Using PDF documents online is always simple with our PDF editor. You can fill in illustration here painlessly. The tool is constantly improved by our team, acquiring useful features and growing to be greater. All it takes is a few easy steps:

Step 1: Click on the orange "Get Form" button above. It is going to open our pdf tool so that you could start filling out your form.

Step 2: When you launch the PDF editor, you will get the form made ready to be filled out. Other than filling out different fields, it's also possible to do other actions with the form, that is putting on any words, changing the initial textual content, inserting graphics, affixing your signature to the PDF, and much more.

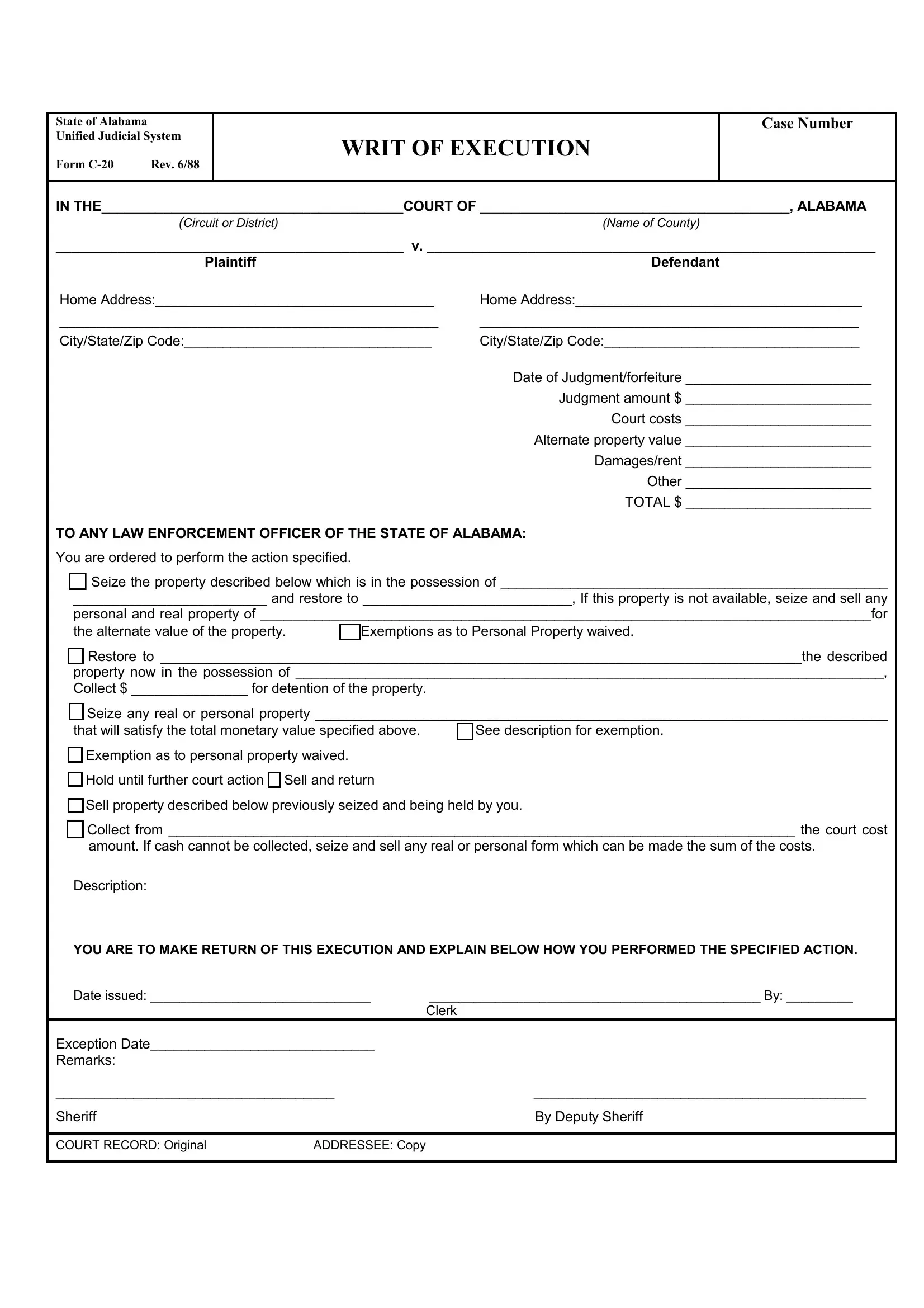

This form will need particular details to be filled out, thus be sure to take the time to fill in exactly what is requested:

1. Start completing your illustration with a group of necessary fields. Note all the required information and make certain there is nothing left out!

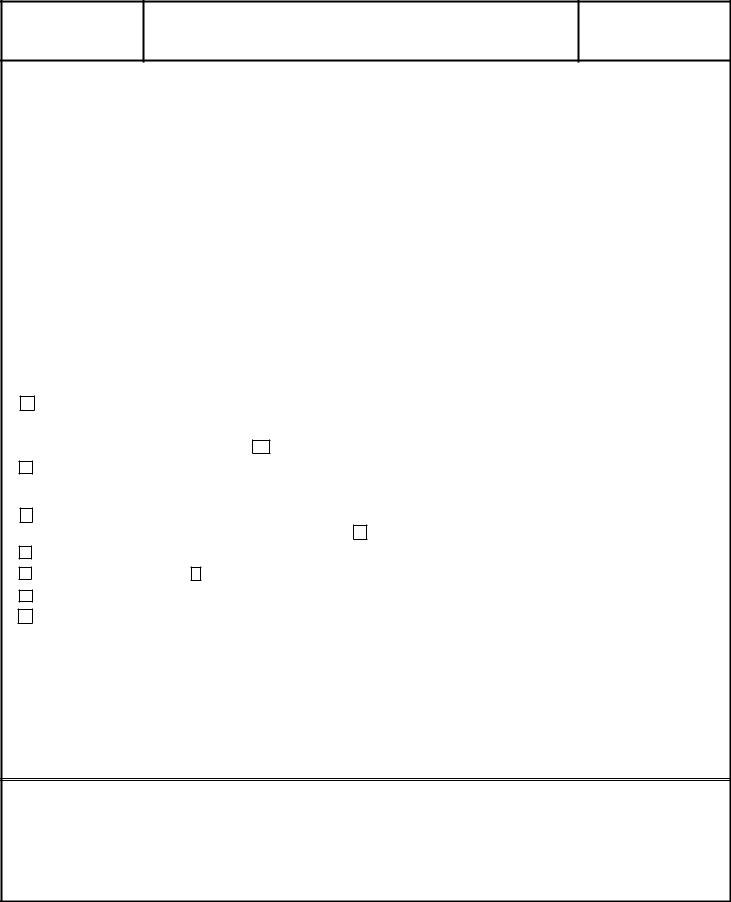

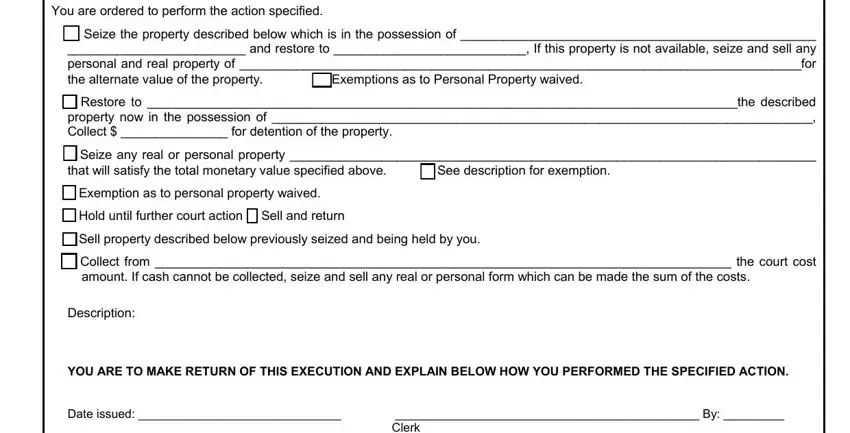

2. After filling in this part, go on to the next part and fill out the essential details in these blanks - You are ordered to perform the, Seize the property described, amount If cash cannot be collected, and Description YOU ARE TO MAKE RETURN.

3. Completing Description YOU ARE TO MAKE RETURN, Exception Date Remarks , Sheriff By Deputy Sheriff, and COURT RECORD Original ADDRESSEE is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

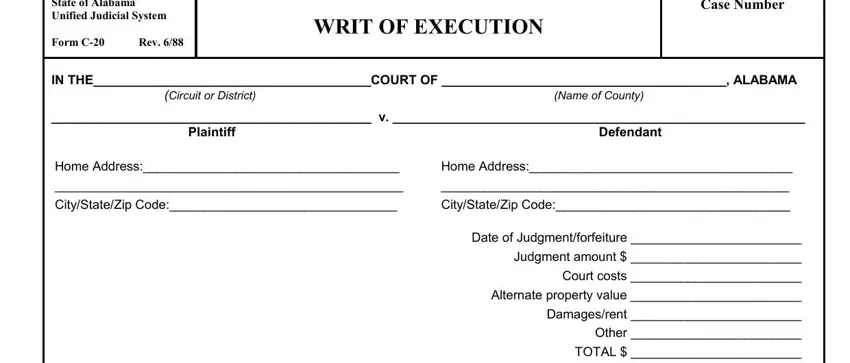

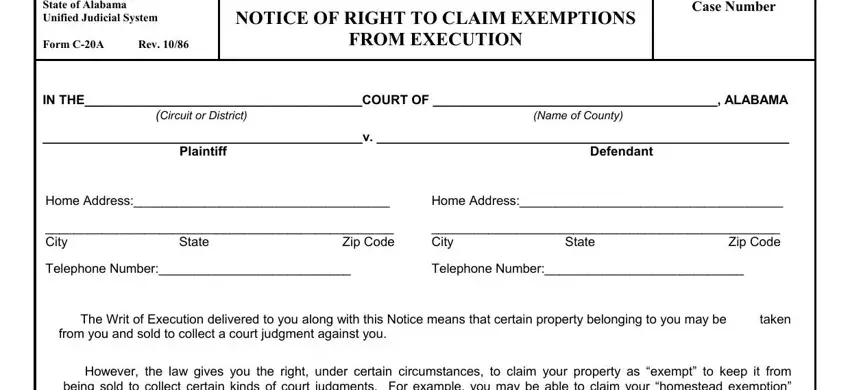

4. The next section needs your involvement in the subsequent parts: State of Alabama Unified Judicial, NOTICE OF RIGHT TO CLAIM EXEMPTIONS, FROM EXECUTION, Case Number, IN THECOURT OF ALABAMA Circuit or, v Plaintiff Defendant, Home Address, Home Address, City State Zip Code, City State Zip Code, Telephone Number, Telephone Number, The Writ of Execution delivered to, and However the law gives you the. Make sure that you enter all needed information to go forward.

A lot of people often make mistakes when completing The Writ of Execution delivered to in this section. You should definitely read again what you enter right here.

Step 3: Reread the information you have entered into the blanks and click the "Done" button. Get your illustration once you sign up for a 7-day free trial. Instantly use the pdf file inside your FormsPal account, along with any edits and changes being automatically preserved! We do not sell or share the details that you type in whenever working with forms at our website.