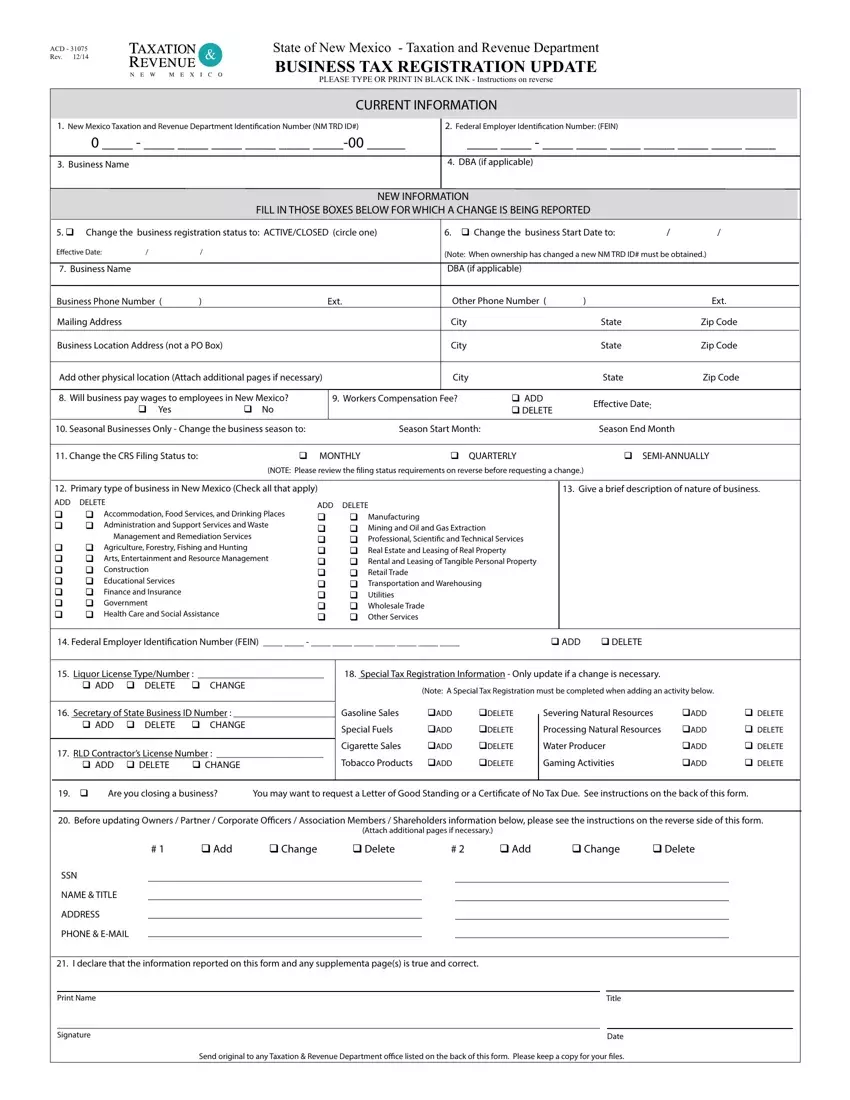

ACD - 31075

Rev. 12/14

This business tax registration update is to be used for the following tax programs: Gross Receipts, Compensating, Withholding, Workers Compensation Fee, Gasoline, Special Fuels, Cigarette, Tobacco Products, Severance, Resource, Water Producers and Gaming Activities. All attachments must contain the business name and New

Mexico Taxation and Revenue Department Identiication Number (NM TRD ID#). Should you need assistance completing this update, please contact the department at one of the ofices listed below.

COMPLETE ONLY THE AREAS TO BE UPDATED OR CHANGED – If the ownership of a proprietorship has changed, a new NM TRD ID# is required (i.e. A proprietorship has now become a corporation; a different family member is now taking ownership of the family business, etc). If the owner- ship of a partnership has changed (i.e. a partner is no longer involved or you wish to add a partner) a new NM TRD ID# is required.

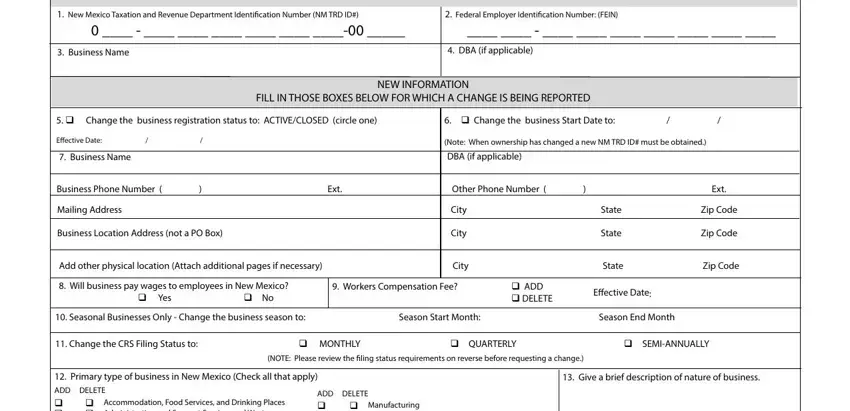

CURRENT INFORMATION

1.Provide the New Mexico Taxation and Revenue Department Identiication Number (NM TRD ID#)

2.Provide the Federal Employer Identiication Number (FEIN) if applicable. If the FEIN has changed as a result of an ownership change, a new NM TRD ID# is required.

3.Provide the current business name and name the business is Doing Business As (DBA) (as it appears on Taxation and Revenue Department records before the change is made).

NEW INFORMATION

4.Enter the name you are DOING BUSINESS AS if applicable.

5.Change the business registration status to ACTIVE or CLOSED. Circle one. Provide an effective date for the status change.

6.Change the Business Start Date if the date originally indicated is incorrect and no business activity has occurred.

7.Change as needed the Business Name, DBA, Business Phone Number and Extension, Other Phone Number, Mailing Address, Business Location Address and add any other physical locations. (Attach additional pages if necessary). Complete ONLY items that have changes.

8.Check Yes or No. Every employer, including employers of some agricultural workers, who withhold a portion of an employee’s wages for payment of federal income tax, must withhold NM income tax..

9.Check the box to Add or Delete the Workers’ Compensation Fee status. Provide an effective date when you become (or plan to become) a covered employer or are no longer subject to the fee. For more information contact the Workers’ Compensation Administration at (505) 841-6000 or www.workerscomp.state.nm.us.

10.Seasonal Businesses only – When the business is engaged in business activity outside the Business Season, the entity is no longer a Seasonal Business. Indicate the new Business Season for a seasonal business only.

11.Request to change the CRS iling Status to Monthly, Quarterly, or Semi-annually. Please be guided by the following iling status requirements:

a)Monthly – due by the 25th of the following month if combined taxes due average more than $200 per month or if you wish to ile monthly regardless of the amount due. Monthly periods are from the 1st of each month to the last day of each month.

b)Quarterly- due by the 25th of the month following the end of the quarter if combined taxes due for the quarter are less than $600 or an average of less than $200 per month in the quarter. Quarters are January 1st - March 31st; April 1st – June 30th ; July 1st – September 30th ; October 1st – December 31st.

c)Semiannual due by the 25th of the month following the end of the 6-month period if combined taxes due are less than $1,200 for the semiannual period or an average less than $200 per month for the 6 month period. Semiannual periods are January 1st - June 30th; July 1st – December 31st.

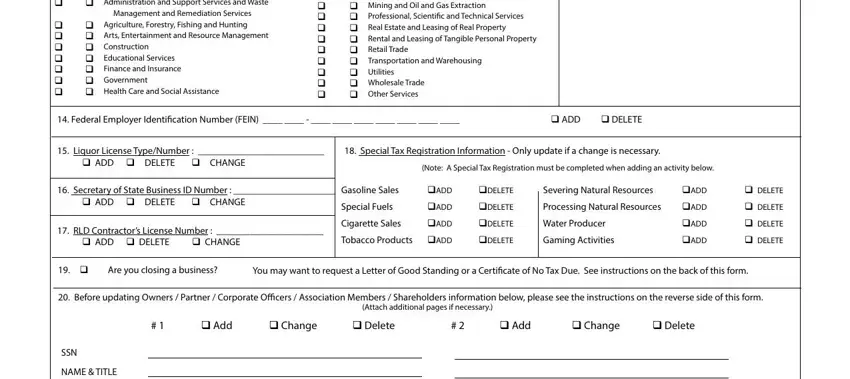

12.Add or Delete the business activity in which the business is engaged. More than one business activity can be selected. Please describe all business activities that are "added". If you are unsure as to your entity's business classiication, please contact one of ofices listed below.

13.Briely describe the nature of the type(s) of business in which you will be engaging. The lack of information may affect the type of NTTC for which you qualify.

14.Add or Delete the Federal Employer Identiication Number (FEIN), issued by the Internal Revenue Service. If the FEIN has changed as a result of an owner ship change, a new NM TRD ID# is required.

15.Liquor License Type/Number. - Add, Delete or Change the Liquor License Type/No. issued by the Alcohol and Gaming Division of the Regulation and Licensing

Department.

16.Secretary of State Business Number. – Add, Delete or Change the Business Number issued by the Secretary of State.

17.RLD Contractor's License Number. – Add, Delete, or Change the License Number issued by the Construction Industries Division of the Regulation and Licensing

Department.

18.Special Tax Registration information – Add or Delete an activity, which qualiies for Special Tax purposes. A Special Tax Registration form must be com pleted when adding an activity. Taxpayers selling, leasing, or transferring a liquor license should request a letter of no objection from the Taxation & Revenue

Department.

19.Check this box if you are closing a business. Proprietorships may want to request a Letter of Good Standing from the Department to verify that there are no outstanding liabilities or non-iled reports for the business you are closing. Corporations dissolving or withdrawing from doing business in New Mexico should request a Corporate Certiicate of No Tax Due and contact the Public Regulation Commission. Purchasers/Lessee’s (Successor in Business) of a business, license, or permit may also request a Certiicate of No Tax Due to ensure they are not liable for any taxes due the department by the seller or lessor. A Request for Tax Clearance or Letter of Good Standing can be downloaded at www.tax.state.nm.us/. For additional information, please contact one of the ofices listed below.

20.You may update an owner’s or partner’s address, telephone number, or e-mail address. You may add, change, or delete Corporate Oficers, Association Members, or Shareholders and their corresponding address, telephone number, or e-mail address. If you are unsure if a new NM TRD ID# is required, please contact the department at one of the ofices listed below. Note: When ownership has changed, a new NM TRD ID# must be obtained.

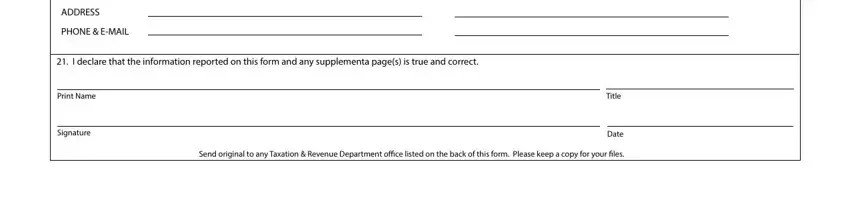

21.he registration update should be signed by an Owner, Partner, Corporate Oicer, Association Member, Shareholder, or authorized representative.

Return this form and all attachments to one of the ofices listed below.

Taxation & Revenue Department |

Taxation & Revenue Department |

Taxation & Revenue Department |

Manuel Lujan Sr. Building |

2540 El Paseo, Bldg #2 |

400 N. Pennsylvania Ste.200 |

1200 South St. Francis Dr. |

PO Box 607 |

PO Box 1557 |

PO Box 5374 |

Las Cruces, NM 88004-0607 |

Roswell, NM 88202-1557 |

Santa Fe, NM 87502-5374 |

(575) 524-6225 |

(575) 624-6065 |

(505) 827-0951 |

|

Taxation & Revenue Department |

Taxation & Revenue Department |

5301 Central NE |

3501 E. Main St., Suite N |

PO Box 8485 |

PO Box 479 |

Albuquerque, NM 87198-8485 |

Farmington, NM 87499-0479 |

(505) 841-6200 |

(505) 325-5049 |