Through the online tool for PDF editing by FormsPal, it is possible to fill in or alter 526 ird form here. To have our tool on the cutting edge of practicality, we aim to put into operation user-driven features and improvements on a regular basis. We're at all times looking for suggestions - play a pivotal part in remolding the way you work with PDF files. Here's what you would need to do to start:

Step 1: Access the PDF doc in our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: As soon as you open the editor, you will get the document ready to be filled in. Apart from filling in different blank fields, you can also do various other actions with the form, specifically adding custom words, changing the original text, adding illustrations or photos, signing the PDF, and much more.

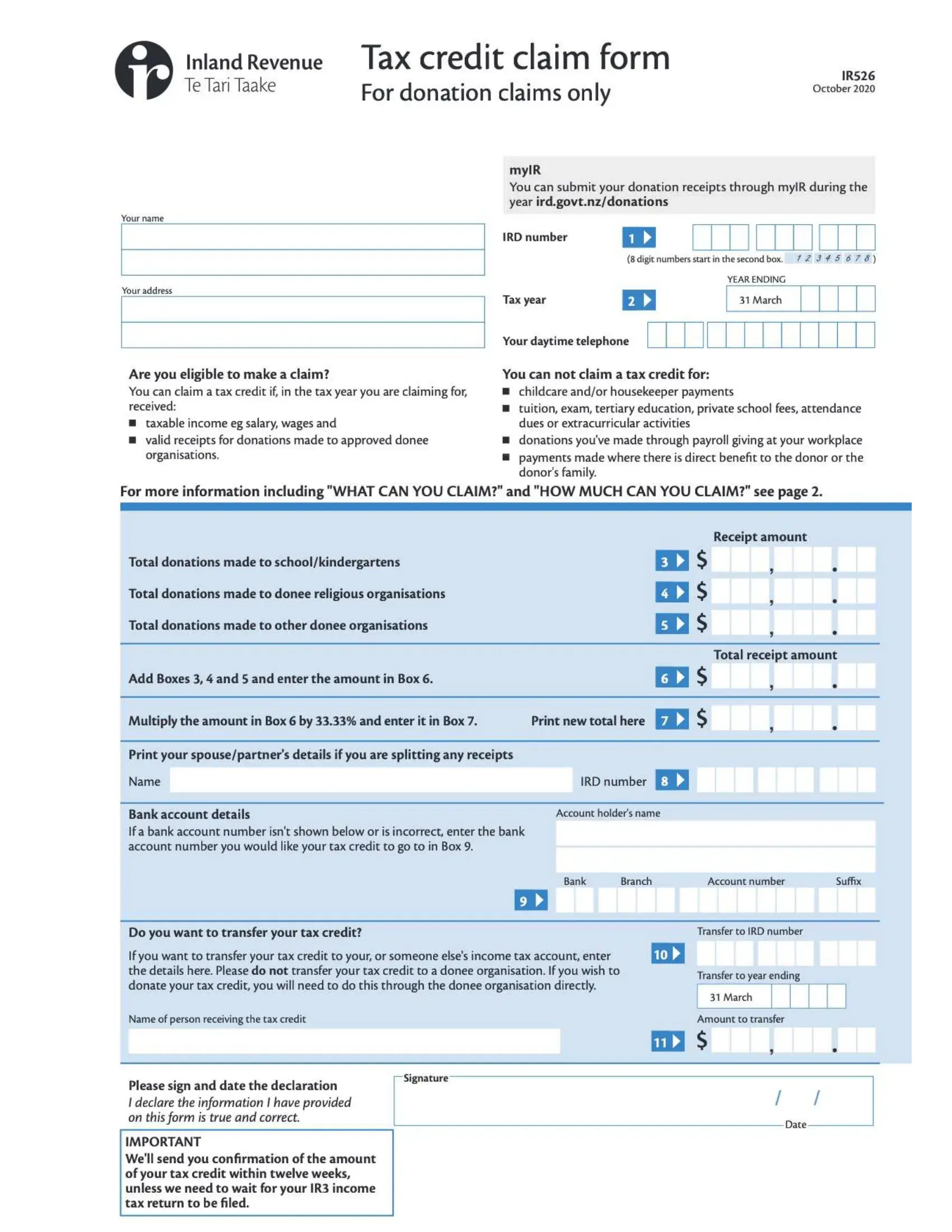

This document requires particular info to be entered, so ensure you take your time to fill in precisely what is requested:

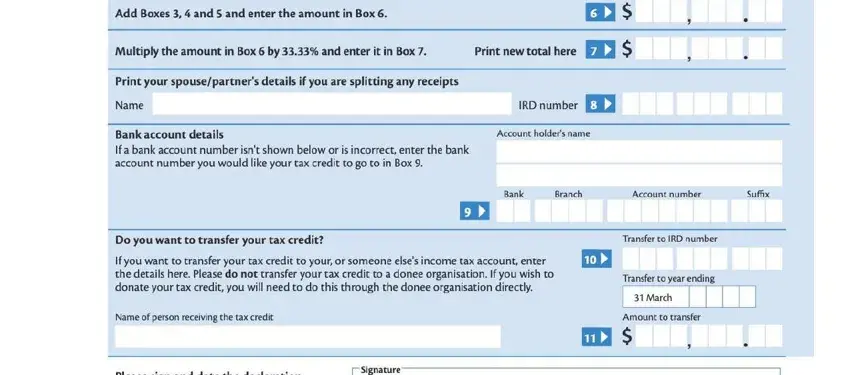

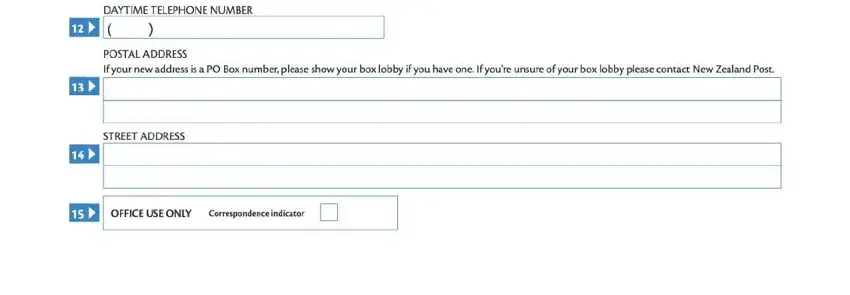

1. To start off, while filling out the 526 ird form, start out with the form section containing following blank fields:

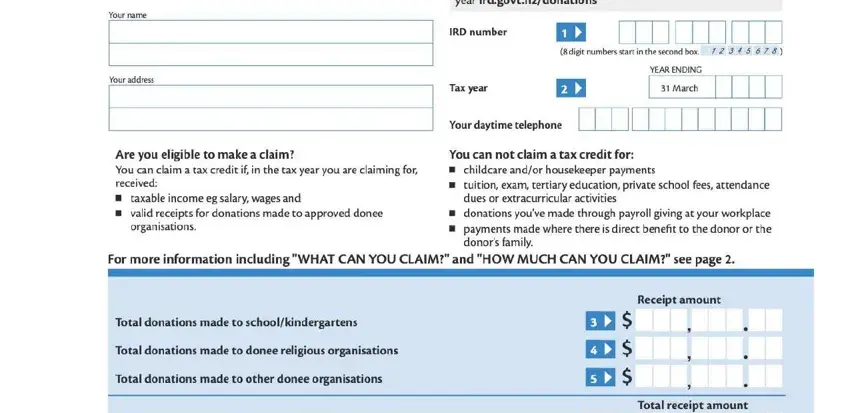

2. Immediately after the prior part is completed, go to enter the applicable information in these - .

3. Throughout this step, have a look at . These will have to be filled in with greatest attention to detail.

Many people generally get some things incorrect while filling out this field in this part. You need to read again whatever you enter here.

4. The fourth paragraph comes with these particular empty form fields to focus on: .

Step 3: Prior to moving on, make certain that form fields have been filled in the right way. As soon as you are satisfied with it, press “Done." Sign up with us now and instantly use 526 ird form, available for downloading. All changes you make are kept , meaning you can edit the pdf at a later time if required. We don't share any information that you type in while completing documents at FormsPal.