Benefits Planning Query Handbook

(BPQY)

Distributed by

Office of Retirement and Disability Policy

Office of Program Development and Research

July 2012

Version 5.2

Release Date 07/19/12

(This version supersedes all previous versions.)

1

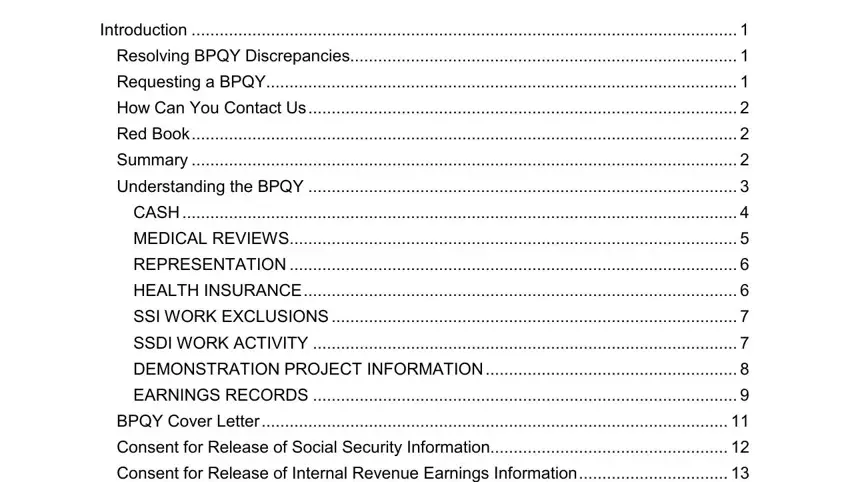

Table of Contents

Introduction |

1 |

Resolving BPQY Discrepancies |

1 |

Requesting a BPQY |

1 |

How Can You Contact Us |

2 |

Red Book |

2 |

Summary |

2 |

Understanding the BPQY |

3 |

CASH |

4 |

MEDICAL REVIEWS |

5 |

REPRESENTATION |

6 |

HEALTH INSURANCE |

6 |

SSI WORK EXCLUSIONS |

7 |

SSDI WORK ACTIVITY |

7 |

DEMONSTRATION PROJECT INFORMATION |

8 |

EARNINGS RECORDS |

9 |

BPQY Cover Letter |

11 |

Consent for Release of Social Security Information |

12 |

Consent for Release of Internal Revenue Earnings Information |

13 |

Medicaid State Listings Chart |

14 |

Possible Medicaid Entries |

15 |

2

BPQY Handbook

Introduction

The Benefits Planning Query (BPQY) is part of the Social Security Administration’s (SSA) efforts to inform Social Security Disability Insurance (SSDI) beneficiaries and Supplemental Security Income (SSI) recipients about their disability benefits and the use of the work incentives. A BPQY statement contains detailed information about the status of a beneficiary's disability cash benefits, scheduled medical reviews, health insurance, and work history. In essence, the BPQY provides a snapshot of the beneficiary's benefits and work history as stored in SSA's electronic records.

The BPQY is a tool used by Area Work Incentive Coordinators (AWIC), the Plan to Achieve Self-Support (PASS) Cadre members, advocates, beneficiaries, and other individuals. The information contained in a BPQY provides customized information on SSA’s employment support programs to beneficiaries with disabilities who want to start or keep working. Analysis of a beneficiary’s disability and work status is the first step when planning a successful return to work.

Resolving BPQY Discrepancies

The BPQY extracts information from our records that is specifically for beneficiaries with disabilities. It encourages planning for return to work by helping them understand how and when work will affect benefits. Please review the BPQY carefully. Report any discrepancies or errors on the BPQY and resolve them through your local Social Security office as soon as possible. Obtain a subsequent BPQY to confirm that correction(s) were made.

Requesting a BPQY

We give the BPQY statement to beneficiaries and their representatives upon request with proper authorization.

Beneficiaries can request a BPQY by contacting their local office, or calling

1-800-772-1213. We mail the BPQY and its cover letter directly to the beneficiary at the address shown on the current SSA record.

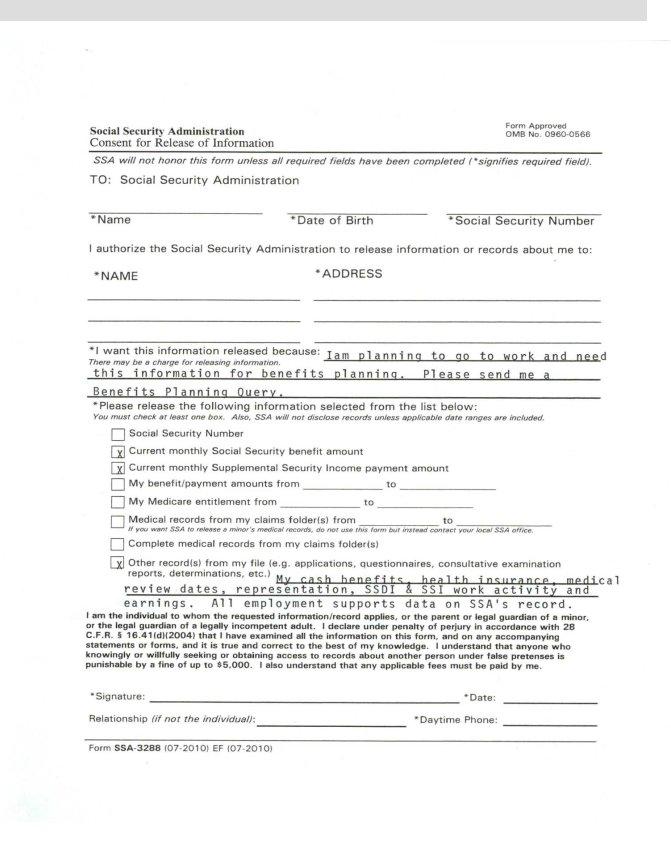

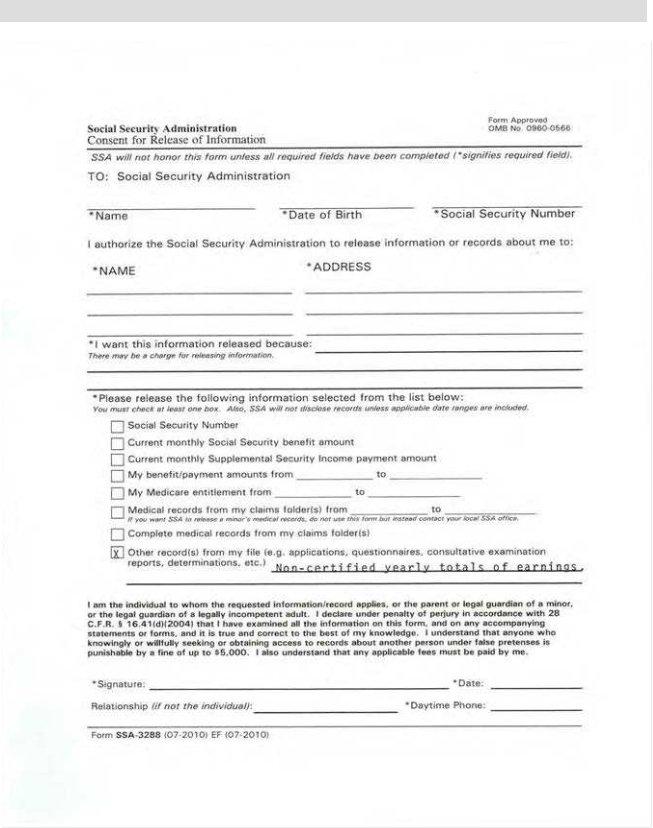

Signed consents are required only if the BPQY will be sent to someone other than the beneficiary, his/her Representative Payee, or Authorized Representative. An advocate, benefits counselor, or an organization must submit two Consent for Release of Information forms (SSA-3288) that have been appropriately signed by the beneficiary. (See Exhibits on pages 13-14.) The first Consent for Release of Information is needed to release information from Social Security records, and the second Consent for Release of Information is to authorize the release of Internal Revenue Service (IRS)

1

BPQY Handbook

earnings records. Both releases must contain the beneficiary’s Social Security Number (SSN) or the Claim Number. An electronic signature of the beneficiary is not acceptable.

How Can You Contact Us

You may contact your local SSA office or call SSA’s toll free number 1-800-772-1213 from 7 a.m. to 7 p.m., Monday through Friday. People who are deaf or hard of hearing may call our toll-free TTY/TDD number, 1-800-325-0778, between 7 a.m. and

7 p.m., on Monday through Friday. A telephone representative will either help you or put you in contact with your local office. Many local telephone directories list local offices under “Social Security.”

If you have internet access, use the Social Security Office Locator on our home page, Social Security Online, at www.socialsecurity.gov. Enter your postal ZIP code and we will give you the address, telephone number, and directions to your local office.

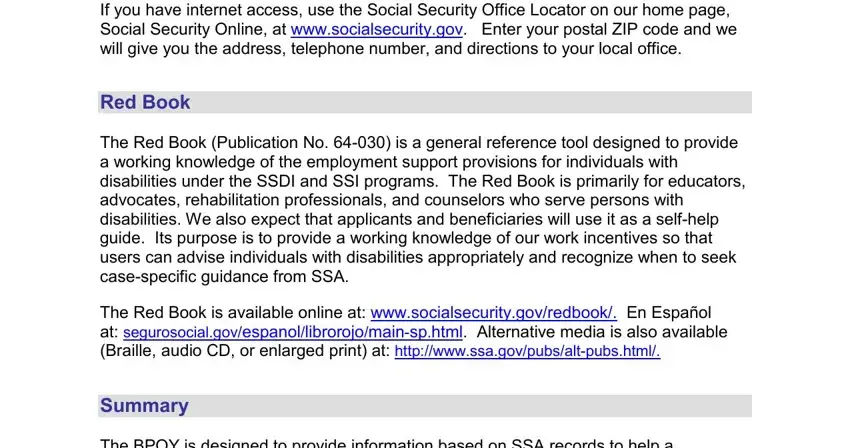

Red Book

The Red Book (Publication No. 64-030) is a general reference tool designed to provide a working knowledge of the employment support provisions for individuals with disabilities under the SSDI and SSI programs. The Red Book is primarily for educators, advocates, rehabilitation professionals, and counselors who serve persons with disabilities. We also expect that applicants and beneficiaries will use it as a self-help guide. Its purpose is to provide a working knowledge of our work incentives so that users can advise individuals with disabilities appropriately and recognize when to seek case-specific guidance from SSA.

The Red Book is available online at: www.socialsecurity.gov/redbook/. En Español

at: segurosocial.gov/espanol/librorojo/main-sp.html. Alternative media is also available

(Braille, audio CD, or enlarged print) at: http://www.ssa.gov/pubs/alt-pubs.html/.

Summary

The BPQY is designed to provide information based on SSA records to help a successful return to work effort. Any plan for returning to work should begin with knowing existing disability benefit status and having an understanding of how work will impact disability benefits. A BPQY is an excellent starting point.

2

BPQY Handbook

Understanding the BPQY

The following sections define terms used in a BPQY statement.

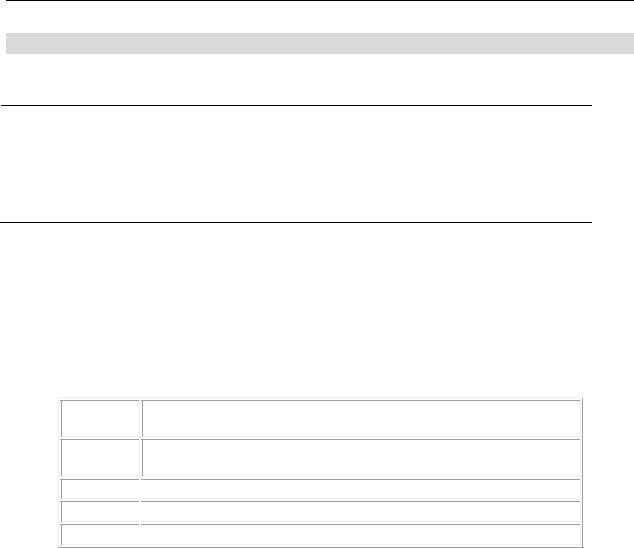

Benefits Planning Query (BPQY)

Confidential Social Security Data

|

NAME: |

EMILY CLAIMANT |

|

SSN: XXX-XX-1234 |

|

|

|

|

|

|

|

|

|

|

|

Social Security Disability |

Supplemental Security Income |

|

|

|

|

Insurance (SSDI) |

(SSI) |

|

|

|

|

|

|

|

|

RECORD |

|

|

See Below |

See Below |

|

CASH |

|

|

|

|

|

|

Type of Benefit |

|

|

Disabled Worker |

Disabled Individual |

|

Current Status |

|

|

Current Pay |

Current Pay |

|

Statutory Blindness |

No |

No |

|

Date of Disability Onset |

07/02 |

05/99 |

|

|

Date of Entitlement |

12/02 |

05/99 |

|

|

Full Amount |

|

|

$292.70 |

$331.00 |

|

|

Net Amount |

|

|

$292.70 |

$331.00 |

|

|

Others Paid on this Record |

No |

No |

|

Total Family Cash Benefit |

$292.70 |

Not Applicable |

|

Overpayment Balance |

$0.00 |

$0.00 |

|

|

Monthly Amount Withheld |

$0.00 |

$0.00 |

|

Name: Name of the individual who is the subject of the BPQY

SSN: BPQY gives the SSN of the individual who is the subject of the statement, even if benefits are being paid from a parent’s or spouse’s record under a different SSN.

3

BPQY Handbook

CASH

This block details type and status of benefits and payment amounts.

Type of Benefit: Shows the type of benefit received. NOTE: In SSDI cases, a beneficiary may receive benefits on more than one record (SSN), but only the current benefit is reported on the BPQY.

•Possible SSDI entries:

Disabled Worker, Disabled Adult Child, Disabled Widow, Disabled Widower, Disallowed Claim, Denied Claim-Medical Denial

•Possible SSI entries:

Disabled Individual, Disabled Spouse, Disabled Child, Blind Individual, Blind Spouse, Blind Child, Disabled Student, Blind Student

Current Status: A beneficiary may be in a “current pay” status (getting a check), suspended, or terminated entitlement.

Statutory Blindness: “Yes” means that SSA has determined that the beneficiary’s visual impairment meets the definition of Statutory Blindness, under the Social Security Act for SSDI/SSI benefit purposes. The substantial gainful activity (SGA) level is higher for statutory blindness than for other types of disabilities.

Date of Disability Onset: The most recent medical disability onset date established by SSA.

Date of Entitlement: The most recent date of entitlement to SSDI benefits and/or the most recent date of eligibility for SSI. Earlier periods of entitlement and/or eligibility are not displayed.

Full Amount: The full amount of the monthly cash benefit before any deductions or reductions for Medicare premiums, overpayment collections, etc.

Possible entries are: Monthly cash benefit amount, suspended, deferred, or terminated.

The SSI full amount includes any federally administered state supplement, but does not include any state administered state supplement payment.

Net Amount: The amount of cash benefits paid by check or electronic funds transfer to the beneficiary’s financial institution. This is the cash amount received after deducting any Medicare premium, overpayment recovery, garnishment, etc. from the “Full Amount.”

Others Paid On This Record: Indicates if other people are entitled to benefits on this record. Other beneficiary’s cash or medical benefits may be affected when the disabled individual’s work activity results in termination of cash benefits. If a disabled adult child/widow(er) benefit is listed as a "Type of Benefit", other beneficiaries on this

4

BPQY Handbook

record will not have their benefits reduced due to the work activity of the disabled adult child/widow(er) but others’ benefits may increase.

Total Family Cash Benefit: The full amount of cash benefits paid to the disability beneficiary and other entitled family members on this record for SSDI. “Not Applicable” will print under the SSI column since SSI is an individual entitlement.

Overpayment Balance: The current balance of any outstanding monies owed to SSA for incorrect cash payments.

Monthly Amount Withheld: The amount of cash benefits that SSA is withholding to apply towards a past overpayment of benefits.

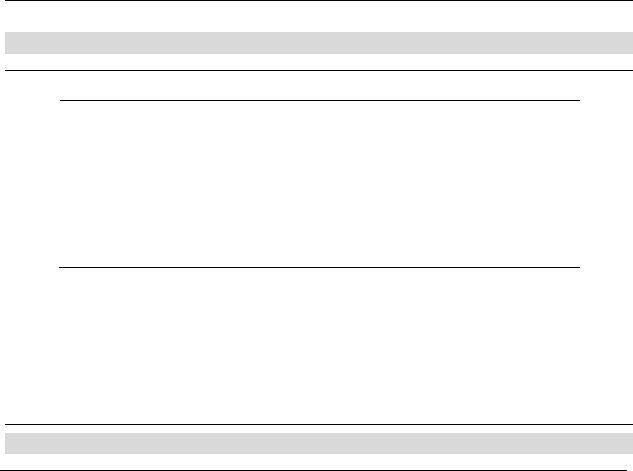

MEDICAL REVIEWS

Shows data from any SSDI or SSI medical review diary.

MEDICAL REVIEWS |

|

|

Next Medical Review |

09/08 |

07/01/06 |

Medical Re-exam Cycle |

3+ years |

3+ years |

Next Medical Review: The date scheduled to review the beneficiary’s medical condition. If “Unknown” is displayed, no medical review is scheduled.

Medical Re-Exam Cycle: There are three types of medical review diaries. The letter codes represent the reason for establishing a periodic review diary of less than 3 years, while the numeric codes represent periodic review diaries of 3 years or

longer. Possible entries are:

Periodic review diary of less than 3 years (medical improvement is expected)

3-year periodic review diary (non-permanent disability)

5-year periodic review diary (permanent disability)

7-year periodic review diary (permanent disability)

NOTE: There may be different periodic review diaries and scheduled dates for SSDI and SSI. The entries will show that the medical diary is deferred due to Ticket to Work.

5

BPQY Handbook

REPRESENTATION

REPRESENTATION |

|

|

Representative Payee |

Yes |

Yes |

Authorized Representative |

No |

No |

Representative Payee: A “No” indicates that the disabled beneficiary receives cash benefits directly; a “Yes” means that he/she has a Representative Payee. There are separate lines for SSDI and SSI because a beneficiary may have a Representative Payee for SSDI and not for SSI or the converse can be true.

Authorized Representative: A “No” indicates that the disabled beneficiary does not have an authorized representative; a “Yes” means that he/she has appointed an Authorized Representative.

HEALTH INSURANCE

HEALTH INSURANCE |

MEDICARE |

|

MEDICAID |

Type |

PART A |

PART B |

Eligible for Medicaid |

|

|

|

(SSI)(1634 States only) |

Start |

12/2004 |

12/2002 |

|

Stop |

|

|

|

Buy-In |

No |

Yes |

|

Type: Shows the type of Medicare and/or Medicaid health insurance entitlement and/or eligibility on SSA’s records. It includes Medicare Part A (hospital) and Part B (medical) and Medicaid eligibility status under SSI.

Start: Date current coverage began.

Stop: Date coverage ended.

NOTE: When an SSDI beneficiary reaches age 65, Medicare converts from Medicare based on disability to Medicare based on age. This occurs even though cash benefits won't convert to retirement benefits until full retirement age, currently age 66. In these

6

BPQY Handbook

situations, the BPQY incorrectly displays a MEDICARE stop date effective with the month of the 65th birthday.

Buy-In: Shows “Yes” or “No” for Parts A & B. A “Yes” means the state of residency pays the premium for this beneficiary. “No” means the premium is either deducted from his or her monthly check or paid by premium billing.

Part A is premium free except for extended Medicare eligibility through Medicare for the Working Disabled.

CAUTION: There are sources of eligibility to Medicaid that are unknown to SSA. If an SSI recipient resides in a state that allows Medicaid eligibility with SSI eligibility (i.e., a 1634 state) the BPQY will show the Medicaid eligibility information. For all other situations (i.e., 209b states or SSI criteria states), verify Medicaid eligibility through the local or state Medicaid Agency. View Medicaid entries here.

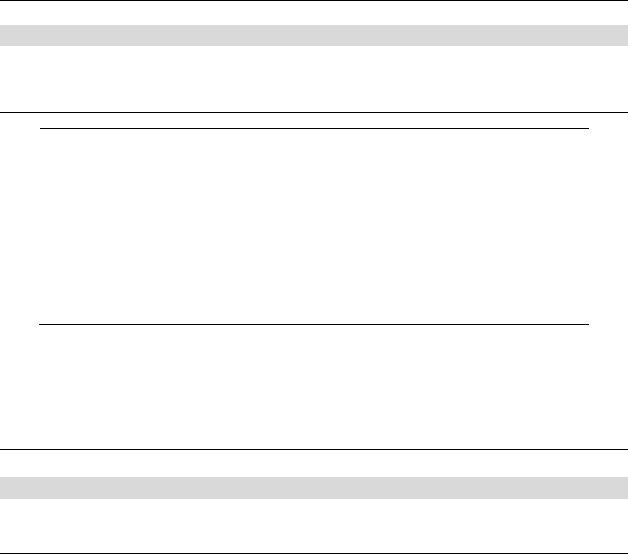

SSI WORK EXCLUSIONS

Details SSI Work Incentives that exclude EARNED income from the calculation of the SSI payment amount.

SSI WORK EXCLUSIONS

Blind Work Expenses

Impairment-Related Work Expenses

Student Earned Income Exclusions

PASS Exclusion

If a work exclusion does not apply, the entry will be blank.

If a work exclusion applies, the dollar amount of the exclusion and the month when it was excluded will be provided.

NOTE: A Plan to Achieve Self-Support (PASS) can also result in an exclusion of unearned income.

SSDI WORK ACTIVITY

Details a beneficiary’s work activity as recorded in SSDI electronic records.

7

|

BPQY Handbook |

SSDI WORK ACTIVITY |

|

|

|

Trial Work Months |

Start: 7/10 End: 4/11 Used: 9 months (completed) |

Month of Cessation |

N/A |

Current SGA Level |

$1,010.00 |

Last Work Review Action |

05/10/2011 |

Trial Work Months: |

|

•Start: Month and year of the first month of Trial Work Period (TWP)

•End: Month and year of last month of TWP

•Used: Total number of months of the TWP completed

This information is based on the most recent work continuing disability review (CDR) determination. In some cases, a work CDR may be pending or overdue, so the information provided may not be current. If you suspect that this information is outdated or incorrect, contact a Social Security representative as soon as possible.

Month of Cessation: The first month after the TWP that, based on SSA records, the beneficiary performed SGA. Payment of cash benefits after the cessation month depends on the beneficiary’s work activity. The beneficiary is entitled to benefits for that month, and the next two months (grace period). It is possible for a beneficiary to have a cessation date but still continue receiving benefits if the gross monthly earnings during the extended period of eligibility are not SGA.

Current SGA Level: The SGA amount appropriate for this beneficiary. The current SGA amount for beneficiaries with disabilities other than blindness and for individuals with blindness may be found in The Red Book

at http://www.ssa.gov/redbook/eng/main.htm. SGA amounts may be updated annually in January.

Last Work Action Review: The last work action review represents either the last work review decision date or the date we started a current review.

DEMONSTRATION PROJECT INFORMATION

Provides information about any applicable demonstration project such as a Benefit Offset National Demonstration.

8

BPQY Handbook

EARNINGS RECORDS

Provides an annual and monthly synopsis of work-related earnings as shown in our records.

IRS RECORDED EARNINGS (YEARLY) |

SSI RECORDED EARNINGS (MONTHLY) |

YEAR |

EARNINGS |

YEAR |

EARNINGS |

MONTHS EARNINGS |

MONTHS |

|

EARNINGS |

|

|

|

|

|

|

|

1997 |

$617.91 |

1998 |

$827.65 |

01/05-01/05 $ |

230.27 (V) |

02/05-02/05 |

$ |

250.98 (V) |

|

|

|

|

|

|

|

1999 |

872.46 |

2000 |

$722.58 |

03/05-03/05 $ |

317.73 (V) |

04/05-04/05 |

$ |

170.97 (V) |

|

|

|

|

|

|

|

2001 |

$1,813.50 |

2002 |

$3,215.55 |

05/05-05/05 $ |

176.53 (V) |

06/05-06/05 |

$ |

264.81 (V) |

|

|

|

|

|

|

|

2003 |

$3,027.95 |

2004 |

$3,843.10 |

10/05-10/05 $ |

73.67 |

(V) |

11/05-11/05 |

$ |

36.00 |

(V) |

|

|

|

|

|

|

|

2005 |

$2,072.73 |

2006 |

$1,018.00 |

12/05-12/05 $ |

54.00 |

(V) |

01/06-01/06 |

$ |

33.50 |

(V) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

05/06-05/06 $ |

36.00 |

(E) |

06/06-06/06 |

$ |

54.00 |

(E) |

|

|

|

|

07/06-07/06 $ |

36.00 |

(E) |

12/06-12/06 |

$ |

54.00 |

(E) |

This section provides a breakdown of annual and monthly earnings. The source of the annual earnings is from the IRS based on employer reports to the IRS and reported to SSA.

The right columns display monthly earnings for the most recent 2 years posted on the SSI record. Verified earnings have a “V” code and estimated earnings have an “E” code.

POSTED SSDI MONTHLY EARNINGS (LAST FIVE YEARS)

Provides a listing of the last five years of monthly SSDI earnings.

5 Most Recent Years’ SSDI Monthly Earnings

|

|

|

Total Countable |

Date |

Gross Wages |

Gross Verification |

Earnings |

9/1/2004 |

$212.98 |

Y |

$112.98 |

|

|

|

|

10/1/2004 |

$625.42 |

Y |

$525.42 |

|

|

|

|

11/1/2004 |

$589.24 |

Y |

$489.24 |

12/1/2004 |

$234.16 |

Y |

$134.16 |

|

|

|

|

1/1/2005 |

$498.76 |

Y |

$398.76 |

|

|

|

|

2/1/2005 |

$443.23 |

Y |

$343.23 |

3/1/2005 |

$277.87 |

Y |

$177.87 |

|

|

|

|

Gross Wages: The monthly earnings for the five most recent years as posted on the SSDI record.

9

BPQY Handbook

Gross Verification: “Y” indicates earnings are verified. If gross earnings are unverified, they are coded with an “N.”

Total Countable Earnings: The total amount of earnings after deductions for subsidies, special conditions, unincurred business expenses, and impairment-related work expenses.

10

BPQY Handbook

BPQY Cover Letter

Social Security

Benefit Information

From: SOCIAL SECURITY ADMINISTRATION

FIELD OFFICE’S ADDRESS DATE OF ISSUE

BENEFICARY’S NAME BENEFICARY’S ADDRESS

You requested the attached Benefits Planning Query (BPQY). The BPQY includes information about your:

•Disability cash payments

•Scheduled medical reviews

•Health insurance

•Work history

Please contact us if this information does not match your records.

You can use the BPQY to help you plan a successful return to work. For information on how work may affect your benefits and our work incentive programs you can request a copy of our free pamphlet, Working While Disabled-How We Can Help (SSA Publication Number 05-10095) or the Red Book, a summary guide to our employment support programs for persons with disabilities. Both of these publications are available online at www.socialsecurity.gov/pubs/10095.html or www.socialsecurity.gov/redbook. Also, these publications include information about the Ticket to Work program, which can help you work or increase your earnings. To learn more, call 1-866-968-7842 (TTY 1-866-833-2967) or

visit www.socialsecurity.gov/work.

What to Report If You Work and Receive Disability

You must let us know right away if:

•You start or stop work;

•Your duties, hours, or pay changes; or

•You start paying for expenses for work due to your disability.

You can report changes in your work activity by phone, fax, mail, or in person. Call our toll-free number 1-800-772-1213 between 7 a.m. and 7 p.m., Monday through Friday, or visit your local Social Security office. You can find your local office by going to our website at www.socialsecurity.gov. We will give you a receipt to verify your report. Keep this receipt with all of your other important papers from Social Security.

Social Security Administration

Form SSA-L634 (9-1986) EF (5-2000)

11

BPQY Handbook

Consent for Release of Social Security Information

12

BPQY Handbook

Consent for Release of Internal Revenue Earnings Information

13

|

|

|

|

|

BPQY Handbook |

|

|

Medicaid State Listings Chart |

|

|

|

|

|

|

|

|

|

|

STATE |

CATEGORY |

|

STATE |

|

CATEGORY |

|

Alabama |

1634* |

|

Montana |

|

1634 |

|

|

|

|

Alaska |

SSI** |

|

N. Carolina |

|

1634 |

|

Arizona |

1634 |

|

N. Dakota |

|

209(b) |

|

Arkansas |

1634 |

|

N. Mariana Islands |

|

SSI |

|

|

|

California |

1634 |

|

Nebraska |

|

SSI |

|

|

|

Colorado |

1634 |

|

Nevada |

|

SSI |

|

|

|

Connecticut |

209(b)*** |

|

New Hampshire |

|

209(b) |

|

|

|

Delaware |

1634 |

|

New Jersey |

|

1634 |

|

|

|

Dist. of Columbia |

1634 |

|

New Mexico |

|

1634 |

|

|

|

Florida |

1634 |

|

New York |

|

1634 |

|

|

|

Georgia |

1634 |

|

Ohio |

|

209(b) |

|

|

|

Hawaii |

209(b) |

|

Oklahoma |

|

209(b) |

|

|

|

Idaho |

SSI |

|

Oregon |

|

SSI |

|

|

|

Illinois |

209(b) |

|

Pennsylvania |

|

1634 |

|

|

|

Indiana |

209(b) |

|

Rhode Island |

|

1634 |

|

|

|

Iowa |

|

1634 |

|

S. Carolina |

|

1634 |

|

|

|

|

Kansas |

SSI |

|

S. Dakota |

|

1634 |

|

|

|

Kentucky |

1634 |

|

Tennessee |

|

1634 |

|

|

|

Louisiana |

1634 |

|

Texas |

|

1634 |

|

|

|

Maine |

1634 |

|

Utah |

|

SSI |

|

|

|

Maryland |

1634 |

|

Vermont |

|

1634 |

|

|

|

Massachusetts |

1634 |

|

Virginia |

|

209(b) |

|

|

|

Michigan |

1634 |

|

W. Virginia |

|

1634 |

|

|

|

Minnesota |

209(b) |

|

Washington |

|

1634 |

|

|

|

Mississippi |

1634 |

|

Wisconsin |

|

1634 |

|

|

|

Missouri |

209(b) |

|

Wyoming |

|

1634 |

|

|

|

Source: TC 23001.020 Medicaid State Categories |

|

|

|

|

|

*1634 |

- State uses Federal SSI eligibility for automatic Medicaid |

|

|

|

**SSI |

- State may use its own criteria or it may ask SSA to make the Medicaid |

determinations

***209(b) - State uses at least one criterion that is more restrictive than the SSI program

14

BPQY Handbook

Possible Medicaid Entries

•Disabled adult child

•Widower

•Eligible for Medicaid (SSI)

•Referred to State for determination, Federal determination not possible

•Federally administered Medicaid coverage should be continued regardless of payment status, e.g., 1619(b) participants

•Eligible for Medicaid (N24 Payment Status Only)

•Refused to assign rights to third party medical payments, or individual refused to provide third party liability information - referred to State, Federal determination not possible.

•Medicaid qualifying trust may exist

•Goldberg-Kelly payment continuation

•Title VIII recipient

•Medicaid qualifying trust may exist

•Title VIII recipient

•Goldberg-Kelly payment continuation

•Deeming waived; child under a State home care plan

•State determination, not SSA responsibility

15