We've used the endeavours of our best programmers to create the PDF editor you intend to take advantage of. Our software will help you fill in the xpress credit application form document with no trouble and don’t waste your time. What you need to undertake is try out these straightforward recommendations.

Step 1: On the webpage, select the orange "Get form now" button.

Step 2: You are now on the document editing page. You may edit, add text, highlight specific words or phrases, place crosses or checks, and include images.

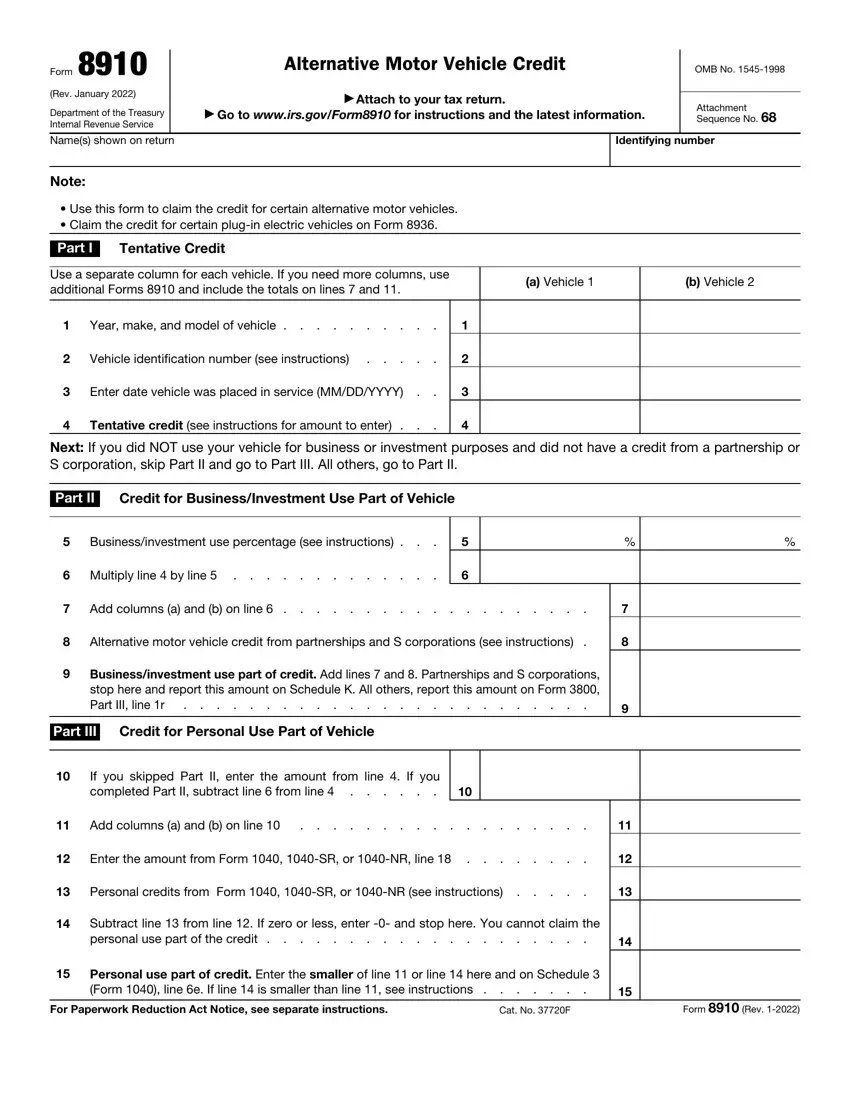

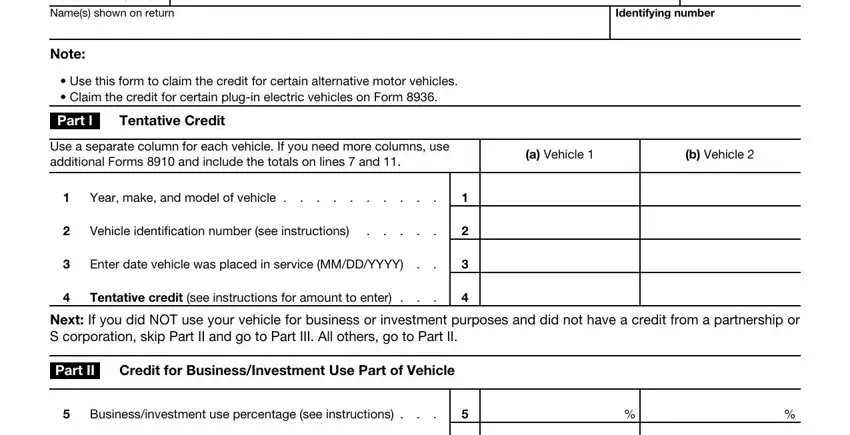

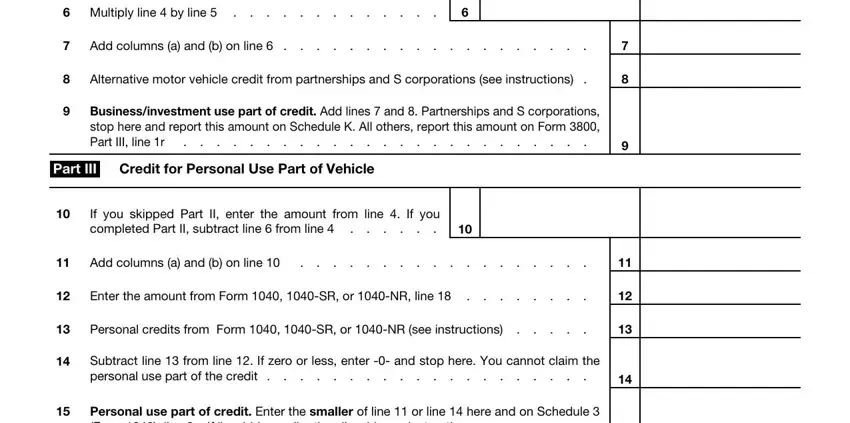

The following sections will make up the PDF form that you'll be creating:

Complete the Multiply line by line, Add columns a and b on line, Alternative motor vehicle credit, Businessinvestment use part of, Part III, Credit for Personal Use Part of, If you skipped Part II enter the, Add columns a and b on line, Enter the amount from Form SR or, Personal credits from Form SR or, Subtract line from line If zero, and Personal use part of credit Enter space using the data required by the platform.

Step 3: Press the Done button to save the file. So now it is at your disposal for upload to your device.

Step 4: Generate a copy of any form. It could save you some time and assist you to refrain from complications later on. By the way, your details won't be revealed or analyzed by us.