Working with PDF files online can be very simple with our PDF editor. You can fill in ca 1 or ca 2 here with no trouble. FormsPal is aimed at providing you with the best possible experience with our editor by continuously presenting new features and upgrades. Our tool has become a lot more helpful as the result of the latest updates! Currently, editing documents is easier and faster than ever. All it takes is just a few simple steps:

Step 1: Click the "Get Form" button at the top of this webpage to open our editor.

Step 2: As soon as you access the file editor, you will find the form all set to be filled out. Other than filling in different blanks, you can also do various other actions with the file, including writing any textual content, changing the original textual content, adding images, placing your signature to the document, and more.

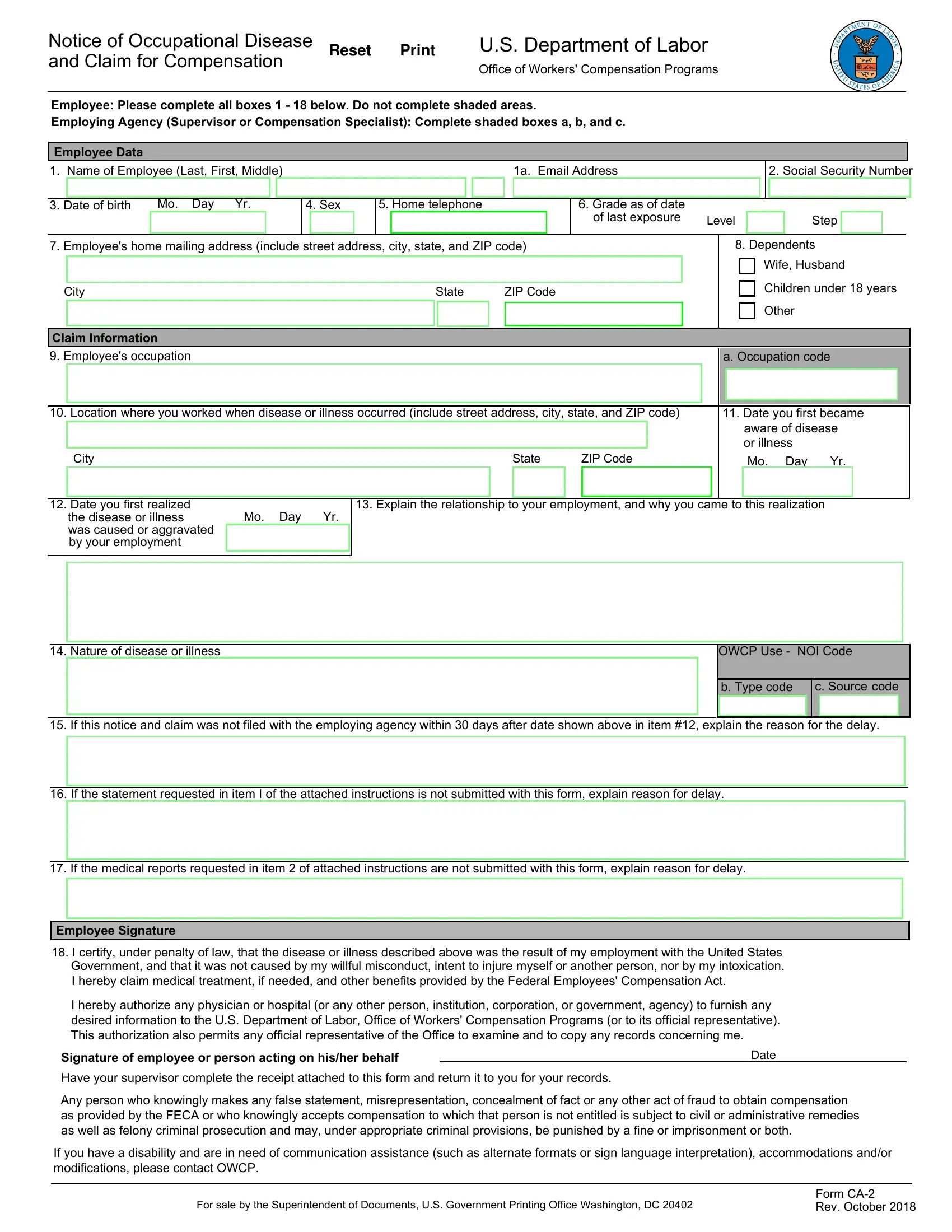

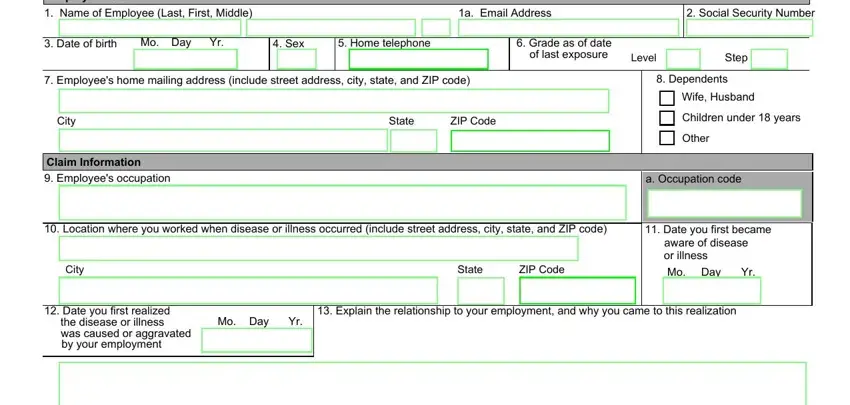

To be able to complete this PDF form, ensure that you enter the right details in each and every field:

1. The ca 1 or ca 2 requires specific information to be entered. Ensure that the subsequent blanks are complete:

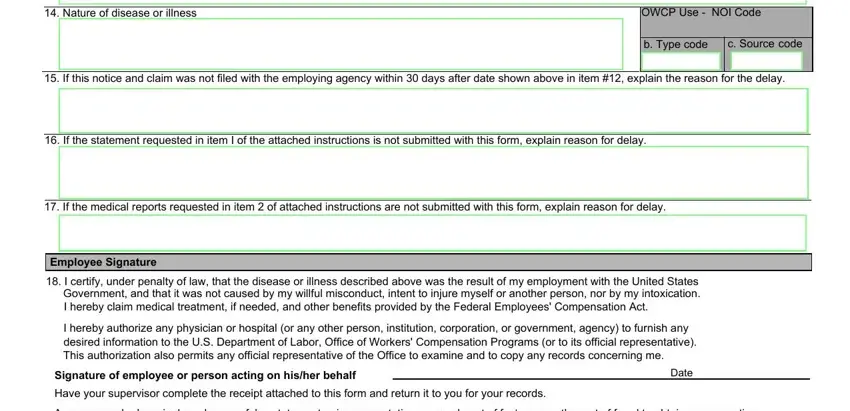

2. Given that the previous part is complete, you'll want to add the necessary details in Nature of disease or illness, OWCP Use NOI Code, b Type code, c Source code, If this notice and claim was not, If the statement requested in, If the medical reports requested, Employee Signature, I certify under penalty of law, I hereby authorize any physician, Signature of employee or person, Date, Have your supervisor complete the, and Any person who knowingly makes any in order to progress further.

Always be extremely mindful when filling in Signature of employee or person and If the statement requested in, because this is the part where many people make a few mistakes.

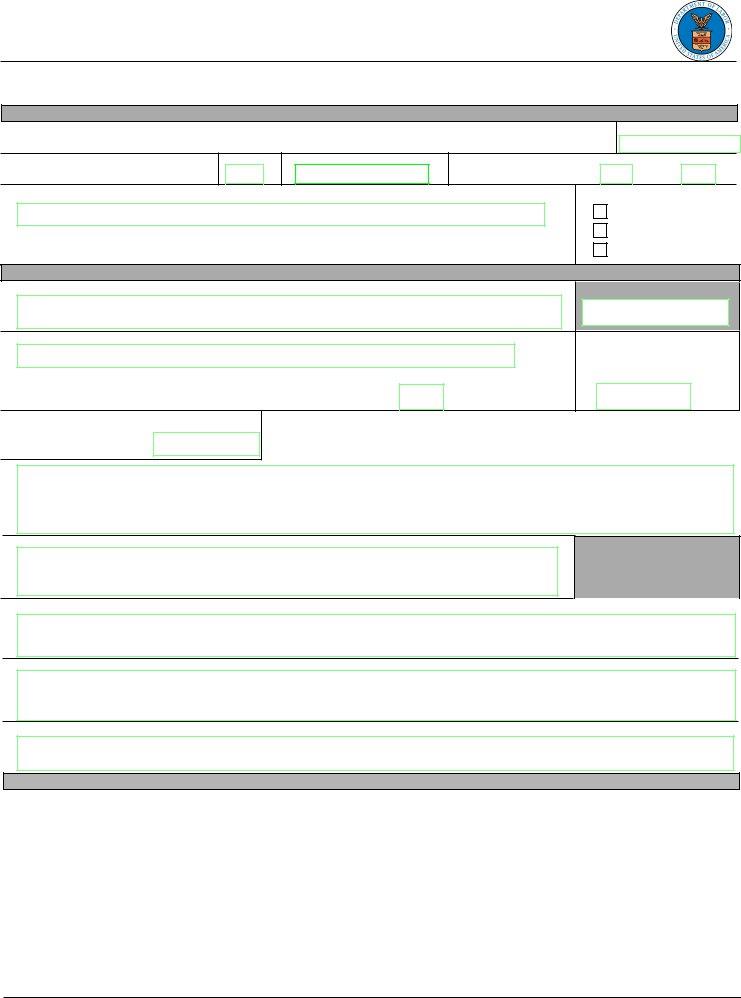

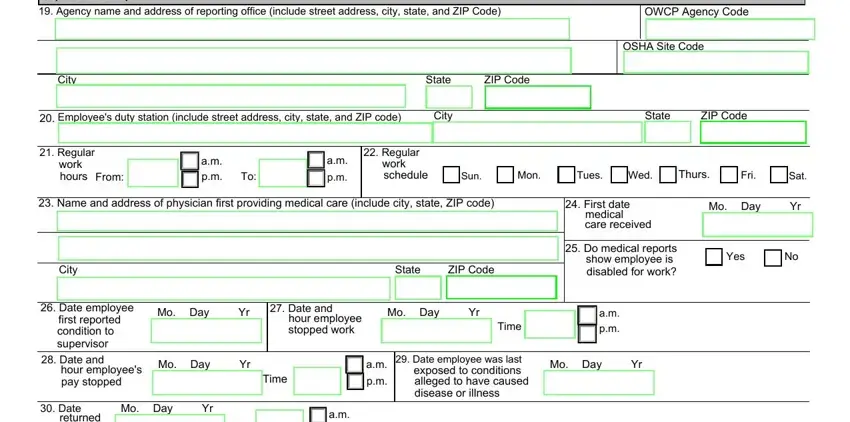

3. This next step is relatively easy, Supervisors Report, Agency name and address of, OWCP Agency Code, OSHA Site Code, City State ZIP Code, Employees duty station include, City State ZIP Code, Regular, work hours From, Regular, work schedule, Sun, Mon, Tues, and Wed - all of these form fields will need to be completed here.

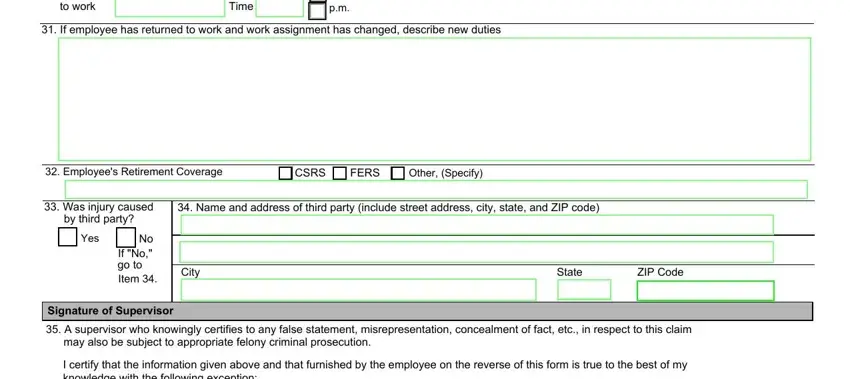

4. All set to fill out the next portion! In this case you'll have all of these returned to work, Time, If employee has returned to work, Employees Retirement Coverage, CSRS, FERS, Other Specify, Was injury caused, Name and address of third party, by third party, Yes, No If No go to Item , Signature of Supervisor, City State ZIP Code, and A supervisor who knowingly empty form fields to complete.

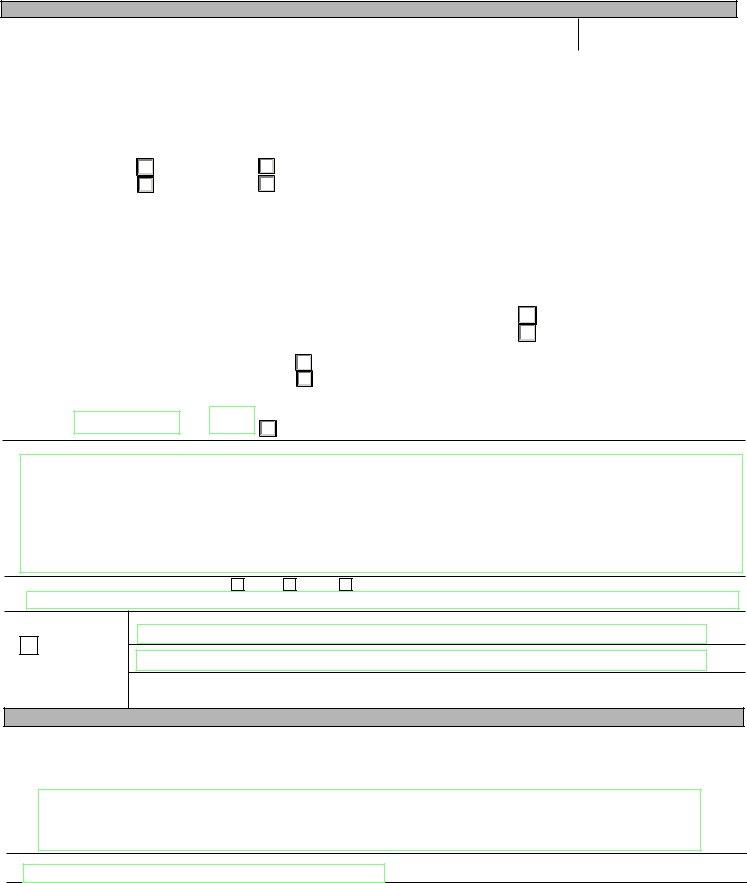

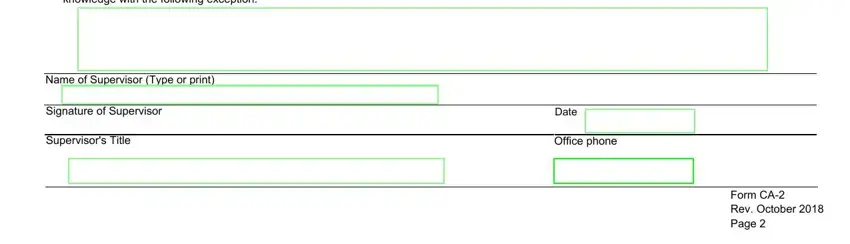

5. The very last stage to finalize this document is essential. Ensure you fill out the necessary form fields, which includes I certify that the information, Name of Supervisor Type or print, Signature of Supervisor, Supervisors Title, Date, Office phone, and Form CA Rev October Page , before submitting. In any other case, it might end up in an incomplete and possibly invalid form!

Step 3: As soon as you've reread the details you given, simply click "Done" to complete your form at FormsPal. Right after starting a7-day free trial account at FormsPal, you'll be able to download ca 1 or ca 2 or email it promptly. The document will also be at your disposal via your personal account page with your changes. FormsPal is focused on the confidentiality of all our users; we make sure that all personal data handled by our system is kept protected.