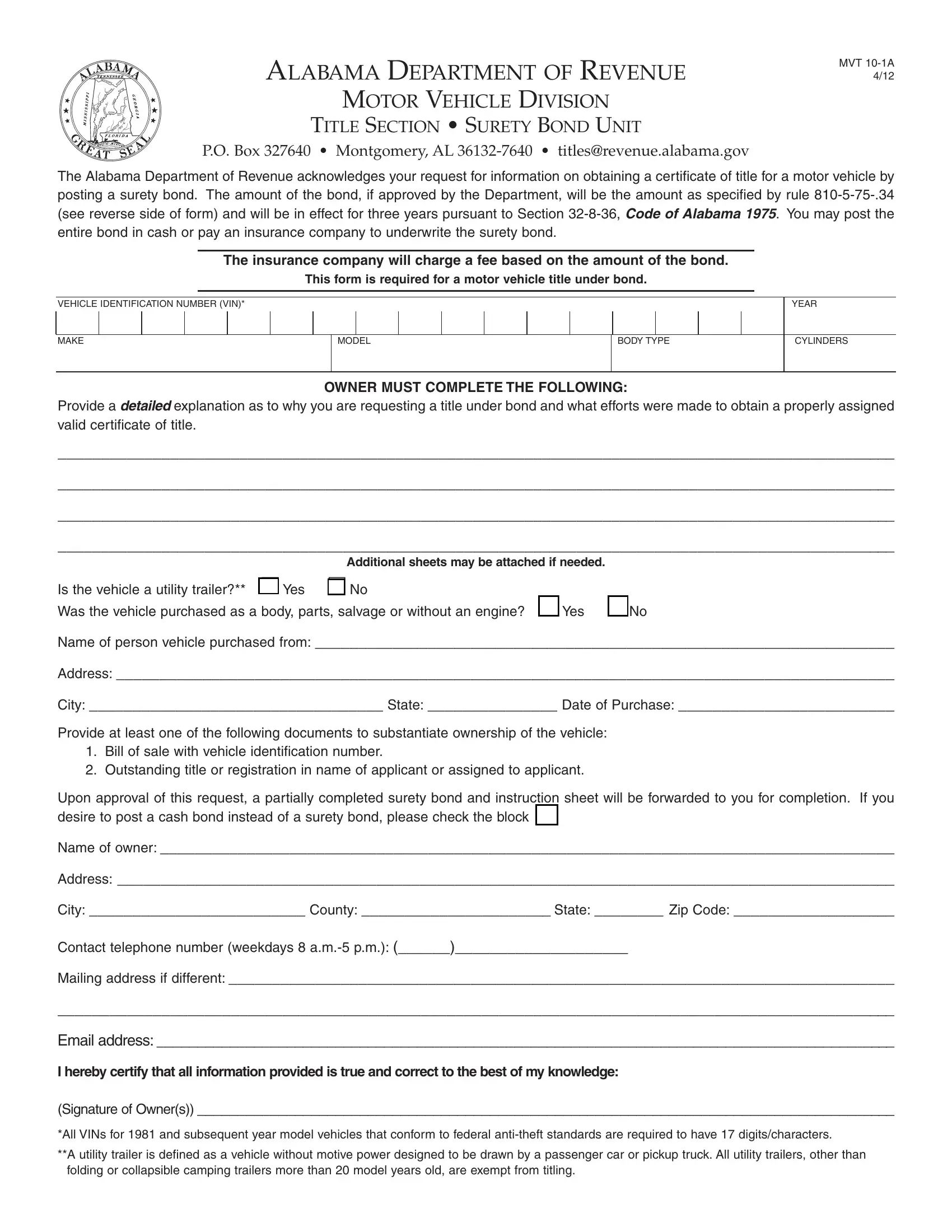

ALABAMA DEPARTMENT OF REVENUE

MOTOR VEHICLE DIVISION

TITLE SECTION • SURETY BOND UNIT

P.O. Box 327640 • Montgomery, AL 36132-7640 • titles@revenue.alabama.gov

The Alabama Department of Revenue acknowledges your request for information on obtaining a certificate of title for a motor vehicle by posting a surety bond. The amount of the bond, if approved by the Department, will be the amount as specified by rule 810-5-75-.34 (see reverse side of form) and will be in effect for three years pursuant to Section 32-8-36, CODE OF ALABAMA 1975. You may post the entire bond in cash or pay an insurance company to underwrite the surety bond.

The insurance company will charge a fee based on the amount of the bond.

This form is required for a motor vehicle title under bond.

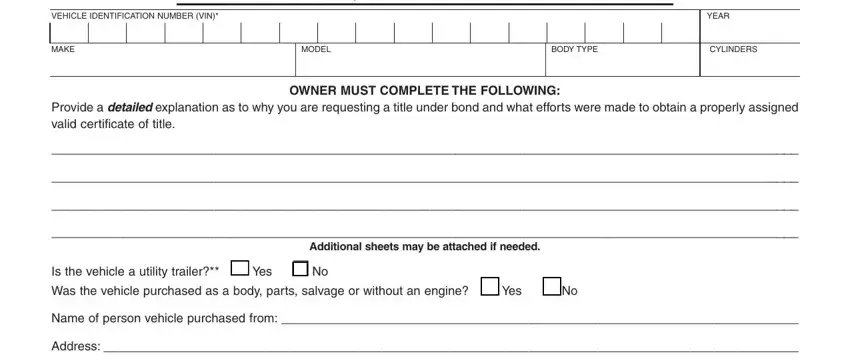

VEHICLE IDENTIFICATION NUMBER (VIN)*

OWNER MUST COMPLETE THE FOLLOWING:

Provide a DETAILED explanation as to why you are requesting a title under bond and what efforts were made to obtain a properly assigned valid certificate of title.

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Additional sheets may be attached if needed.

Is the vehicle a utility trailer?** Yes No

Was the vehicle purchased as a body, parts, salvage or without an engine?

Name of person vehicle purchased from: ___________________________________________________________________

Address: __________________________________________________________________________________________

City: __________________________________ State: _______________ Date of Purchase: _________________________

Provide at least one of the following documents to substantiate ownership of the vehicle:

1.Bill of sale with vehicle identification number.

2.Outstanding title or registration in name of applicant or assigned to applicant.

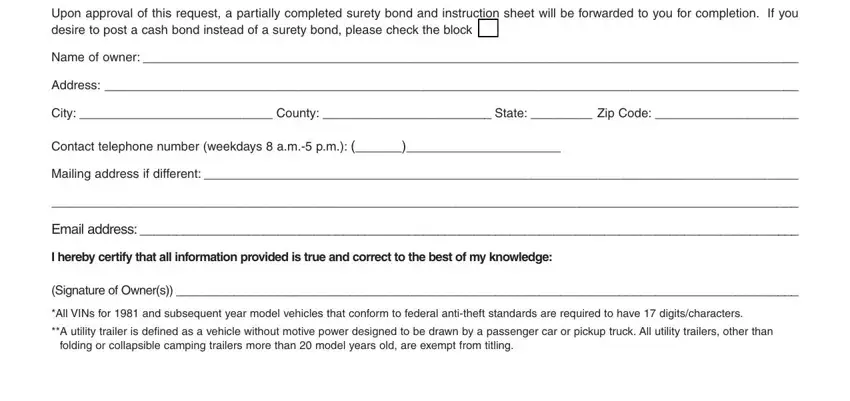

Upon approval of this request, a partially completed surety bond and instruction sheet will be forwarded to you for completion. If you desire to post a cash bond instead of a surety bond, please check the block .

Name of owner: _____________________________________________________________________________________

Address: __________________________________________________________________________________________

City: _________________________ County: ______________________ State: ________ Zip Code: ___________________

Contact telephone number (weekdays 8 a.m.-5 p.m.): (______)____________________

Mailing address if different: _____________________________________________________________________________

_________________________________________________________________________________________________

Email address: ___________________________________________________________________________________________

I hereby certify that all information provided is true and correct to the best of my knowledge:

(Signature of Owner(s)) ______________________________________________________________________________________

*All VINs for 1981 and subsequent year model vehicles that conform to federal anti-theft standards are required to have 17 digits/characters.

**A utility trailer is defined as a vehicle without motive power designed to be drawn by a passenger car or pickup truck. All utility trailers, other than folding or collapsible camping trailers more than 20 model years old, are exempt from titling.

The standardized amount of the surety bonds shall be as follows:

1.Trailers:

a.Less than five (5) model years old – $25,000

b.Five (5) model years old but less than ten (10) model years old – $10,000

b.Ten (10) or more model years old – $5,000

2.Passenger vehicles and pickup trucks:

a.Less than five (5) model years old – $50,000

b.Five (5) model years old but less than ten (10) model years old – $25,000

c.Ten (10) or more model years old – $10,000

3.Trucks, buses and recreational vehicles:

a.Less than five (5) model years old – $100,000

b.Five (5) model years old but less than ten (10) model years old – $50,000

c.Ten (10) or more model years old – $25,000

4.Motorcycles:

a.Less than five (5) model years old – $25,000

b.Five (5) model years old but less than ten (10) model years old – $10,000

c.Ten (10) or more model years old – $5,000

5.Manufactured homes*:

a.Less than (10) model years old – $50,000

b.Ten (10) or more model years old – $25,000

*Manufactured home bond requests must be initiated directly through a designated agent of the Revenue Department using the elec- tronic title application processing system (ETAPS).

Exemptions

(1)Effective January 1, 2012, no certificate of title shall be issued for any manufactured homes, trailer, semi-trailer, travel trailer, or fold- ing or collapsible camping trailer more than twenty (20) model years old. This exemption is applicable on January 1 of each year and applies to all manufactured homes, trailers, semi-trailers, travel trailers, and folding or collapsible camping trailers with a model year, as designated by the manufacturer, older than twenty (20) years from the current calendar year. All utility trailers, other than folding or collapsible camping trailers, are still exempt from titling regardless of the year model.

Example: As of January 1, 2012, all 1991 and prior year model manufactured homes, trailers, semi-trailers, travel trailers, and fold- ing or collapsible camping trailers are exempt from the titling provisions of Chapter 8, Title 32, CODE OF ALABAMA 1975.

(2)Effective January 1, 2012, no certificate of title shall be issued for any motor vehicle more than thirty-five (35) model years old. This exemption is applicable on January 1 of each year and applies to all motor vehicles with a model year, as designated by the manu- facturer, older than thirty-five (35) years from the current calendar year.

Example: As of January 1, 2012, all 1976 and prior year model motor vehicles are exempt from the titling provisions of Chapter 8,

Title 32, CODE OF ALABAMA 1975.

(3)Effective January 1, 2012, no certificate of title shall be issued for a low speed vehicle. A low speed vehicle is defined as a four- wheeled motor vehicle with a top speed of not greater than 25 miles per hour, a gross vehicle weight rating (GVWR) of which is less than 3,000 pounds and complying with the safety standards provided in 49 C.F.R. Section 571.500. The term includes neighborhood electric vehicles.

NOTE: The exemption from titling does not invalidate any Alabama certificate of title that is currently in effect. However, no

subsequent title, including a replacement certificate of title, can be issued if the vehicle is exempt from titling.