We were designing this PDF editor having the notion of allowing it to be as quick to use as possible. That's the reason the procedure of managing the misrepresents will undoubtedly be smooth follow these steps:

Step 1: Get the button "Get Form Here" and click it.

Step 2: So you should be within the document edit page. You can include, adjust, highlight, check, cross, insert or delete areas or text.

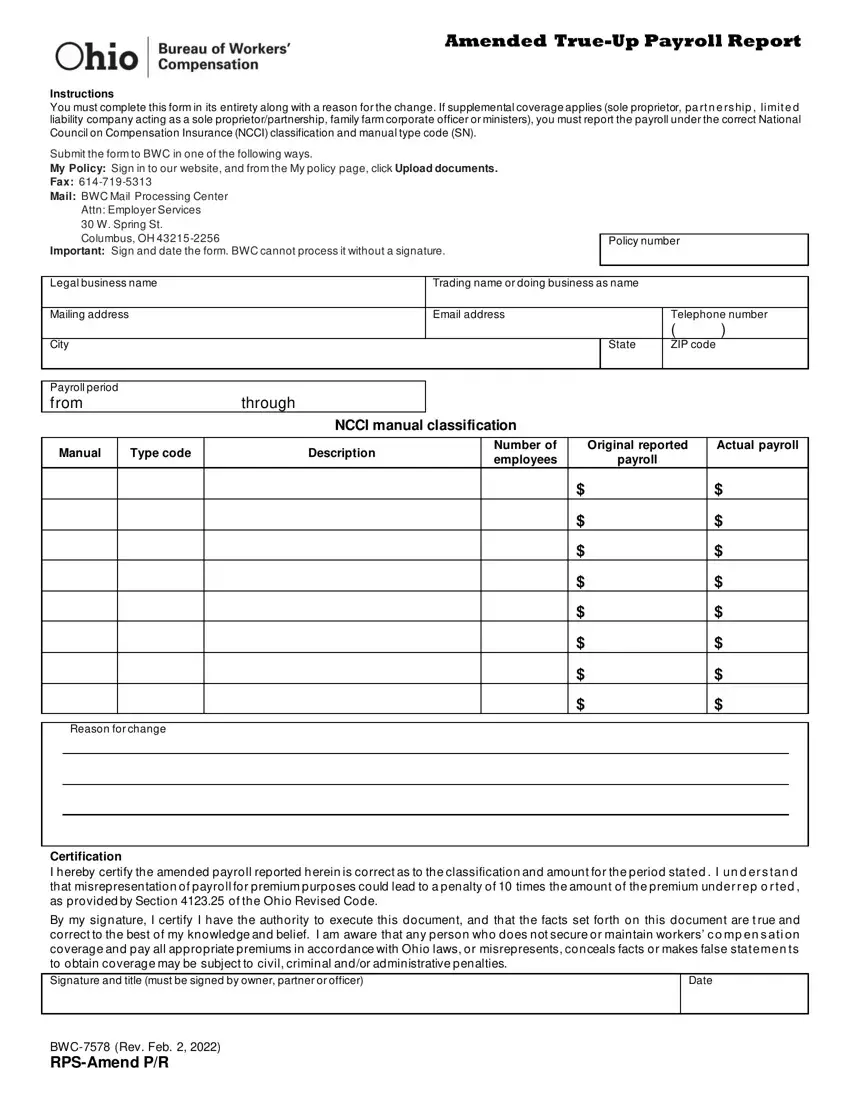

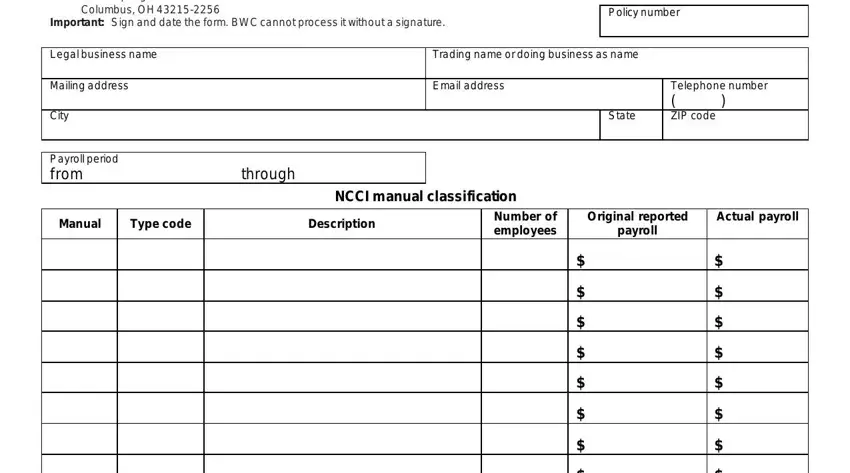

The following sections are what you will have to fill out to get your finished PDF file.

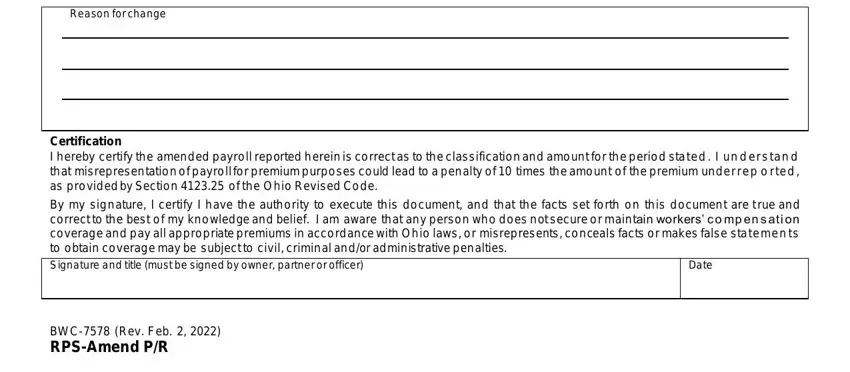

Write down the data in the Reason for change, Certification I hereby certify the, By my signature I certify I have, Date, and BWC Rev Feb RPSAmend PR field.

Step 3: As soon as you hit the Done button, the final document is easily exportable to each of your gadgets. Alternatively, you might deliver it via email.

Step 4: Come up with around two or three copies of the file to keep clear of any specific upcoming troubles.