alabama 20s can be completed without any problem. Simply use FormsPal PDF editing tool to finish the job without delay. The editor is continually improved by our team, getting handy functions and growing to be better. All it takes is several basic steps:

Step 1: Click on the orange "Get Form" button above. It will open our tool so that you can start filling out your form.

Step 2: The tool enables you to modify nearly all PDF files in many different ways. Modify it by adding your own text, correct what's already in the document, and put in a signature - all close at hand!

This form requires specific details; to guarantee consistency, you should bear in mind the tips further on:

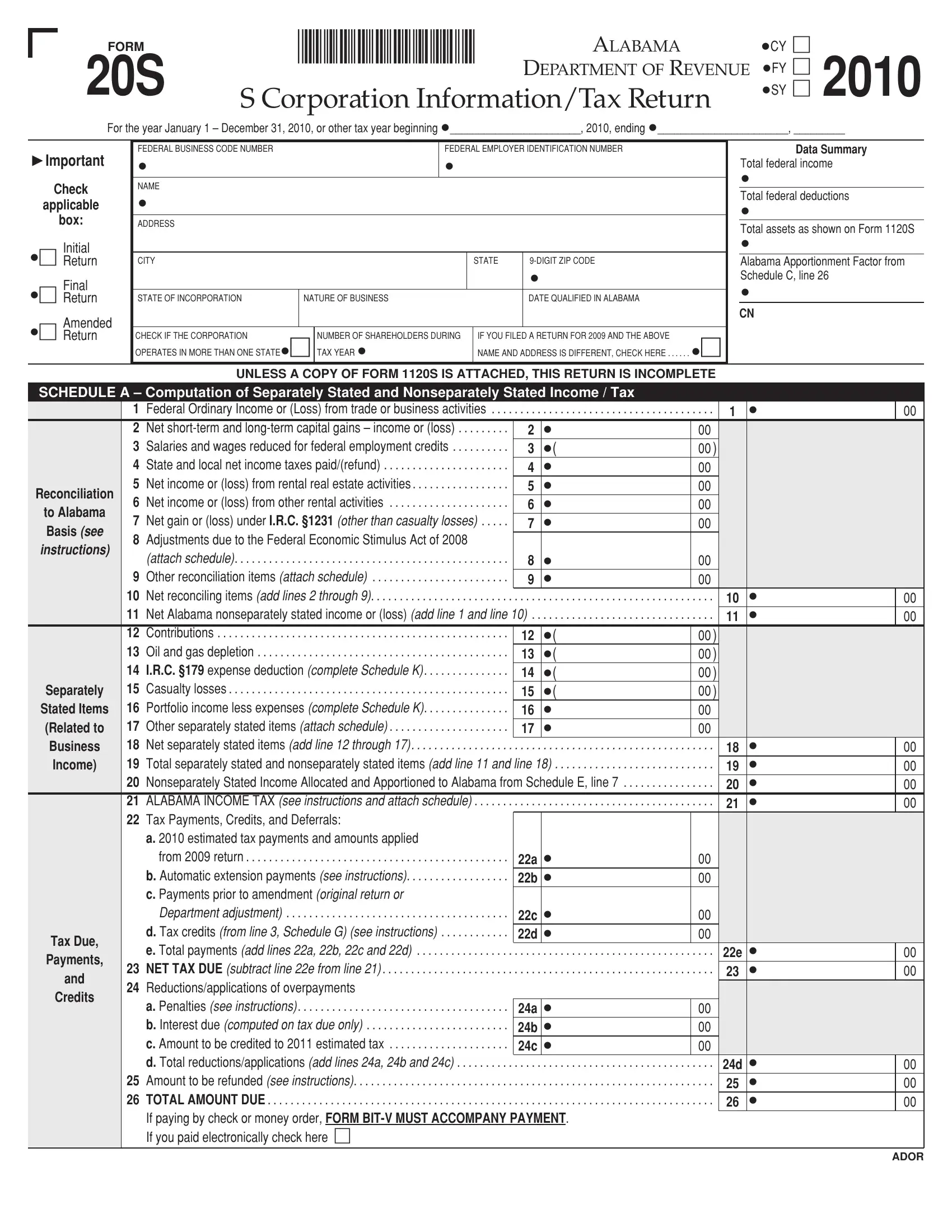

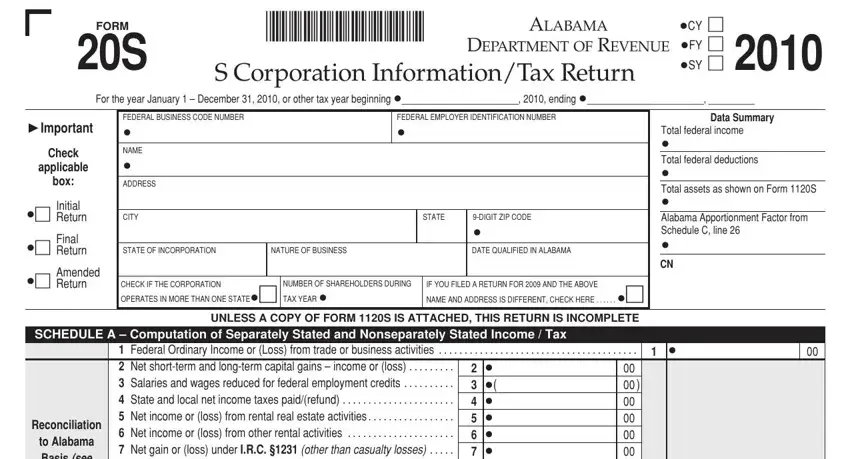

1. The alabama 20s needs certain details to be inserted. Make certain the subsequent blanks are complete:

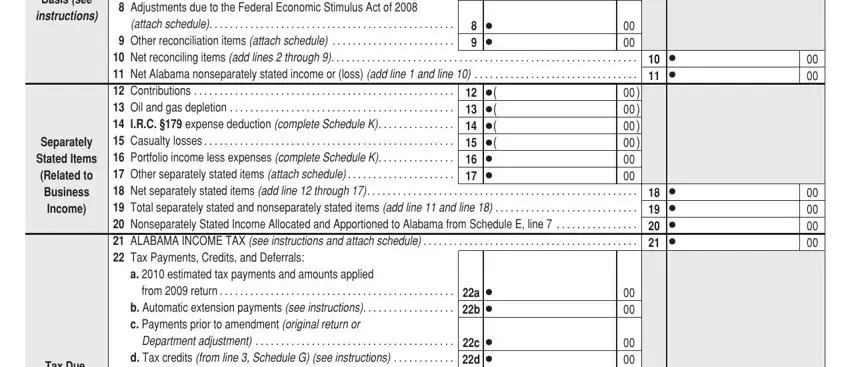

2. Once your current task is complete, take the next step – fill out all of these fields - to Alabama Basis see instructions, Separately Stated Items Related to, Tax Due Payments, Federal Ordinary Income or Loss, attach schedule , a estimated tax payments and, from return , a b, Department adjustment , and c d with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

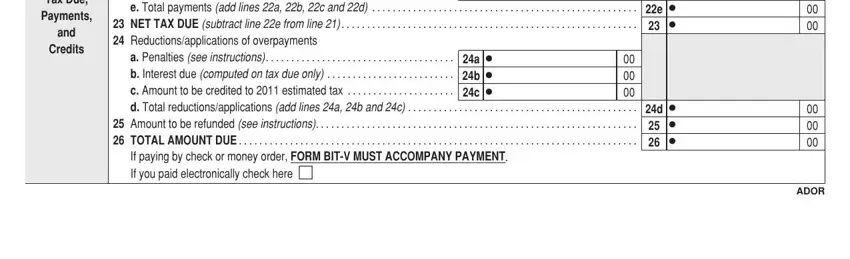

3. The following section is all about Tax Due Payments, and, Credits, Department adjustment , c d, a Penalties see instructions , a b c, If paying by check or money order, d , and ADOR - fill out every one of these blank fields.

People who use this form generally make mistakes while completing a Penalties see instructions in this part. Ensure you go over whatever you type in here.

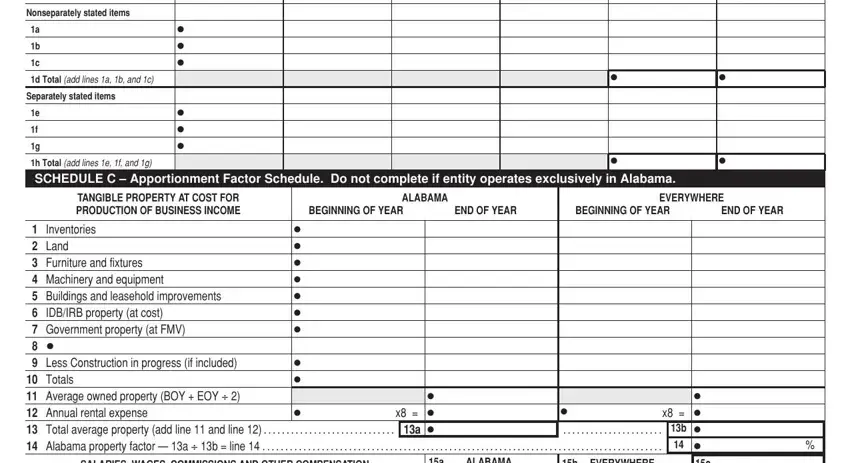

4. The fourth part comes next with the following blank fields to consider: Col A less Col C, Col B less Col D, Nonseparately stated items, d Total add lines a b and c, Separately stated items, h Total add lines e f and g, TANGIBLE PROPERTY AT COST FOR, BEGINNING OF YEAR, END OF YEAR, BEGINNING OF YEAR, END OF YEAR, ALABAMA, EVERYWHERE, Inventories Land Furniture and, and x b.

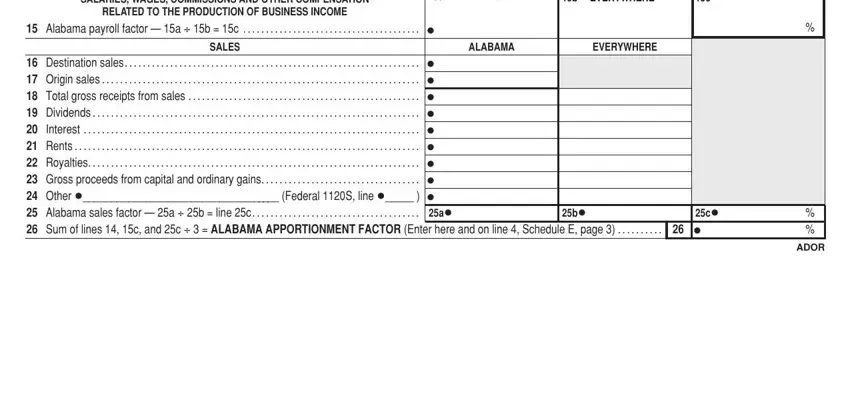

5. The very last notch to complete this form is pivotal. Be sure to fill out the displayed blank fields, consisting of SALARIES WAGES COMMISSIONS AND, RELATED TO THE PRODUCTION OF, ALABAMA, b EVERYWHERE, Alabama payroll factor a b c , SALES, ALABAMA, EVERYWHERE, Destination sales , a, and ADOR, before submitting. Failing to do so might result in an unfinished and potentially unacceptable document!

Step 3: Soon after looking through the filled out blanks, click "Done" and you are done and dusted! Try a 7-day free trial account with us and get direct access to alabama 20s - download, email, or change from your FormsPal account page. FormsPal offers risk-free document completion without data recording or any kind of sharing. Be assured that your data is secure here!