Using PDF forms online can be surprisingly easy using our PDF tool. Anyone can fill out XYZ here within minutes. Our editor is continually evolving to deliver the best user experience achievable, and that's thanks to our commitment to continuous enhancement and listening closely to testimonials. All it takes is several easy steps:

Step 1: Press the orange "Get Form" button above. It's going to open up our tool so that you could begin filling out your form.

Step 2: With the help of our online PDF tool, you may do more than merely fill in blank form fields. Edit away and make your forms appear great with customized textual content added in, or tweak the original input to perfection - all that comes with the capability to incorporate stunning graphics and sign the document off.

It's an easy task to fill out the pdf with this helpful guide! Here's what you should do:

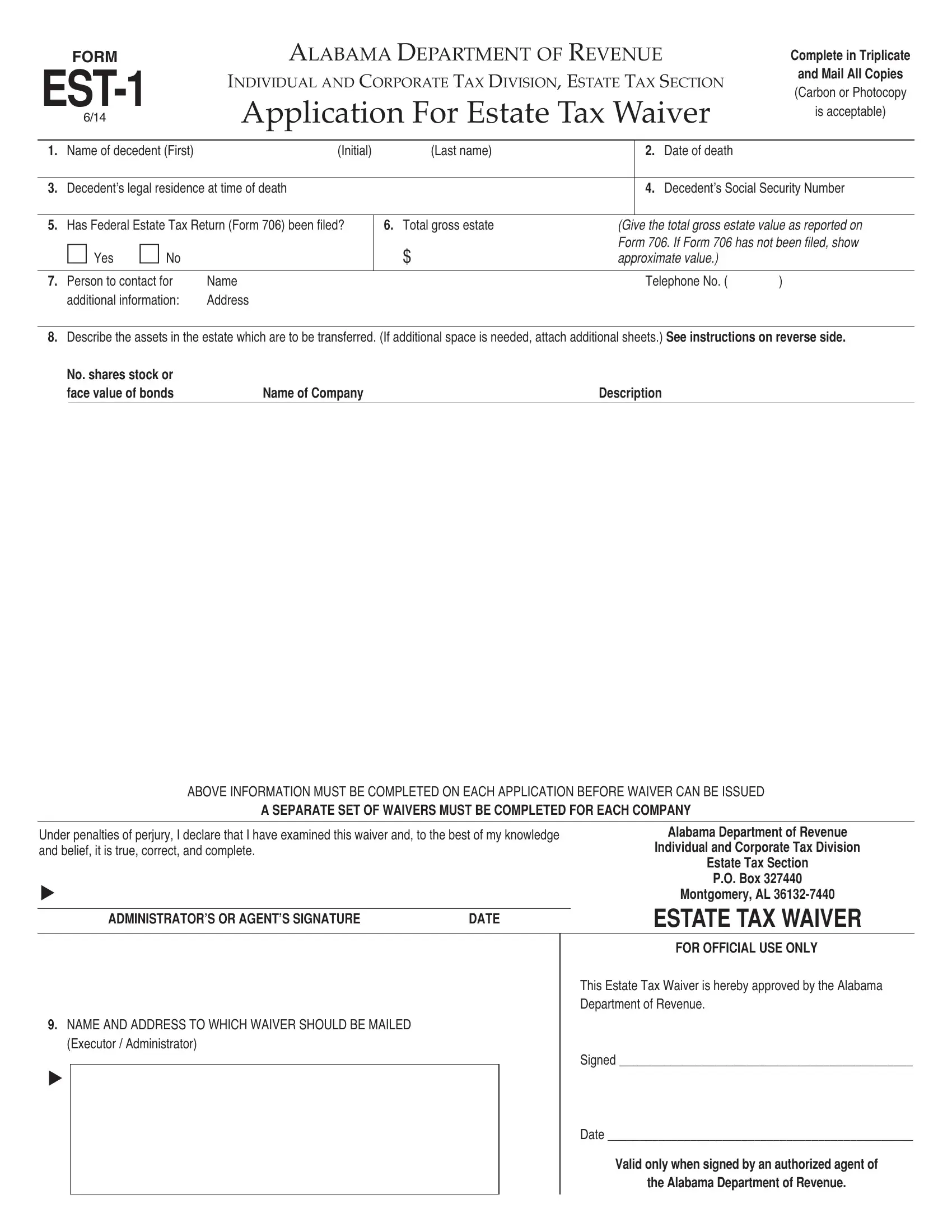

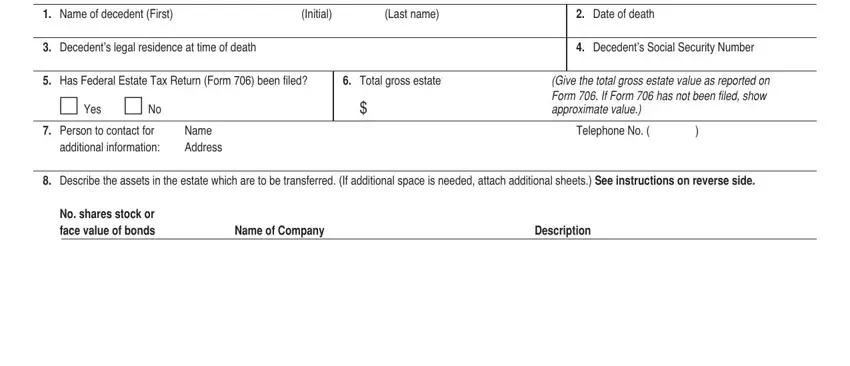

1. It is crucial to fill out the XYZ accurately, thus be mindful while filling out the areas comprising these fields:

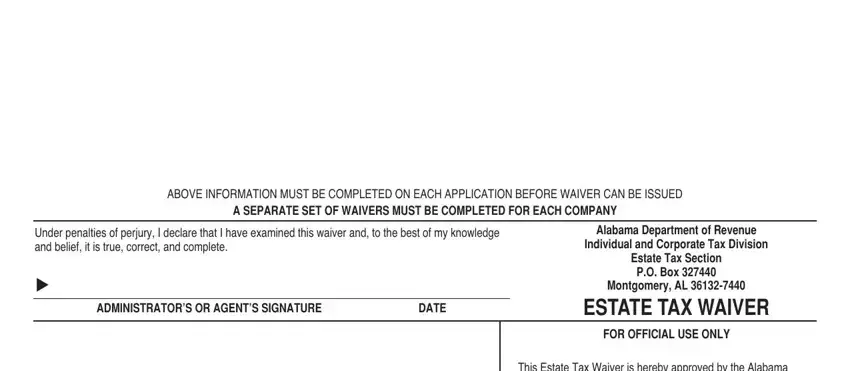

2. When this segment is done, you need to insert the needed details in ABOVE INFORMATION MUST BE, A SEPARATE SET OF WAIVERS MUST BE, Under penalties of perjury I, ADMINISTRATORS OR AGENTS SIGNATURE, Alabama Department of Revenue, Individual and Corporate Tax, Estate Tax Section PO Box , Montgomery AL , ESTATE TAX WAIVER, FOR OFFICIAL USE ONLY, and This Estate Tax Waiver is hereby so that you can move forward to the next stage.

3. Completing NAME AND ADDRESS TO WHICH WAIVER, Signed , Date , Valid only when signed by an, and the Alabama Department of Revenue is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

As to NAME AND ADDRESS TO WHICH WAIVER and the Alabama Department of Revenue, ensure that you get them right here. Both these are the key fields in this form.

Step 3: Once you have looked again at the information in the blanks, click on "Done" to finalize your FormsPal process. Acquire your XYZ the instant you sign up for a free trial. Quickly get access to the pdf file from your FormsPal cabinet, with any edits and adjustments conveniently saved! FormsPal offers secure document editor devoid of data record-keeping or any type of sharing. Be assured that your information is in good hands with us!