In the heart of Maryland's vibrant business landscape, the AT3-51 form emerges as a crucial document for sole proprietorships and general partnerships navigating the realms of personal property tax obligations. Administered by the State of Maryland Department of Assessments and Taxation, this annually required submission not only demands meticulous detail about the personal property assets of a business but also underscores the state's commitment to accurate taxation and fairness across its diverse commercial sectors. From declaring the total gross sales to outlining the exact locations of all reported personal property, the form serves as a comprehensive account of a business's tangible assets as of January 1, 2013, with a filing deadline set for April 15 of the same year. It delves into the specifics of the nature of the business, fiscal year timelines, and even the leasing or disposal of business assets, thereby painting a full picture of a business's operational footprint. Pertinently, for businesses operating entirely in specified exempt counties or whose personal property falls below the $10,000 mark, the form provides pathways for exemption, embodying the state's nuanced approach to personal property taxation. This attention to detail ensures that Maryland businesses are assessed fairly, fostering a transparent and equitable taxation environment.

| Question | Answer |

|---|---|

| Form Name | At3 51 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | E-mail, 2018 form at3 51, form at3 51, maryland form at3 51 |

STATE OF MARYLAND |

|

|

DEPARTMENT OF ASSESSMENTS AND TAXATION |

|

|

PERSONAL PROPERTY DIVISION |

|

|

301 West Preston Street, Room 801 |

|

|

Baltimore, MD |

|

|

www.dat.state.md.us |

|

|

(410) |

ANNUAL PERSONAL PROPERTY RETURN OF |

|

MRS |

SOLE PROPRIETORSHIPS AND GENERAL PARTNERSHIPS |

|

|

|

AS OF JANUARY 1, 2013 |

|

|

DUE APRIL 15, 2013 |

OWNER’S NAME, TRADING AS NAME, AND MAILING ADDRESS:

DEPARTMENT ID NO.

2013

Form

Date Received by Department

Check here if you use a preparer and do not want personal property forms mailed to you next year.

PART A

1. |

Provide your federal employer ID # __ __ |

__ __ |

__ |

__ __ |

__ __ (if none, provide social security number of owner). |

2. |

Provide your federal principal business code # |

____ |

____ |

____ |

____ ____ ____ (from IRS Schedule C or Form 1065). |

3.IMPORTANT: List exact location of all personal property reported on this return including county, town, and street address. This assures proper distribution of assessments. If property is located in two or more locations, please attach additional copies of Part B for each location.

NOTE: If all of the personal property of this business is located entirely in the following exempt counties: Frederick, Garrett, Kent, Queen Anne’s, or Talbot, you may be eligible to skip Part B, Line Items ➀ through ➄. Be sure to complete signature section. Refer to Specific Instructions, Part A, 3 for more information.

________________________________________________________________________________________________________

(STREET NUMBER & NAME) |

(ZIP CODE) |

(COUNTY) |

(INCORP. TOWN) |

Check if this location has changed from the 2012 return.

4.State your nature of business or profession: _____________________________________________Date began:______________

5.Total gross sales or amount of business transacted during 2012. $ ___________________________________________________

If the business has sales in Maryland and does not report any personal property, in remarks below explain how the business is conducted without personal property. If the business is using the personal property of another business, provide the name and address of that business.

6.Only sole proprietors complete questions 6a and 6b.

6a. Is this location the principal residence of the business owner? ___________

(Yes or No)

6b. Is the total original cost of all the property, including inventory and excluding licensed vehicles, less than $10,000? _________

If you answer yes to both 6a and 6b, your property is exempt. |

(Yes or No) |

Skip to signature line on page 2. |

|

7.State the opening and closing dates of your fiscal year. ____________________________________________________________

8.Do you have any fully depreciated property or property expensed under IRS rules? ___________ If yes, have you

(Yes or No)

included such property on this return?

(Yes or No)

9.Property leased by your business. See Instructions for Part A, 9.

10.Has the business disposed of assets during 2012? __________ If yes, supply a schedule of disposition by

year of acquisition and manner of disposal.

REMARKS __________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

This form was printed from the DAT web site. |

10/12 |

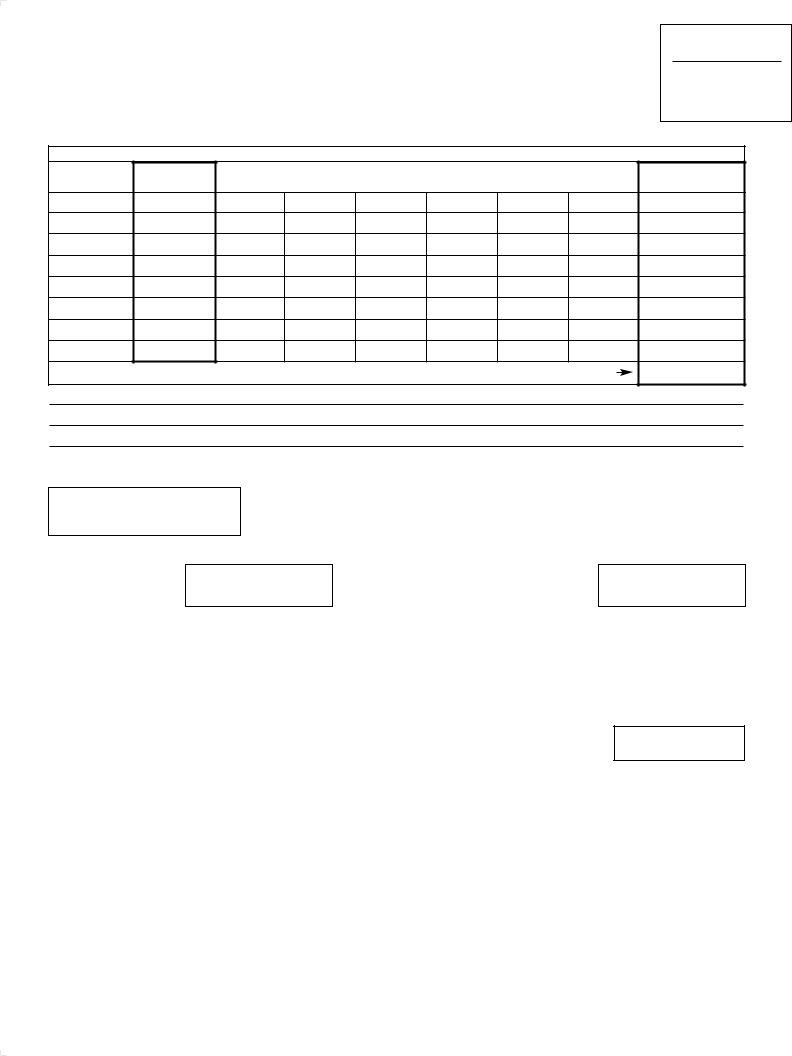

PART B

➀Furniture, fixtures, office equipment, tools, machinery, equipment NOT used in manufacturing

or research and development. See Instruction ➀. Failure to provide the required detail will result in the reported property being assessed at 10% rate of depreciation.

2013

Form

O R I G I N A L C O S T B Y Y E A R O F A C Q U I S I T I O N

|

|

SPECIAL DEPRECIATION RATES (See Instruction ➀) |

|

|

|

||

A |

B |

C |

D |

E |

F |

G |

TOTAL COST |

2012

2011

2010

2009

2008

2007

2006

2005 and prior

TOTAL COST COLUMNS

DESCRIBE B through G PROPERTY HERE:

➁Commercial Inventory — See Instruction ➁.

Average Monthly Inventory

$

Furnish from the latest Maryland Income Tax return:

Opening Inventory - date _____________________ amount $ _________________________

Closing Inventory - date _____________________ amount $ _________________________

Note: Businesses that need a Trader’s License must report commercial inventory here.

➂Supplies

See Instruction ➂.

Average Cost

$

➃Manufacturing and/or research and development inventory. See Instruction ➃.

Average Monthly Inventory

$

➄Tools, machinery and equipment used for manufacturing and/or research & development. If this business is engaged in manufacturing / R&D, and is claiming such an exemption for the first time, a manufacturing/R&D exemption application must

be submitted on or before September 1, 2013 before an exemption can be granted. Contact the Department or visit www.dat.state.md.us for an application. See instruction ➄. Exception for tax years beginning after June 30, 2009 - an exemption application may be filed within 6 months after the date of the first assessment notice for the taxable year that includes the manufacturing personal property.

|

ORIGINAL COST BY YEAR OF ACQUISITION |

|||

|

|

|

|

|

2012 |

|

|

2008 |

|

|

|

|

|

|

2011 |

|

|

2007 |

|

|

|

|

|

|

2010 |

|

|

2006 |

|

|

|

|

|

|

2009 |

|

|

2005 and prior |

|

|

|

|

|

|

The following section must be completed.

TOTAL COST

$

I declare under the penalties of perjury, pursuant to the Tax Property Article

|

|

|

|

|

|

Taxpayer’s Signature |

Date |

|

Phone Number |

|

|

|

|

|

|

|

|

Preparer’s Signature |

Date |

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Preparer |

|

|

|

|

|

This form was printed from the DAT web site.