Our PDF editor was developed with the objective of making it as simple and easy-to-use as possible. These particular steps will help make filling up the bir 2305 pdf quick and simple.

Step 1: Choose the button "Get form here" to get into it.

Step 2: When you have accessed the bir 2305 pdf editing page you'll be able to discover all the actions you may carry out relating to your document within the top menu.

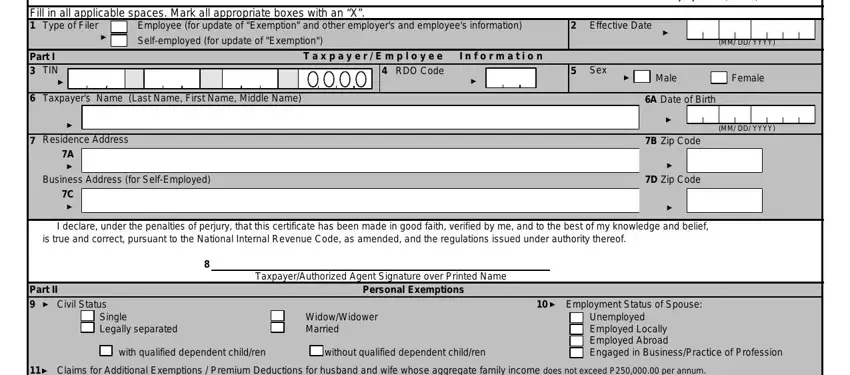

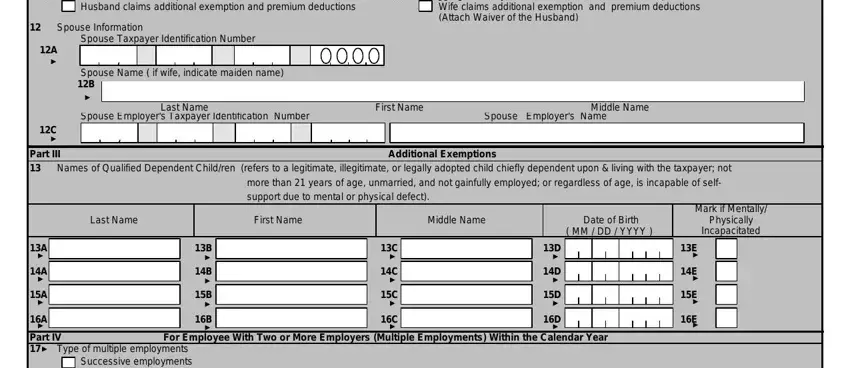

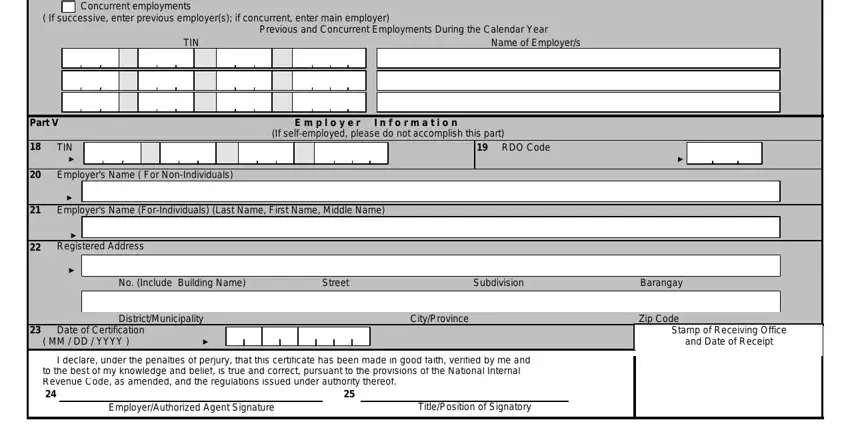

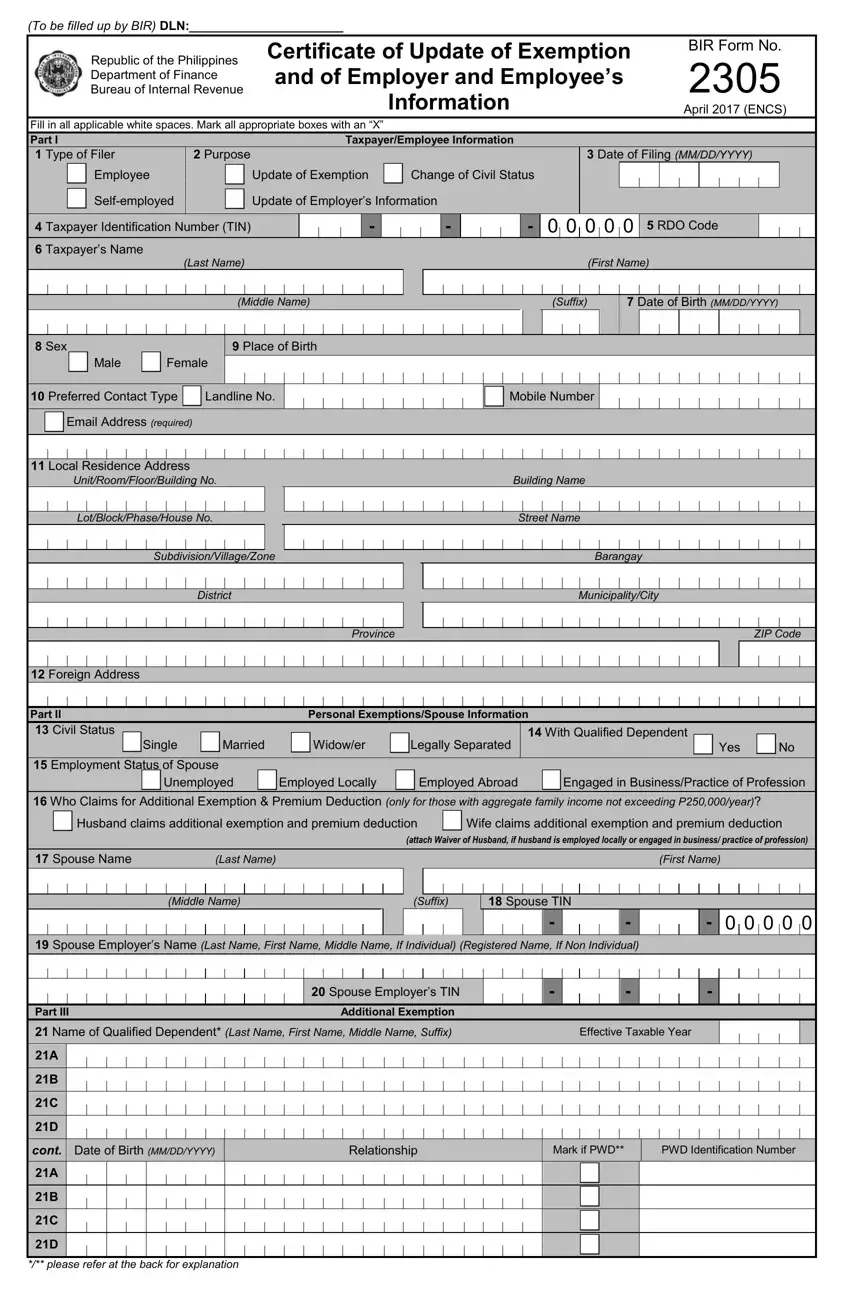

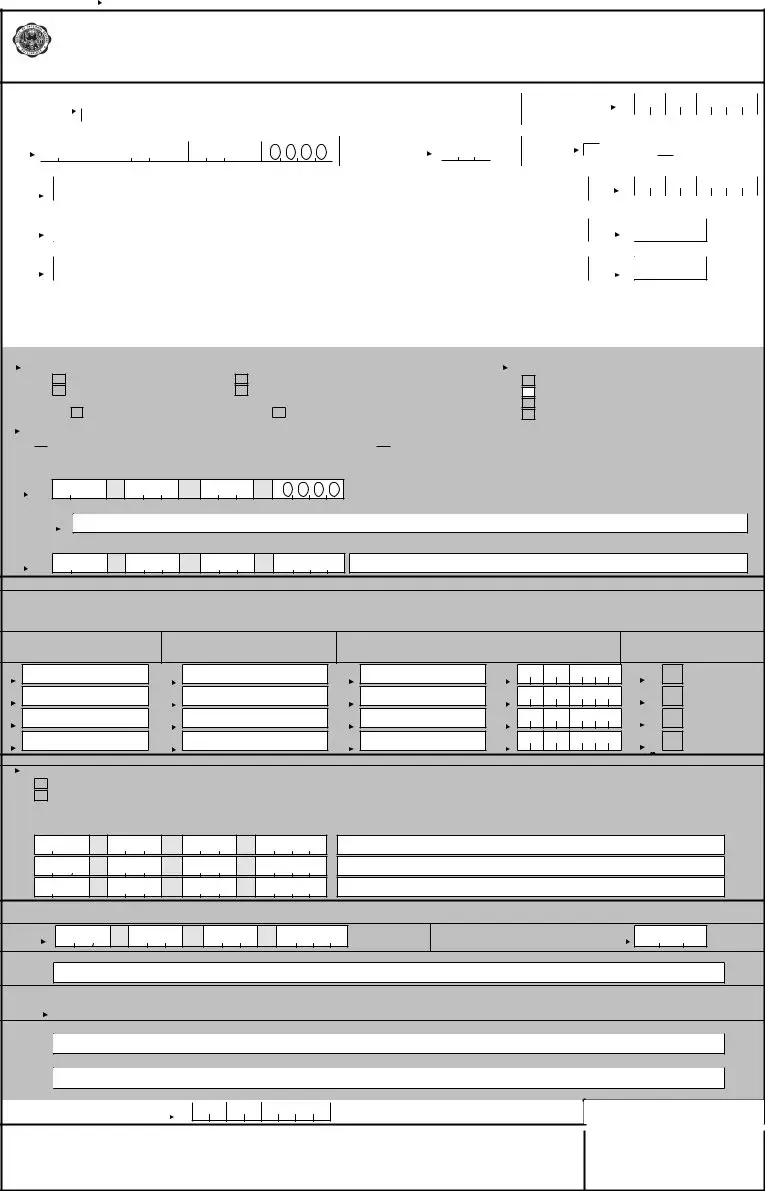

Prepare the bir 2305 pdf PDF by entering the content meant for each individual section.

Write down the required data in Husband claims additional, Claims for Additional Exemptions, Wife claims additional exemption, Spouse Taxpayer Identification, I I I I, I I I I, I I I, Spouse Name if wife indicate, I I I, Last Name, Spouse Employers Taxpayer, I I, I I I I, I I I I, and I I I I area.

You can be required particular important data if you need to prepare the Type of multiple employments, If successive enter previous, Previous and Concurrent, I I I I I I, Part V, I I I I I I I I I I I, TIN, I I I I I I I I I I I I, I I I I I I I I I I I I, I I I I I I, I E m p l o y e r, I n f o r m a t i o n, Name of Employers, If selfemployed please do not, and I I I I part.

Step 3: Select the "Done" button. Next, you may export your PDF document - save it to your electronic device or send it by using email.

Step 4: Get a duplicate of each separate file. It will certainly save you time and help you remain away from issues in the future. Keep in mind, the information you have is not shared or checked by us.

I

I I

I