You'll be able to fill out dol ca16 effectively with our online tool for PDF editing. The tool is continually upgraded by our team, receiving new functions and growing to be greater. Should you be seeking to get going, here is what it will take:

Step 1: Press the "Get Form" button above on this page to get into our PDF tool.

Step 2: When you start the PDF editor, you will see the document all set to be filled out. Apart from filling in different blank fields, you might also perform several other actions with the PDF, that is adding any words, modifying the original textual content, inserting graphics, signing the form, and a lot more.

This document will require you to type in some specific information; in order to guarantee correctness, you need to heed the next steps:

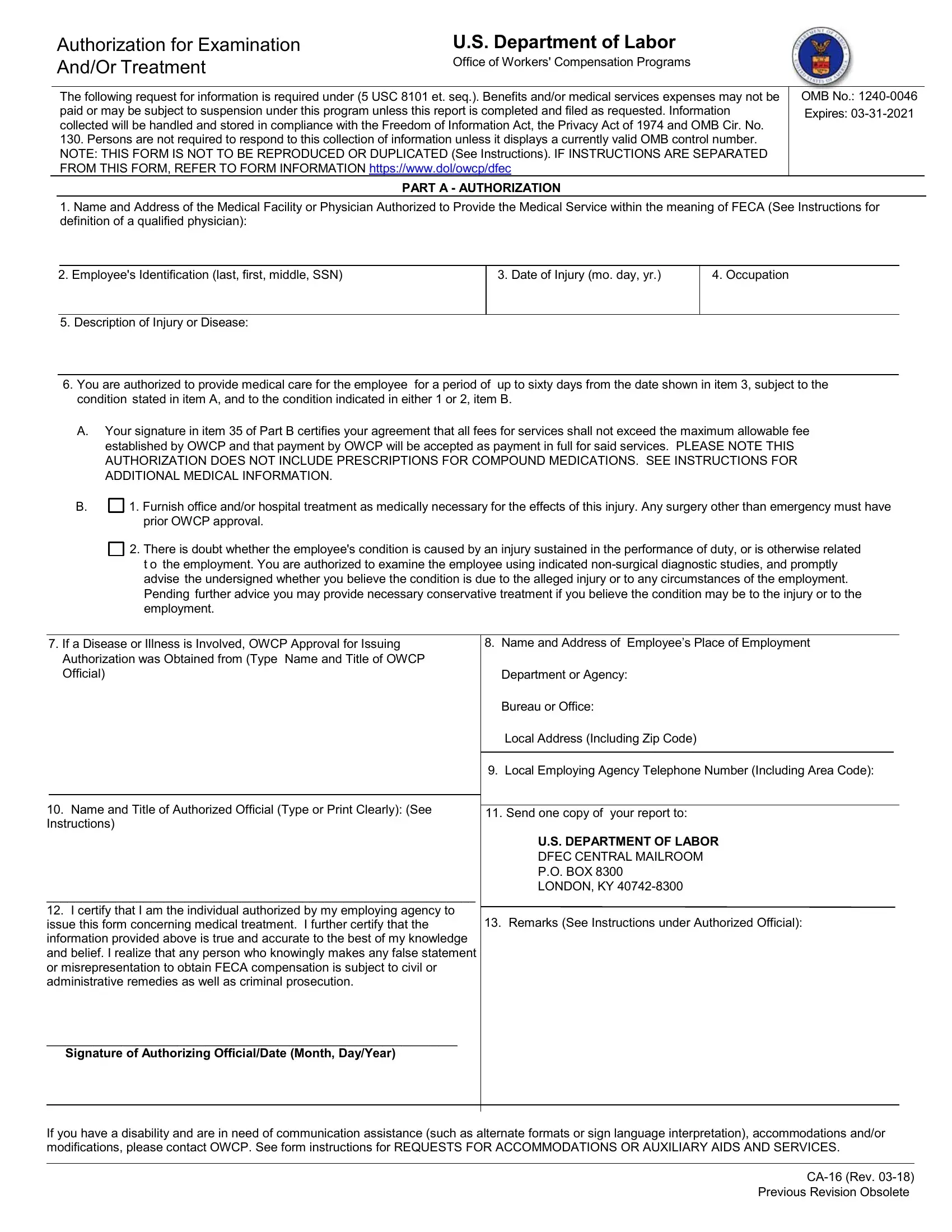

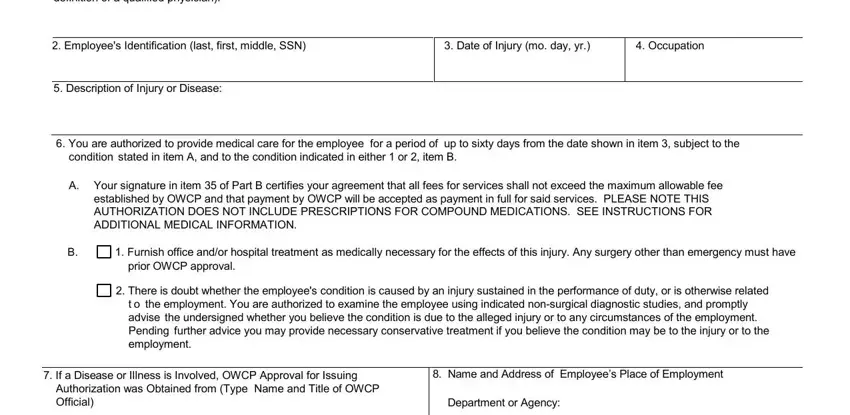

1. It's very important to fill out the dol ca16 correctly, so pay close attention when filling in the areas that contain these blanks:

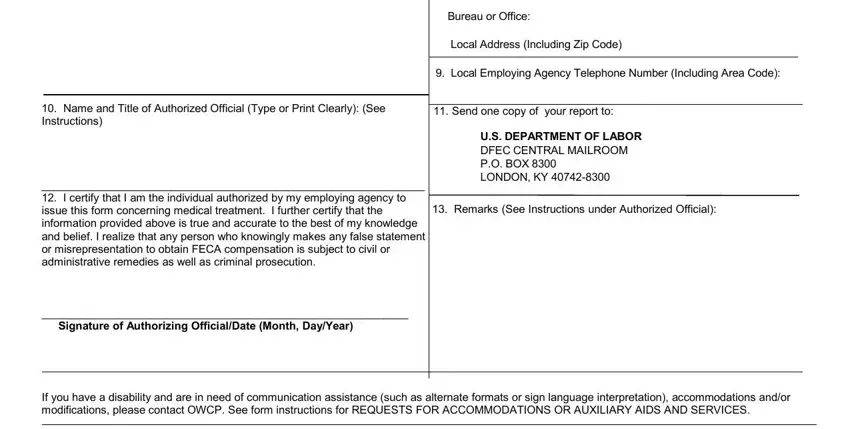

2. Soon after finishing the last step, go on to the next step and fill out the necessary particulars in these blank fields - Bureau or Office, Local Address Including Zip Code, Local Employing Agency Telephone, Name and Title of Authorized, Send one copy of your report to, US DEPARTMENT OF LABOR DFEC, Remarks See Instructions under, I certify that I am the individual, issue this form concerning, Signature of Authorizing, and If you have a disability and are.

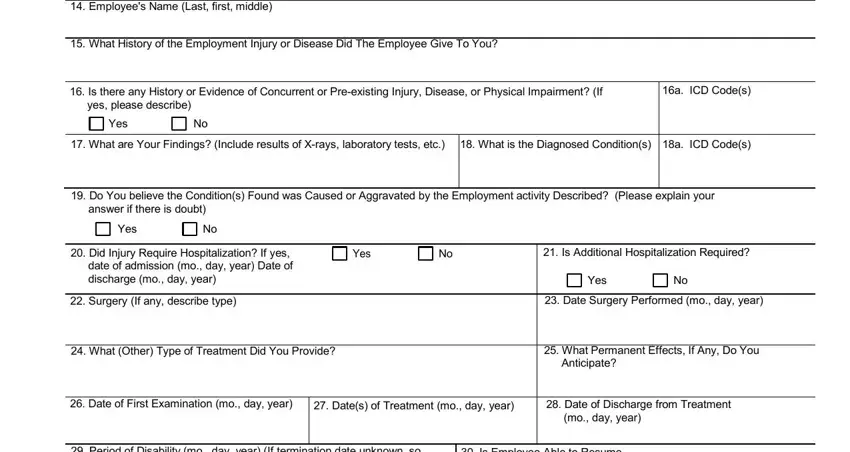

3. This third part is simple - fill out every one of the empty fields in Employees Name Last first middle, What History of the Employment, Is there any History or Evidence, a ICD Codes, yes please describe, Yes, What are Your Findings Include, What is the Diagnosed Conditions, Do You believe the Conditions, answer if there is doubt, Yes, Did Injury Require, Surgery If any describe type, Yes, and Is Additional Hospitalization in order to complete this part.

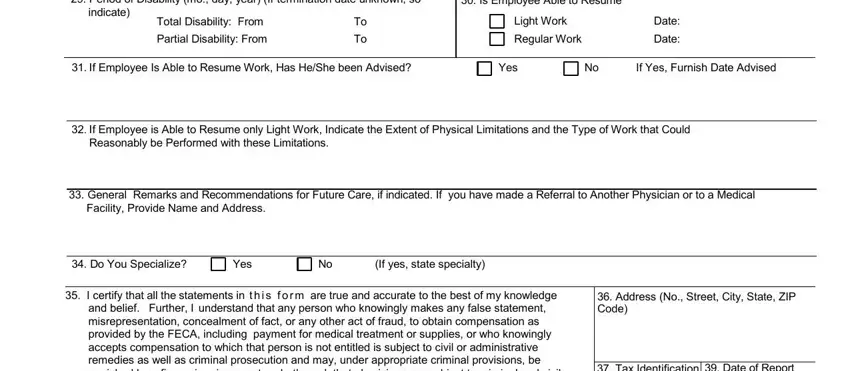

4. The next paragraph requires your input in the subsequent parts: Period of Disability mo day year, Is Employee Able to Resume, indicate, Total Disability From, Partial Disability From, Light Work, Regular Work, Date, Date, If Employee Is Able to Resume, Yes, If Yes Furnish Date Advised, If Employee is Able to Resume, Reasonably be Performed with these, and General Remarks and. Ensure you provide all requested information to move forward.

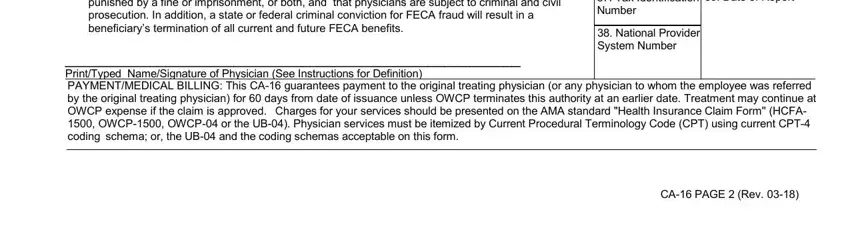

5. The final step to complete this document is critical. You need to fill out the displayed fields, consisting of and belief Further I understand, Tax Identification Number, Date of Report, National Provider System Number, PrintTyped NameSignature of, and CA PAGE Rev, prior to submitting. Otherwise, it can lead to an incomplete and probably invalid form!

Be very mindful when completing Tax Identification Number and Date of Report, as this is where most people make a few mistakes.

Step 3: Right after taking another look at your completed blanks, press "Done" and you are all set! After starting a7-day free trial account here, it will be possible to download dol ca16 or send it via email right away. The document will also be easily accessible through your personal account page with your every single change. FormsPal is committed to the confidentiality of our users; we always make sure that all information put into our system is kept confidential.