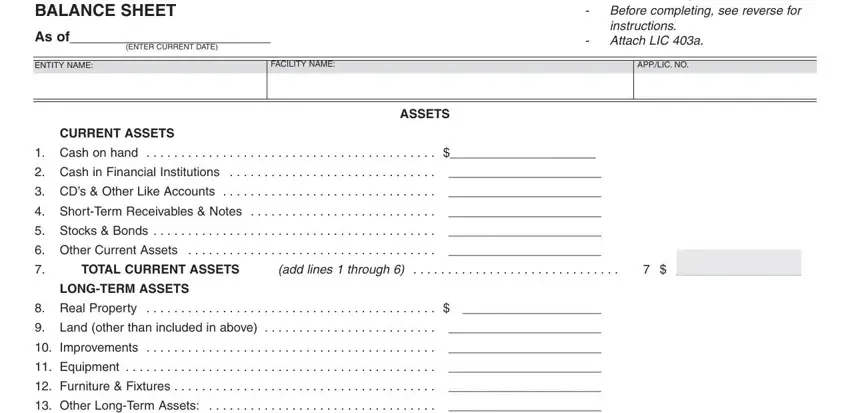

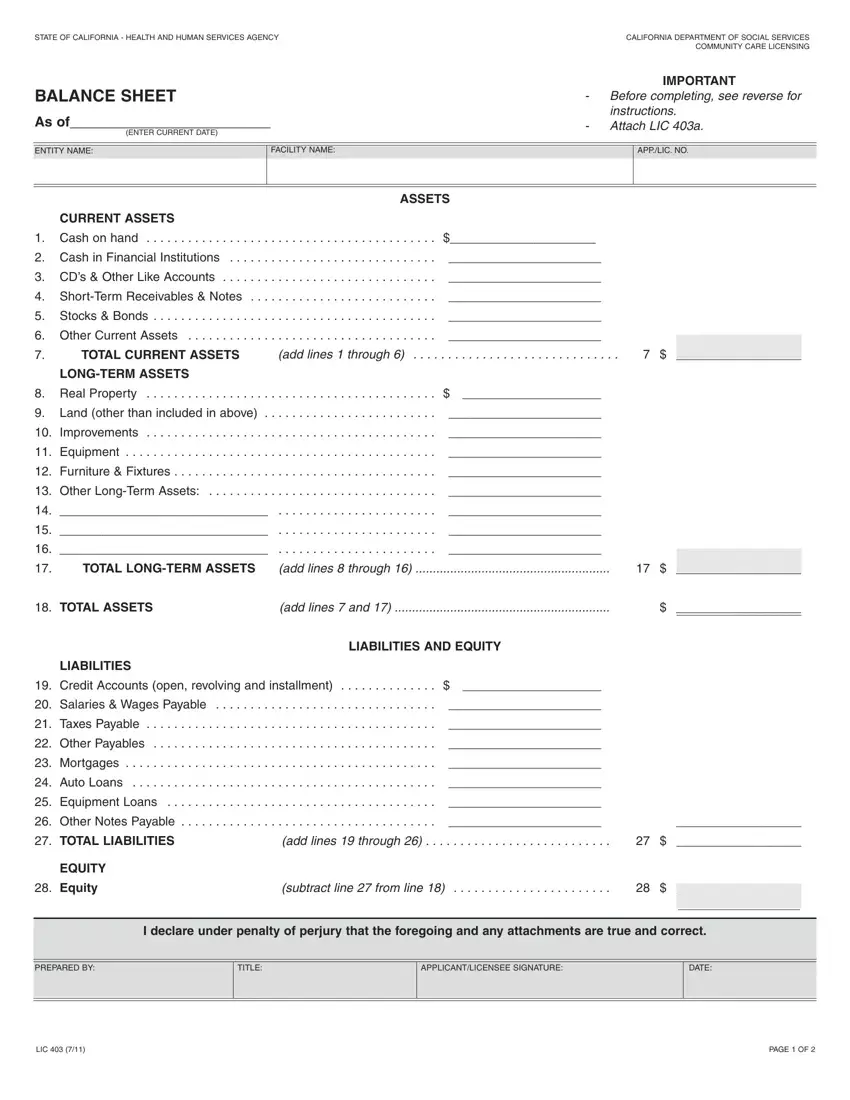

BALANCE SHEET

GENERAL INFORMATION: To complete the Balance Sheet LIC 403, first complete the LIC 403a, Balance Sheet Supplemental Schedule. The LIC 403a is a worksheet to be used in compiling the detailed information which is then totaled and displayed on the Balance Sheet, LIC 403. Submit the LIC 403a attached to the LIC 403.

Each applicant/licensee (sole proprietorship, partnership or corporation) must submit a LIC 403, and a LIC 403a. Information to be reported is to disclose all the entity’s assets and liabilities, not just those related to the operation of the care facility.

FOR SOLE PROPRIETORSHIPS - For a facility operated by a husband or wife individually, information reported must pertain to both, such as individual credit card balances which are listed either solely under one name or under both the husband and wife, and which may be unrelated to the facility’s actual operation or the person who will actually operate the facility.

FOR GENERAL PARTNERS - In addition to financial statements for the partnership, each general partner must file a personal Balance Sheet, LIC 403, accompanied with a LIC 403a, to reflect their individual financial position.

Information shown on the LIC 403 and LIC 403a is subject to verification. Additional documentation may be requested to support any or all of the Balance Sheet amounts reported.

INSTRUCTIONS: Include the required information at the top of this form to identify: 1) current date for the Balance Sheet, 2) entity name, (this is the sole proprietorship, partner, partnership or corporate name for whom the information is being reported) 3) facility name and 4) application/license number. Transfer the totals from the worksheet LIC 403a to the corresponding lines on the LIC 403. Below is a brief description of the type of information to be contained on each line.

ASSETS

Line #

1.Cash on hand, not deposited in a financial institution.

2.Cash in checking accounts.

3.CD’s, savings account(s) and all other like accounts.

4.Revenues receivable and all short-term notes receivable (less than one year).

5.Stocks, bonds or other securities.

6.Other current assets readily converted to cash, such as the cash surrender value of whole life insurance policies.

7.Add the amounts on lines 1 through 6 and enter here.

8.Real property is buildings, land and structures.

9.Land (developed or undeveloped) not already included on line 8.

10.Improvements to real property or leasehold improvements as appropriate.

11.Business or personal equipment, (other than that being leased).

12.Business or personal furniture and fixtures, as appropriate, (other than that being leased).

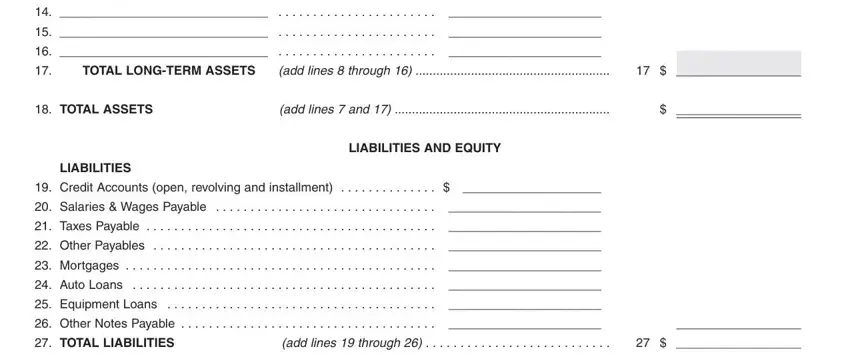

13-16. Other Long-Term Assets (Autos, motor homes inventory, etc.)

17.Add the amounts reported on lines 8 through 16 and enter here.

18.Add the amounts on line 7 and line 17 and enter here.

LIABILITIES

19.Credit Accounts (Open, Revolving and Installment).

20.Salaries, wages, bonuses and other benefits payable.

21.Federal, state or local income, sales or payroll taxes.

22.Other notes or payables not included above.

23.Current balances for all of the outstanding mortgages.

24.Vehicle loans.

25.Loans payable for furniture and equipment.

26.Other long-term notes or payables.

27.Add the amounts on lines 19 through 26 and enter here.

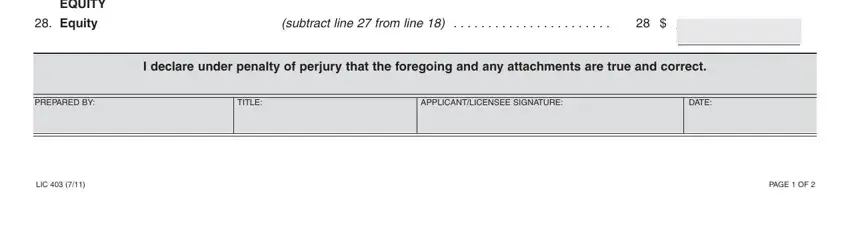

EQUITY

28.The equity is the difference between your total assets and total liabilities. Subtract line 27 from line 18 and enter here.

SIGNATURE BLOCK

The name of the preparer is to be printed in the space provided. The applicant or licensee is required to sign this form attesting to the financial information. Failure to sign, date and attest to the accuracy of the information reported on the Balance Sheet (LIC 403) shall constitute non-compliance and the rejection of this report.