ADDITIONAL INSTRUCTIONS FOR FSA CLAIMS

1.Only employees participating in the plan can submit a reimbursement form.

2.Current employees may submit claims for up to a specific number of days after the plan year-end for expenses incurred during the prior plan year or applicable grace period. Please consult your benefits dept or bswift for this information.

3.Terminated employees may be reimbursed for expenses incurred through the last day of participation (termination date). Claims must be submitted within a specific number of days after the date termination occurred. Please consult your benefits dept or bswift for this information.

4.Reimbursements may only be made for eligible expenses incurred during the plan year or applicable grace period.

5.IRS rules stipulate that any money left in your account(s) after all reimbursements for the Plan Year have been processed may not be carried forward or returned. Money left in the health care spending account may not be used to reimburse dependent care expenses, and vice versa.

6.If you receive reimbursement for expenses, you may not claim these expenses as a deduction for income tax purposes.

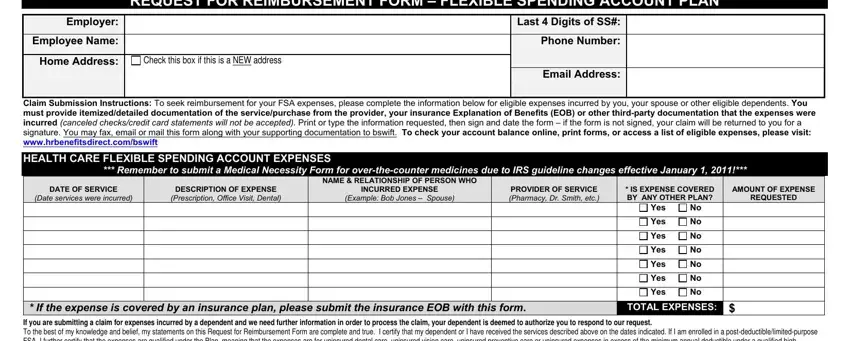

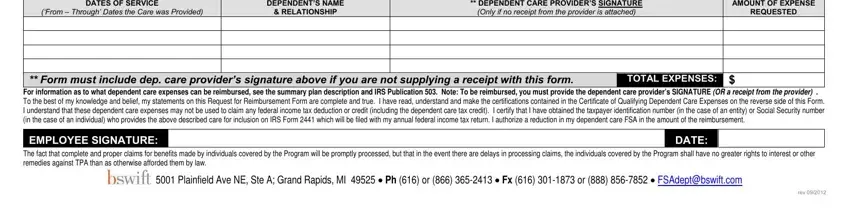

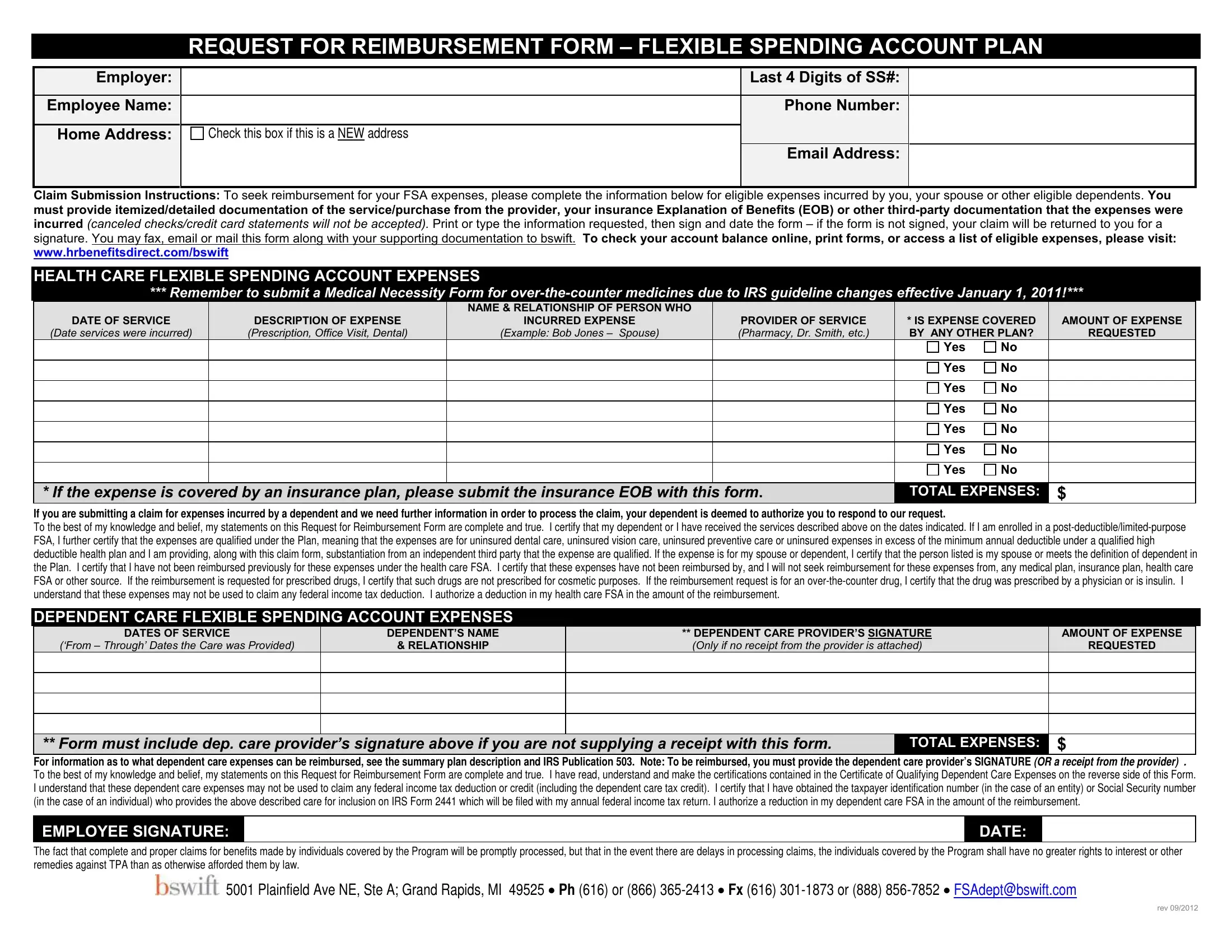

7.Complete the information on the reimbursement request form for each amount claimed for reimbursement.

8.Attach an itemized receipt or bill showing the date of service, amount of charge, patient name, name and address of provider and a complete description of the expense. Make a photocopy of the documentation and the reimbursement form for your records. If you have medical/Rx, dental, vision coverage for the expenses, please attach copies of Explanation of Benefits (EOBs) from your insurance carrier(s).

9.Submit your reimbursement form to bswift. A blank Request for Reimbursement Form will be sent with your reimbursement check. Additional forms are available from your Employer’s Human Resources Department or via web at: www.hrbenefitsdirect.com/bswift

ELIGIBLE HEALTH CARE EXPENSES

Following is a list of the more common eligible expenses. A comprehensive list is available online under Health Care Expense Table. Some expenses may require a medical necessity form from the treating physician. For more information, please contact your bswift representative directly.

-Acupuncture

-Bandages

-Blood-pressure Monitoring Devices

-Blood-sugar Test Kits and Test Strips

-Braces and Supports

-Catheters

-Chiropractic Care

-Contact Lenses (corrective lenses - not cosmetic),Supplies and Solution

-Co-pays and Co-insurance Amounts

-Deductibles

-Dental Cleanings, X-rays, Fillings, Braces, Extractions

-Diabetic Supplies

-Eye Exams, Eyeglasses (corrective lenses), Equipment and Materials (excluding clip-on sunglasses/non-Rx sunglasses)

-First Aid Supplies

-Flu Shots

-Hearing Aids

-Immunizations

-Incontinence Supplies

-Insulin

-Laboratory Fees

-Laser Eye Surgery/Lasik

-Mileage for Person to Receive Medical Care

-Obstetrical Expenses

-Occlusal Guards to Prevent Teeth Grinding

-Orthodontia

-Physical Exams

-Physical Therapy

-Pregnancy Tests

-Prescribed Contraceptives

-Prescription Drugs/Medicines

-Psychiatric Care

-Reading Glasses

-Smoking Cessation Programs

-Therapy (medically-related only - NOT marriage counseling, general mental health wellness, relief of stress)

-Walkers, Wheelchairs, Canes

INELIGIBLE HEALTH CARE EXPENSES

Following are examples of SOME expenses that are not eligible under the HCFSA plan. This is not a complete list. If you have specific questions, please contact your bswift representative directly.

-Amounts paid by a health insurance plan or any other plan (FSA, HRA, HSA)

-COBRA Premiums

-Cosmetic Procedures

-Diet Foods

-Expenses You Claim on Your Federal Income Tax Return

-Expenses Incurred Before you began Participating in the FSA

-Face Creams

-Feminine Hygiene Products (Tampons, etc.)

-Funeral Expenses

-Hair Removal/Transplants

-Illegal Operations and Treatments

-Insurance Premiums

-Late Fees/Missed Appointment Fees

-Makeup/Nail Polish

-Marijuana or Other Controlled Substances in Violation of Federal Law

-Maternity Clothes

-Mouthwash/Dental Floss/Toothbrush/Toothpaste

-Nursing Services for Health Baby

-One-A-Day Vitamins

-Over-the-counter Drugs Unless Prescribed by a Physician or the Drug is Insulin

-Prepayments for Services

-Safety Glasses (non-prescription)

-Shampoo/Soap/Moisturizers/Deodorant

-Shaving Cream/Lotion

-Tanning Salons/Equipment

-Teeth Whitening

-Vision Discount Program/Service Agreements/Warranties

DEPENDENT CARE FSA REQUIREMENTS

By signing and submitting the Reimbursement Request Form, you are certifying that expenses for which you request reimbursement meet ALL of the following conditions:

1.The expenses are incurred for services rendered after the date of your election to receive dependent care assistance benefits and during the plan year to which the election applies.

2.The expenses are incurred so you (and your spouse, if you are married) can work or look for work. Exception: If your spouse is not working or looking for work when the expenses are incurred, you certify that he or she is a full- time student or is physically or mentally incapable of self-care.

3.The amount of the reimbursement requested, when aggregated with all other reimbursements received by you under the Plan during the same calendar year, do not exceed the lesser of (A) your earned income; or (B) if you are married, your spouse’s actual or deemed earned income.

Please refer to IRS Publication 503 to determine the earned income amount for your spouse.

4.Each dependent for whom you incur the expenses is (A) a person under age 13 for whom you are entitled to claim a dependency exemption on your federal income tax return, or (B) your spouse or a person who is your dependent under federal tax law (even if you may not claim the dependency exemption on your federal income tax return), but only if he or she is physically or mentally incapable of self-care.

5.You (or you and your spouse together) are providing at least 50% of the cost of maintaining your household, and the expenses are incurred when at least one member of your household is a person described in 4(A) or 4(B) above.

6.The expenses are incurred for the care of a dependent, or for related incidental household services.

7.If the expenses are incurred for services outside your household, they are incurred for the care of a dependent who is described in 4(A) above

(or who is described in 4(B) above and regularly spends at least eight hours per day in your household).

8.If the expenses are incurred for services provided by a dependent care center (i.e., a facility that provides care for more than six individuals not residing at the facility), the center complies with all applicable state and local laws and regulations.

9.The person who provided care was not your spouse or a person whom you can claim as a tax dependent. If your child provided the care, he or she must be age 19 or older at the end of the year in which the expenses are incurred.

10.The expenses are not paid for services outside your household at a camp where the dependent stays overnight.