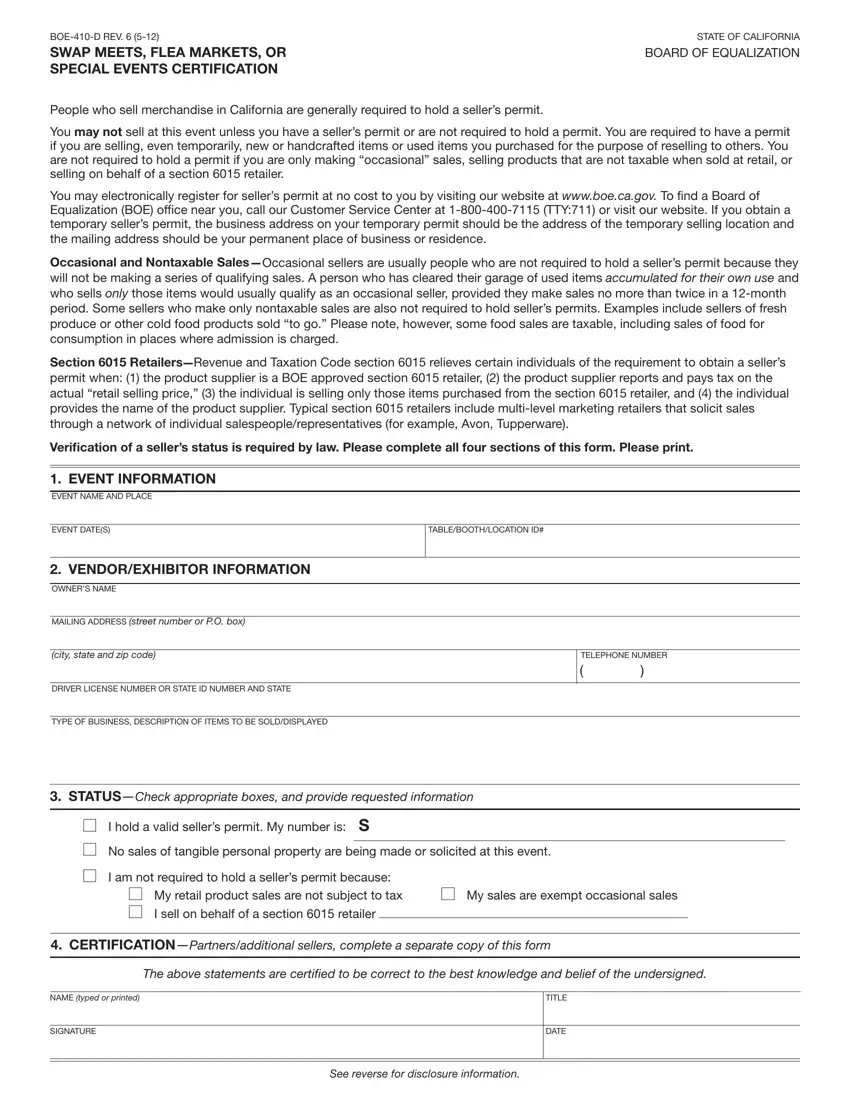

BOE-410-D REV. 6 (5-12) |

STATE OF CALIFORNIA |

SWAP MEETS, FLEA MARKETS, OR |

BOARD OF EQUALIZATION |

SPECIAL EVENTS CERTIFICATION |

|

People who sell merchandise in California are generally required to hold a seller’s permit.

You may not sell at this event unless you have a seller’s permit or are not required to hold a permit. You are required to have a permit if you are selling, even temporarily, new or handcrafted items or used items you purchased for the purpose of reselling to others. You are not required to hold a permit if you are only making “occasional” sales, selling products that are not taxable when sold at retail, or selling on behalf of a section 6015 retailer.

You may electronically register for seller’s permit at no cost to you by visiting our website at www.boe.ca.gov. To ind a Board of Equalization (BOE) ofice near you, call our Customer Service Center at 1-800-400-7115 (TTY:711) or visit our website. If you obtain a temporary seller’s permit, the business address on your temporary permit should be the address of the temporary selling location and the mailing address should be your permanent place of business or residence.

Occasional and Nontaxable Sales—Occasional sellers are usually people who are not required to hold a seller’s permit because they will not be making a series of qualifying sales. A person who has cleared their garage of used items accumulated for their own use and who sells only those items would usually qualify as an occasional seller, provided they make sales no more than twice in a 12-month period. Some sellers who make only nontaxable sales are also not required to hold seller’s permits. Examples include sellers of fresh produce or other cold food products sold “to go.” Please note, however, some food sales are taxable, including sales of food for consumption in places where admission is charged.

Section 6015 Retailers—Revenue and Taxation Code section 6015 relieves certain individuals of the requirement to obtain a seller’s permit when: (1) the product supplier is a BOE approved section 6015 retailer, (2) the product supplier reports and pays tax on the actual “retail selling price,” (3) the individual is selling only those items purchased from the section 6015 retailer, and (4) the individual provides the name of the product supplier. Typical section 6015 retailers include multi-level marketing retailers that solicit sales through a network of individual salespeople/representatives (for example, Avon, Tupperware).

Verification of a seller’s status is required by law. Please complete all four sections of this form. Please print.

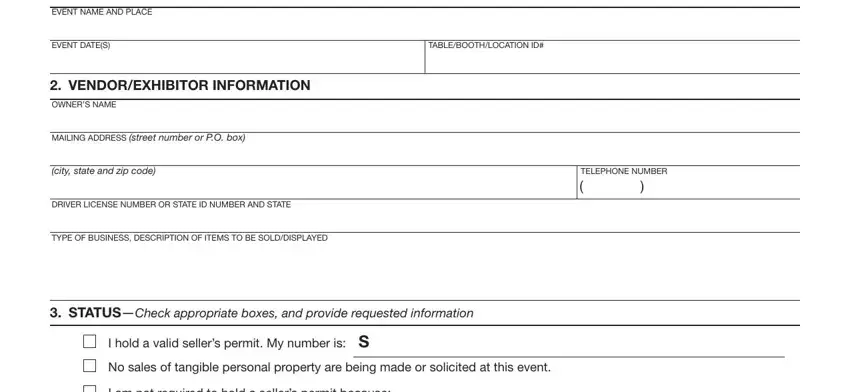

1. EVENT INFORMATION

EVENT NAME AND PLACE

EVENT DATE(S) |

TABLE/BOOTH/LOCATION ID# |

|

|

2. VENDOR/EXHIBITOR INFORMATION

OWNER’S NAME

MAILING ADDRESS (street number or P.O. box)

(city, state and zip code) |

TELEPHONE NUMBER |

|

( |

) |

|

|

|

DRIVER LICENSE NUMBER OR STATE ID NUMBER AND STATE

TYPE OF BUSINESS, DESCRIPTION OF ITEMS TO BE SOLD/DISPLAYED

3.STATUS—Check appropriate boxes, and provide requested information

I hold a valid seller’s permit. My number is: S

No sales of tangible personal property are being made or solicited at this event.

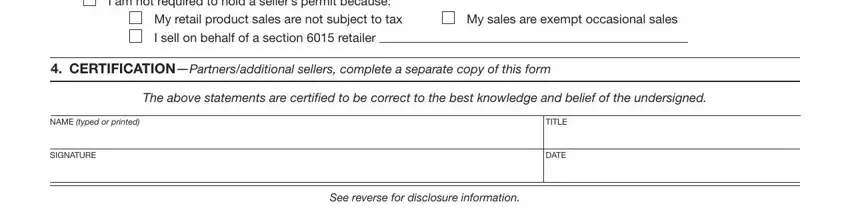

I am not required to hold a seller’s permit because:

My retail product sales are not subject to tax I sell on behalf of a section 6015 retailer

My sales are exempt occasional sales

4.CERTIFICATION—Partners/additional sellers, complete a separate copy of this form

The above statements are certified to be correct to the best knowledge and belief of the undersigned.

See reverse for disclosure information.

BOE-324-GEN-S REV. 8 (8-12) |

STATE OF CALIFORNIA |

BOARD OF EQUALIZATION

Privacy Notice

This is not a request for you to provide information. This is an informational notice according to the requirements of the Information Practices Act (Civil Code §1798.17). No action is required.

We ask you for information so that the BOE can administer the state’s tax and fee laws. The BOE will use the information to determine whether you are paying the correct amount of tax and to collect any amounts you owe. You must provide all information requested, including your social security number (used for identiication purposes [see Title 42 U.S. Code sec.405(c)(2)(C)(i)]). A list of authorized agencies, among others, who the BOE may disclose information to, and a complete list of the California Revenue and Taxation Codes is available on our website at www.boe.ca.gov/pdf/boe324gen.pdf, then scroll to the second page.

What happens if I don’t provide the information?

If your registration information is incomplete, the BOE may not issue your permit, certiicate, or license. If you do not ile complete returns, you may have to pay penalties and interest. Penalties may also apply if you do not provide other information the BOE requests or that is required by law, or if you provide fraudulent information. In some cases, you may be subject to criminal prosecution.

In addition, if you do not provide the requested information to support your exemptions, credits, exclusions, or adjustments, they may not be allowed. You may owe more tax or fees or receive a smaller refund.

Can anyone else see my information?

Your records are covered by state laws that protect your privacy. However, the BOE may share information regarding your account with speciic state, local, and federal government agencies. The BOE may also share speciic information with companies authorized to represent local governments.

Under some circumstances, the BOE may release the information printed on your permit, certiicate, or license, such as account start and closeout dates, and names of business owners or partners, to the public. When you sell a business, the BOE may give the buyer or other involved parties information regarding your outstanding tax liability.

With your written permission, the BOE can release information regarding your account to anyone you designate.

Can I review my records?

Yes. Requests should be made in writing to your closest BOE ofice. A complete listing of BOE locations can be found at www.boe.ca.gov. Additional information regarding your records can be found in publication 58-A, How to Inspect and Correct Your Records. For a copy of this publication, go to www.boe.ca.gov or call the Customer Service Center at

1-800-400-7115 (TTY:711), Monday through Friday, 8:00 a.m. to 5:00 p.m. (Paciic time), except state holidays. If you need more information, you may contact the BOE’s Disclosure Oficer at 1-916-445-2918 or by writing:

Disclosure Oficer, MIC:82

State Board of Equalization

PO Box 942879

Sacramento, CA 94279-0082

Who is responsible for maintaining my records?

The oficials listed below are responsible for maintaining your records.

Sales and Use Tax Department |

Property and Special Taxes Department |

Board of Equalization |

Board of Equalization |

Deputy Director, SUTD, MIC:43 |

Deputy Director, PSTD, MIC:63 |

PO Box 942879 |

PO Box 942879 |

Sacramento, CA 94279-0043 |

Sacramento, CA 94279-0063 |

1-916-445-1441 |

1-916-445-1516 |