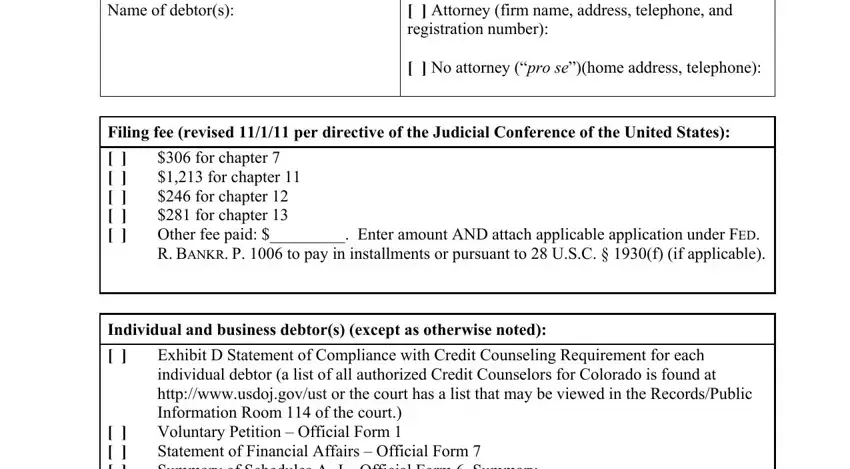

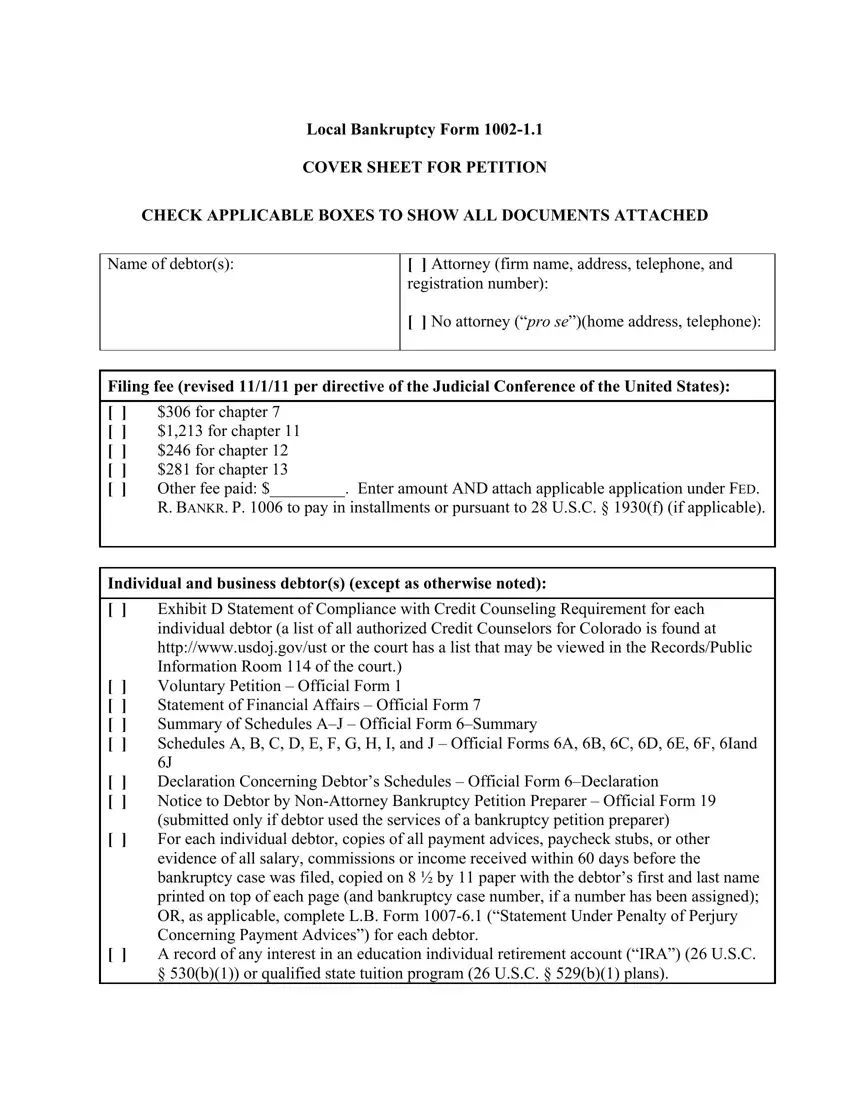

Local Bankruptcy Form 1002-1.1

COVER SHEET FOR PETITION

CHECK APPLICABLE BOXES TO SHOW ALL DOCUMENTS ATTACHED

Name of debtor(s): |

[ |

] Attorney (firm name, address, telephone, and |

|

registration number): |

|

[ |

] No attorney (“pro se”)(home address, telephone): |

|

|

|

Filing fee (revised 11/1/11 per directive of the Judicial Conference of the United States):

[ ] $306 for chapter 7

[ ] $1,213 for chapter 11 [ ] $246 for chapter 12 [ ] $281 for chapter 13

[ ] Other fee paid: $_________. Enter amount AND attach applicable application under FED.

R. BANKR. P. 1006 to pay in installments or pursuant to 28 U.S.C. § 1930(f) (if applicable).

Individual and business debtor(s) (except as otherwise noted):

[ ] Exhibit D Statement of Compliance with Credit Counseling Requirement for each individual debtor (a list of all authorized Credit Counselors for Colorado is found at http://www.usdoj.gov/ust or the court has a list that may be viewed in the Records/Public Information Room 114 of the court.)

[ ] Voluntary Petition – Official Form 1

[ ] Statement of Financial Affairs – Official Form 7

[ ] Summary of Schedules A–J – Official Form 6–Summary

[ ] Schedules A, B, C, D, E, F, G, H, I, and J – Official Forms 6A, 6B, 6C, 6D, 6E, 6F, 6Iand 6J

[ ] Declaration Concerning Debtor’s Schedules – Official Form 6–Declaration

[ ] Notice to Debtor by Non-Attorney Bankruptcy Petition Preparer – Official Form 19 (submitted only if debtor used the services of a bankruptcy petition preparer)

[ ] For each individual debtor, copies of all payment advices, paycheck stubs, or other evidence of all salary, commissions or income received within 60 days before the bankruptcy case was filed, copied on 8 ½ by 11 paper with the debtor’s first and last name printed on top of each page (and bankruptcy case number, if a number has been assigned); OR, as applicable, complete L.B. Form 1007-6.1 (“Statement Under Penalty of Perjury Concerning Payment Advices”) for each debtor.

[ ] A record of any interest in an education individual retirement account (“IRA”) (26 U.S.C. § 530(b)(1)) or qualified state tuition program (26 U.S.C. § 529(b)(1) plans).

[] Attorney Fee Disclosure Statement – Director’s Procedural Form B 203

[] Verification of Creditors’ Matrix – L.B. Form 1007-2.1

[] Creditors’ Matrix (see L.B.R. 1007-2 and L.B.R. 1007-2App. for instructions).

Additional items due from ALL individual debtors:

[] Statement of Social Security Number(s) – Official Form 21

Chapter 7 individual debtors also must file:

[] Statement of Current Monthly Income and Means Test Calculation – Official Form 22A*

[] Statement of Intention – Official Form 8 (due thirty days post-petition) (the failure to comply with this statement and file reaffirmation agreements or motions to redeem personal property that the debtor does not intend to surrender has ramifications 45 days after the first scheduled meeting of creditors under 11 U.S.C. § 362(h) of the Bankruptcy Code)

Chapter 11 individual debtors also must file:

[] Statement of Current Monthly Income – Official Form 22B Chapter 13 individual debtors also must file:

[] Statement of Current Monthly Income and Disposable Income Calculation – Official Form 22C*

[] Plan –L.B. Form 3015.1

*The links for the updated Internal Revenue Service and Census Bureau Information that may be needed to complete Statement of Current Monthly Income, Official Forms 22A and 22B, can be reached from the web site: http://www.usdoj.gov/ust/. (Not applicable in chapter 7 cases if debts are primarily business debts.)

Additional items due from chapter 11 debtors:

[] List of Twenty Largest Creditors – Official Form 4

[] Corporate Ownership Statement – Required by FED. R BANKR. P. 1007(a)(1) for corporations. L.B. Form 1007-4.1.

[] List of Equity Interest Holders – Required by FED. R. BANKR. P. 1007(a)(3) for

corporations. L.B. Form 1007-4.2.

[] Small business debtors must file the most recent 1) balance sheet, 2) statements of operations, 3) cash-flow statement and 4) federal income tax return; OR a verified statement that those documents do not exist and have not been prepared or filed.

[] Disclosure Regarding Receivers Bankruptcy Form 1007-7.1.

Printed name of party signing:

Signature of attorney (or debtor without counsel):

UNITED STATES BANKRUPTCY COURT

DISTRICT OF COLORADO

NOTICE REGARDING E-MAIL NOTIFICATION FOR DEBTORS WITHOUT AN

ATTORNEY AND PARTIES WITHOUT AN ATTORNEY

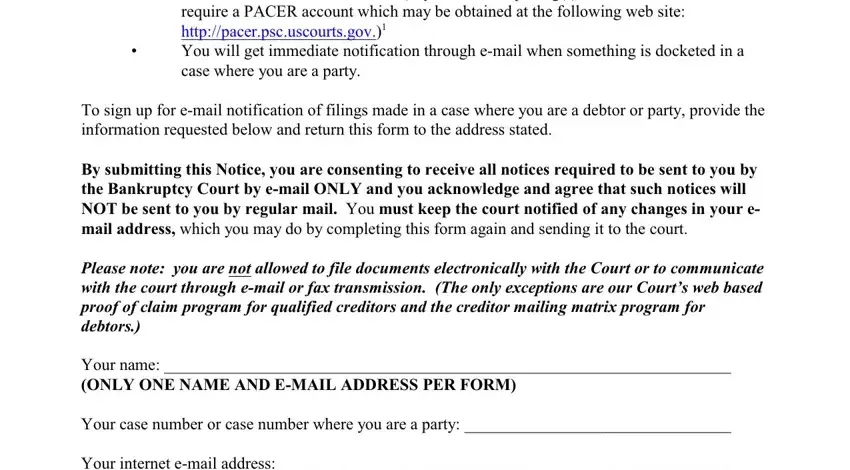

If you are not represented by an attorney and are a debtor or party in a bankruptcy case and you have an internet e-mail address, you can receive an electronic notice by e-mail whenever a filing is made in a case where you are a debtor or party. Benefits of receiving such notices are:

•If your e-mail program supports viewing documents from hyper links and you have Adobe Acrobat Reader installed, you may be able to view the document filed through a hyperlink in the e-mail notice.

•One look at the document is free (any additional opening(s) of the document will require a PACER account which may be obtained at the following web site: http://pacer.psc.uscourts.gov.)1

•You will get immediate notification through e-mail when something is docketed in a case where you are a party.

To sign up for e-mail notification of filings made in a case where you are a debtor or party, provide the information requested below and return this form to the address stated.

By submitting this Notice, you are consenting to receive all notices required to be sent to you by the Bankruptcy Court by e-mail ONLY and you acknowledge and agree that such notices will NOT be sent to you by regular mail. You must keep the court notified of any changes in your e- mail address, which you may do by completing this form again and sending it to the court.

Please note: you are not allowed to file documents electronically with the Court or to communicate with the court through e-mail or fax transmission. (The only exceptions are our Court’s web based proof of claim program for qualified creditors and the creditor mailing matrix program for debtors.)

Your name: ____________________________________________________________________

(ONLY ONE NAME AND E-MAIL ADDRESS PER FORM)

Your case number or case number where you are a party: ________________________________

Your internet e-mail address: ______________________________________________________

Return Completed form to:

US Bankruptcy Court

721 19th St.

Denver, CO 80202

VISIT OUR WEBSITE FOR MORE INFORMATION: http://www.cob.uscourts.gov

1It is recommended that you download the document or print it out at that time.

B1 (Official Form 1) (04/13)

|

|

UNITED STATES BANKRUPTCY COURT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________ District of __________ |

|

|

|

|

|

VOLUNTARY PETITION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Debtor (if individual, enter Last, First, Middle): |

|

|

|

Name of Joint Debtor (Spouse) (Last, First, Middle): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Other Names used by the Debtor in the last 8 years |

|

|

|

|

|

|

All Other Names used by the Joint Debtor in the last 8 years |

|

|

|

(include married, maiden, and trade names): |

|

|

|

|

|

|

(include married, maiden, and trade names): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last four digits of Soc. Sec. or Individual-Taxpayer I.D. (ITIN)/Complete EIN |

|

Last four digits of Soc. Sec. or Individual-Taxpayer I.D. (ITIN)/Complete EIN |

(if more than one, state all): |

|

|

|

|

|

|

|

(if more than one, state all): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address of Debtor (No. and Street, City, and State): |

|

|

|

Street Address of Joint Debtor (No. and Street, City, and State): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

ZIP CODE |

|

County of Residence or of the Principal Place of Business: |

|

|

|

|

|

County of Residence or of the Principal Place of Business: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address of Debtor (if different from street address): |

|

|

|

Mailing Address of Joint Debtor (if different from street address): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

ZIP CODE |

|

Location of Principal Assets of Business Debtor (if different from street address above): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP CODE |

|

|

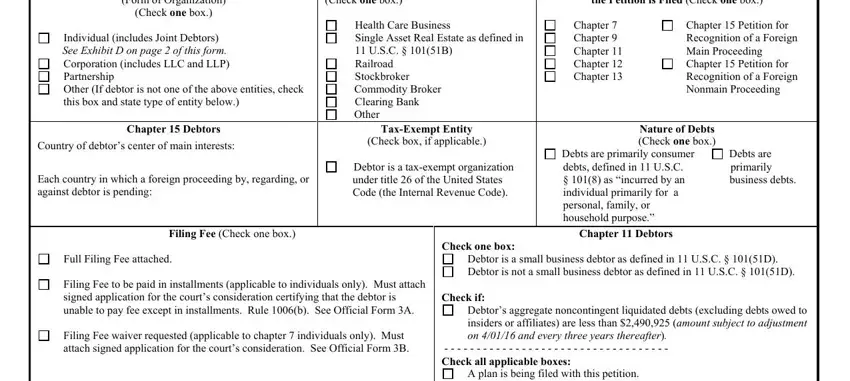

Type of Debtor |

|

|

|

|

Nature of Business |

|

|

|

Chapter of Bankruptcy Code Under Which |

|

(Form of Organization) |

|

|

|

(Check one box.) |

|

|

|

|

|

the Petition is Filed (Check one box.) |

|

(Check one box.) |

|

|

|

|

Health Care Business |

|

|

|

Chapter 7 |

Chapter 15 Petition for |

|

|

|

|

|

|

|

|

|

|

Individual (includes Joint Debtors) |

|

|

|

|

Single Asset Real Estate as defined in |

|

Chapter 9 |

Recognition of a Foreign |

See Exhibit D on page 2 of this form. |

|

|

|

|

11 U.S.C. § 101(51B) |

|

|

|

Chapter 11 |

Main Proceeding |

Corporation (includes LLC and LLP) |

|

|

|

Railroad |

|

|

|

|

|

Chapter 12 |

Chapter 15 Petition for |

Partnership |

|

|

|

|

|

Stockbroker |

|

|

|

|

|

Chapter 13 |

Recognition of a Foreign |

Other (If debtor is not one of the above entities, check |

|

Commodity Broker |

|

|

|

|

Nonmain Proceeding |

this box and state type of entity below.) |

|

|

|

Clearing Bank |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

Chapter 15 Debtors |

|

|

|

|

Tax-Exempt Entity |

|

|

|

|

Nature of Debts |

|

|

|

Country of debtor’s center of main interests: |

|

|

|

(Check box, if applicable.) |

|

|

|

|

(Check one box.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debts are primarily consumer |

Debts are |

|

|

|

|

|

|

|

Debtor is a tax-exempt organization |

|

Each country in which a foreign proceeding by, regarding, or |

|

|

debts, defined in 11 U.S.C. |

primarily |

|

under title 26 of the United States |

|

§ 101(8) as “incurred by an |

business debts. |

against debtor is pending: |

|

|

|

|

|

Code (the Internal Revenue Code). |

|

individual primarily for a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

personal, family, or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

household purpose.” |

|

|

|

|

|

Filing Fee (Check one box.) |

|

|

|

|

|

|

|

|

Chapter 11 Debtors |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check one box: |

|

|

|

|

|

|

|

Full Filing Fee attached. |

|

|

|

|

|

|

|

Debtor is a small business debtor as defined in 11 U.S.C. § 101(51D). |

Filing Fee to be paid in installments (applicable to individuals only). Must attach |

Debtor is not a small business debtor as defined in 11 U.S.C. § 101(51D). |

|

|

|

|

|

|

|

|

|

|

|

signed application for the court’s consideration certifying that the debtor is |

|

Check if: |

|

|

|

|

|

|

|

|

|

|

unable to pay fee except in installments. Rule 1006(b). See Official Form 3A. |

|

Debtor’s aggregate noncontingent liquidated debts (excluding debts owed to |

|

|

|

|

|

|

|

|

|

|

insiders or affiliates) are less than $2,490,925 (amount subject to adjustment |

Filing Fee waiver requested (applicable to chapter 7 individuals only). Must |

|

on 4/01/16 and every three years thereafter). |

|

|

|

attach signed application for the court’s consideration. See Official Form 3B. |

|

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check all applicable boxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A plan is being filed with this petition. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Acceptances of the plan were solicited prepetition from one or more classes |

|

|

|

|

|

|

|

|

|

|

of creditors, in accordance with 11 U.S.C. § 1126(b). |

|

|

|

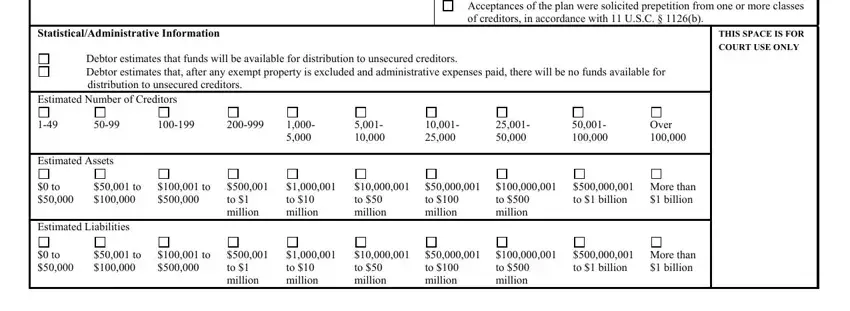

Statistical/Administrative Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THIS SPACE IS FOR |

|

Debtor estimates that funds will be available for distribution to unsecured creditors. |

|

|

|

|

|

|

|

COURT USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

Debtor estimates that, after any exempt property is excluded and administrative expenses paid, there will be no funds available for |

|

|

|

|

|

distribution to unsecured creditors. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Number of Creditors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1-49 |

50-99 |

100-199 |

200-999 |

1,000- |

|

|

5,001- |

|

10,001- |

25,001- |

|

50,001- |

Over |

|

|

|

|

|

|

|

|

5,000 |

|

|

10,000 |

|

25,000 |

50,000 |

|

|

100,000 |

100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 to |

$50,001 to |

$100,001 to |

$500,001 |

$1,000,001 |

$10,000,001 |

|

$50,000,001 |

$100,000,001 |

$500,000,001 |

More than |

|

|

|

|

$50,000 |

$100,000 |

$500,000 |

to $1 |

to $10 |

to $50 |

to $100 |

to $500 |

to $1 billion |

$1 billion |

|

|

|

|

|

|

|

million |

million |

million |

million |

million |

|

|

|

|

|

|

|

Estimated Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 to |

$50,001 to |

$100,001 to |

$500,001 |

$1,000,001 |

$10,000,001 |

|

$50,000,001 |

$100,000,001 |

$500,000,001 |

More than |

|

|

|

|

$50,000 |

$100,000 |

$500,000 |

to $1 |

to $10 |

to $50 |

to $100 |

to $500 |

to $1 billion |

$1 billion |

|

|

|

|

|

|

|

million |

million |

million |

million |

million |

|

|

|

|

|

|

|

B1 (Official Form 1) (04/13) |

Page 2 |

Voluntary Petition |

Name of Debtor(s): |

(This page must be completed and filed in every case.) |

|

All Prior Bankruptcy Cases Filed Within Last 8 Years (If more than two, attach additional sheet.)

Location |

|

Case Number: |

Date Filed: |

Where Filed: |

|

|

|

Location |

|

Case Number: |

Date Filed: |

Where Filed: |

|

|

|

|

Pending Bankruptcy Case Filed by any Spouse, Partner, or Affiliate of this Debtor (If more than one, attach additional sheet.) |

Name of Debtor: |

|

Case Number: |

Date Filed: |

|

|

|

|

District: |

|

Relationship: |

Judge: |

|

|

|

|

Exhibit A |

|

Exhibit B |

(To be completed if debtor is required to file periodic reports (e.g., forms 10K and |

|

(To be completed if debtor is an individual |

10Q) with the Securities and Exchange Commission pursuant to Section 13 or 15(d) |

|

whose debts are primarily consumer debts.) |

of the Securities Exchange Act of 1934 and is requesting relief under chapter 11.) |

I, the attorney for the petitioner named in the foregoing petition, declare that I have |

|

|

informed the petitioner that [he or she] may proceed under chapter 7, 11, 12, or 13 |

|

of title 11, United States Code, and have explained the relief available under each |

|

such chapter. I further certify that I have delivered to the debtor the notice required |

Exhibit A is attached and made a part of this petition. |

by 11 U.S.C. § 342(b). |

|

|

|

|

|

|

|

X |

|

|

|

|

Signature of Attorney for Debtor(s) |

(Date) |

|

Exhibit C

Does the debtor own or have possession of any property that poses or is alleged to pose a threat of imminent and identifiable harm to public health or safety?

Yes, and Exhibit C is attached and made a part of this petition.

No.

Exhibit D

(To be completed by every individual debtor. If a joint petition is filed, each spouse must complete and attach a separate Exhibit D.)

Exhibit D, completed and signed by the debtor, is attached and made a part of this petition.

If this is a joint petition:

Exhibit D, also completed and signed by the joint debtor, is attached and made a part of this petition.

Information Regarding the Debtor - Venue

(Check any applicable box.)

Debtor has been domiciled or has had a residence, principal place of business, or principal assets in this District for 180 days immediately preceding the date of this petition or for a longer part of such 180 days than in any other District.

There is a bankruptcy case concerning debtor’s affiliate, general partner, or partnership pending in this District.

Debtor is a debtor in a foreign proceeding and has its principal place of business or principal assets in the United States in this District, or has no principal place of business or assets in the United States but is a defendant in an action or proceeding [in a federal or state court] in this District, or the interests of the parties will be served in regard to the relief sought in this District.

Certification by a Debtor Who Resides as a Tenant of Residential Property

(Check all applicable boxes.)

Landlord has a judgment against the debtor for possession of debtor’s residence. (If box checked, complete the following.)

(Name of landlord that obtained judgment)

(Address of landlord)

Debtor claims that under applicable nonbankruptcy law, there are circumstances under which the debtor would be permitted to cure the entire monetary default that gave rise to the judgment for possession, after the judgment for possession was entered, and

Debtor has included with this petition the deposit with the court of any rent that would become due during the 30-day period after the filing of the petition.

Debtor certifies that he/she has served the Landlord with this certification. (11 U.S.C. § 362(l)).

B1 (Official Form 1) (04/13) |

|

|

Page 3 |

Voluntary Petition |

Name of Debtor(s): |

|

|

|

|

(This page must be completed and filed in every case.) |

|

|

|

|

|

|

|

|

|

Signatures |

|

|

|

|

|

Signature(s) of Debtor(s) (Individual/Joint) |

|

Signature of a Foreign Representative |

I declare under penalty of perjury that the information provided in this petition is true |

I declare under penalty of perjury that the information provided in this petition is true |

and correct. |

and correct, that I am the foreign representative of a debtor in a foreign proceeding, |

[If petitioner is an individual whose debts are primarily consumer debts and has |

and that I am authorized to file this petition. |

chosen to file under chapter 7] I am aware that I may proceed under chapter 7, 11, 12 |

(Check only one box.) |

|

|

|

|

or 13 of title 11, United States Code, understand the relief available under each such |

|

|

|

|

|

|

|

|

|

|

chapter, and choose to proceed under chapter 7. |

|

I request relief in accordance with chapter 15 of title 11, United States Code. |

[If no attorney represents me and no bankruptcy petition preparer signs the petition] I |

|

|

Certified copies of the documents required by 11 U.S.C. § 1515 are attached. |

have obtained and read the notice required by 11 U.S.C. § 342(b). |

|

|

|

|

|

|

|

I request relief in accordance with the chapter of title 11, United States Code, |

|

Pursuant to 11 U.S.C. § 1511, I request relief in accordance with the |

chapter of title 11 specified in this petition. A certified copy of the |

specified in this petition. |

|

order granting recognition of the foreign main proceeding is attached. |

X |

|

|

X |

|

|

|

|

|

Signature of Debtor |

|

(Signature of Foreign Representative) |

|

|

|

X |

|

|

|

|

|

|

|

|

|

Signature of Joint Debtor |

|

(Printed Name of Foreign Representative) |

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number (if not represented by attorney) |

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

Signature of Attorney* |

|

Signature of Non-Attorney Bankruptcy Petition Preparer |

X |

I declare under penalty of perjury that: |

(1) I am a bankruptcy petition preparer as |

|

Signature of Attorney for Debtor(s) |

|

defined in 11 U.S.C. § 110; (2) I prepared this document for compensation and have |

|

|

|

|

provided the debtor with a copy of this document and the notices and information |

|

Printed Name of Attorney for Debtor(s) |

required under 11 U.S.C. §§ 110(b), 110(h), and 342(b); and, (3) if rules or |

|

|

|

|

guidelines have been promulgated pursuant to 11 U.S.C. § 110(h) setting a maximum |

|

Firm Name |

|

fee for services chargeable by bankruptcy petition preparers, I have given the debtor |

|

|

|

|

notice of the maximum amount before preparing any document for filing for a debtor |

|

|

|

|

or accepting any fee from the debtor, as required in that section. Official Form 19 is |

|

|

|

|

attached. |

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number |

|

|

Printed Name and title, if any, of Bankruptcy Petition Preparer |

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

*In a case in which § 707(b)(4)(D) applies, this signature also constitutes a |

|

Social-Security number (If the bankruptcy petition preparer is not an individual, |

|

state the Social-Security number of the officer, principal, responsible person or |

certification that the attorney has no knowledge after an inquiry that the information |

|

partner of the bankruptcy petition preparer.) (Required by 11 U.S.C. § 110.) |

in the schedules is incorrect. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Debtor (Corporation/Partnership) |

|

|

|

|

|

|

I declare under penalty of perjury that the information provided in this petition is true |

|

|

|

|

|

|

|

Address |

|

|

|

|

and correct, and that I have been authorized to file this petition on behalf of the |

|

|

|

|

|

|

debtor. |

X |

|

|

|

|

The debtor requests the relief in accordance with the chapter of title 11, United States |

|

|

|

|

|

Signature |

|

|

|

|

Code, specified in this petition. |

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

Date |

|

|

|

|

|

Signature of Authorized Individual |

|

|

|

|

|

|

|

|

|

|

|

Signature of bankruptcy petition preparer or officer, principal, responsible person, or |

|

Printed Name of Authorized Individual |

|

partner whose Social-Security number is provided above. |

|

|

|

|

|

|

|

|

|

Title of Authorized Individual |

|

Names and Social-Security numbers of all other individuals who prepared or assisted |

|

|

|

|

|

|

|

|

in preparing this document unless the |

bankruptcy petition preparer is not an |

|

Date |

|

individual. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If more than one person prepared this document, attach additional sheets conforming |

|

|

|

|

to the appropriate official form for each person. |

|

|

|

|

A bankruptcy petition preparer’s failure to comply with the provisions of title 11 and |

|

|

|

|

the Federal Rules of Bankruptcy Procedure may result in fines or imprisonment or |

|

|

|

|

both. 11 U.S.C. § 110; 18 U.S.C. § 156. |

|

|

|

|

B 1D (Official Form 1, Exhibit D) (12/09)

UNITED STATES BANKRUPTCY COURT

__________ District of __________

In re__________________________ |

Case No._____________ |

Debtor |

(if known) |

EXHIBIT D - INDIVIDUAL DEBTOR’S STATEMENT OF COMPLIANCE WITH

CREDIT COUNSELING REQUIREMENT

Warning: You must be able to check truthfully one of the five statements regarding credit counseling listed below. If you cannot do so, you are not eligible to file a bankruptcy case, and the court can dismiss any case you do file. If that happens, you will lose whatever filing fee you paid, and your creditors will be able to resume collection activities against you. If your case is dismissed and you file another bankruptcy case later, you may be required to pay a second filing fee and you may have to take extra steps to stop creditors’ collection activities.

Every individual debtor must file this Exhibit D. If a joint petition is filed, each spouse must complete and file a separate Exhibit D. Check one of the five statements below and attach any documents as directed.

’1. Within the 180 days before the filing of my bankruptcy case, I received a briefing from a credit counseling agency approved by the United States trustee or bankruptcy administrator that outlined the opportunities for available credit counseling and assisted me in performing a related budget analysis, and I have a certificate from the agency describing the services provided to me. Attach a copy of the certificate and a copy of any debt repayment plan developed through the agency.

’2. Within the 180 days before the filing of my bankruptcy case, I received a briefing from a credit counseling agency approved by the United States trustee or bankruptcy administrator that outlined the opportunities for available credit counseling and assisted me in performing a related budget analysis, but I do not have a certificate from the agency describing the services provided to me. You must file a copy of a certificate from the agency describing the services provided to you and a copy of any debt repayment plan developed through the agency no later than 14 days after your bankruptcy case is filed.

B 1D (Official Form 1, Exh. D) (12/09) – Cont. |

Page 2 |

|

’3. I certify that I requested credit counseling services from an approved agency but was unable to obtain the services during the seven days from the time I made my request, and the following exigent circumstances merit a temporary waiver of the credit counseling requirement so I can file my bankruptcy case now. [Summarize exigent circumstances here.]

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

If your certification is satisfactory to the court, you must still obtain the credit counseling briefing within the first 30 days after you file your bankruptcy petition and promptly file a certificate from the agency that provided the counseling, together with a copy of any debt management plan developed through the agency. Failure to fulfill these requirements may result in dismissal of your case. Any extension of the 30-day deadline can be granted only for cause and is limited to a maximum of 15 days. Your case may also be dismissed if the court is not satisfied with your reasons for filing your bankruptcy case without first receiving a credit counseling briefing.

’4. I am not required to receive a credit counseling briefing because of: [Check the applicable statement.] [Must be accompanied by a motion for determination by the court.]

’Incapacity. (Defined in 11 U.S.C. § 109(h)(4) as impaired by reason of mental illness or mental deficiency so as to be incapable of realizing and making rational decisions with respect to financial responsibilities.);

’Disability. (Defined in 11 U.S.C. § 109(h)(4) as physically impaired to the extent of being unable, after reasonable effort, to participate in a credit counseling briefing in person, by telephone, or through the Internet.);

’Active military duty in a military combat zone.

’5. The United States trustee or bankruptcy administrator has determined that the credit counseling requirement of 11 U.S.C. ' 109(h) does not apply in this district.

I certify under penalty of perjury that the information provided above is true and correct.

Signature of Debtor: ________________________

Date: _________________

B 1D (Official Form 1, Exhibit D) (12/09)

UNITED STATES BANKRUPTCY COURT

__________ District of __________

In re__________________________ |

Case No._____________ |

Debtor |

(if known) |

EXHIBIT D - INDIVIDUAL DEBTOR’S STATEMENT OF COMPLIANCE WITH

CREDIT COUNSELING REQUIREMENT

Warning: You must be able to check truthfully one of the five statements regarding credit counseling listed below. If you cannot do so, you are not eligible to file a bankruptcy case, and the court can dismiss any case you do file. If that happens, you will lose whatever filing fee you paid, and your creditors will be able to resume collection activities against you. If your case is dismissed and you file another bankruptcy case later, you may be required to pay a second filing fee and you may have to take extra steps to stop creditors’ collection activities.

Every individual debtor must file this Exhibit D. If a joint petition is filed, each spouse must complete and file a separate Exhibit D. Check one of the five statements below and attach any documents as directed.

’1. Within the 180 days before the filing of my bankruptcy case, I received a briefing from a credit counseling agency approved by the United States trustee or bankruptcy administrator that outlined the opportunities for available credit counseling and assisted me in performing a related budget analysis, and I have a certificate from the agency describing the services provided to me. Attach a copy of the certificate and a copy of any debt repayment plan developed through the agency.

’2. Within the 180 days before the filing of my bankruptcy case, I received a briefing from a credit counseling agency approved by the United States trustee or bankruptcy administrator that outlined the opportunities for available credit counseling and assisted me in performing a related budget analysis, but I do not have a certificate from the agency describing the services provided to me. You must file a copy of a certificate from the agency describing the services provided to you and a copy of any debt repayment plan developed through the agency no later than 14 days after your bankruptcy case is filed.

B 1D (Official Form 1, Exh. D) (12/09) – Cont. |

Page 2 |

|

’3. I certify that I requested credit counseling services from an approved agency but was unable to obtain the services during the seven days from the time I made my request, and the following exigent circumstances merit a temporary waiver of the credit counseling requirement so I can file my bankruptcy case now. [Summarize exigent circumstances here.]

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

If your certification is satisfactory to the court, you must still obtain the credit counseling briefing within the first 30 days after you file your bankruptcy petition and promptly file a certificate from the agency that provided the counseling, together with a copy of any debt management plan developed through the agency. Failure to fulfill these requirements may result in dismissal of your case. Any extension of the 30-day deadline can be granted only for cause and is limited to a maximum of 15 days. Your case may also be dismissed if the court is not satisfied with your reasons for filing your bankruptcy case without first receiving a credit counseling briefing.

’4. I am not required to receive a credit counseling briefing because of: [Check the applicable statement.] [Must be accompanied by a motion for determination by the court.]

’Incapacity. (Defined in 11 U.S.C. § 109(h)(4) as impaired by reason of mental illness or mental deficiency so as to be incapable of realizing and making rational decisions with respect to financial responsibilities.);

’Disability. (Defined in 11 U.S.C. § 109(h)(4) as physically impaired to the extent of being unable, after reasonable effort, to participate in a credit counseling briefing in person, by telephone, or through the Internet.);

’Active military duty in a military combat zone.

’5. The United States trustee or bankruptcy administrator has determined that the credit counseling requirement of 11 U.S.C. ' 109(h) does not apply in this district.

I certify under penalty of perjury that the information provided above is true and correct.

Signature of Debtor: ________________________

Date: _________________