Our PDF editor allows you to manage the personal business rendition document. It's possible to generate the document right away through these simple actions.

Step 1: You can press the orange "Get Form Now" button at the top of the following page.

Step 2: The document editing page is currently available. It's possible to add text or change existing details.

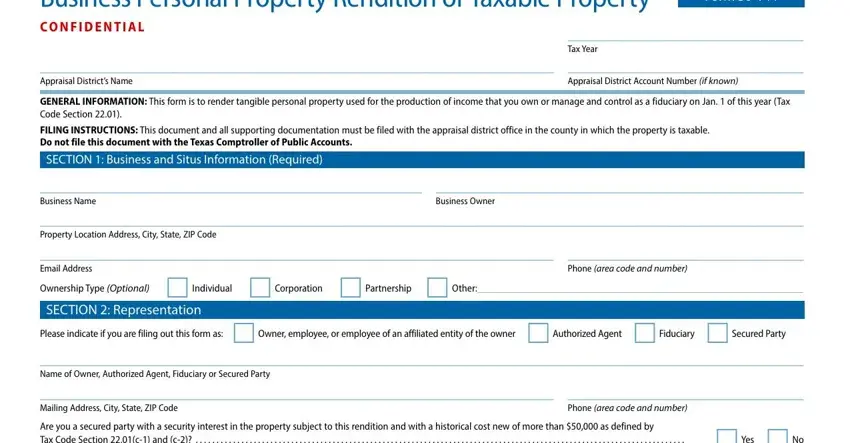

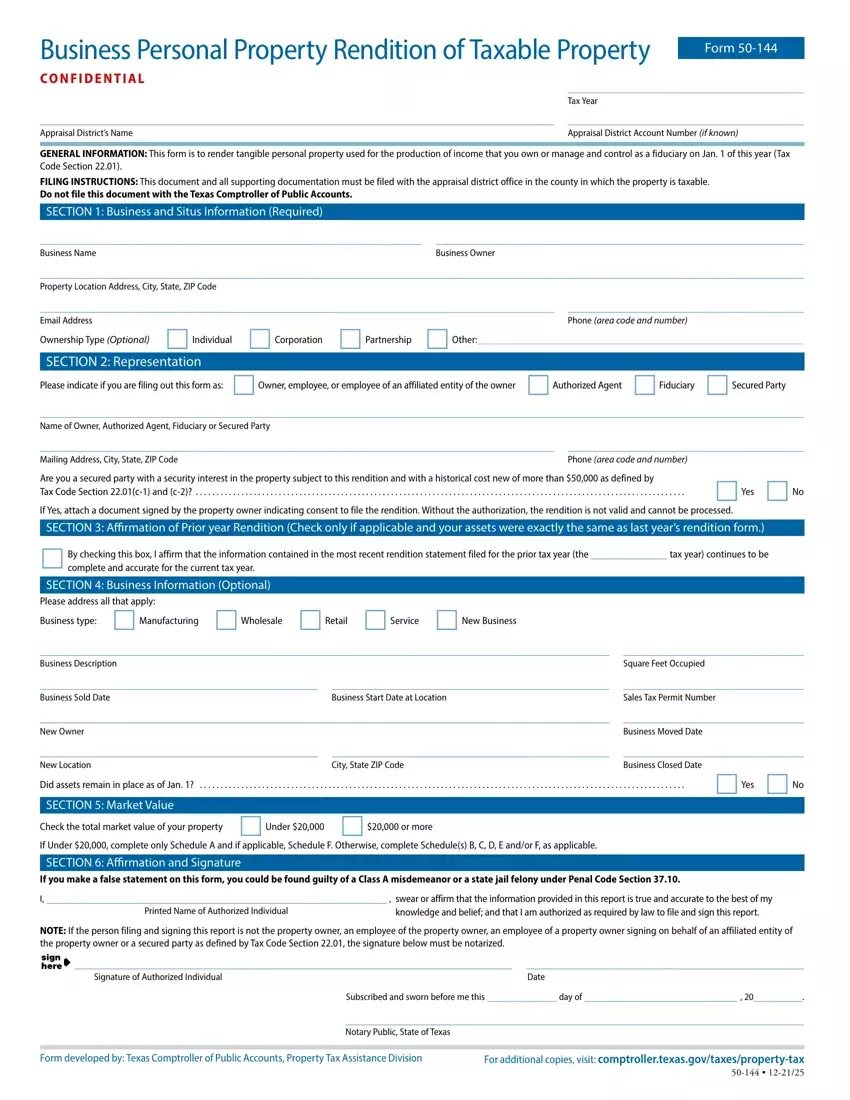

You should provide the following information to prepare the personal business rendition PDF:

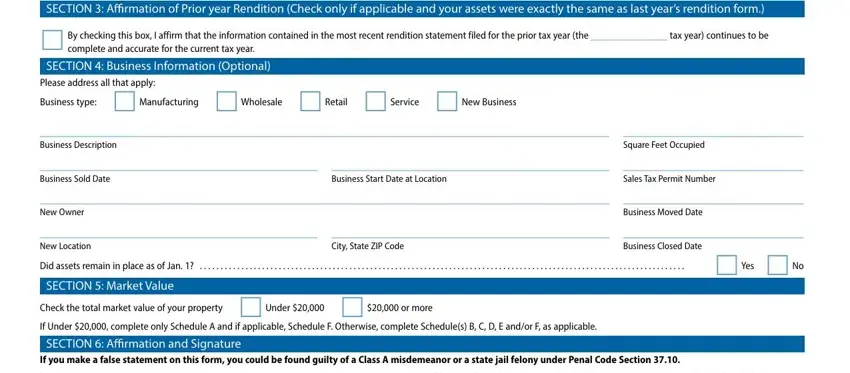

Jot down the data in the SECTION Affirmation of Prior year, By checking this box I affirm, complete and accurate for the, Business type Manufacturing, Square Feet Occupied, Business Sold Date, Business Start Date at Location, Sales Tax Permit Number, New Owner, Business Moved Date, New Location Business Closed, City State ZIP Code, SECTION Market Value, Check the total market value of, and If Under complete only Schedule A area.

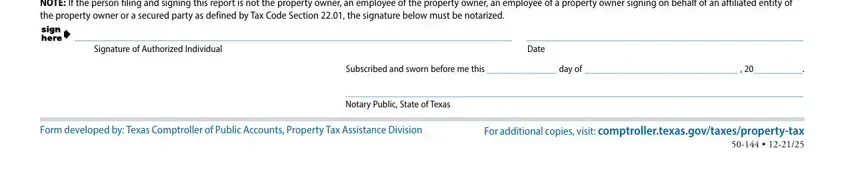

Write the crucial particulars in NOTE If the person filing and, Form developed by Texas, and For additional copies visit segment.

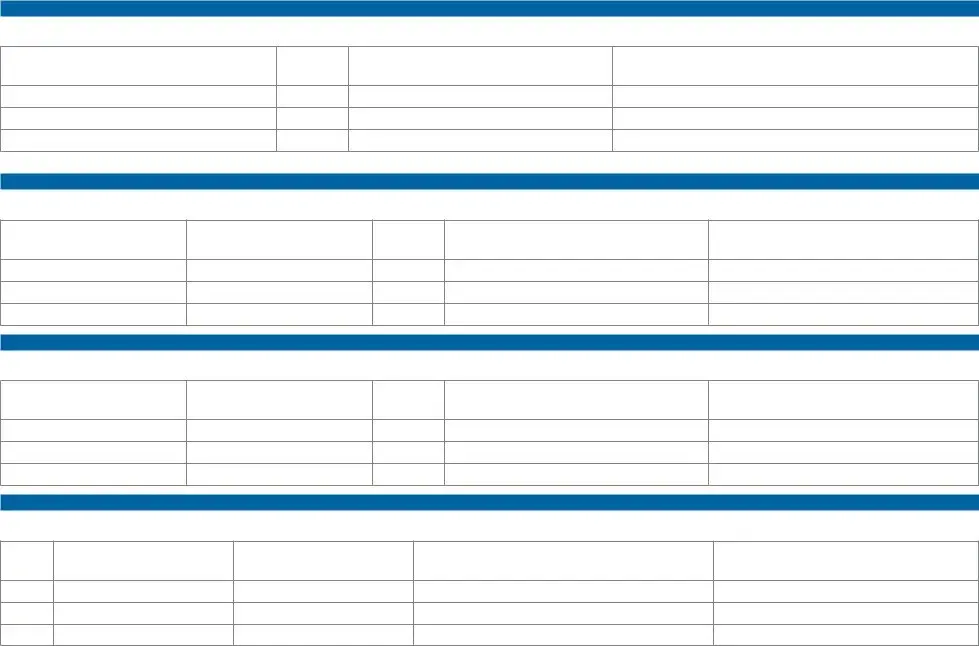

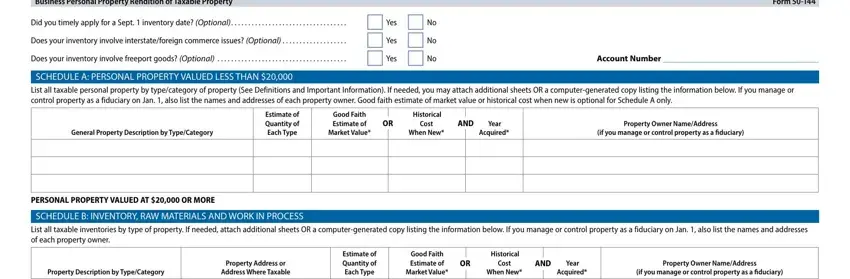

Through space Did you timely apply for a Sept, Account Number, SCHEDULE A PERSONAL PROPERTY, General Property Description by, Estimate of Quantity of Each Type, Good Faith Estimate of Market Value, Historical Cost When New, Year Acquired, Property Owner NameAddress if you, PERSONAL PROPERTY VALUED AT OR, SCHEDULE B INVENTORY RAW MATERIALS, Property Description by, Property Address or Address Where, Estimate of Quantity of Each Type, and Good Faith Estimate of Market Value, indicate the rights and obligations.

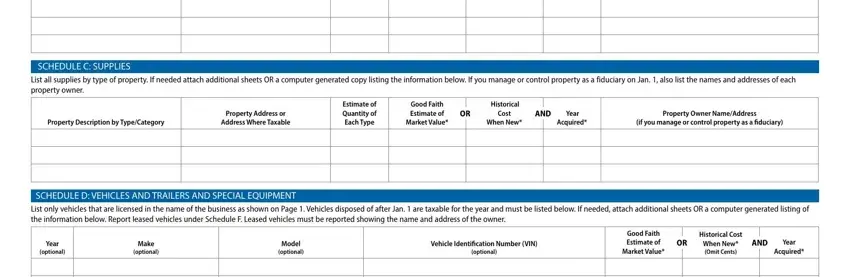

Finish by reviewing these sections and preparing them as required: SCHEDULE C SUPPLIES List all, Property Description by, Property Address or Address Where, Estimate of Quantity of Each Type, Good Faith Estimate of Market Value, Historical Cost When New, AND, Year Acquired, Property Owner NameAddress if you, SCHEDULE D VEHICLES AND TRAILERS, Year optional, Make optional, Model optional, Vehicle Identification Number VIN, and Good Faith Estimate of Market Value.

Step 3: Hit the "Done" button. Next, it is possible to export the PDF file - download it to your electronic device or send it via email.

Step 4: In order to prevent possible forthcoming risks, please be sure to obtain at the very least two or more duplicates of each document.

_______________________________________________________________ ________________________________________

_______________________________________________________________ ________________________________________