When using the online PDF tool by FormsPal, you can complete or edit elects 7 7a form here. To keep our tool on the forefront of practicality, we strive to put into operation user-oriented features and enhancements on a regular basis. We're always thankful for any feedback - assist us with remolding PDF editing. Should you be looking to get going, this is what it will require:

Step 1: First of all, open the pdf editor by pressing the "Get Form Button" above on this page.

Step 2: As soon as you launch the file editor, you'll see the form prepared to be filled out. Besides filling in various blanks, you may as well perform some other actions with the Document, including writing custom words, modifying the original text, inserting graphics, placing your signature to the document, and more.

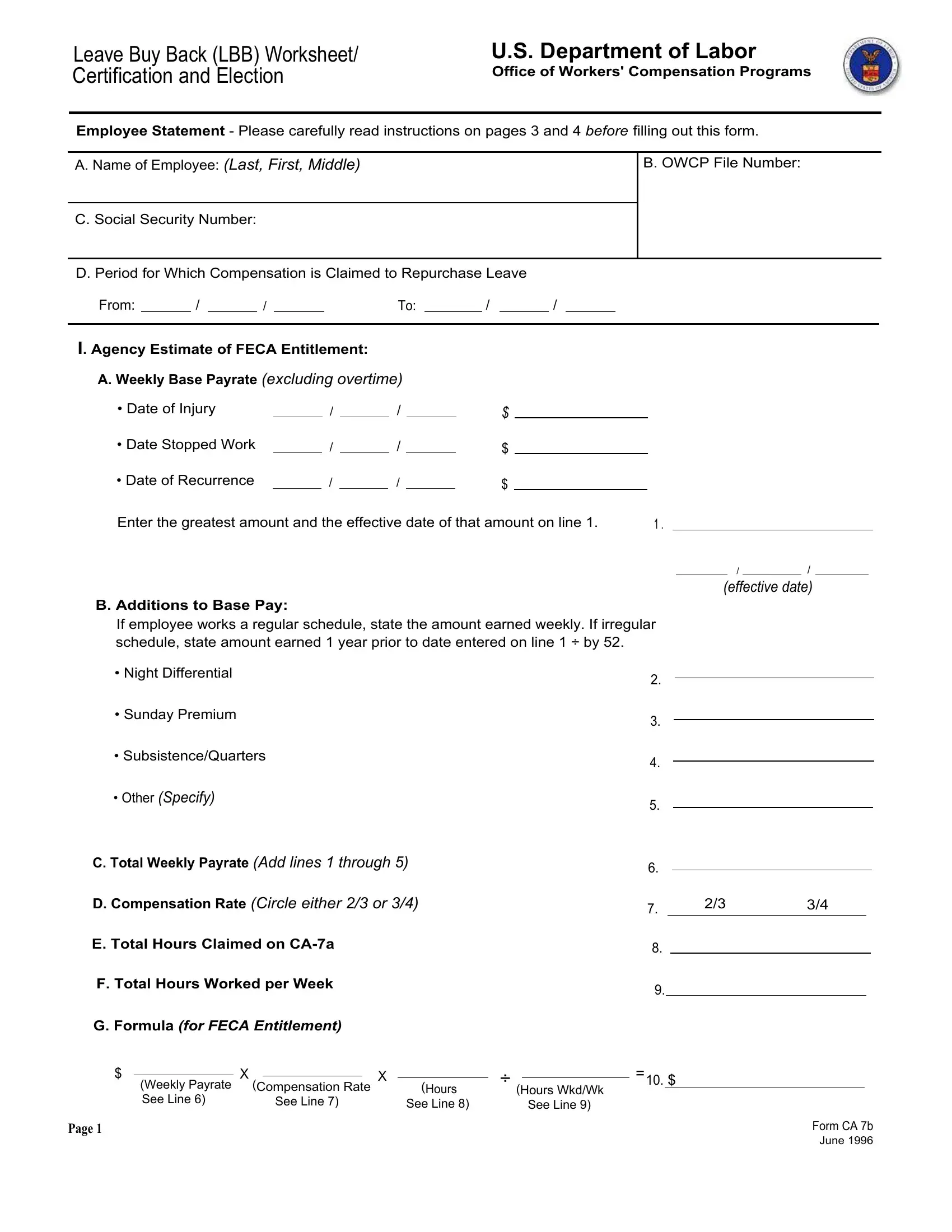

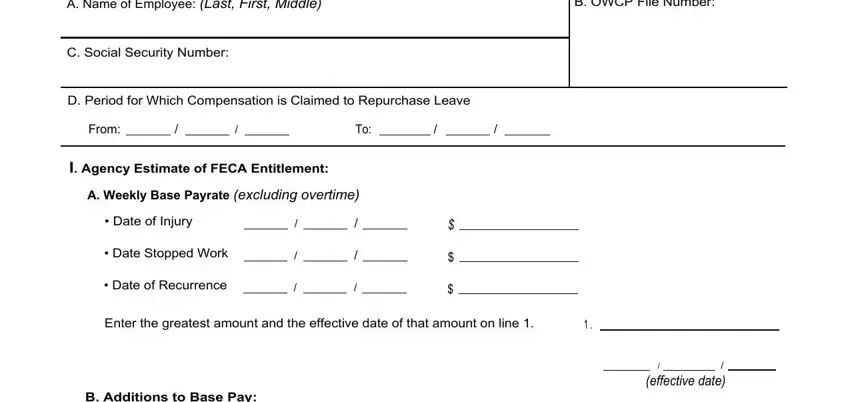

In order to fill out this PDF form, ensure that you type in the information you need in each and every blank field:

1. When filling out the elects 7 7a form, make sure to complete all essential blanks within the associated section. This will help to hasten the work, allowing for your information to be processed without delay and appropriately.

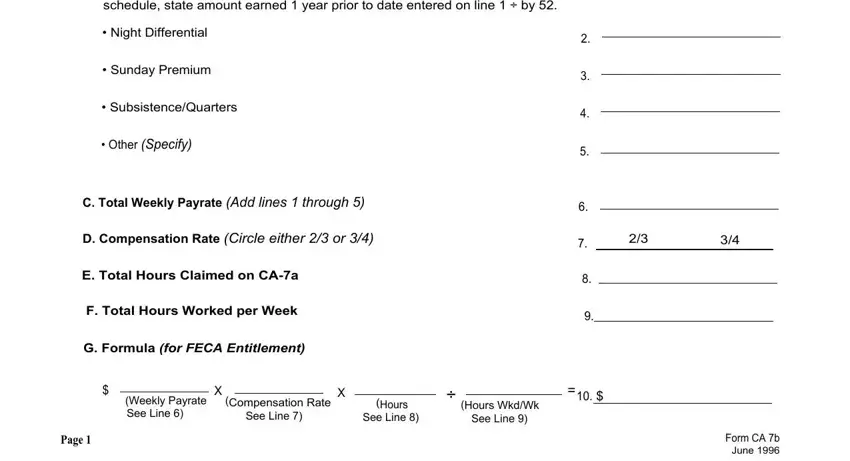

2. Now that this array of fields is complete, it's time to put in the required specifics in If employee works a regular, cid Night Differential, cid Sunday Premium, cid SubsistenceQuarters, cid Other Specify, C Total Weekly Payrate Add lines, D Compensation Rate Circle either, E Total Hours Claimed on CAa, F Total Hours Worked per Week, G Formula for FECA Entitlement, Weekly Payrate Compensation Rate, See Line, See Line, See Line, and Page in order to move forward further.

Always be really mindful when completing D Compensation Rate Circle either and See Line, as this is where a lot of people make mistakes.

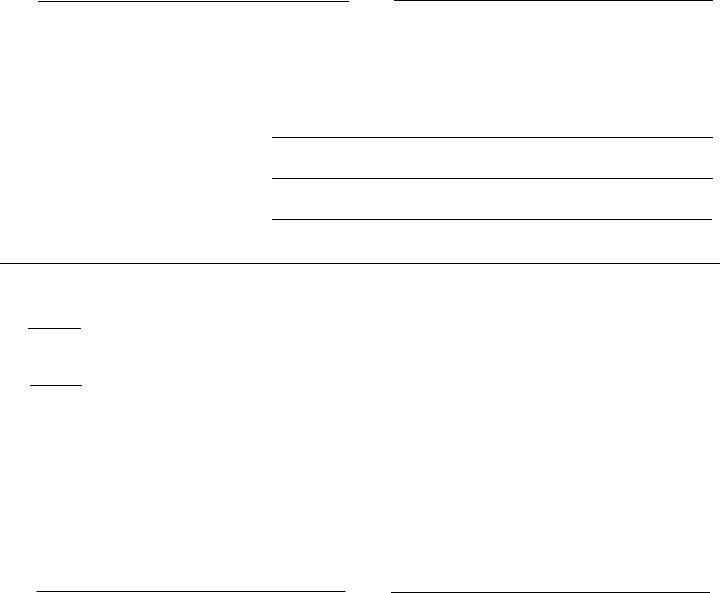

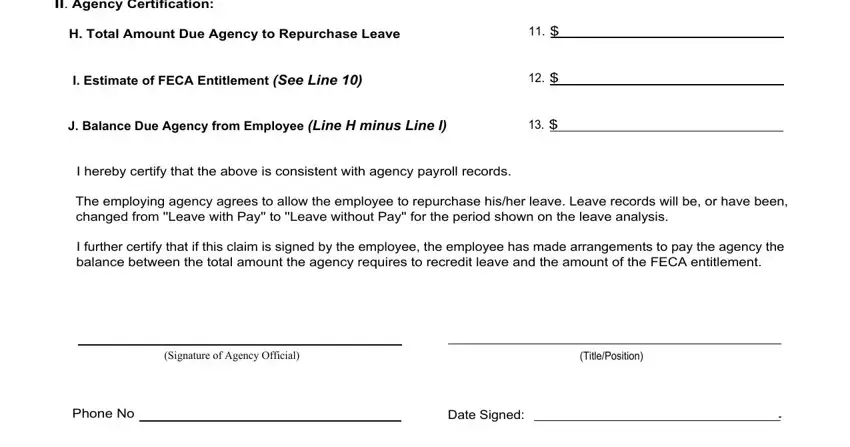

3. This 3rd segment is rather simple, II Agency Certification, H Total Amount Due Agency to, I Estimate of FECA Entitlement See, J Balance Due Agency from Employee, I hereby certify that the above is, The employing agency agrees to, I further certify that if this, Signature of Agency Official, TitlePosition, Phone No, and Date Signed - every one of these form fields must be filled out here.

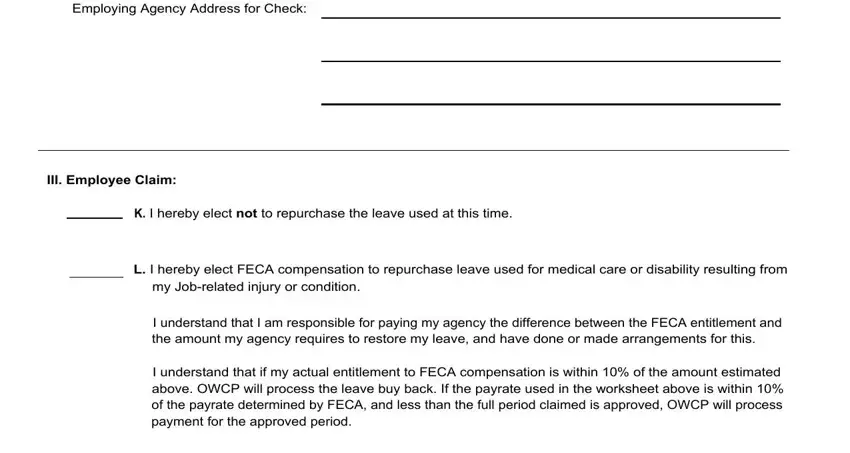

4. The subsequent section will require your information in the subsequent areas: Employing Agency Address for Check, III Employee Claim, K I hereby elect not to repurchase, L I hereby elect FECA compensation, my Jobrelated injury or condition, I understand that I am responsible, and I understand that if my actual. Just be sure you enter all required information to go further.

5. To finish your form, the final part requires a few additional blanks. Entering Signature of Claimant, Date Signed, and Page should conclude everything and you can be done in an instant!

Step 3: Immediately after proofreading your form fields you have filled in, click "Done" and you are all set! Join FormsPal today and easily use elects 7 7a form, set for download. Every single modification you make is conveniently preserved , letting you change the form further if needed. FormsPal guarantees your information privacy via a secure method that never saves or distributes any sort of private information provided. Be confident knowing your documents are kept safe any time you use our service!