doh 4495a ny can be filled out easily. Just try FormsPal PDF editing tool to finish the job quickly. Our development team is always working to develop the editor and insure that it is even better for users with its extensive functions. Bring your experience to another level with constantly growing and exciting opportunities available today! Here's what you would want to do to start:

Step 1: Hit the "Get Form" button in the top part of this page to get into our PDF editor.

Step 2: With the help of this handy PDF editing tool, you're able to do more than merely complete blank form fields. Express yourself and make your forms appear great with customized textual content incorporated, or tweak the original content to perfection - all comes with the capability to insert any type of photos and sign it off.

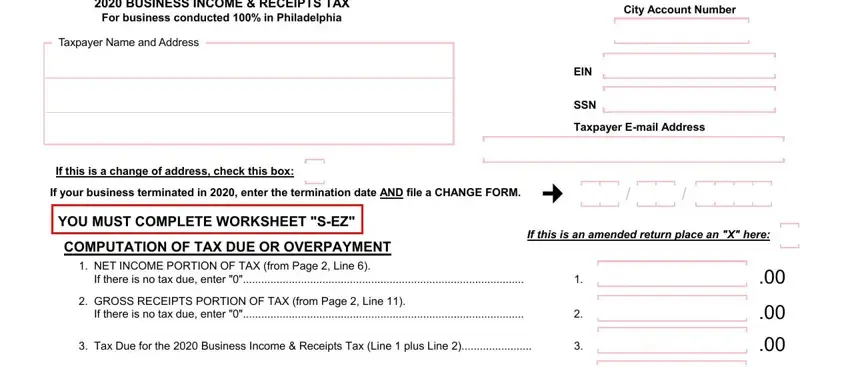

For you to fill out this document, make sure that you type in the necessary details in every blank:

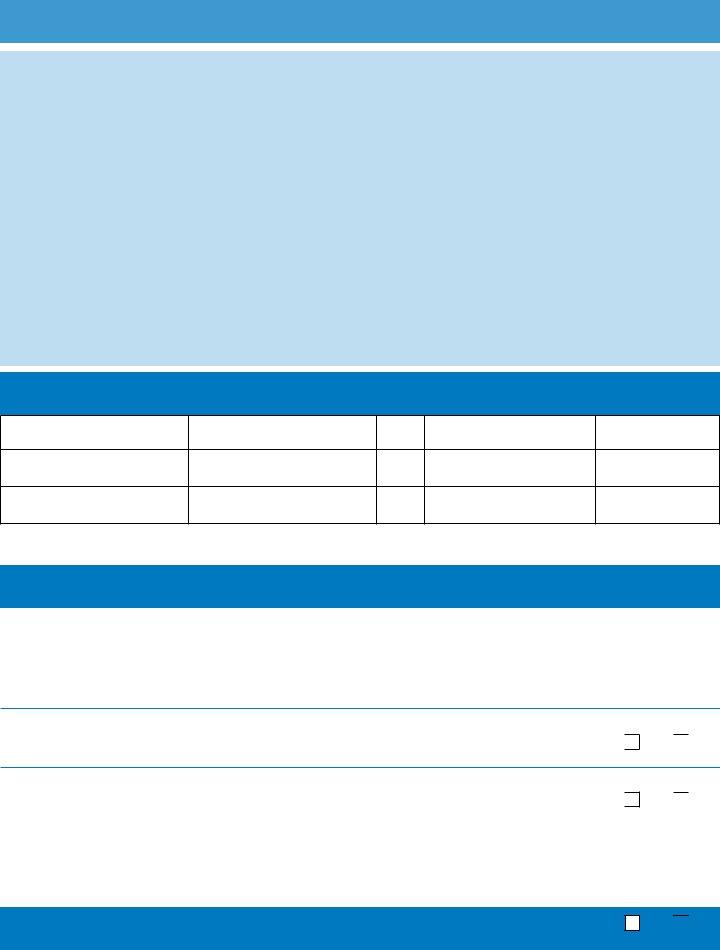

1. Whenever filling in the doh 4495a ny, make certain to include all of the necessary blanks within the corresponding part. It will help to speed up the work, allowing for your details to be processed quickly and properly.

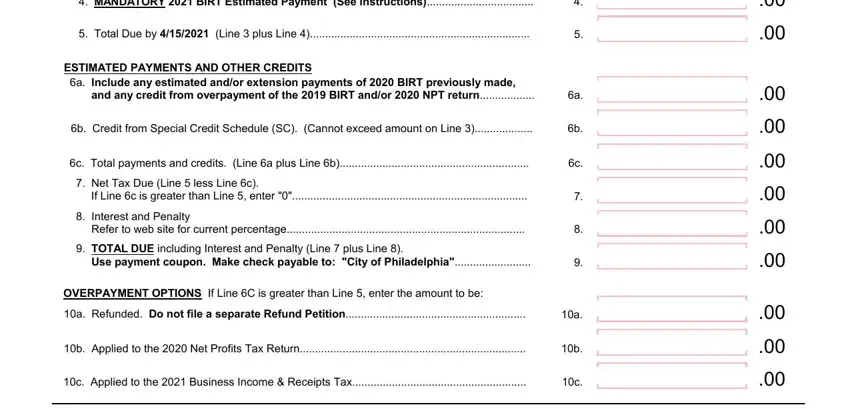

2. Once your current task is complete, take the next step – fill out all of these fields - MANDATORY BIRT Estimated Payment, Total Due by Line plus Line , ESTIMATED PAYMENTS AND OTHER, and any credit from overpayment of, b Credit from Special Credit, c Total payments and credits Line, Net Tax Due Line less Line c, If Line c is greater than Line , Interest and Penalty, Refer to web site for current, TOTAL DUE including Interest and, Use payment coupon Make check, OVERPAYMENT OPTIONS If Line C is, b Applied to the Net Profits Tax, and c Applied to the Business Income with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

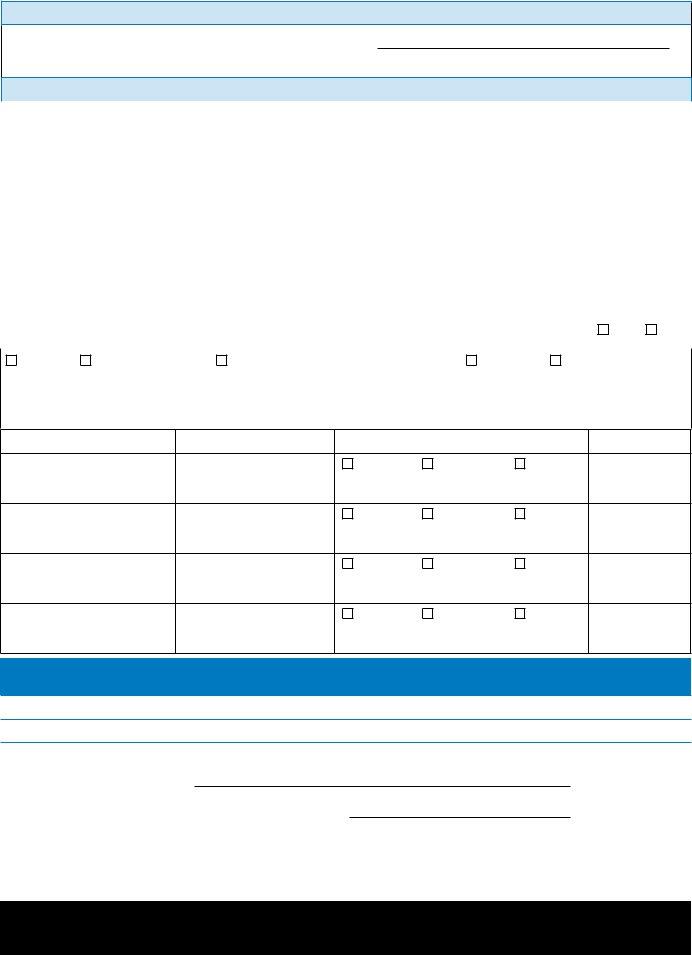

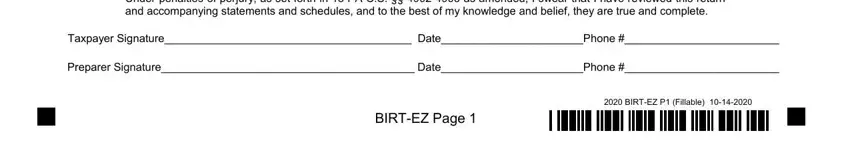

3. The third step is generally straightforward - fill out all the fields in Under penalties of perjury as set, Taxpayer Signature DatePhone , Preparer Signature DatePhone , BIRTEZ Page , and BIRTEZ P Fillable to complete this part.

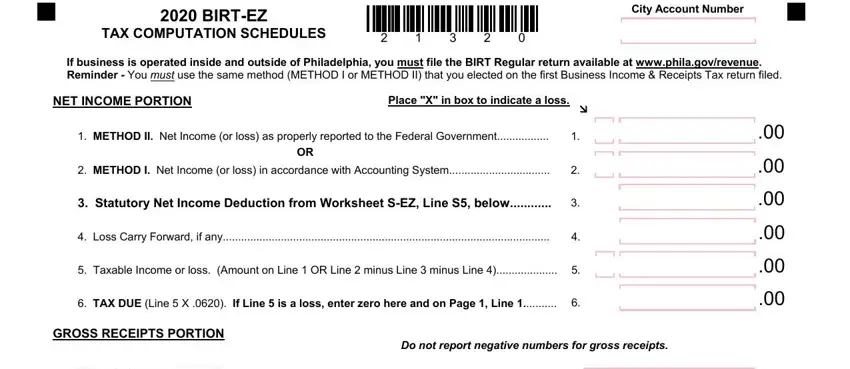

4. The subsequent section will require your details in the subsequent areas: BIRTEZ, TAX COMPUTATION SCHEDULES, City Account Number, If business is operated inside and, NET INCOME PORTION, Place X in box to indicate a loss, METHOD II Net Income or loss as, METHOD I Net Income or loss in, Statutory Net Income Deduction, Loss Carry Forward if any, Taxable Income or loss Amount on, TAX DUE Line X If Line is a, GROSS RECEIPTS PORTION, Do not report negative numbers for, and TAXABLE GROSS RECEIPTS from a. Make certain you fill out all of the required information to go forward.

As for Loss Carry Forward if any and Place X in box to indicate a loss, be sure that you review things in this section. These are thought to be the key ones in the PDF.

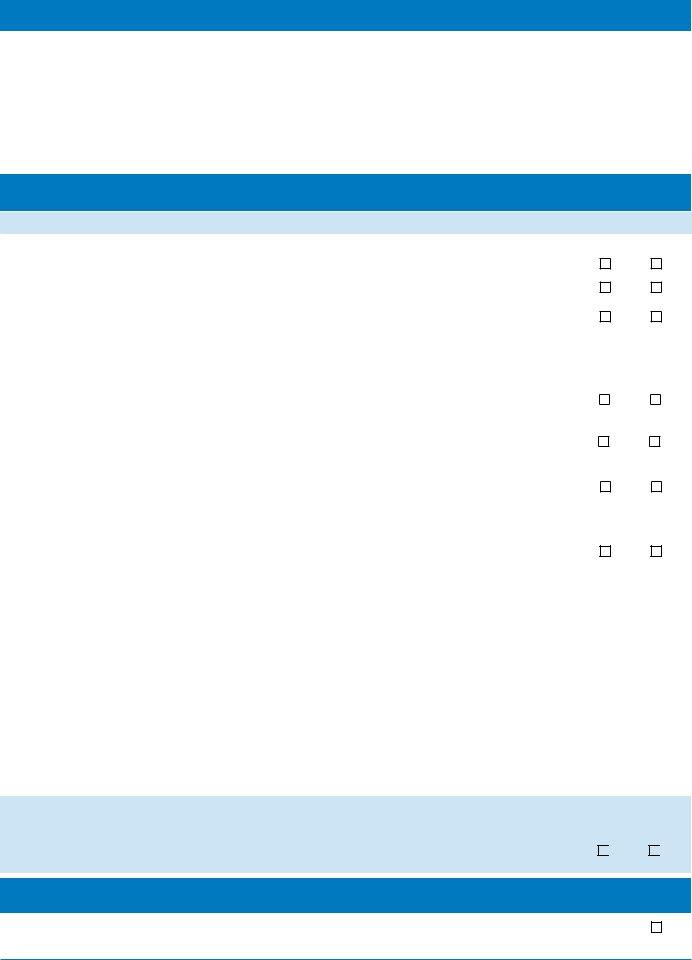

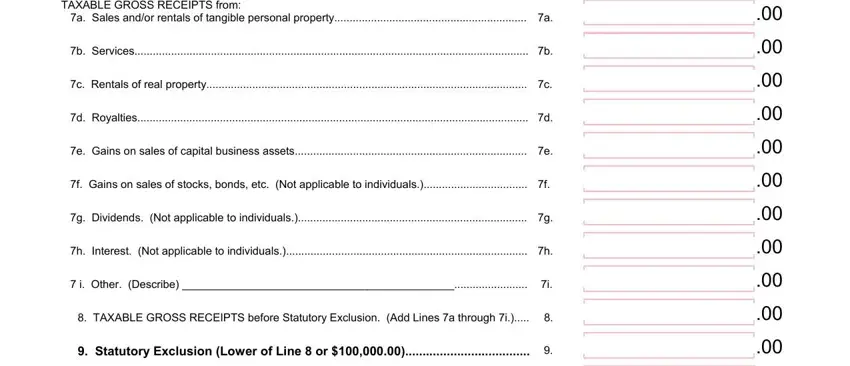

5. Since you draw near to the final parts of the file, you will find several more points to do. Particularly, TAXABLE GROSS RECEIPTS from a, b Services, c Rentals of real property, d Royalties, e Gains on sales of capital, f Gains on sales of stocks bonds, g Dividends Not applicable to, h Interest Not applicable to, i Other Describe , TAXABLE GROSS RECEIPTS before, and Statutory Exclusion Lower of Line must all be filled in.

Step 3: Before finishing the file, make sure that form fields have been filled out correctly. As soon as you are satisfied with it, click “Done." Try a free trial plan at FormsPal and get immediate access to doh 4495a ny - which you'll be able to then begin using as you want inside your FormsPal account. FormsPal is devoted to the confidentiality of all our users; we make sure all personal information entered into our editor remains protected.