DONATION FORM

Please print and complete this form then mail to:

The Salvation Army - 2 Overlea Blvd, Toronto, ON M4H 1P4

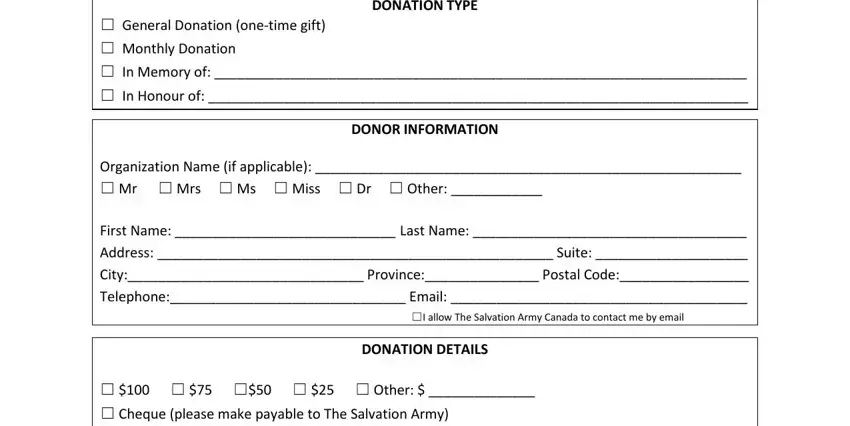

DONATION TYPE

☐General Donation (one-time gift)

☐Monthly Donation

☐In Memory of: ______________________________________________________________________

☐In Honour of: _______________________________________________________________________

DONOR INFORMATION

Organization Name (if applicable): ________________________________________________________

☐ Mr ☐ Mrs ☐ Ms ☐ Miss ☐ Dr ☐ Other: ____________

First Name: _____________________________ Last Name: ____________________________________

Address: ____________________________________________________ Suite: ____________________

City:_______________________________ Province:_______________ Postal Code:_________________

Telephone:_______________________________ Email: _______________________________________

☐I allow The Salvation Army Canada to contact me by email

DONATION DETAILS

☐ $100 ☐ $75 ☐$50 ☐ $25 ☐ Other: $ ______________

☐Cheque (please make payable to The Salvation Army)

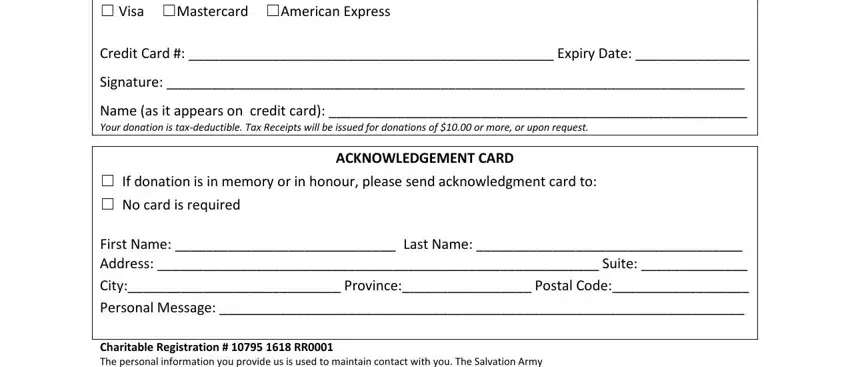

☐Visa ☐Mastercard ☐American Express

Credit Card #: ________________________________________________ Expiry Date: _______________

Signature: ____________________________________________________________________________

Name (as it appears on credit card): _______________________________________________________

Your donation is tax-deductible. Tax Receipts will be issued for donations of $10.00 or more, or upon request.

ACKNOWLEDGEMENT CARD

☐If donation is in memory or in honour, please send acknowledgment card to:

☐No card is required

First Name: _____________________________ Last Name: ___________________________________

Address: __________________________________________________________ Suite: ______________

City:____________________________ Province:_________________ Postal Code:__________________

Personal Message: _____________________________________________________________________

Charitable Registration # 10795 1618 RR0001

The personal information you provide us is used to maintain contact with you. The Salvation Army

does not sell, trade or share your information. If you wish to be removed from this mailing list, simply contact us by phone at 1-800-SAL-ARMY or by visiting SalvationArmy.ca/FAQ.