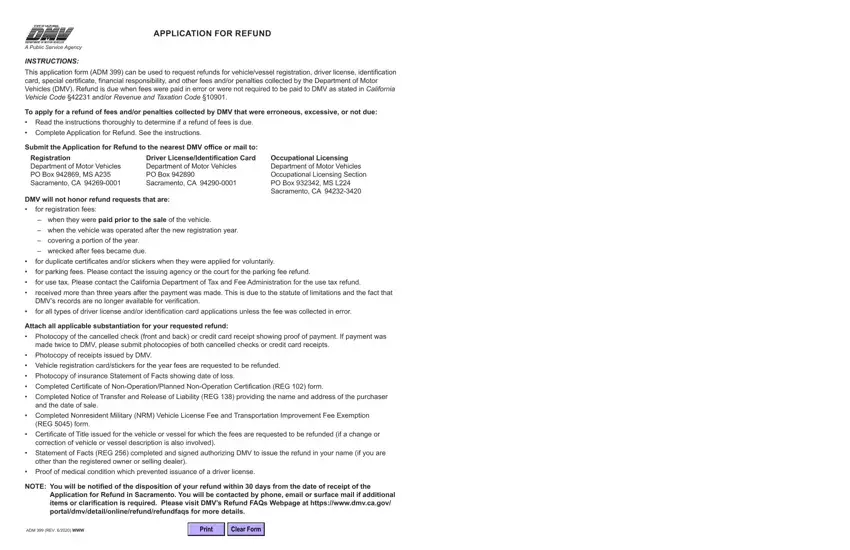

APPLICATION FOR REFUND

A Public Service Agency

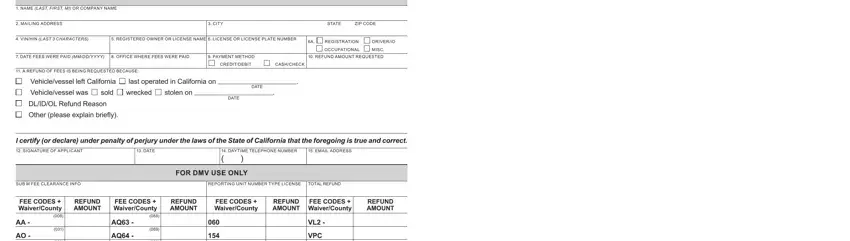

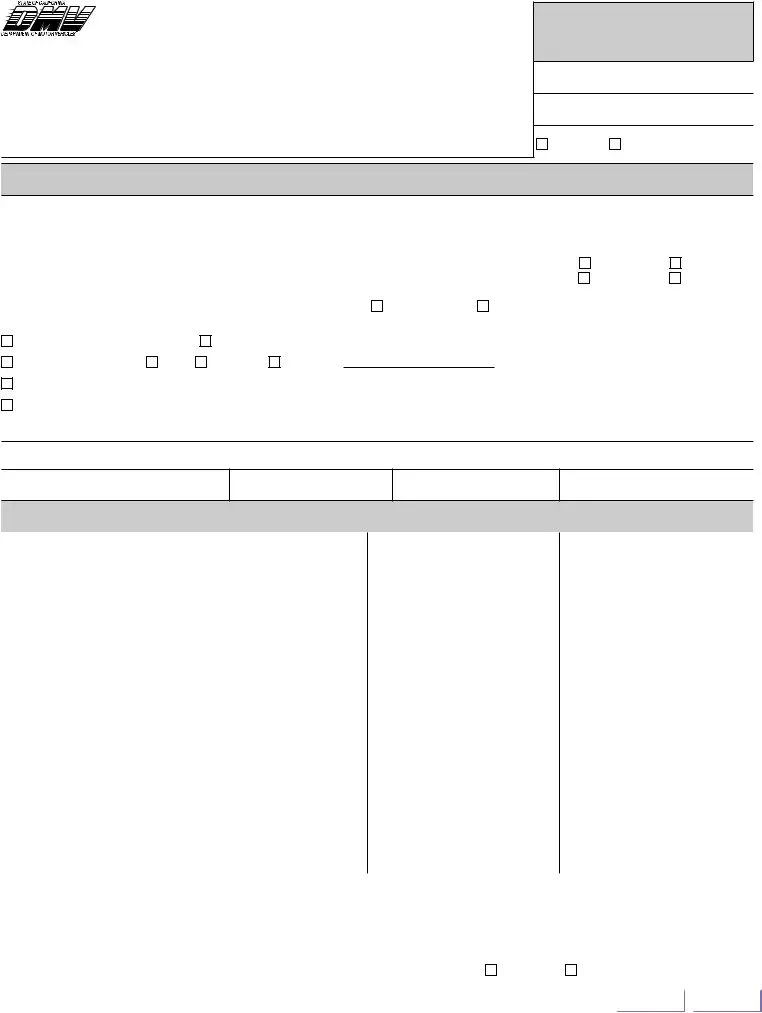

INSTRUCTIONS:

This application form (ADM 399) can be used to request refunds for vehicle/vessel registration, driver license, identification card, special certificate, financial responsibility, and other fees and/or penalties collected by the Department of Motor Vehicles (DMV). Refund is due when fees were paid in error or were not required to be paid to DMV as stated in California Vehicle Code §42231 and/or Revenue and Taxation Code §10901.

To apply for a refund of fees and/or penalties collected by DMV that were erroneous, excessive, or not due:

•Read the instructions thoroughly to determine if a refund of fees is due.

•Complete Application for Refund. See the instructions.

Submit the Application for Refund to the nearest DMV office or mail to: |

|

Registration |

Driver License/Identification Card |

Occupational Licensing |

Department of Motor Vehicles |

Department of Motor Vehicles |

Department of Motor Vehicles |

PO Box 942869, MS A235 |

PO Box 942890 |

Occupational Licensing Section |

Sacramento, CA 94269-0001 |

Sacramento, CA 94290-0001 |

PO Box 932342, MS L224 |

|

|

Sacramento, CA 94232-3420 |

DMV will not honor refund requests that are:

•for registration fees:

–when they were paid prior to the sale of the vehicle.

–when the vehicle was operated after the new registration year.

–covering a portion of the year.

–wrecked after fees became due.

•for duplicate certificates and/or stickers when they were applied for voluntarily.

•for parking fees. Please contact the issuing agency or the court for the parking fee refund.

•for use tax. Please contact the California Department of Tax and Fee Administration for the use tax refund.

•received more than three years after the payment was made. This is due to the statute of limitations and the fact that DMV’s records are no longer available for verification.

•for all types of driver license and/or identification card applications unless the fee was collected in error.

Attach all applicable substantiation for your requested refund:

•Photocopy of the cancelled check (front and back) or credit card receipt showing proof of payment. If payment was made twice to DMV, please submit photocopies of both cancelled checks or credit card receipts.

•Photocopy of receipts issued by DMV.

•Vehicle registration card/stickers for the year fees are requested to be refunded.

•Photocopy of insurance Statement of Facts showing date of loss.

•Completed Certificate of Non-Operation/Planned Non-Operation Certification (REG 102) form.

•Completed Notice of Transfer and Release of Liability (REG 138) providing the name and address of the purchaser and the date of sale.

•Completed Nonresident Military (NRM) Vehicle License Fee and Transportation Improvement Fee Exemption (REG 5045) form.

•Certificate of Title issued for the vehicle or vessel for which the fees are requested to be refunded (if a change or correction of vehicle or vessel description is also involved).

•Statement of Facts (REG 256) completed and signed authorizing DMV to issue the refund in your name (if you are other than the registered owner or selling dealer).

•Proof of medical condition which prevented issuance of a driver license.

NOTE: You will be notified of the disposition of your refund within 30 days from the date of receipt of the Application for Refund in Sacramento. You will be contacted by phone, email or surface mail if additional items or clarification is required. Please visit DMV’s Refund FAQs Webpage at https://www.dmv.ca.gov/ portal/dmv/detail/online/refund/refundfaqs for more details.