Managing the business income report worksheet file is simple using our PDF editor. Follow the following actions to prepare the document straight away.

Step 1: The first step would be to select the orange "Get Form Now" button.

Step 2: Now you can manage your business income report worksheet. You may use the multifunctional toolbar to include, remove, and adjust the content of the file.

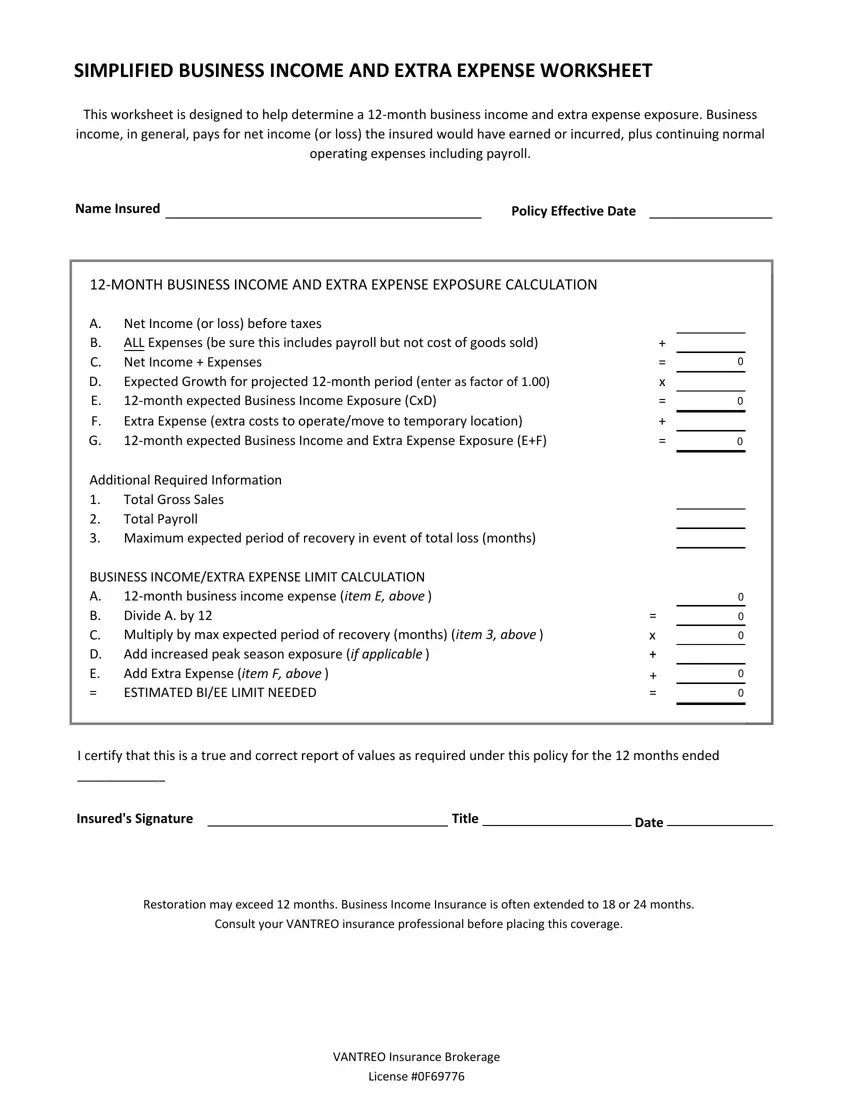

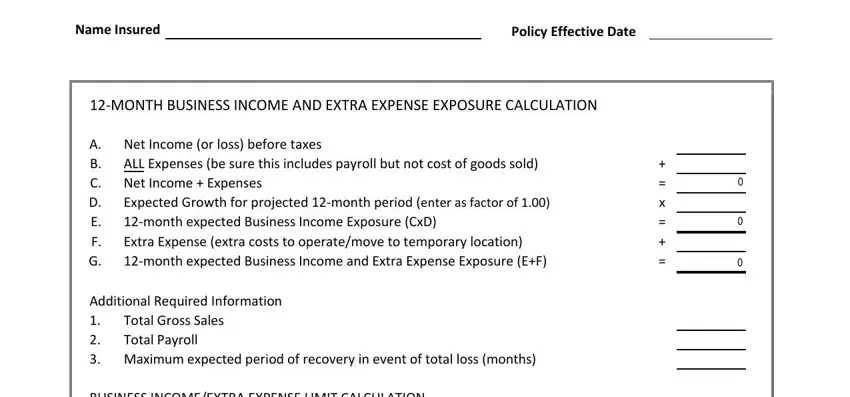

The particular parts will make up the PDF form:

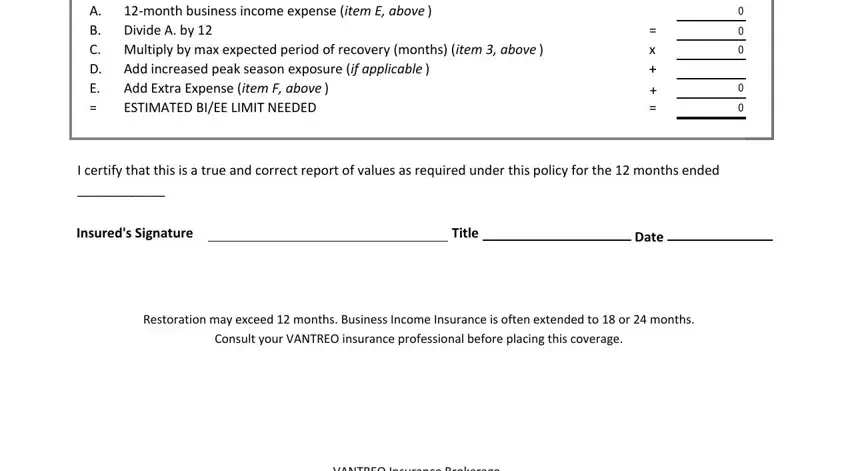

In the BUSINESS INCOMEEXTRA EXPENSE LIMIT, Add increased peak season exposure, I certify that this is a true and, Insureds Signature, Title, Date, Restoration may exceed months, and VANTREO Insurance Brokerage area, put down your information.

Step 3: Press the Done button to save the document. At this point it is available for upload to your device.

Step 4: You will need to make as many duplicates of the form as you can to prevent future worries.