This PDF editor was built with the objective of allowing it to be as effortless and easy-to-use as possible. The following steps can certainly make completing the walmart critical illness quick and simple.

Step 1: The web page includes an orange button that says "Get Form Now". Select it.

Step 2: Right now, you are able to change your walmart critical illness. Our multifunctional toolbar helps you include, remove, transform, highlight, as well as undertake other sorts of commands to the content and fields within the file.

The next areas are what you will need to complete to obtain the finished PDF form.

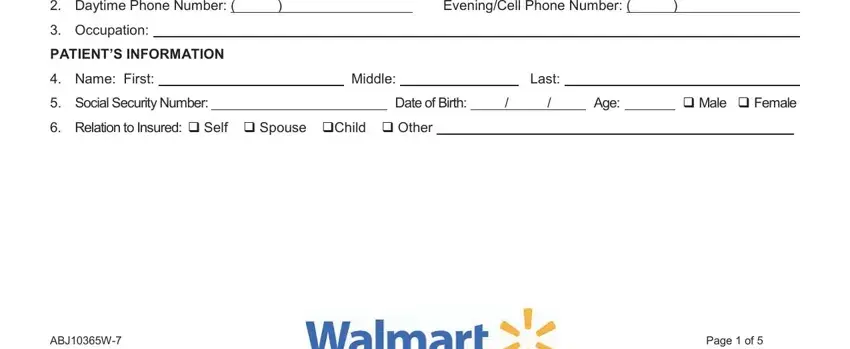

Provide the demanded details in the Daytime Phone Number, EveningCell Phone Number, Occupation, PATIENTS INFORMATION, Name First, Social Security Number, Middle, Last, Date of Birth Age, cid Male cid Female, Relation to Insured cid Self cid, ABJW, and Page of field.

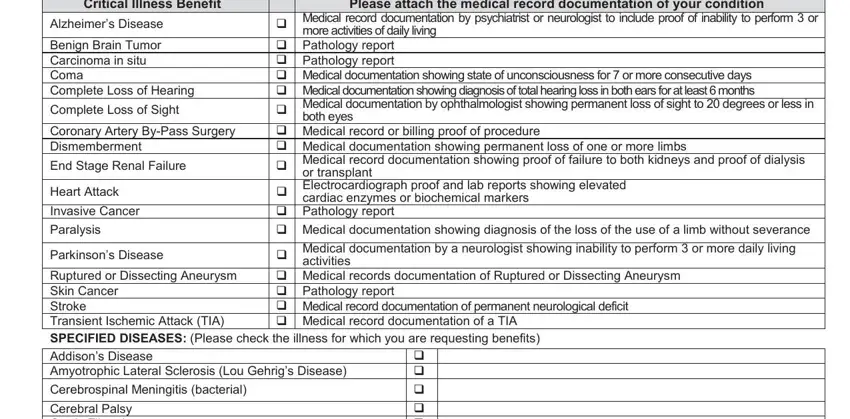

Within the section dealing with Critical Illness Benefit, Alzheimers Disease, Benign Brain Tumor Carcinoma in, Complete Loss of Sight, Coronary Artery ByPass Surgery, End Stage Renal Failure, Heart Attack, Invasive Cancer, Paralysis, Parkinsons Disease, more activities of daily living, Please attach the medical record, cardiac enzymes or biochemical, or transplant, and both eyes, one should note some appropriate information.

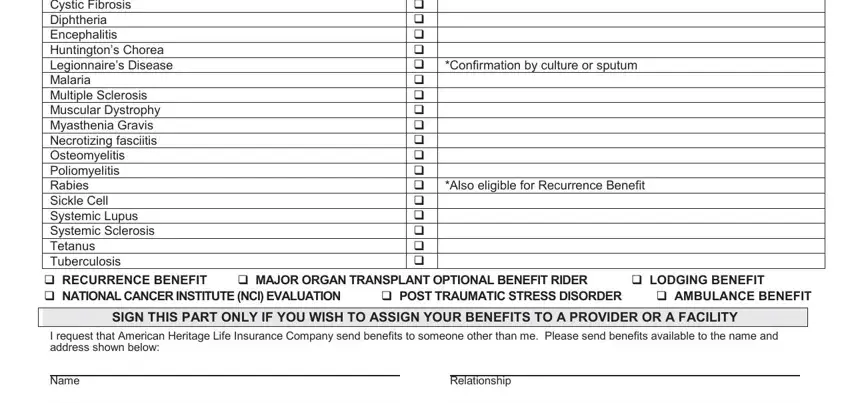

Spell out the rights and responsibilities of the sides within the space Cerebral Palsy Cystic Fibrosis, cid cid cid cid cid cid, cid MAJOR ORGAN TRANSPLANT, cid LODGING BENEFIT, cid POST TRAUMATIC STRESS DISORDER, cid AMBULANCE BENEFIT, SIGN THIS PART ONLY IF YOU WISH TO, I request that American Heritage, Name, and Relationship.

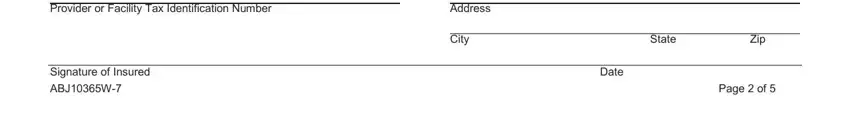

Look at the areas Provider or Facility Tax, Signature of Insured ABJW, Address, City, State, Zip, Date, and Page of and next complete them.

Step 3: As soon as you are done, press the "Done" button to transfer your PDF form.

Step 4: To protect yourself from any type of difficulties as time goes on, be sure to create a minimum of two or three copies of the document.