Any time you would like to fill out Alabama Form 40, it's not necessary to install any kind of applications - simply try using our PDF editor. The editor is continually improved by us, receiving new awesome features and turning out to be a lot more versatile. Here is what you would have to do to get going:

Step 1: Press the "Get Form" button in the top section of this page to get into our PDF tool.

Step 2: The tool enables you to work with your PDF form in various ways. Change it by writing any text, correct what's already in the document, and include a signature - all doable in no time!

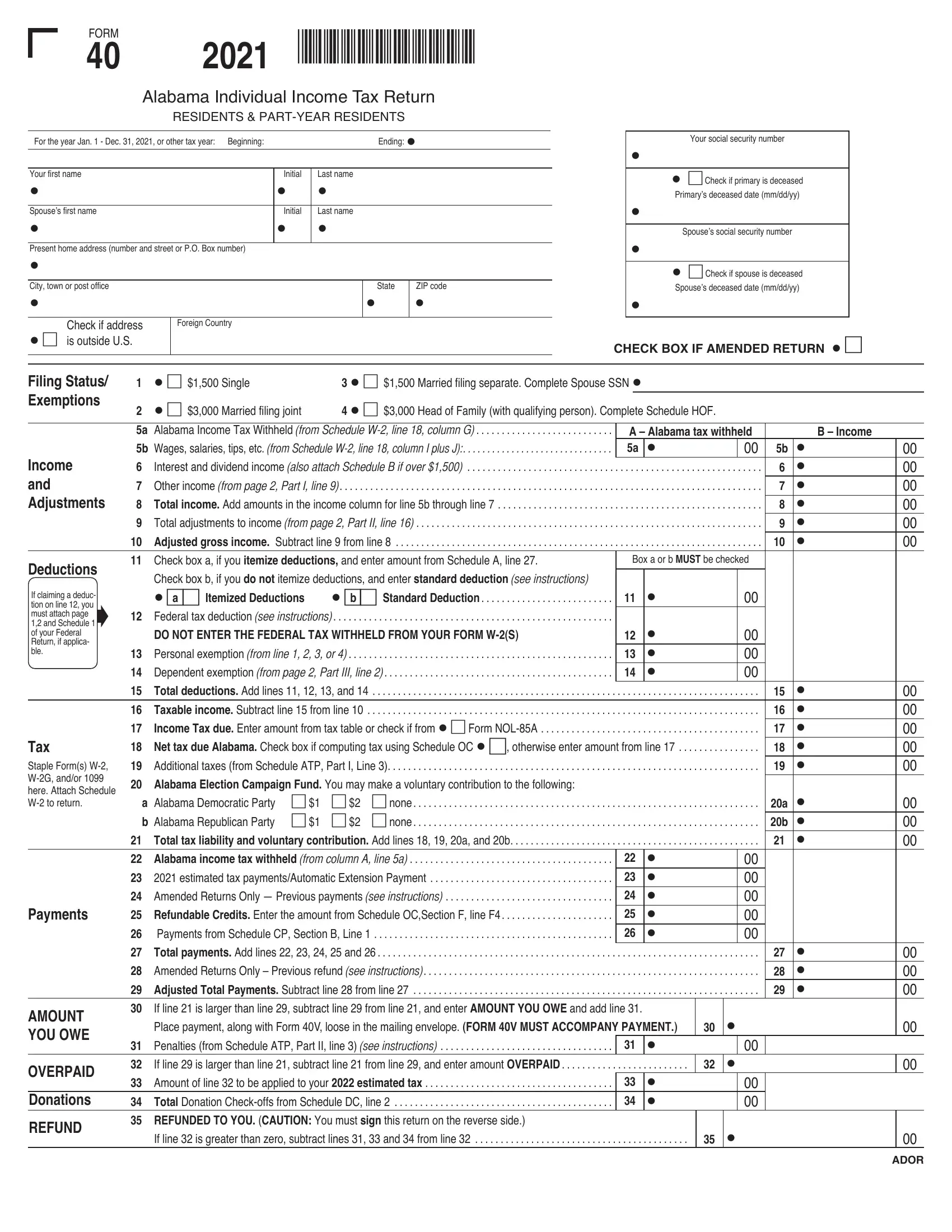

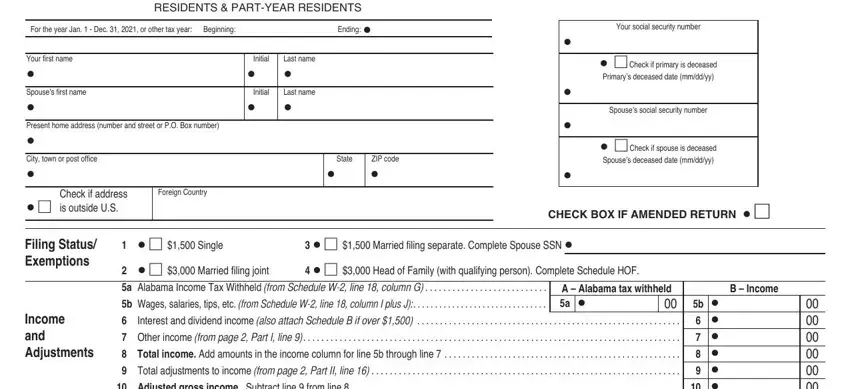

As for the blank fields of this particular PDF, here is what you want to do:

1. Start completing your Alabama Form 40 with a number of essential blanks. Gather all of the required information and ensure nothing is overlooked!

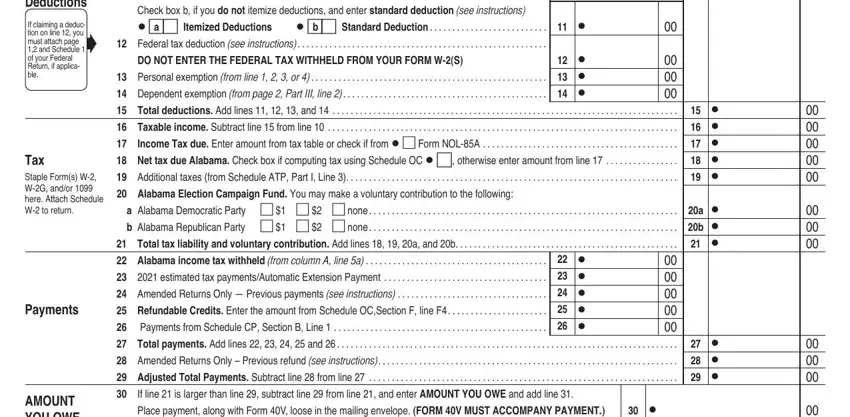

2. Your next part is to submit these particular fields: Deductions, If claiming a deduc tion on line , Tax Staple Forms W WG andor here, Payments, AMOUNT YOU OWE, Check box a if you itemize, Check box b if you do not itemize, a Itemized Deductions b , DO NOT ENTER THE FEDERAL TAX, Dependent exemption from page , Personal exemption from line , Total deductions Add lines , Alabama Election Campaign Fund, estimated tax paymentsAutomatic, and Alabama income tax withheld from.

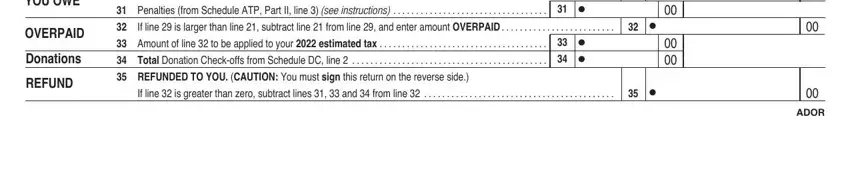

3. This subsequent part is considered fairly straightforward, AMOUNT YOU OWE, OVERPAID, Donations, REFUND, Place payment along with Form V, Penalties from Schedule ATP Part, If line is larger than line , Amount of line to be applied to, Total Donation Checkoffs from, REFUNDED TO YOU CAUTION You must, If line is greater than zero, and ADOR - all these form fields has to be completed here.

Be very attentive when filling in Place payment along with Form V and REFUNDED TO YOU CAUTION You must, because this is where many people make errors.

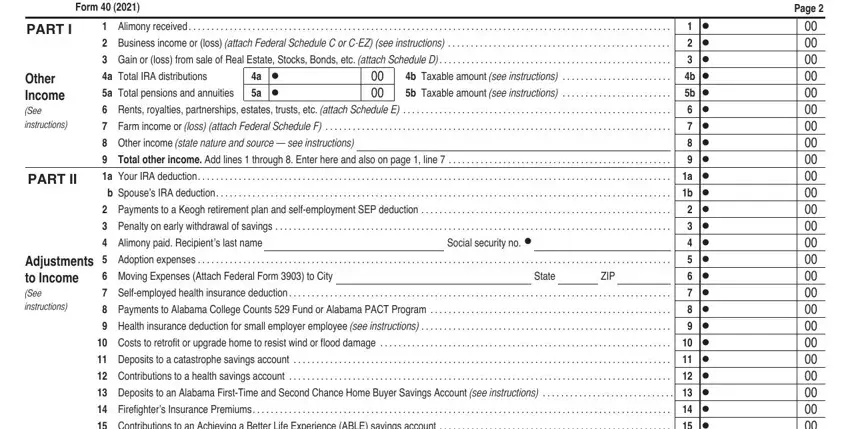

4. The next section requires your involvement in the following places: Form , PART I, Alimony received , Business income or loss attach, Gain or loss from sale of Real, Other Income See instructions, a Total IRA distributions, a Total pensions and annuities a, a , b Taxable amount see instructions, Rents royalties partnerships, Farm income or loss attach, Other income state nature and, Total other income Add lines , and PART II. Make certain to give all required info to go further.

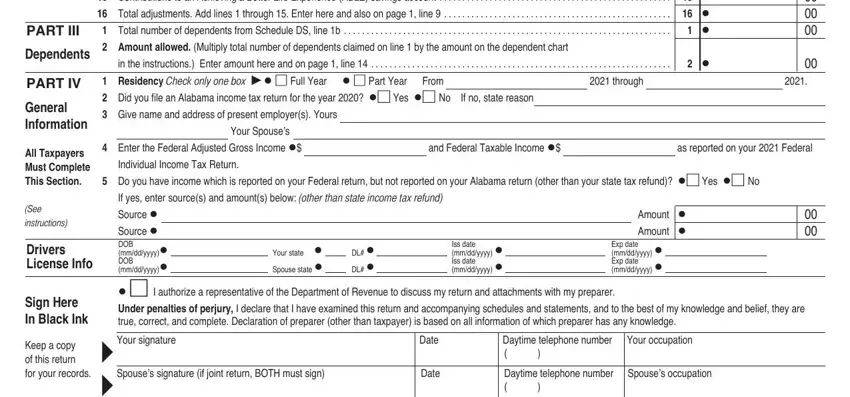

5. When you reach the conclusion of the form, there are actually a couple extra requirements that must be fulfilled. Specifically, Contributions to an Achieving a, Total adjustments Add lines , PART III, Total number of dependents from, Page , Dependents, PART IV, General Information, All Taxpayers Must Complete This, See instructions, Drivers License Info, Sign Here In Black Ink, Keep a copy of this return for, Amount allowed Multiply total, and in the instructions Enter amount should be filled out.

Step 3: Reread everything you've typed into the blank fields and then hit the "Done" button. Download your Alabama Form 40 once you subscribe to a free trial. Conveniently access the form in your personal cabinet, together with any edits and adjustments all saved! We don't share or sell any information you type in while completing forms at our website.