We found the finest web programmers to design this PDF editor. The application will let you prepare the arizona department of revenue forms document without difficulty and won't take a lot of your time and effort. This easy-to-follow instruction will allow you to begin.

Step 1: The first thing is to select the orange "Get Form Now" button.

Step 2: Once you've got accessed the editing page arizona department of revenue forms, you'll be able to find all the actions intended for the form within the upper menu.

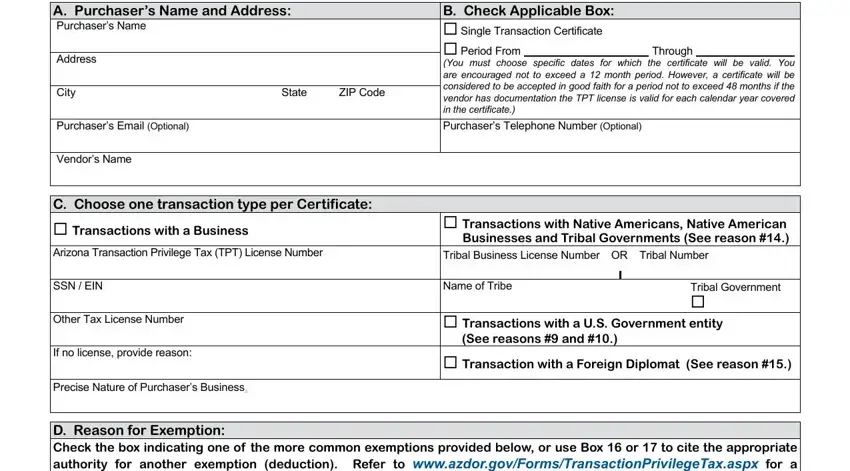

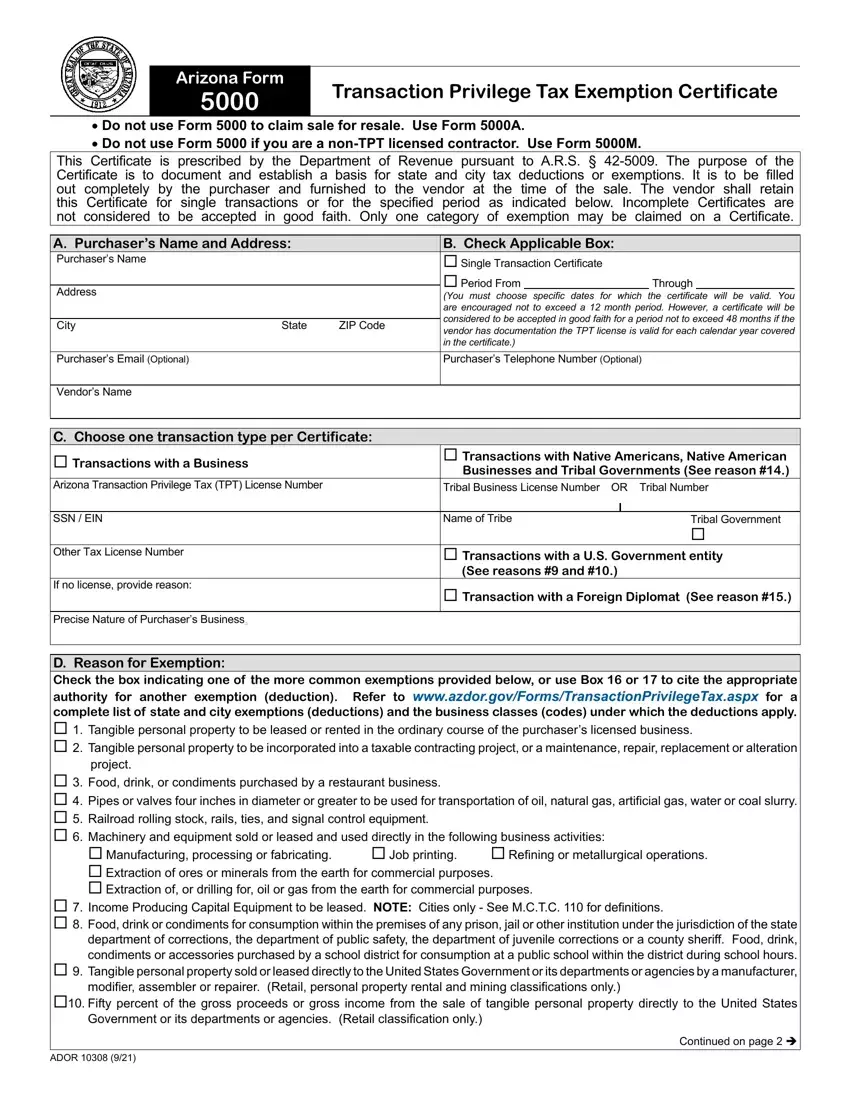

These sections are what you are going to fill in to get your finished PDF document.

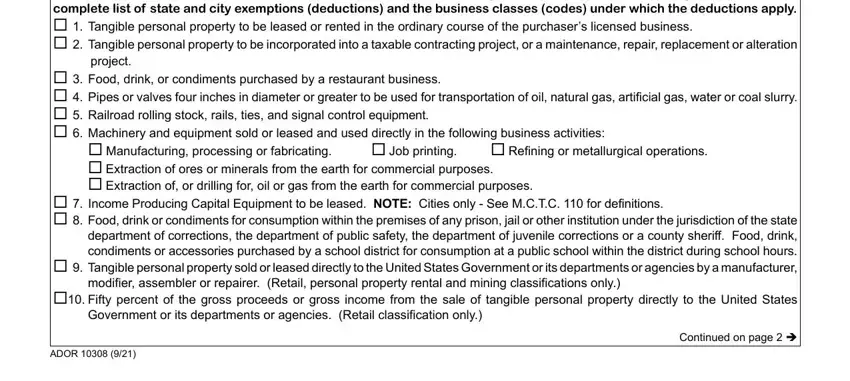

Note the required information in D Reason for Exemption Check the, project, Food drink or condiments, Manufacturing processing or, Job printing, Refining or metallurgical, Extraction of ores or minerals, Extraction of or drilling for oil, Income Producing Capital, modifier assembler or repairer, Fifty percent of the gross, Government or its departments or, and Continued on page area.

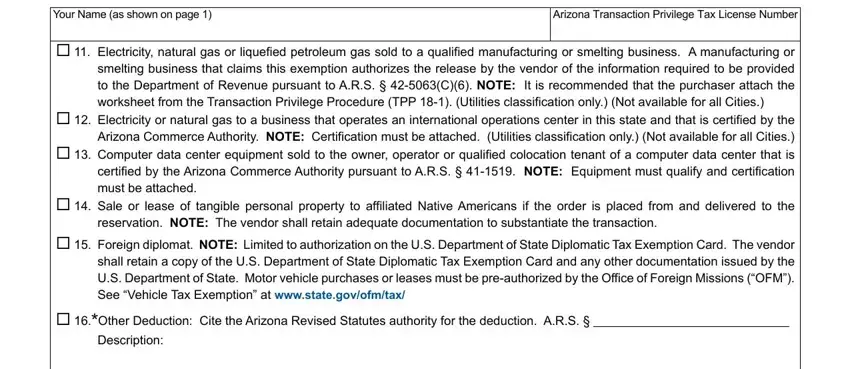

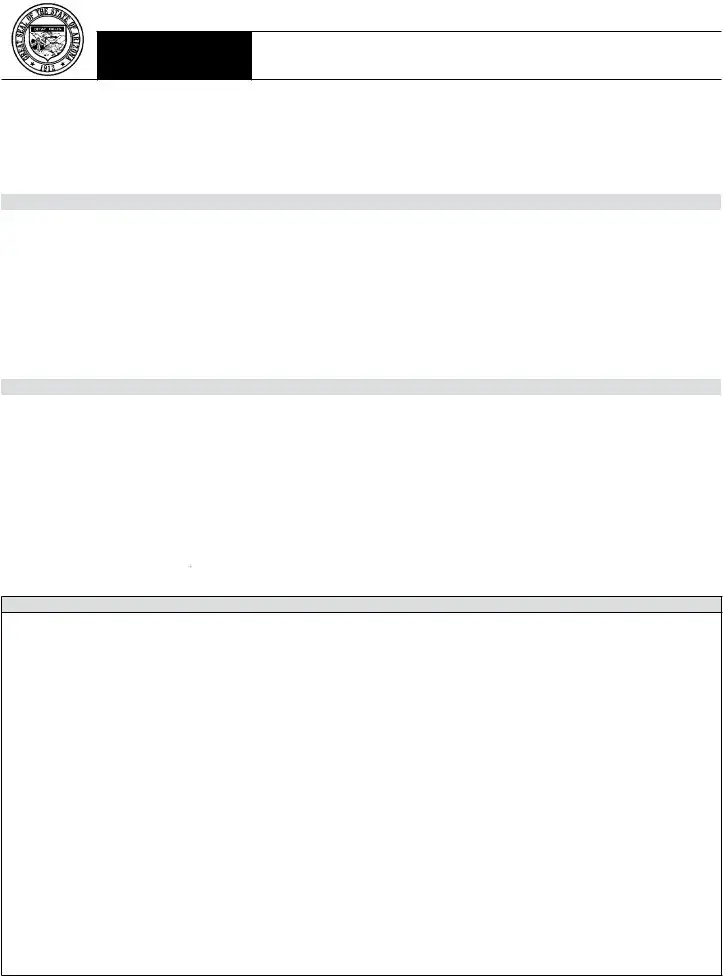

Inside the segment talking about Your Name as shown on page, Arizona Transaction Privilege Tax, Electricity natural gas or, Sale or lease of tangible, reservation NOTE The vendor shall, Foreign diplomat NOTE Limited to, Other Deduction Cite the Arizona, and Description, you have got to write down some necessary information.

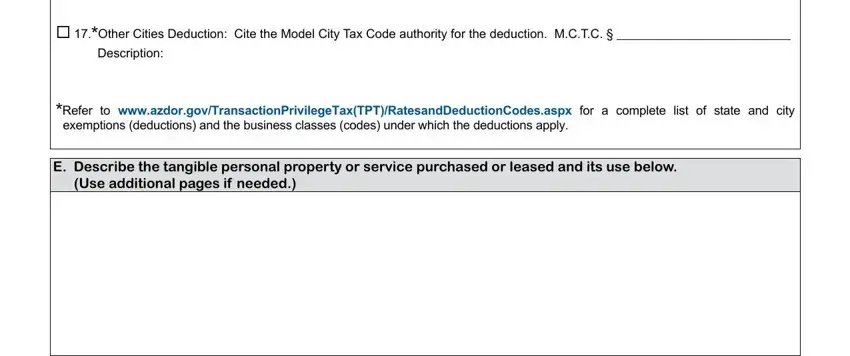

For box Other Cities Deduction Cite the, Description, Refer to, E Describe the tangible personal, and Use additional pages if needed, identify the rights and obligations.

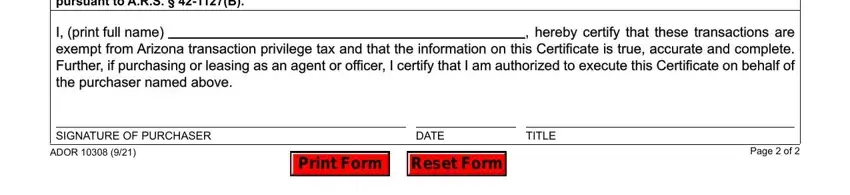

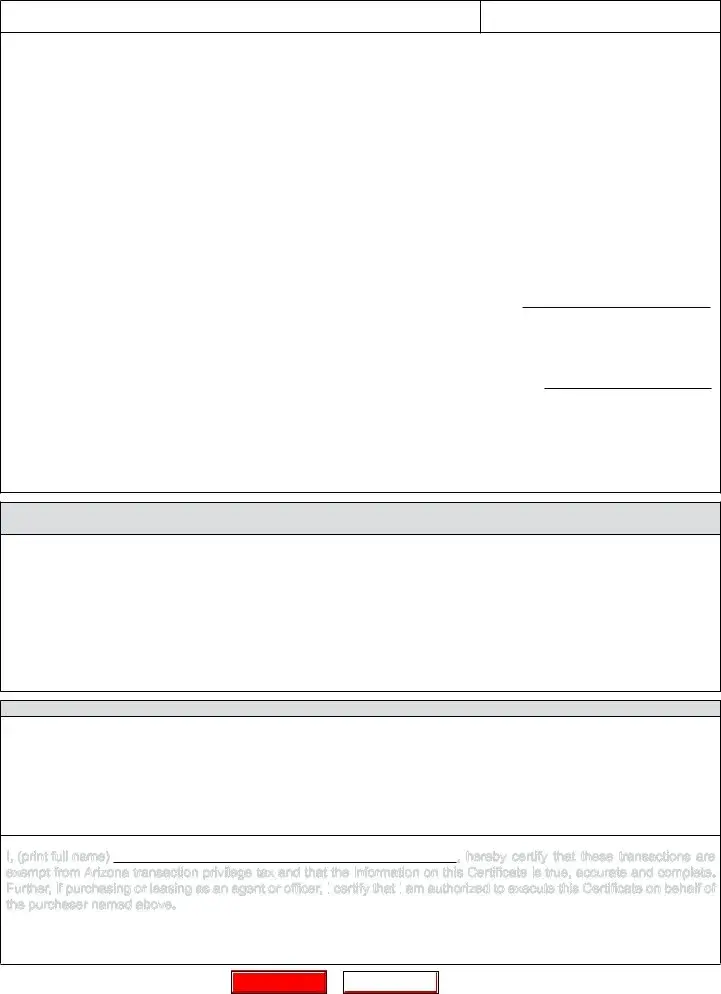

Fill out the template by reading these fields: F Certification A vendor that has, hereby certify that these, SIGNATURE OF PURCHASER, DATE, TITLE, and Page of.

Step 3: Click "Done". It's now possible to upload the PDF document.

Step 4: To protect yourself from possible future issues, ensure that you have up to two copies of each separate form.

on this Certificate is

on this Certificate is true, accurate and complete. Further, if

true, accurate and complete. Further, if purchasing or leasing as an agent or officer, I

purchasing or leasing as an agent or officer, I certify that I

certify that I am authorized to execute this Certificate on behalf of the purchaser named above.

am authorized to execute this Certificate on behalf of the purchaser named above.