The PDF editor makes managing files stress-free. It is very easy to modify the [FORMNAME] form. Use the following steps in order to accomplish this:

Step 1: Look for the button "Get Form Here" on this site and select it.

Step 2: It's now possible to update your business tax receipt application. The multifunctional toolbar lets you insert, remove, improve, and highlight content or perhaps carry out many other commands.

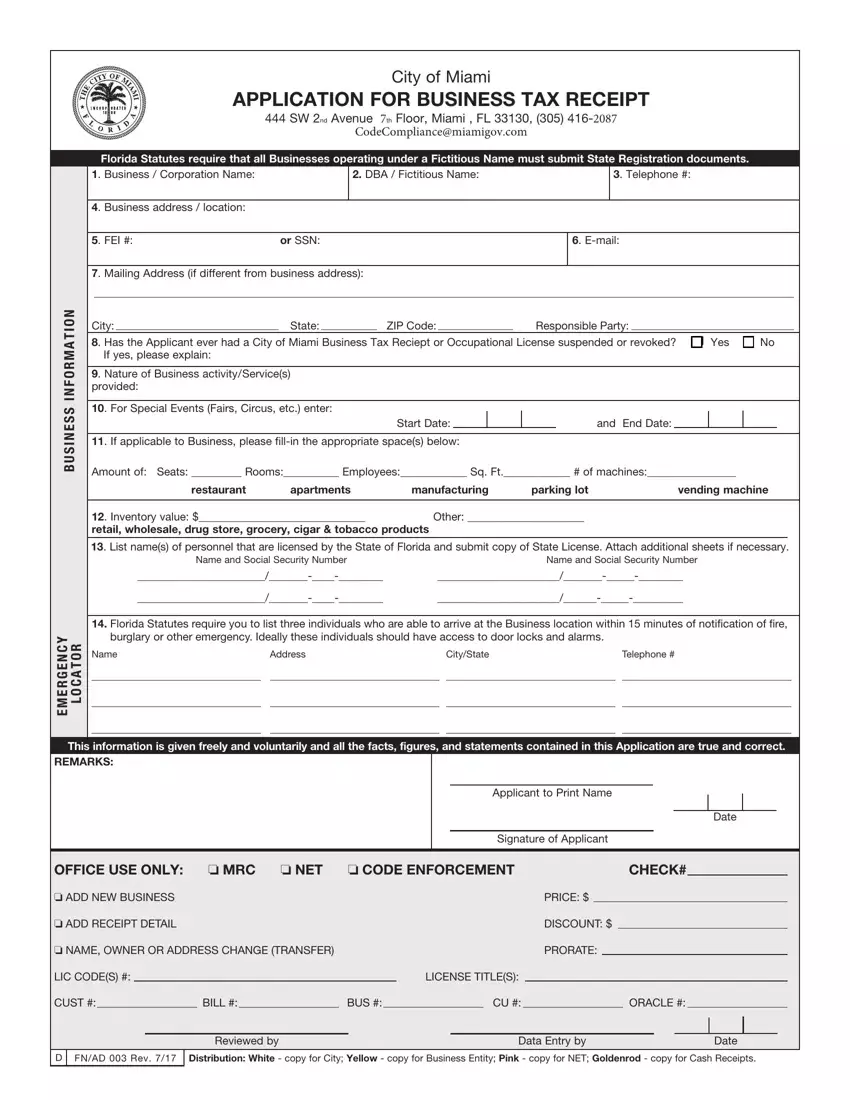

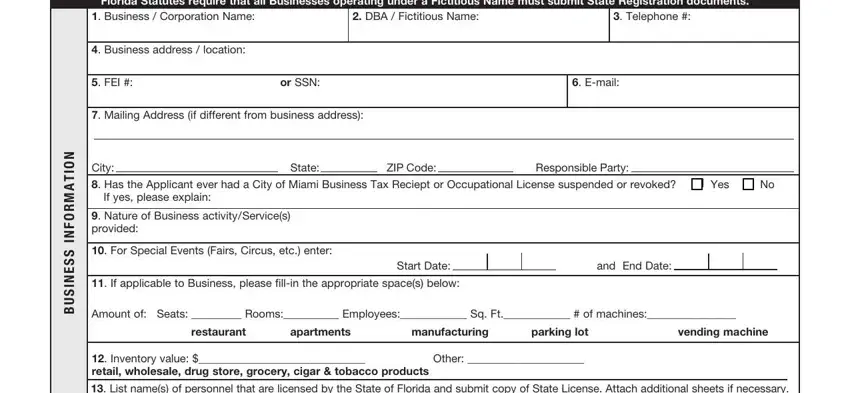

To fill in the document, enter the content the platform will ask you to for each of the following areas:

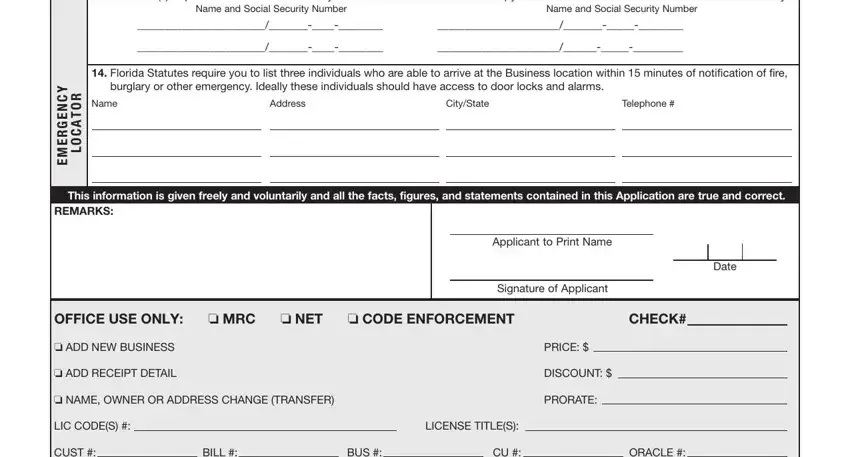

Provide the appropriate particulars in the List names of personnel that are, Name and Social Security Number, Name and Social Security Number, Florida Statutes require you to, burglary or other emergency, Name, Address, CityState, Telephone, R O T A C O L, Y C N E G R E M E, This information is given freely, REMARKS, Applicant to Print Name, and Signature of Applicant box.

Step 3: Click the "Done" button. You can now transfer the PDF document to your device. As well as that, it is possible to deliver it by email.

Step 4: In order to avoid any headaches in the long run, you should prepare no less than two or three duplicates of the form.