The form 8974 for filling out course of action is quick. Our software lets you work with any PDF file.

Step 1: Get the button "Get Form Here" and select it.

Step 2: You are now able to modify form 8974 for. You possess plenty of options with our multifunctional toolbar - you can include, erase, or change the content material, highlight the particular components, and perform several other commands.

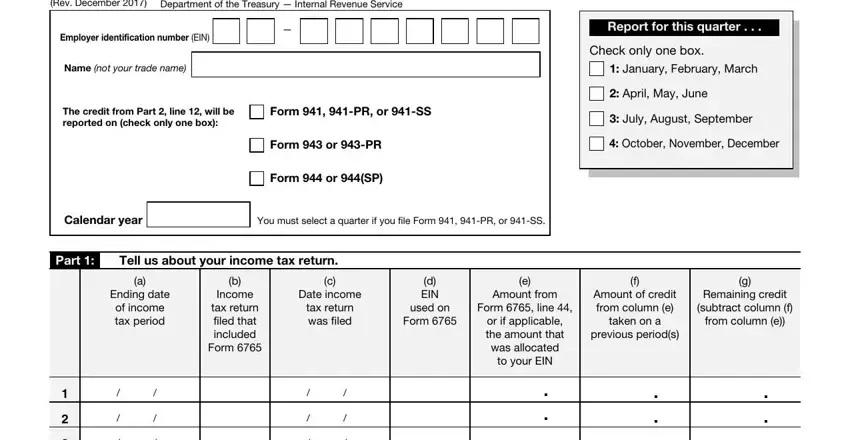

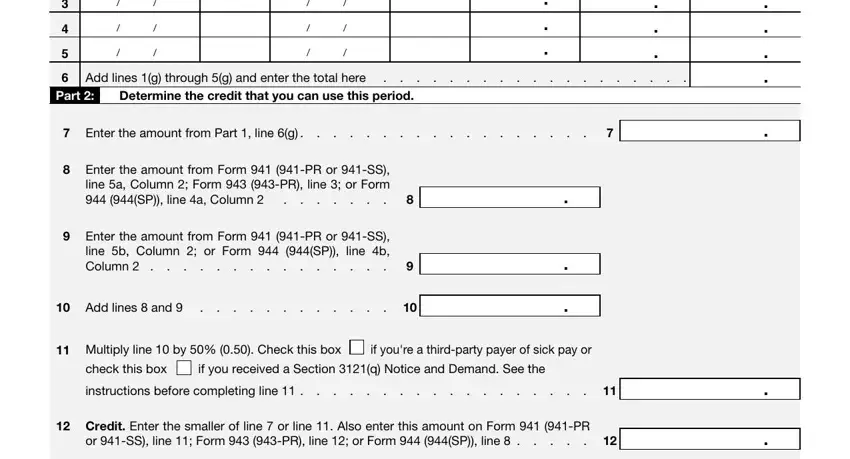

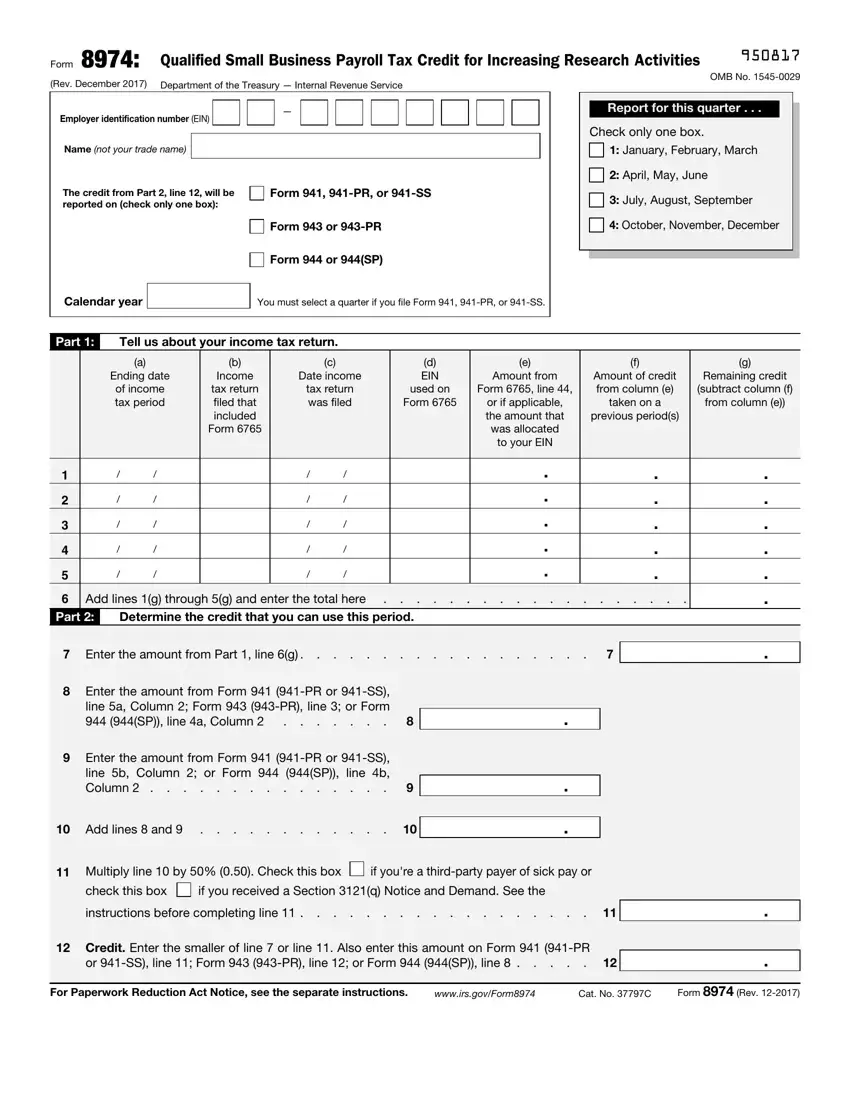

The next areas are included in the PDF form you'll be creating.

Provide the necessary data in the Add lines g through g and enter, Part, Determine the credit that you can, Enter the amount from Part line g, Enter the amount from Form PR or, Enter the amount from Form PR or, Add lines and, Multiply line by Check this box, if youre a thirdparty payer of, check this box, if you received a Section q Notice, instructions before completing, Credit Enter the smaller of line, and or SS line Form PR line or Form area.

Step 3: Choose the Done button to save your form. At this point it is obtainable for export to your device.

Step 4: To prevent different hassles in the foreseeable future, be sure to generate up to two or three duplicates of the file.

if you're a

if you're a

if you received a Section 3121(q) Notice and Demand. See the

if you received a Section 3121(q) Notice and Demand. See the