You are able to fill in incorporator without difficulty by using our PDFinity® editor. In order to make our editor better and easier to work with, we continuously develop new features, with our users' suggestions in mind. All it requires is several easy steps:

Step 1: Firstly, access the pdf tool by clicking the "Get Form Button" above on this webpage.

Step 2: This tool gives you the capability to modify PDF forms in a range of ways. Enhance it by adding your own text, correct original content, and add a signature - all close at hand!

Be attentive when filling out this form. Make sure that all required fields are done properly.

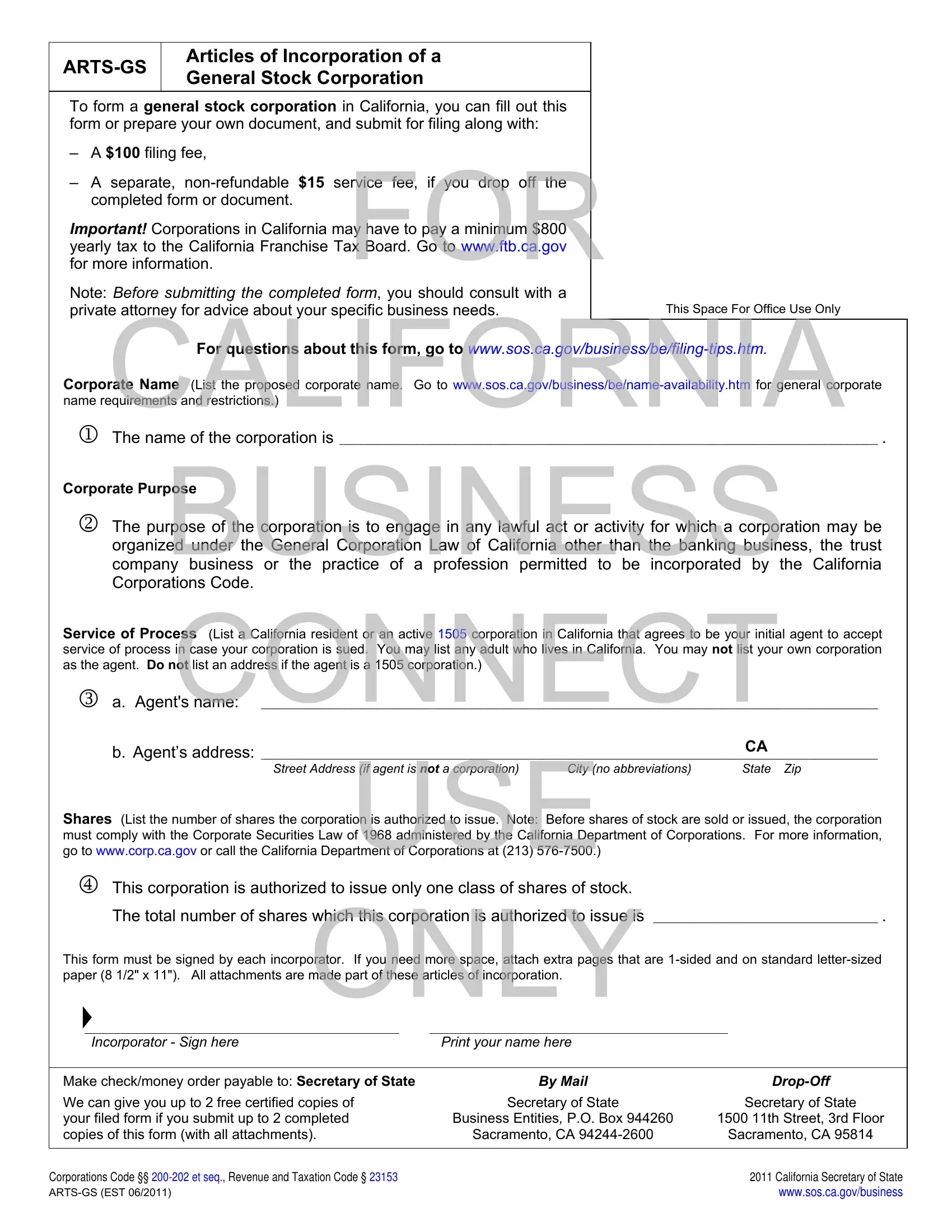

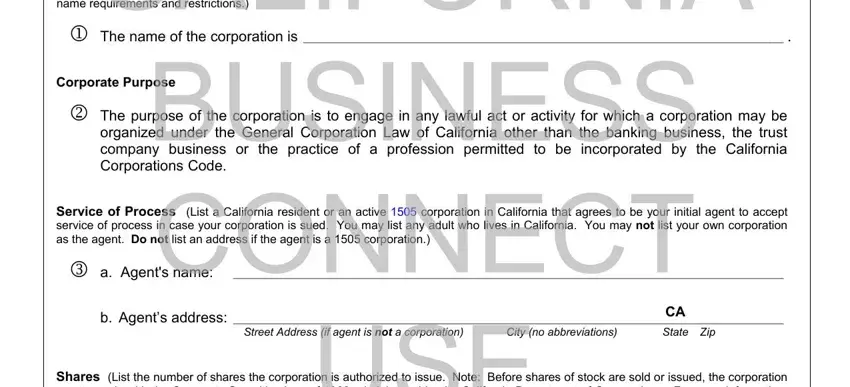

1. For starters, when completing the incorporator, begin with the form section that features the next blank fields:

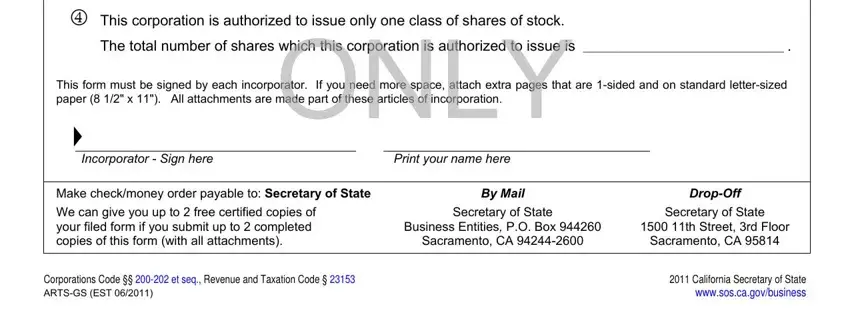

2. The next step is usually to fill in the following blanks: This corporation is authorized to, The total number of shares which, This form must be signed by each, ONLY, Incorporator Sign here, Print your name here, Make checkmoney order payable to, We can give you up to free, By Mail, Secretary of State, DropOff, Secretary of State, Business Entities PO Box , th Street rd Floor, and Sacramento CA .

Be very attentive when filling in This corporation is authorized to and Secretary of State, because this is where many people make a few mistakes.

Step 3: Spell-check the information you have entered into the form fields and hit the "Done" button. Make a free trial plan at FormsPal and get instant access to incorporator - download or edit in your FormsPal cabinet. At FormsPal, we do our utmost to be certain that your information is maintained protected.