The A2 Cum Retail Outward Remittance Application form plays a crucial role in the process of drawing foreign exchange for a variety of purposes, underscored by a framework designed for ease and compliance. It is meticulously structured to ensure applicants provide comprehensive details, from personal and beneficiary information to the specifics of the foreign exchange required. Whether it's remitting a fixed amount in foreign currency, equivalent foreign currency for a fixed rupee amount, or specifying the purpose of the remittance complete with purpose codes, this form encapsulates all necessary fields to facilitate a seamless transaction. Furthermore, it offers options for the remitter to decide how charges are borne and provides a declaration to conform to regulatory requirements under the FEMA 1999. Notably, it includes conditions regarding permissible transactions and a detailed list of relationship definitions pertinent to maintenance remittances. This document is not only pivotal for individuals and entities engaging in remittances but also serves as a testament to the regulated yet flexible nature of foreign exchange transactions, embodying a blend of compliance, convenience, and clarity.

| Question | Answer |

|---|---|

| Form Name | A2 Cum Retail Outward Application Form |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | form a2 axis bank in word format, form a2 axis bank, retail outward remittance form axis bank, axisbank outward remittance form |

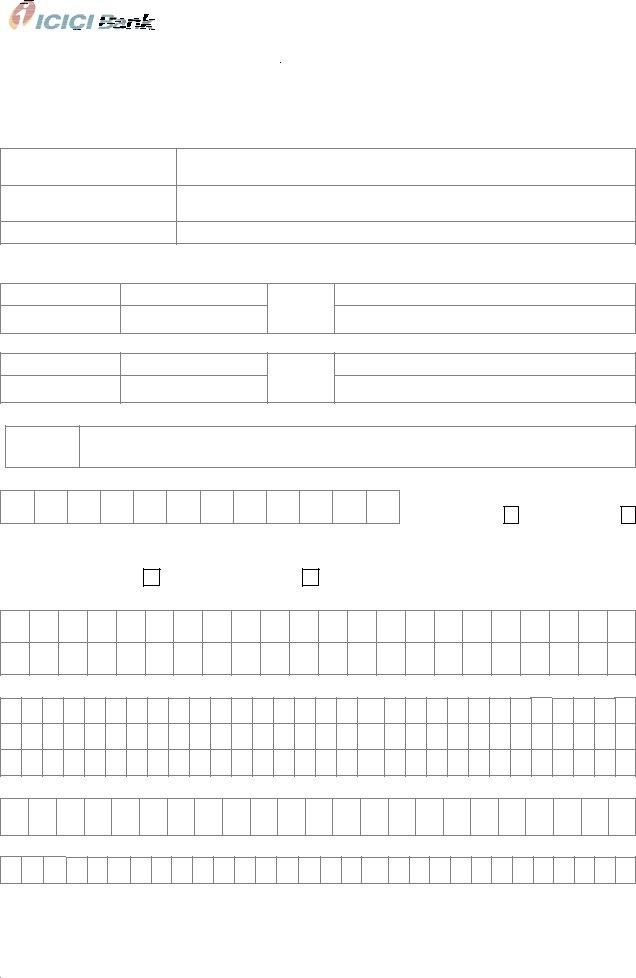

A2 CUM RETAIL OUTWARD REMITTANCE APPLICATION

|

|

|

|

|

|

|

|

|

|

|

|

For Official Use only |

Track Number |

|

Originating Br. ID |

|

|

Scan Br. ID |

|

AD Code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(To be completed by the applicant in block letters using black ink pen)

Application for drawal of Foreign Exchange

I. Details of the Applicant (Remitter)

a. Name of the Applicant

b. Address (Not mandatory for ICICI A/c holders)

Applicant Phone numbers

II.Details of Foreign Exchange required

Foreign Currency

FC Amt in figures

FC

Amount

In Words

(OR) II b. For remittance of equivalent of Foreign Currency of Fixed Rupee Amount

Foreign Currency

INR Amt in figures

INR

Amount

In Words

II c. Purpose of Remittance with Purpose Code (For details refer Annexure – I in page 4)

Code

Description

III.I / We authorize you to debit my / our below Account together with your charges

* Charges borne by beneficiary (BEN)

*Charges borne by remitter (REM)

* Charges will be to the Account of Beneficiary (BEN) if no option is selected

III a. Please issue

Telegraphic Transfer (TT)

(or) Demand Draft (DD)

Beneficiary Name

Beneficiary Address

℡

IV a. Beneficiary A/c Number (Incase of TT)

IV b. Name of the Bank where the beneficiary A/c is maintained (In case of TT)

IV c. SWIFT & SORT Code details of beneficiary Bank (In case of TT)

IBAN for remittance made |

|

|

|

to UK, Europe, Bahrain |

|

|

|

Saudi Arabia & UAE |

|

|

|

Sort Code for remittance to |

|

SWIFT code (or) routing Number |

|

UK (or) BSB Code for |

|

|

|

|

for remittance to any other Country |

|

|

remittance to Australia |

|

|

|

|

|

|

Page 1 of 1 |

Ver |

A2 CUM RETAIL OUTWARD REMITTANCE APPLICATION

IV d. Beneficiary Bank address including Country at which the beneficiary maintains A/c ( mandatory in case of TT in CAD Currency)

℡

IV e. Furnish the following details of Correspondent Bank if the Foreign Currency is sent to a Country other than the home Country of the Currency

SWIFT Code |

Correspondent Bank Name |

V. If the purpose selected is one of the below then it is mandatory to furnish the details sought for

Maintenance

The relationship of beneficiary with the remitter (for list of close relatives refer the table given below)

Education

Purchase of Property

Investment abroad

Details

The Student Name and Student ID (if any). Country of study abroad

The location of property being purchased (Country / State)

Nature of instrument (Equity / MF / Debt Instrument) and country of incorporation of the company in which the investment is made

List of close relatives as per Sec VI of Companies Act

Brother (including step Brother) |

Daughter’s Son’s Wife |

Mother (including Step Mother) |

Son’s Daughter |

Brother’s wife |

Daughter’s Husband |

Mother’s Father |

Son’s Daughter’s Husband |

Daughter (Including Step Daughter) |

Father |

Mother’s Mother |

Son’s Son |

Daughter’s Daughter |

Father’s Father |

Sister (Including Step Sister) |

Son’s Son’s wife |

Daughter’s Daughter’s Husband |

Father’s Mother |

Sister’s Husband |

Son’s wife |

Daughter’s Son |

Member of HUF |

Son (Including step Son) |

Husband (or) Wife |

VI. Furnish below if a message to be sent along with wire transfer on your behalf

………………………… …………………………………………………………………………………………………………….………………………

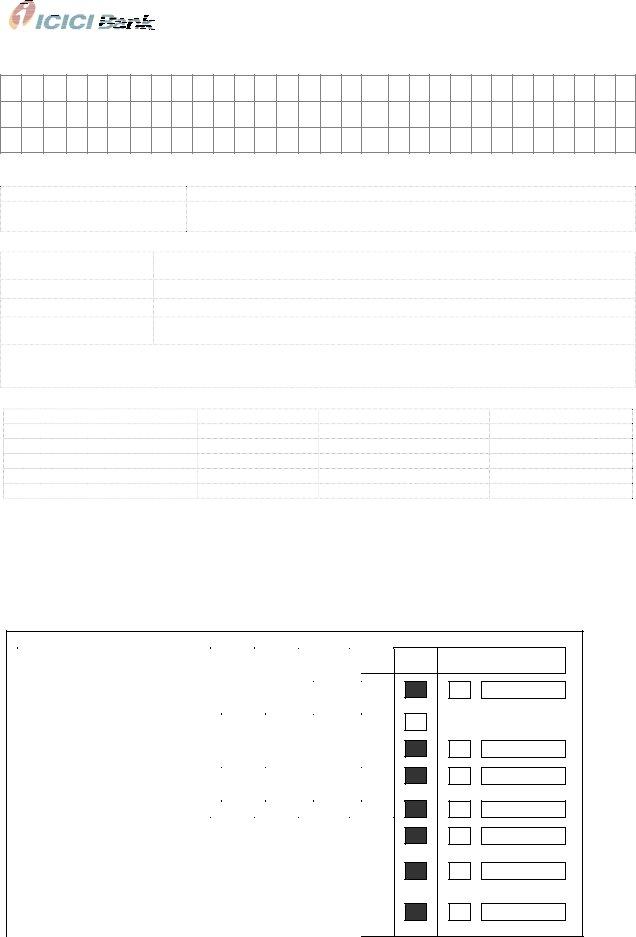

Declaration

I / We hereby declare that the total amount of foreign exchange purchased from or remitted through all sources in India during this Calendar / Financial year including this application is within USD Limit as prescribed by RBI for the said purpose under FEMA 1999

(Tick the appropriate box).

<- - - - - - - - - - - - - - - - - - Limit Category - - - - - - - - - - - - - - - - - - >

|

Customer Category |

|

|

USD |

|

USD |

|

USD |

|

Net |

||||

|

|

1 Lac |

2 Lacs |

10 Lacs |

Salary |

|||||||||

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Resident Indian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NRI / PIO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) NRE / FCNR A/c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b) NRO A/c of an NRI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c) NRO A/c of a PIO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign National |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) Foreign Tourist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b) Employed in India |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c) Employed in India (not |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

permanently resident) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust / Association / Society / |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Club |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No Limit

Others (Mention the Limit

in USD)

If Limit Category “Others” is chosen then enclose necessary support document.

Page 2 of 2 |

Ver |

A2 CUM RETAIL OUTWARD REMITTANCE APPLICATION

I/ We hereby declare that the transaction mentioned above doesn’t involve, and is not designed for any purpose for which the drawing of foreign exchange is prohibited under rule 3 of the FEMA Current A/c transactions Rules, 2000 read with schedule I therefore of Viz,

1.Travel to Nepal & or Bhutan

2.Transaction with a person resident in Nepal or Bhutan

3.Remittance out of lottery winnings

4.Remittance of Income from Racing / riding etc. or any other hobby.

5.Remittance for purchases of Lottery tickets, banned or prescribed magazines, football pools, sweep stakes, schemes involving money circulations, securing prize money awards etc.

6.Payment of commission on exports made towards equity investments in joint ventures / wholly owned subsidiaries abroad of Indian Companies

7.Remittance of dividend by any company to which the requirement of dividend balancing is applicable.

8.Payment of commission on export under rupee state credit route except commission up to 10% in invoice value of exports of Tea & Tobacco.

9.Payment related to “Call back services” or telephones.

10.Remittance of interest income on funds held in

I / We, being a person(s) resident in India, hereby declare that for transactions done under the Liberalized Remittance Scheme (LRS) for resident individuals, issued and amended by RBI from time to time, is not in the nature of remittance for margin calls to overseas exchanges / overseas counter parties under this scheme.

I / We, being a person(s) resident outside India, here by declare that under Sec 4(b) of FEMA Permissible Capital A/c Transaction regulation, 2000, the transaction mentioned above doesn’t involve and is not designed for any repatriation outside India out of the proceeds of any investment in India, in any form, in any Company, Partnership firm (or) Proprietary concern or any entity, whether incorporated or not, which is engaged or proposes to engage

a. In the business of chit funds or b. As Nidhi company or

c. In agricultural or plantation activity, or

d. In real estate business, or construction of farm houses (real estate business shall not include development of townships construction of residential / commercial premises roads or bridges), or

e. In trading and transferable development rights (TDRs)

I / We being a person(s) resident outside India, here by declare that no portion / part of outward remittance represents interest on refunds of funds received from outside India for purchase of shares in India. Updated list of prohibited transactions under FEMA can be accessed on ICICI Bank website (www.icicibank.com).

Other relevant declarations:

I/we hereby declare that the purpose and transaction details as mentioned above are true to the best of my knowledge does not involve, and is not designed for the purpose of any contravention or evasion of the provisions of the FEMA, 1999 or any rule, regulation, notification, direction or order made there under. I/We agree that I/We shall be responsible and liable for any incorrect detail provided by me/us.

I/We also hereby agree and undertake to give such information / documents as will reasonably satisfy you about this transaction in terms of the above declaration.

I/we agree that in the event of transaction could not be executed/debited to my/ our account after submitting the request for processing to the bank on account of insufficient/ unclear balance at the same time of execution of the transaction in my/ our account any exchange losses incurred in this connection due to reversal of the Forex deal can be charged to my/our ICICI account.

I/we agree that in the event the transaction is cancelled or revoked by me/us after submitting the request for processing to the bank any exchange losses incurred in this connection can be charged to my/our ICICI account. I/we further agree that once the funds remitted by me/us have been transmitted by ICICI bank to the correspondent and/or beneficiary banks, ICICI bank shall not be responsible for any delays I the disbursement of such funds including the withholding of such funds by the correspondent and/or beneficiary banks. I/We further agree that once the funds remitted by me / us have been transmitted by ICICI Bank, intermediary Bank charges may be levied by Correspondent and / or Beneficiary Banks, which may vary from bank to bank.

I/we agree that in the event the transaction being rejected by the beneficiary bank because of incorrect information submitted by me, any charges levied by the beneficiary bank or exchange losses incurred in this connection can be charged to my ICICI bank account.

I/we also understand that if I/we refuse to comply with any such requirement or make only unsatisfactory compliance therewith, the bank shall refuse in writing to undertake the transaction and shall, if it has reason to believe that any contravention/evasion in contemplated by me/us, report that matter to the RBI.

I/we also agree that the exchange rate will be applicable at the time of deal booking and may vary from the rate prevailing when the request is submitted . I/we also understand that the rate communicated to us (if any) is an indicative rate and the actual rate may be different from the same.

I / We authorize you to remit outwardly as per details provided in the application.

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

Date ……………………. |

Signature of Remitter / Mandate Holder |

(The signature by mandate holder will be accepted only for Non resident A/c holders where mandate is duly registered with the Bank )

I certify that I have verified the Customer’s signature as per Bank records and retained the originals of all the scanned documents and forms submitted by the remitter for the above transaction.

Name & employee ID |

Bank Stamp & Employee Signature |

Page 3 of 3 |

Ver |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A2 CUM RETAIL OUTWARD REMITTANCE APPLICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

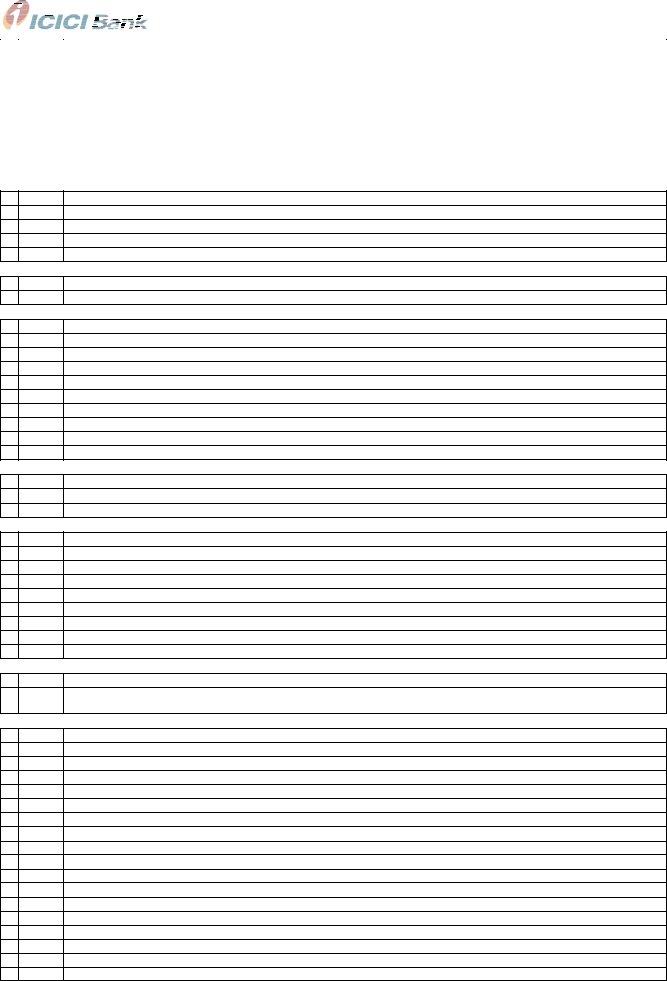

Annexure - I |

|

|

|

|

AD / Branch Official should put a tick against appropriate purpose code |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PURPOSECODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PURPOSE CODE DESCRIPTION FOR REPORTING UNDER FETERS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0017 |

Acquisition of |

||||||||||||||||||

|

|

acquired by government, use of natural resources) – Government |

|||||||||||||||||||

|

|

S0019 |

Acquisition of |

||||||||||||||||||

|

|

natural resources) – |

|||||||||||||||||||

|

|

S0026 |

Capital transfers ( Guarantees payments, Investment Grand given by the government/international organization, exceptionally |

||||||||||||||||||

|

|

|

large |

||||||||||||||||||

|

|

S0027 |

Capital transfers ( Guarantees payments, Investment Grand given by the |

||||||||||||||||||

|

|

claims) – |

|||||||||||||||||||

|

|

S0099 |

Other capital payments not included elsewhere |

||||||||||||||||||

Foreign Direct Investment |

|||||||||||||||||||||

|

|

S0003 |

Indian Direct Investment abroad (In Branches and wholly owned Subsidiaries) |

||||||||||||||||||

|

|

S0004 |

Indian Direct investment abroad (in subsidiaries and associates) in debt instruments |

||||||||||||||||||

|

|

S0005 |

Indian investment abroad – in real estate |

||||||||||||||||||

|

|

S0006 |

Repatriation of Foreign Direct Investment made by overseas Investors in India – in equity shares |

||||||||||||||||||

|

|

S0007 |

Repatriation of Foreign Direct Investment in made by overseas Investors India – in debt instruments |

||||||||||||||||||

|

|

S0008 |

Repatriation of Foreign Direct Investment made by overseas Investors in India – in real estate |

||||||||||||||||||

Foreign Portfolio Investments |

|||||||||||||||||||||

|

|

S0001 |

Indian Portfolio investment abroad – in equity shares |

||||||||||||||||||

|

|

S0002 |

Indian Portfolio investment abroad – in debt instruments |

||||||||||||||||||

|

|

S0009 |

Repatriation of Foreign Portfolio Investment made by overseas Investors in India – in equity shares |

||||||||||||||||||

|

|

S0010 |

Repatriation of Foreign Portfolio Investment made by overseas Investors in India – in debt instruments |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

External Commercial Borrowings |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0011 |

Loans extended to |

||||||||||||||||||

|

|

S0012 |

Repayment of long & medium term loans with original maturity above one year received from |

||||||||||||||||||

Short Term Loans |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0013 |

Repayment of short term loans with original maturity up to one year received from |

||||||||||||||||||

Banking Capital |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0014 |

Repatriation of |

||||||||||||||||||

|

|

S0015 |

Repayment of loans & overdrafts taken by ADs on their own account. |

||||||||||||||||||

|

|

S0016 |

Sale of a foreign currency against another foreign currency |

||||||||||||||||||

Financial derivatives and others |

|||||||||||||||||||||

|

|

S0020 |

Payments made on A/c of margin payments, premium payment and settlement amt etc. under Financial derivative transactions. |

||||||||||||||||||

|

|

S0021 |

Payments made on account of sale of share under Employee stock option |

||||||||||||||||||

|

|

S0022 |

Investment in Indian Depositories Receipts (IDRs) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0023 |

Remittances made under Liberalized Remittance Scheme (LRS) for Individuals |

||||||||||||||||||

External Assistance |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0024 |

External Assistance extended by India. e.g. Loans and advances extended by India to Foreign Govt. under various agreements |

||||||||||||||||||

|

|

S0025 |

Repayments made on account of External Assistance received by India. |

||||||||||||||||||

Imports |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0101 |

Advance payment against imports made to countries other than Nepal and Bhutan |

||||||||||||||||||

|

|

S0102 |

Payment towards imports- settlement of invoice other than Nepal and Bhutan |

||||||||||||||||||

|

|

S0103 |

Imports by diplomatic missions other than Nepal and Bhutan |

||||||||||||||||||

|

|

S0104 |

Intermediary trade/transit trade, i.e., third country export passing through India |

||||||||||||||||||

|

|

S0108 |

Goods acquired under merchanting / Payment against import leg of merchanting trade* |

||||||||||||||||||

|

|

S0109 |

Payments made for Imports from Nepal and Bhutan, if any |

||||||||||||||||||

Transport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0201 |

Payments for surplus freight/passenger fare by foreign shipping companies operating in India |

||||||||||||||||||

|

|

S0202 |

Payment for operating expenses of Indian shipping companies operating abroad |

||||||||||||||||||

|

|

S0203 |

Freight on imports – Shipping companies |

||||||||||||||||||

|

|

S0204 |

Freight on exports – Shipping companies |

||||||||||||||||||

|

|

S0205 |

Operational leasing/Rental of Vessels (with crew) |

||||||||||||||||||

|

|

S0206 |

Booking of passages abroad – Shipping companies |

||||||||||||||||||

|

|

S0207 |

Payments for surplus freight/passenger fare by foreign Airlines companies operating in India |

||||||||||||||||||

|

|

S0208 |

Operating expenses of Indian Airlines companies operating abroad |

||||||||||||||||||

|

|

S0209 |

Freight on imports – Airlines companies |

||||||||||||||||||

|

|

S0210 |

Freight on exports – Airlines companies |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0211 |

Operational leasing / Rental of Vessels (with crew) – Airline companies |

||||||||||||||||||

|

|

S0212 |

Booking of passages abroad – Airlines companies |

||||||||||||||||||

|

|

S0214 |

Payments on account of stevedoring, demurrage, port handling charges etc.(Shipping companies) |

||||||||||||||||||

|

|

S0215 |

Payments on account of stevedoring, demurrage, port handling charges, etc.(Airlines companies) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

S0216 |

Payments for Passenger - Shipping companies |

||||||||||||||||||

|

Page 4 of 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ver |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A2 CUM RETAIL OUTWARD REMITTANCE APPLICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0217 |

Other payments by Shipping companies |

|||||||||||||||

|

S0218 |

Payments for Passenger - Airlines companies |

|||||||||||||||

|

S0219 |

Other Payments by Airlines companies |

|||||||||||||||

|

S0220 |

Payments on A/c of freight under other modes of transport (Internal Waterways, Roadways, Railways, Pipeline transports and |

|||||||||||||||

|

|

others) |

|||||||||||||||

|

S0221 |

Payments on account of passenger fare under other modes of transport (Internal Waterways, Roadways, Railways, Pipeline |

|||||||||||||||

|

transports and others) |

||||||||||||||||

|

S0222 |

Postal & Courier services by Air |

|||||||||||||||

|

S0223 |

Postal & Courier services by Sea |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

S0224 |

Postal & Courier services by others |

|||||||||||||||

Travel

S0301 Business travel.

S0303 Travel for pilgrimage

S0304 Travel for medical treatment

S0305 Travel for education (including fees, hostel expenses etc.)

S0306 Other travel (including holiday trips and payments for settling international credit cards transactions) Construction Services

S0501 Construction of projects abroad by Indian companies including import of goods at project site abroad

S0502 cost of construction etc. of projects executed by foreign companies in India.

Insurance and Pension Services

S0601 Life Insurance premium except term insurance

S0602 Freight insurance – relating to import & export of goods

S0603 Other general insurance premium including reinsurance premium; and term life insurance premium

S0605 Auxiliary services including commission on insurance

S0607 Insurance claim Settlement of

S0608 Life Insurance Claim Settlements

S0609 Standardized guarantee services

S0610 Premium for pension funds

S0611 Periodic pension entitlements e.g. monthly quarterly or yearly payments of pension amounts by Indian Pension Fund Companies.

S0612 Invoking of standardized guarantees

Financial Services

S0701 Financial intermediation, except investment banking - Bank charges, collection charges, LC charges etc.

S0702 Investment banking – brokerage, under writing commission etc.

S0703 Auxiliary services – charges on operation & regulatory fees, custodial services, depository services etc. Telecommunication, Computer & Information Services

S0801 Hardware consultancy/implementation

S0802 Software consultancy / implementation

S0803 Data base, data processing charges

S0804 Repair and maintenance of computer and software

S0805 News agency services

S0806 Other information services- Subscription to newspapers, periodicals

S0807

S0808 Telecommunication services including electronic mail services and voice mail services

S0809 Satellite services including space shuttle and rockets etc.

Charges for the use of intellectual property n.i.e

S0901 Franchises services

S0902 Payment for use, through licensing arrangements, of produced originals or prototypes (such as manuscripts and films), patents, copyrights, trademarks and industrial processes etc.

Other Business Services

S1002 Trade related services – commission on exports / imports

S1003 Operational leasing services (other than financial leasing) without operating crew, including charter hire- Airlines companies

S1004 Legal services

S1005 Accounting, auditing,

S1006 Business and management consultancy and public relations services

S1007 Advertising, trade fair service

S1008 Research & Development services

S1009 Architectural services

S1010 Agricultural services like protection against insects & disease, increasing of harvest yields, forestry services.

S1011 Payments for maintenance of offices abroad

S1013 Environmental Services

S1014 Engineering Services

S1015 Tax consulting services

S1016 Market research and public opinion polling service

S1017 Publishing and printing services

S1018 Mining services like

S1020 Commission agent services

S1021 Wholesale and retailing trade services.

Page 5 of 5 |

Ver |