The form 100 es instructions filling in procedure is simple. Our tool enables you to work with any PDF file.

Step 1: The first thing will be to select the orange "Get Form Now" button.

Step 2: At this point, you can start editing your form 100 es instructions. Our multifunctional toolbar is readily available - add, eliminate, change, highlight, and undertake several other commands with the text in the document.

Fill out the form 100 es instructions PDF by providing the content required for each individual section.

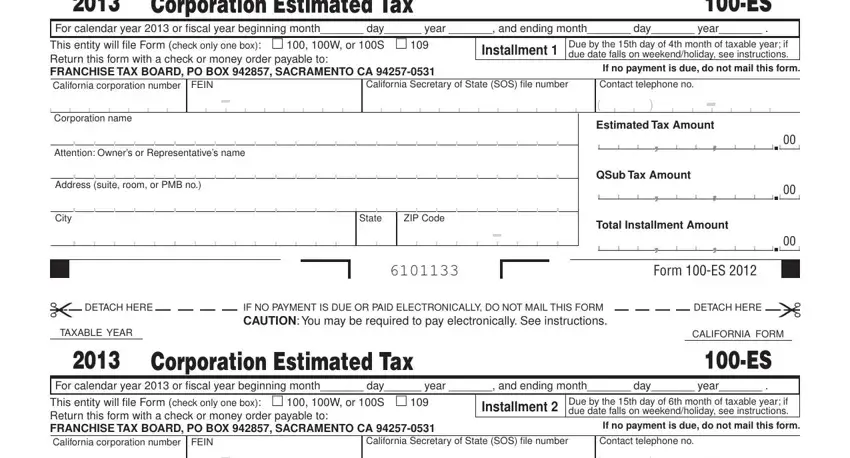

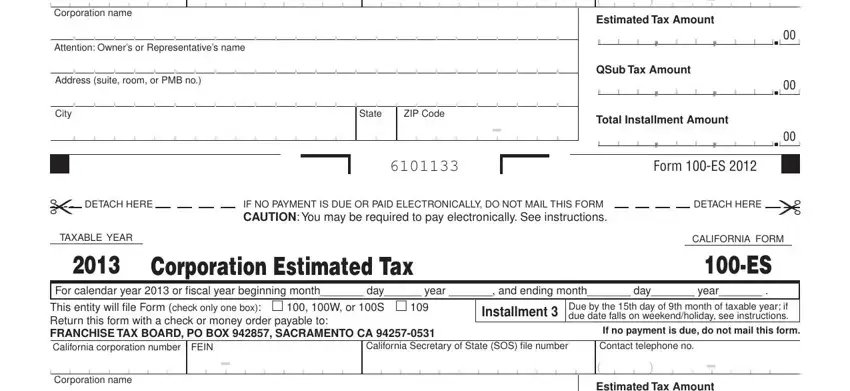

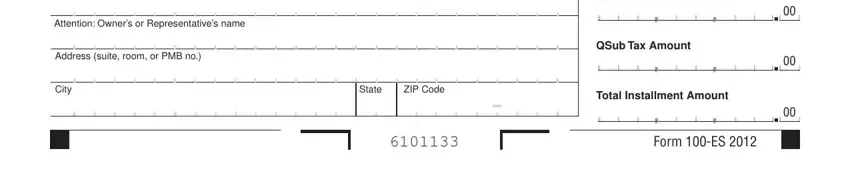

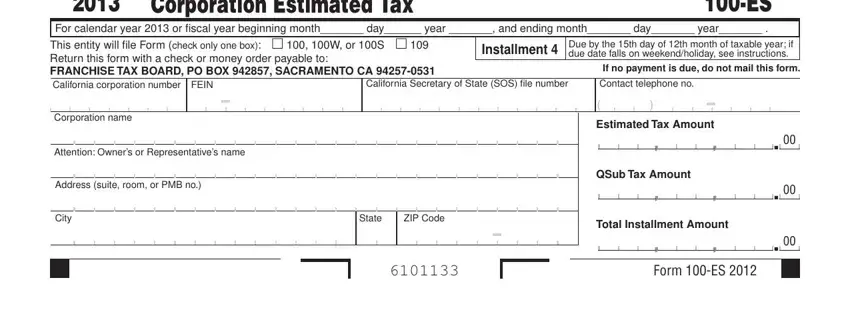

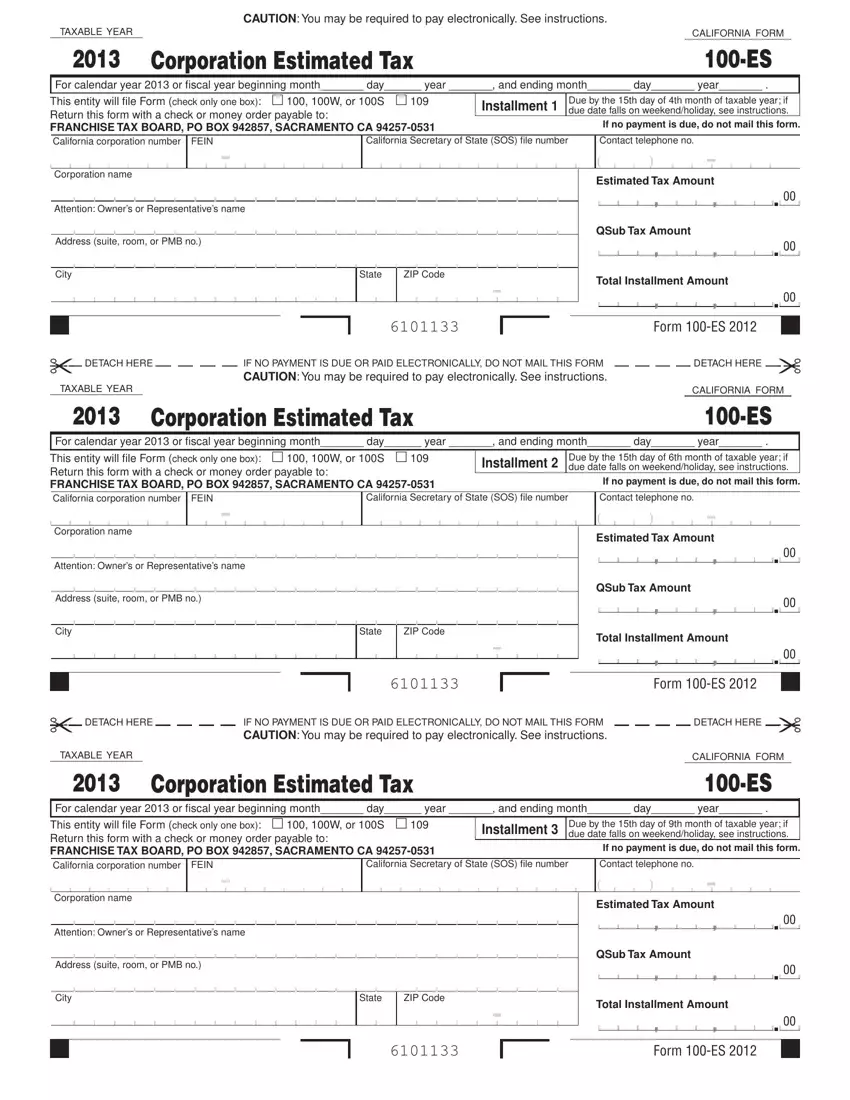

The application will need you to fill out the Corporation name, Attention Owners or, Address suite room or PMB no, City, State, ZIP Code, Estimated Tax Amount, QSub Tax Amount, Total Installment Amount, Form ES, DETACH HERE, TAXABLE YEAR, IF NO PAYMENT IS DUE OR PAID, Corporation Estimated Tax, and DETACH HERE segment.

Be sure to emphasize the crucial data in the Attention Owners or, Address suite room or PMB no, City, State, ZIP Code, Estimated Tax Amount, QSub Tax Amount, Total Installment Amount, and Form ES box.

The Corporation Estimated Tax, For calendar year or fiscal year, Installment Due by the th day of, California Secretary of State SOS, Contact telephone no, FEIN, Corporation name, Attention Owners or, Address suite room or PMB no, City, State, ZIP Code, Estimated Tax Amount, QSub Tax Amount, and Total Installment Amount area could be used to identify the rights and responsibilities of both parties.

Step 3: Choose the Done button to be sure that your finalized file can be transferred to every electronic device you select or forwarded to an email you indicate.

Step 4: It may be more convenient to have duplicates of the file. You can be sure that we won't distribute or check out your particulars.

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,