Through the online PDF tool by FormsPal, it is possible to complete or change A6 right here and now. To keep our tool on the leading edge of practicality, we aim to adopt user-driven capabilities and improvements regularly. We are routinely pleased to get feedback - play a vital role in reshaping the way you work with PDF files. To get the ball rolling, take these simple steps:

Step 1: Click the "Get Form" button above on this page to open our PDF editor.

Step 2: The tool will let you modify your PDF document in a variety of ways. Modify it by writing customized text, correct original content, and place in a signature - all at your fingertips!

It's simple to fill out the form using this helpful guide! This is what you have to do:

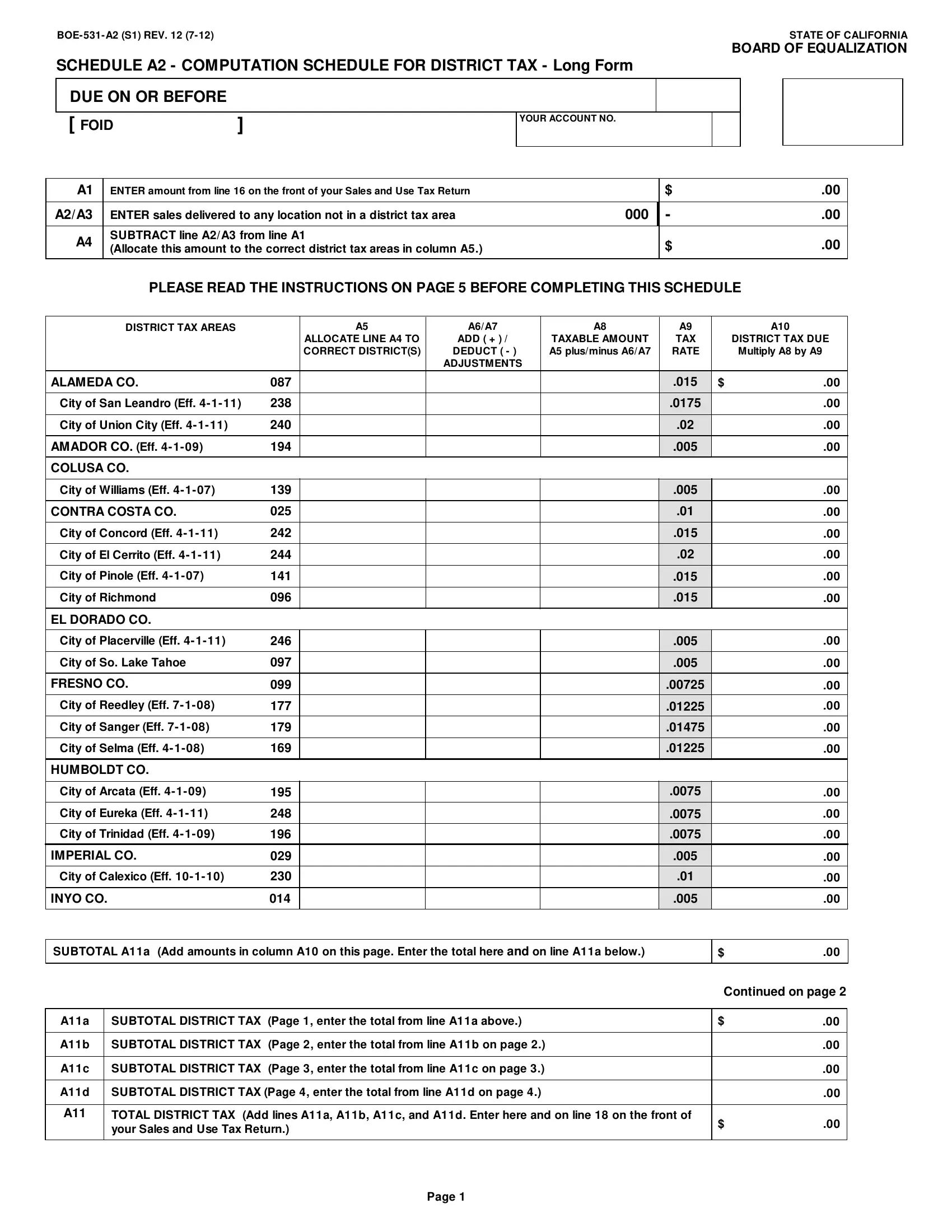

1. While filling out the A6, ensure to include all needed blank fields in its corresponding section. This will help facilitate the process, allowing your information to be processed without delay and appropriately.

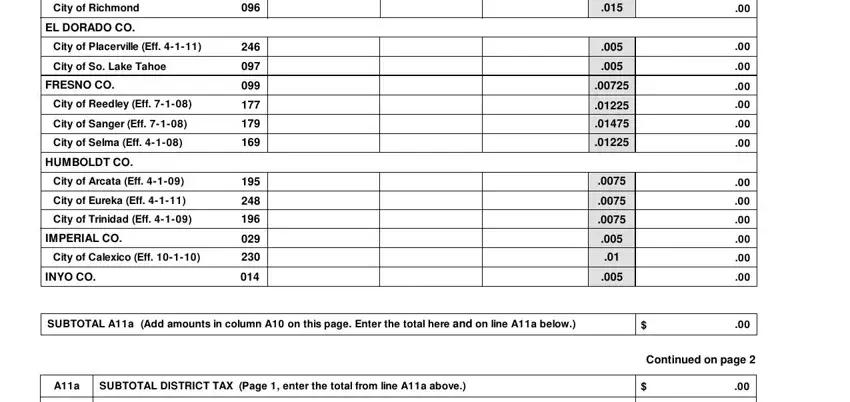

2. Once your current task is complete, take the next step – fill out all of these fields - City of Richmond, EL DORADO CO, City of Placerville Eff , City of So Lake Tahoe, FRESNO CO, City of Reedley Eff , City of Sanger Eff , City of Selma Eff , HUMBOLDT CO, City of Arcata Eff , City of Eureka Eff , City of Trinidad Eff , IMPERIAL CO, City of Calexico Eff , and INYO CO with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be really attentive while filling in City of Arcata Eff and City of Richmond, since this is where many people make errors.

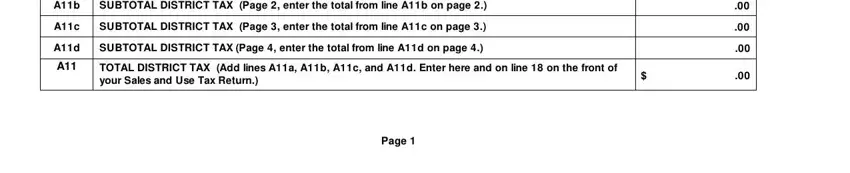

3. Completing SUBTOTAL DISTRICT TAX Page enter, SUBTOTAL DISTRICT TAX Page enter, SUBTOTAL DISTRICT TAX, Page enter the total from line Ad, TOTAL DISTRICT TAX your Sales and, Add lines Aa Ab Ac and Ad Enter, and Page is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

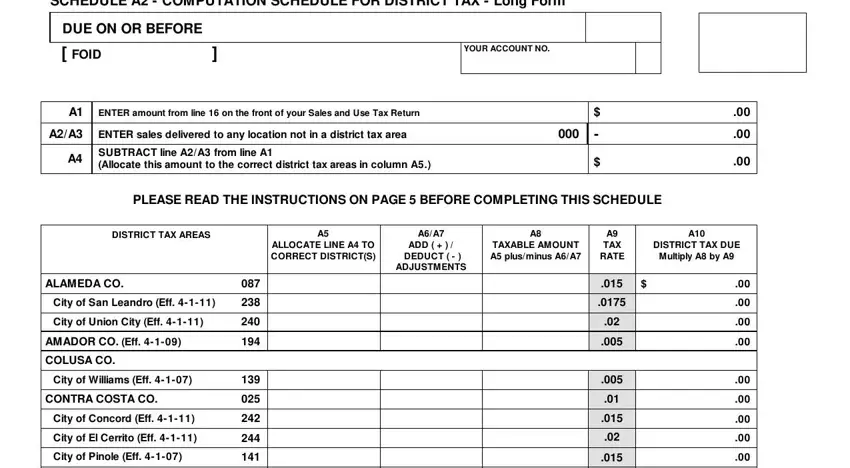

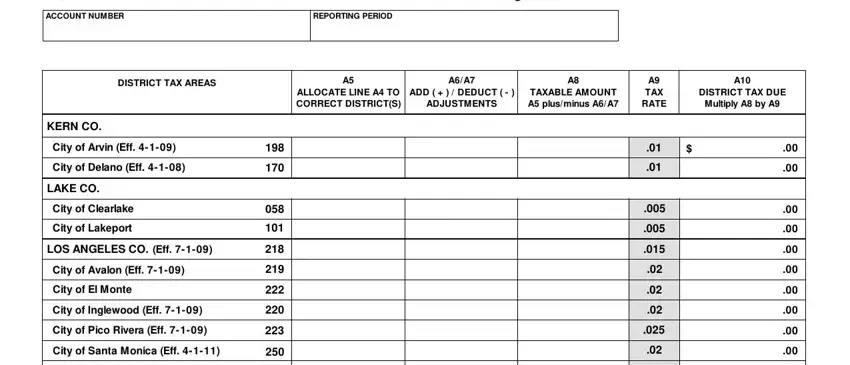

4. To move onward, this fourth stage requires typing in a handful of empty form fields. Included in these are SCHEDULE A COMPUTATION SCHEDULE, ACCOUNT NUMBER, REPORTING PERIOD, DISTRICT TAX AREAS, ALLOCATE LINE A TO CORRECT, ADD DEDUCT , ADJUSTMENTS, TAXABLE AMOUNT A plusminus AA, A TAX RATE, DISTRICT TAX DUE, Multiply A by A, KERN CO, City of Arvin Eff , City of Delano Eff , and LAKE CO, which you'll find key to moving forward with this particular process.

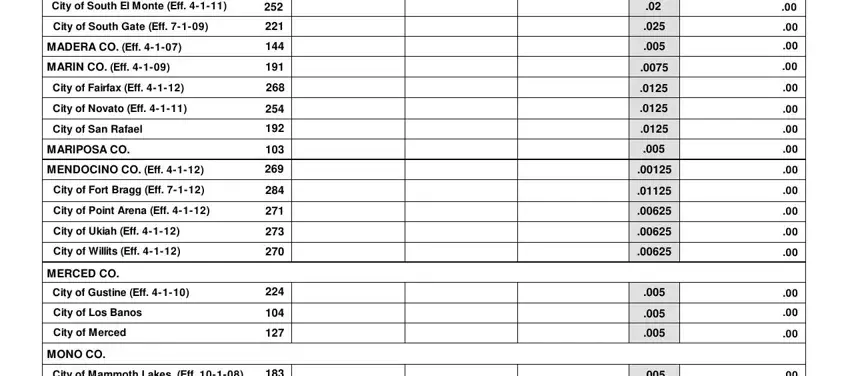

5. To finish your document, this particular segment incorporates several additional blanks. Entering City of South El Monte Eff , City of South Gate Eff , MADERA CO, Eff , MARIN CO Eff , City of Fairfax Eff , City of Novato Eff , City of San Rafael, MARIPOSA CO, MENDOCINO CO Eff , City of Fort Bragg Eff , City of Point Arena Eff , City of Ukiah Eff , City of Willits Eff , and MERCED CO will finalize the process and you'll surely be done in no time!

Step 3: Check what you have entered into the form fields and then click on the "Done" button. After starting a7-day free trial account here, it will be possible to download A6 or send it via email promptly. The form will also be readily accessible via your personal account menu with all of your changes. When using FormsPal, you'll be able to fill out documents without needing to get worried about personal information breaches or entries being shared. Our protected platform makes sure that your private information is kept safely.