Once you open the online PDF tool by FormsPal, you can easily fill out or alter aflac cancer claim form here and now. To keep our tool on the forefront of convenience, we aim to integrate user-oriented features and improvements on a regular basis. We're always thankful for any feedback - assist us with revolutionizing how you work with PDF files. If you are looking to get going, here is what it's going to take:

Step 1: Click on the "Get Form" button above on this page to access our PDF editor.

Step 2: With the help of this state-of-the-art PDF tool, you could accomplish more than simply fill out blank fields. Express yourself and make your forms seem great with custom textual content added, or fine-tune the file's original input to perfection - all that accompanied by the capability to insert any photos and sign the file off.

Completing this PDF will require care for details. Make sure all mandatory fields are filled out properly.

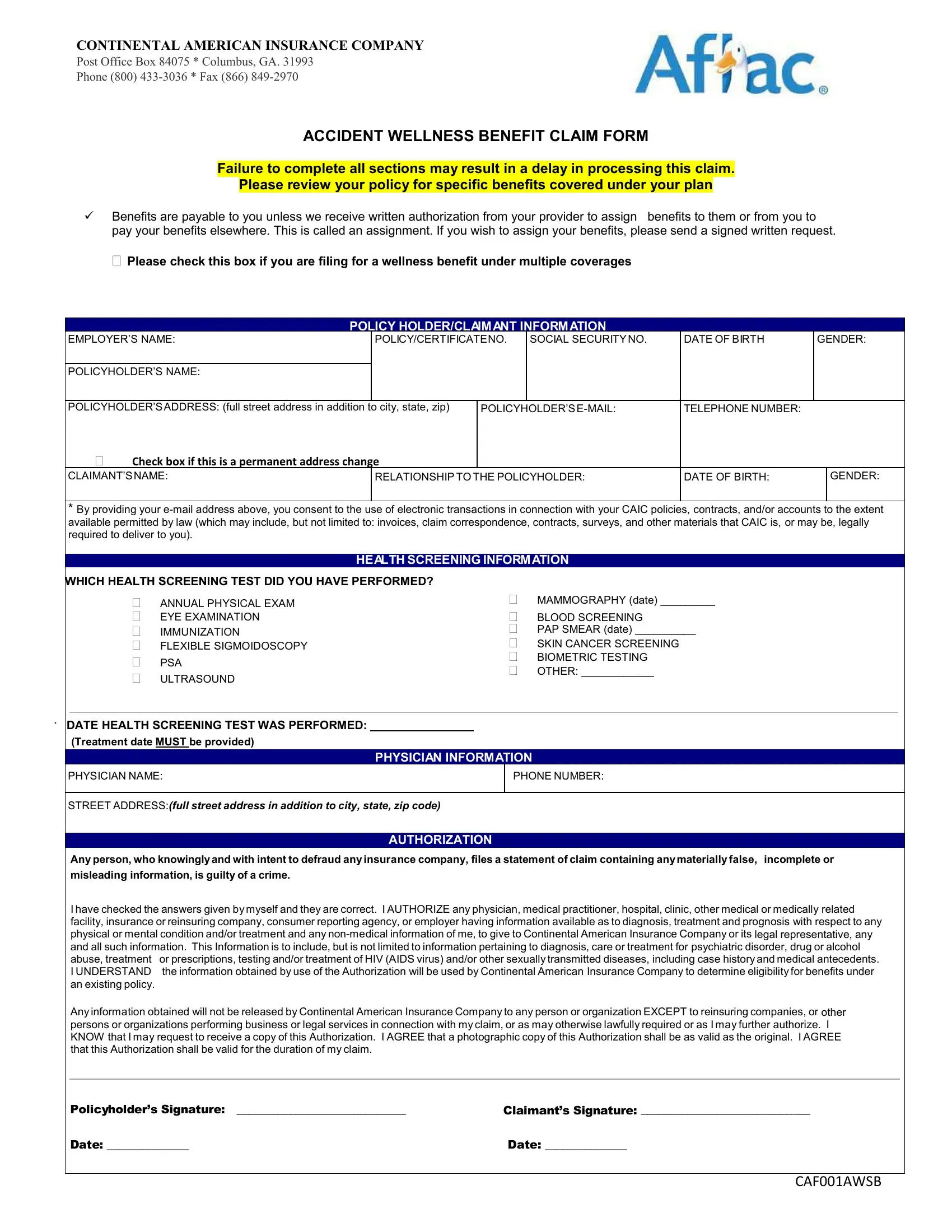

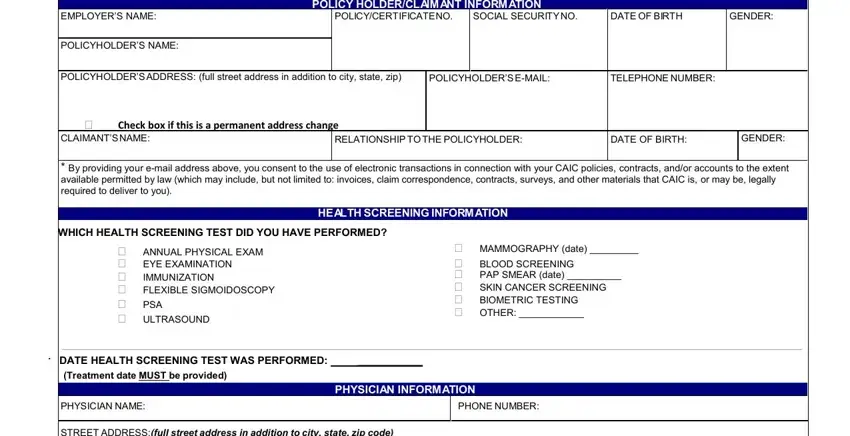

1. To start off, when completing the aflac cancer claim form, start with the form section containing next blanks:

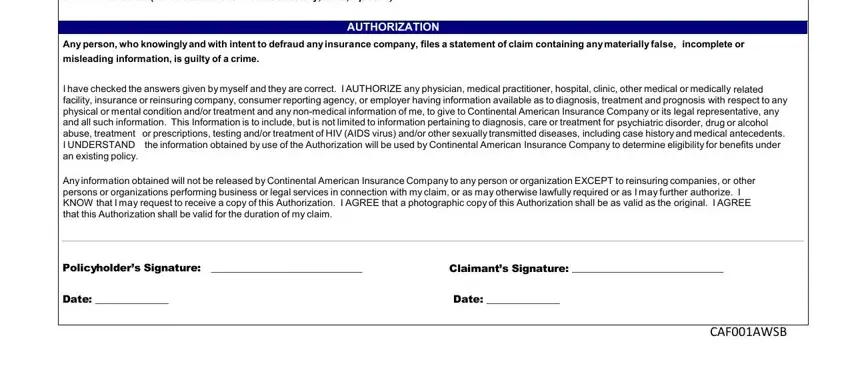

2. Once your current task is complete, take the next step – fill out all of these fields - STREET ADDRESSfull street address, Any person who knowingly and with, misleading information is guilty, AUTHORIZATION, I have checked the answers given, Any information obtained will not, Policyholders Signature , Claimants Signature , Date , Date , and CAFAWSB with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

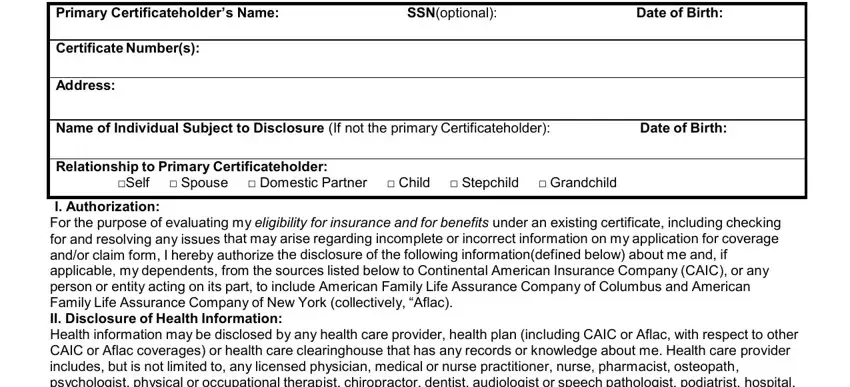

3. Within this step, review Primary Certificateholders Name, SSNoptional, Date of Birth, Certificate Numbers, Address, Name of Individual Subject to, Date of Birth, Relationship to Primary, Self Spouse Domestic Partner , and I Authorization For the purpose of. Each one of these will need to be filled out with greatest attention to detail.

4. To move onward, this fourth section will require filling out several fields. Examples of these are If records are on an adult, Signature of Individual Subject to, Date Signed, Legal Representatives Printed Name, Legal Representatives Signature, Date Signed, and AGC, which are crucial to carrying on with this PDF.

Always be extremely attentive while filling out Legal Representatives Signature and Date Signed, because this is the section where most people make a few mistakes.

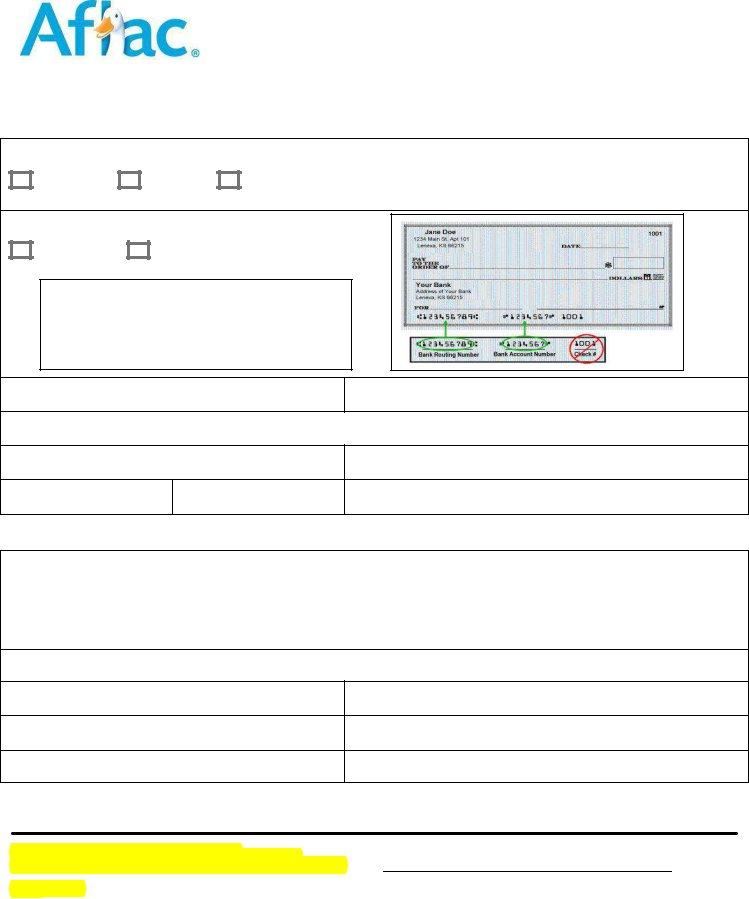

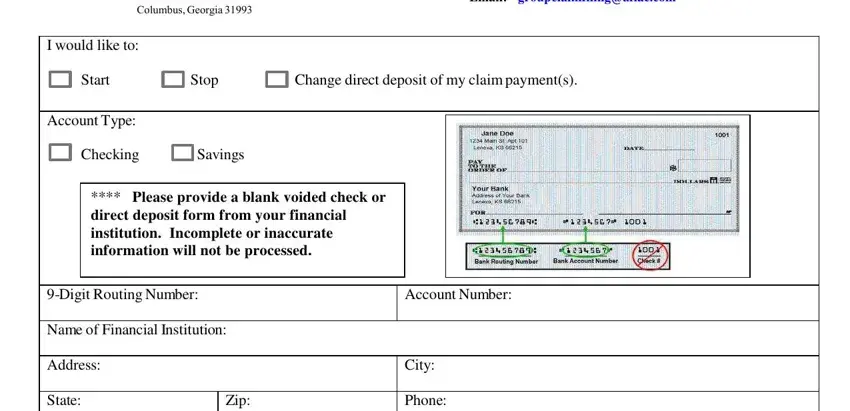

5. The very last section to finalize this PDF form is critical. Be sure you fill in the appropriate blank fields, including Continental American Insurance, Phone Fax Email, I would like to, Start, Stop, Change direct deposit of my claim, Account Type, Checking, Savings, Please provide a blank voided, Digit Routing Number, Account Number, Name of Financial Institution, Address, and State, before using the form. Otherwise, it might lead to an incomplete and potentially invalid form!

Step 3: As soon as you've reread the information you filled in, simply click "Done" to complete your FormsPal process. Make a 7-day free trial subscription with us and obtain instant access to aflac cancer claim form - download, email, or change inside your FormsPal account. At FormsPal, we aim to ensure that all of your information is kept protected.