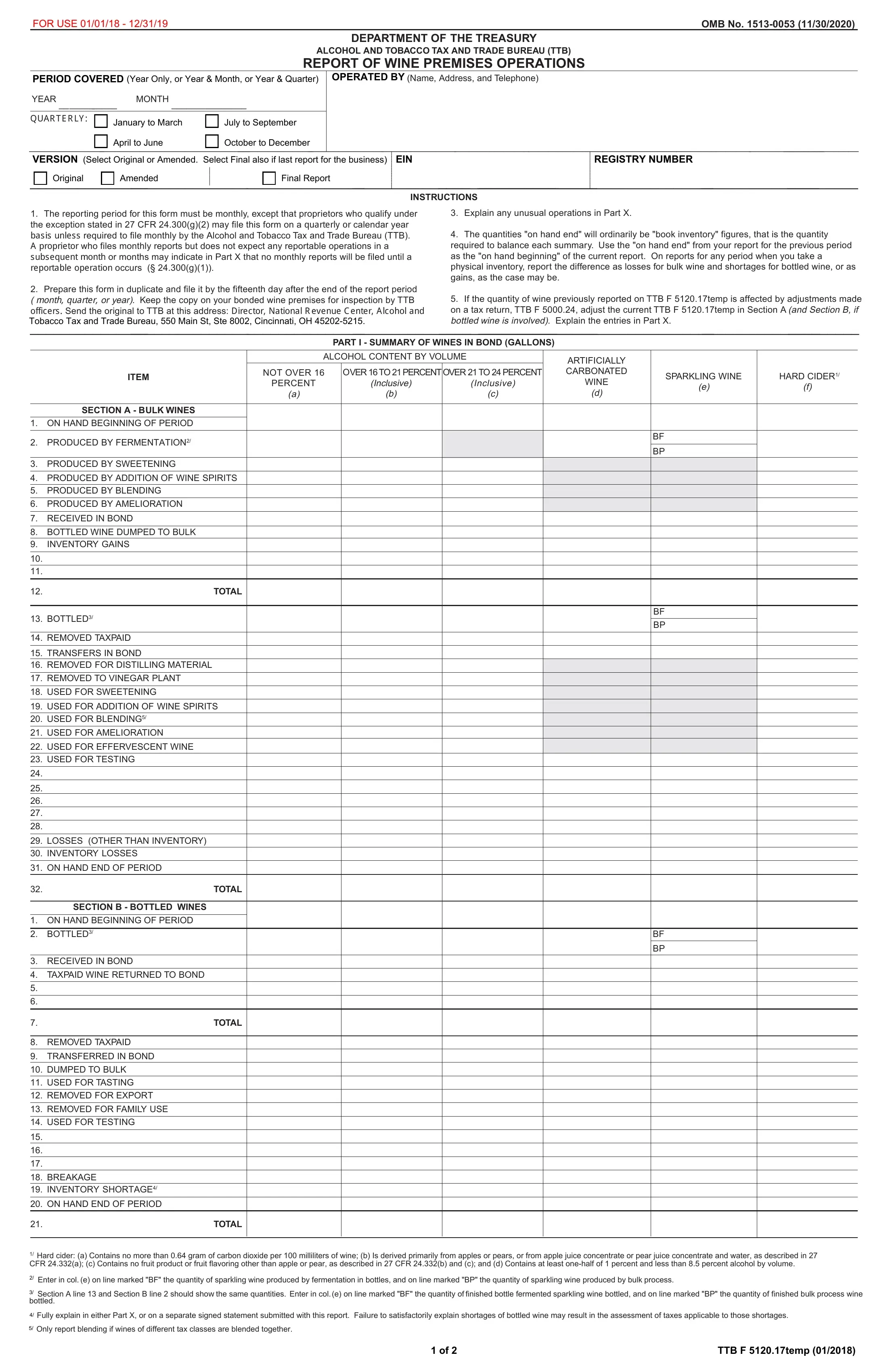

This PDF will require specific info to be entered, thus ensure that you take the time to provide precisely what is asked:

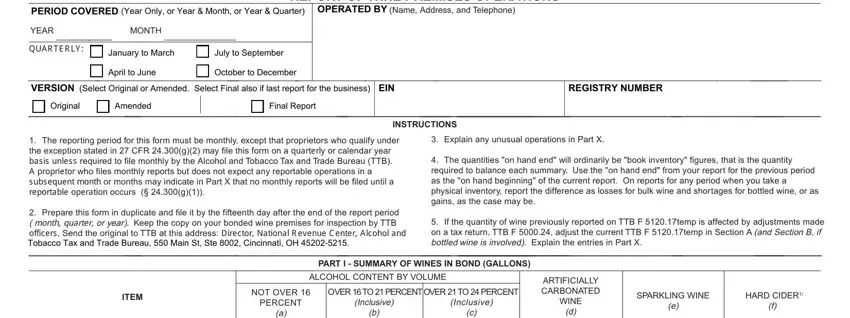

1. You need to fill out the ttb f 5120 17 form properly, so be attentive when filling in the sections containing all these fields:

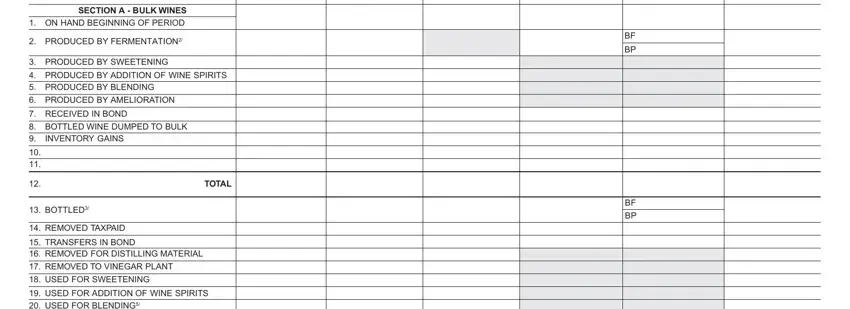

2. Soon after this part is filled out, proceed to enter the relevant information in these: SECTION A BULK WINES ON HAND, PRODUCED BY FERMENTATION, PRODUCED BY SWEETENING PRODUCED, INVENTORY GAINS, BOTTLED, TOTAL, REMOVED TAXPAID TRANSFERS IN, BF BP, and BF BP.

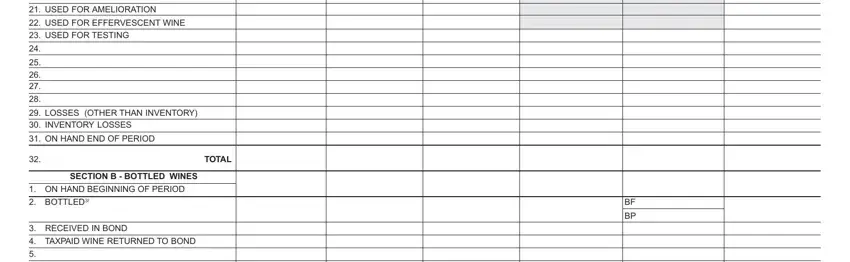

3. The following portion will be focused on REMOVED TAXPAID TRANSFERS IN, TOTAL, SECTION B BOTTLED WINES, ON HAND BEGINNING OF PERIOD , RECEIVED IN BOND TAXPAID WINE, and BF BP - fill out all these blanks.

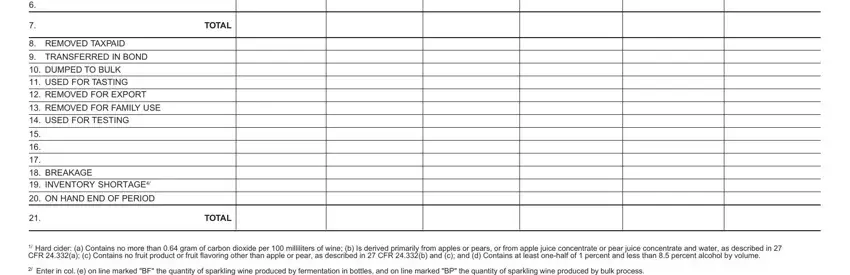

4. It's time to complete the next section! Here you have these RECEIVED IN BOND TAXPAID WINE, TOTAL, REMOVED TAXPAID TRANSFERRED IN, TOTAL, and Hard cider a Contains no more fields to do.

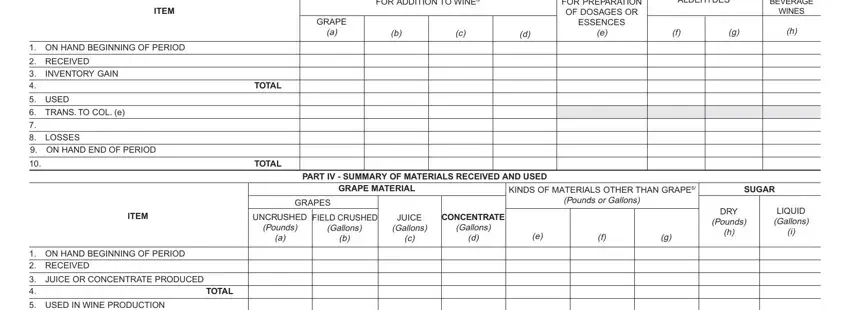

5. Now, the following last segment is what you have to complete prior to finalizing the PDF. The blanks at this stage include the next: FOR PREPARATION OF DOSAGES OR, ESSENCES, ALDEHYDES, SPIRITS FOR USE IN NON BEVERAGE, WINES, FOR ADDITION TO WINE, GRAPE, TOTAL, TOTAL, PART IV SUMMARY OF MATERIALS, GRAPE MATERIAL, GRAPES, UNCRUSHED, Pounds, and FIELD CRUSHED.

It's very easy to get it wrong when filling in your FIELD CRUSHED, hence make sure you go through it again before you'll finalize the form.

Step 3: Prior to moving on, make sure that blank fields were filled out the correct way. The moment you verify that it is fine, click on “Done." Try a 7-day free trial subscription at FormsPal and get instant access to ttb f 5120 17 form - downloadable, emailable, and editable inside your FormsPal cabinet. When using FormsPal, you'll be able to complete documents without the need to worry about information incidents or data entries getting distributed. Our secure platform helps to ensure that your personal information is maintained safely.