The how to llc statement filling in course of action is very simple. Our software lets you work with any PDF form.

Step 1: On the page, click the orange "Get form now" button.

Step 2: Once you've entered the how to llc statement editing page you'll be able to find all the actions you'll be able to perform concerning your document at the top menu.

Fill in the how to llc statement PDF and type in the material for each section:

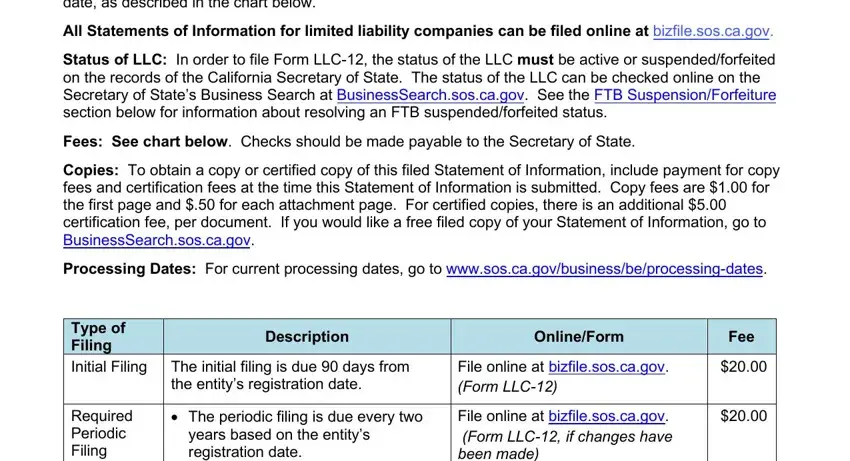

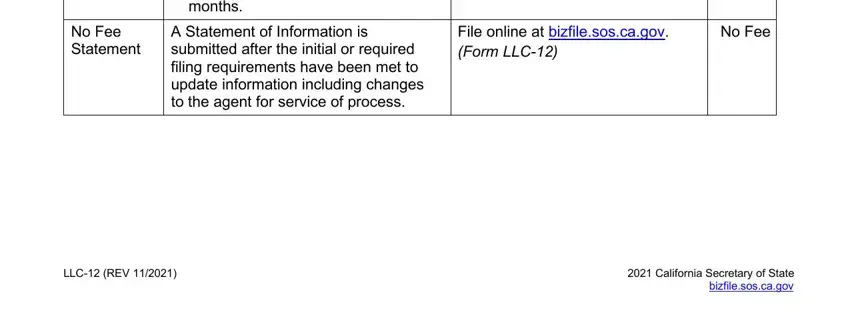

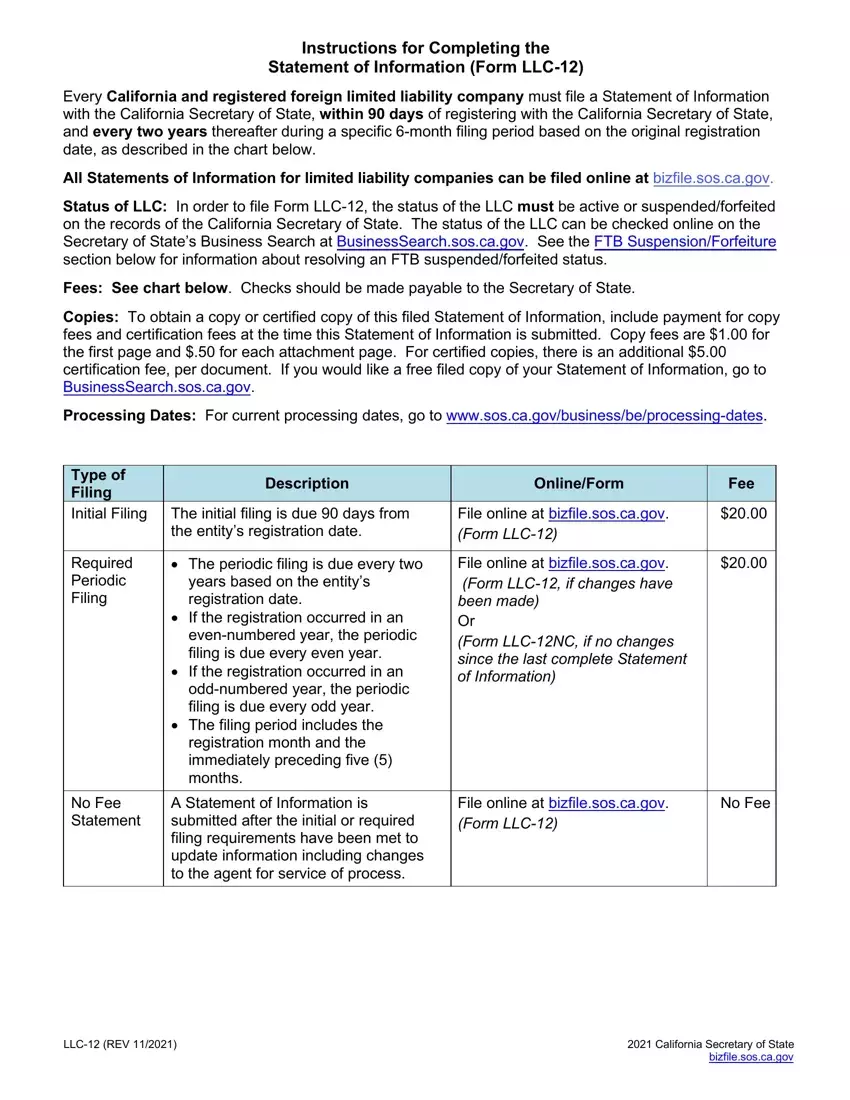

Fill in the No Fee Statement, evennumbered year the periodic, A Statement of Information is, File online at bizfilesoscagov, No Fee, LLC REV, and California Secretary of State space using the information requested by the application.

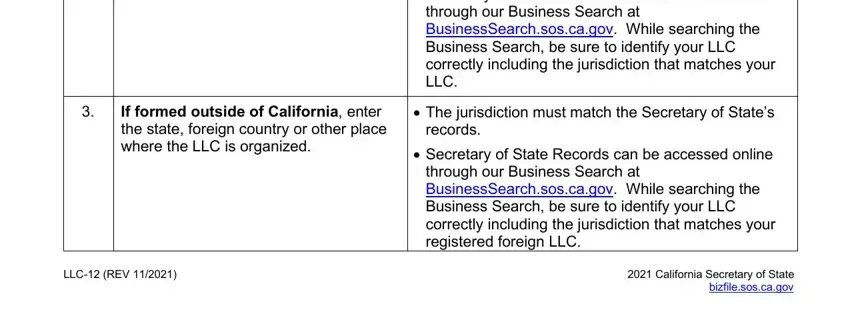

In the If formed outside of California, Secretary of State Records can be, through our Business Search at, The jurisdiction must match the, records, Secretary of State Records can be, through our Business Search at, LLC REV, and California Secretary of State area, emphasize the important data.

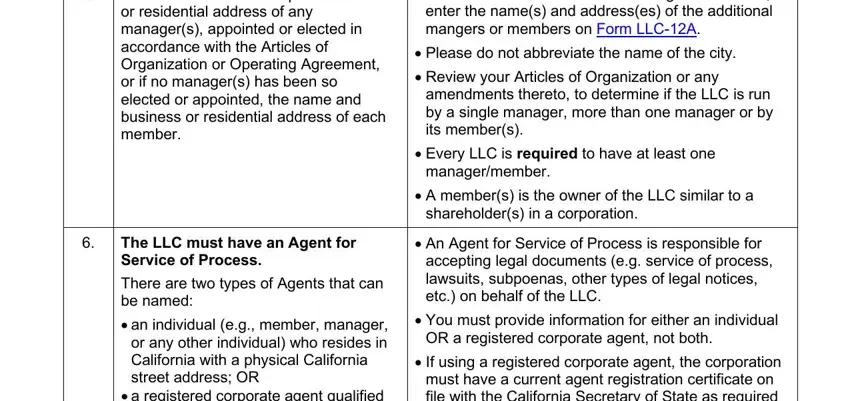

The Enter the name and complete, If the LLC has more than one, Please do not abbreviate the name, amendments thereto to determine if, Every LLC is required to have at, managermember, A members is the owner of the LLC, shareholders in a corporation, The LLC must have an Agent for, a registered corporate agent, An Agent for Service of Process, accepting legal documents eg, You must provide information for, OR a registered corporate agent, and If using a registered corporate area will be used to note the rights or responsibilities of both parties.

Fill in the document by taking a look at these fields: Many times a small LLC will, LLC REV, and California Secretary of State.

Step 3: After you've clicked the Done button, your file will be readily available export to each gadget or email you indicate.

Step 4: Be sure to create as many copies of the document as you can to remain away from possible troubles.

Print Form

Print Form