es kentucky tax can be completed easily. Simply try FormsPal PDF editing tool to complete the task without delay. To have our editor on the forefront of practicality, we aim to put into practice user-driven features and enhancements on a regular basis. We are always looking for suggestions - join us in reshaping how we work with PDF files. For anyone who is seeking to begin, here is what you will need to do:

Step 1: Just press the "Get Form Button" in the top section of this webpage to access our pdf editing tool. There you will find all that is required to fill out your document.

Step 2: Using this online PDF tool, you'll be able to do more than just complete blank form fields. Edit away and make your forms seem faultless with customized text added in, or fine-tune the original content to perfection - all that comes along with the capability to add almost any pictures and sign it off.

Filling out this form will require attention to detail. Make sure each and every field is done properly.

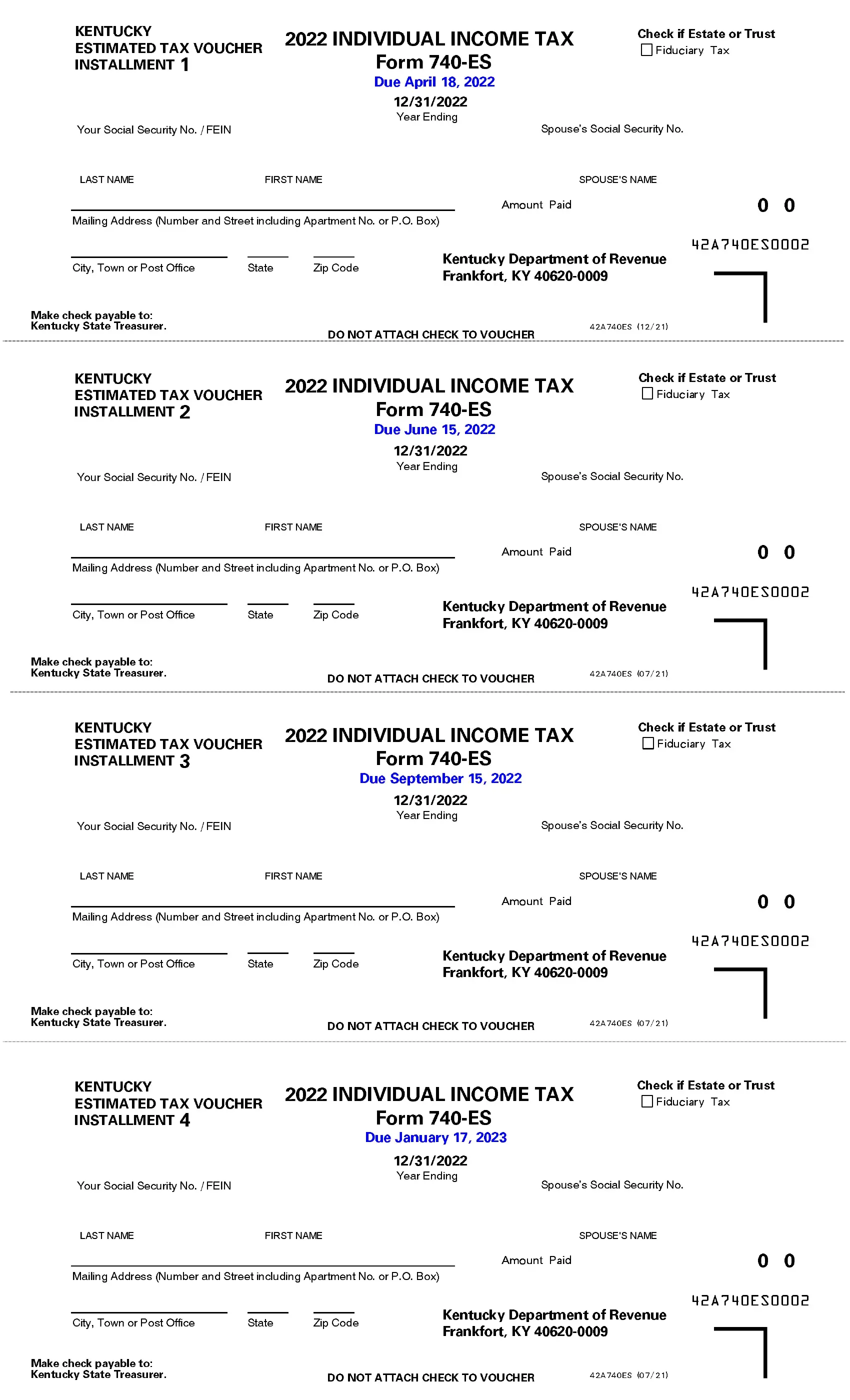

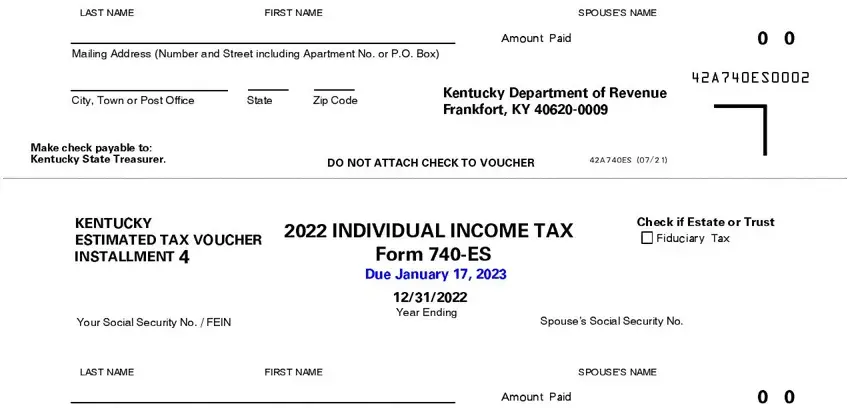

1. You will need to complete the es kentucky tax correctly, so be attentive while working with the areas including all of these fields:

2. Right after this selection of fields is done, go on to type in the applicable information in all these - Your Social Security No FEIN, Year Ending, Spouses Social Security No, LAST NAME FIRST NAME SPOUSES NAME, Mailing Address Number and Street, Amount Paid, AES, City Town or Post Office, State, Zip Code, Kentucky Department of Revenue, Make check payable to Kentucky, DO NOT ATTACH CHECK TO VOUCHER, AES , and KENTUCKY ESTIMATED TAX VOUCHER.

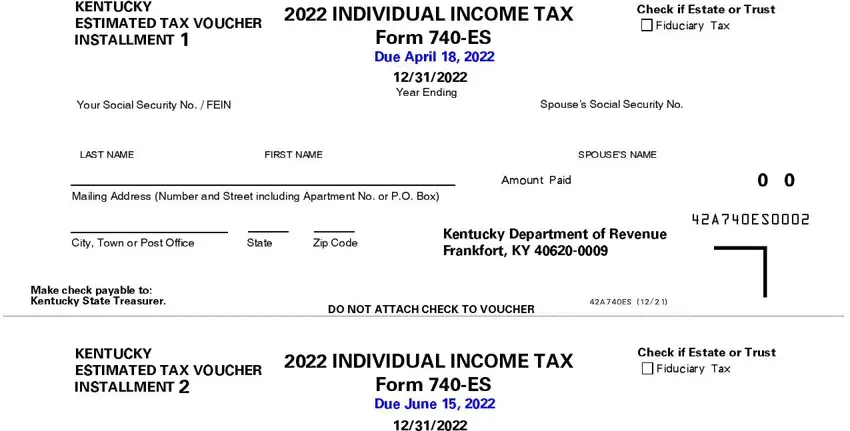

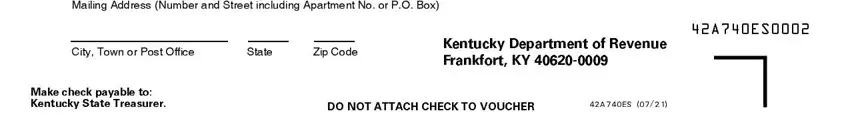

3. Through this stage, look at LAST NAME FIRST NAME SPOUSES NAME, Mailing Address Number and Street, Amount Paid, AES, City Town or Post Office, State, Zip Code, Kentucky Department of Revenue, Make check payable to Kentucky, DO NOT ATTACH CHECK TO VOUCHER, AES , KENTUCKY ESTIMATED TAX VOUCHER, INDIVIDUAL INCOME TAX, Form ES, and Due January . Every one of these are required to be filled in with highest accuracy.

Always be extremely attentive when filling in State and Due January , since this is where most users make errors.

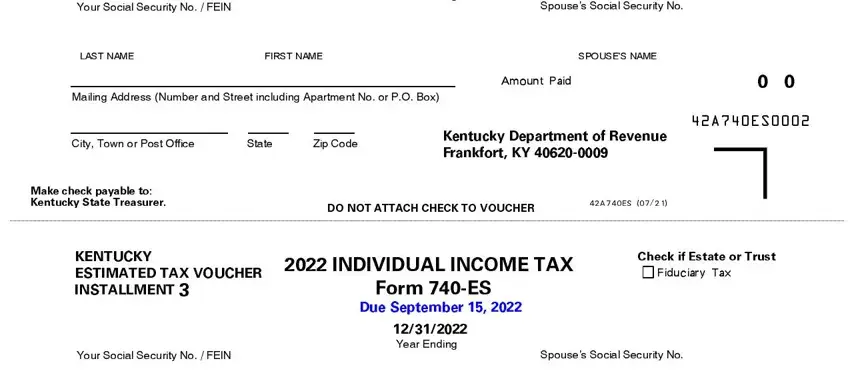

4. This next section requires some additional information. Ensure you complete all the necessary fields - Mailing Address Number and Street, AES, City Town or Post Office, State, Zip Code, Kentucky Department of Revenue, Make check payable to Kentucky, DO NOT ATTACH CHECK TO VOUCHER, and AES - to proceed further in your process!

Step 3: Check what you have entered into the blanks and click on the "Done" button. Join FormsPal now and immediately use es kentucky tax, ready for download. All modifications you make are kept , making it possible to modify the pdf at a later stage if required. FormsPal is dedicated to the confidentiality of all our users; we always make sure that all personal data handled by our tool remains protected.