Dealing with PDF documents online is definitely super easy with our PDF tool. Anyone can fill in s-edge here painlessly. In order to make our tool better and more convenient to use, we consistently implement new features, considering feedback coming from our users. This is what you would want to do to begin:

Step 1: Press the "Get Form" button at the top of this webpage to access our tool.

Step 2: The tool lets you change PDF files in many different ways. Modify it by including personalized text, correct existing content, and put in a signature - all within the reach of several clicks!

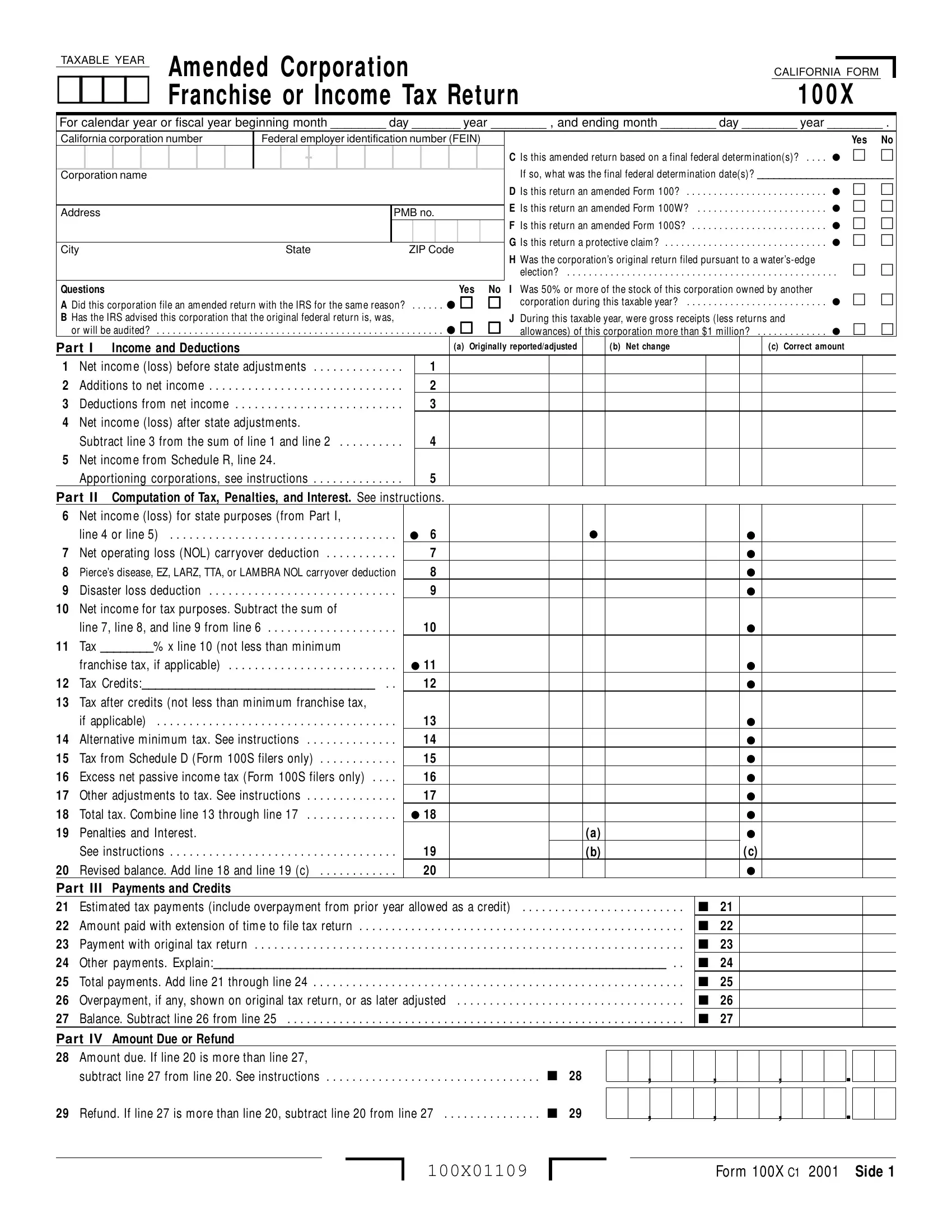

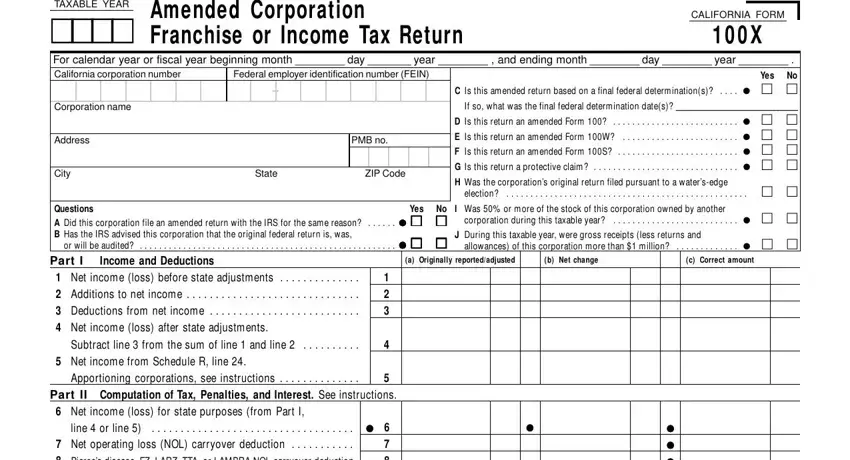

In order to fill out this PDF document, be sure to provide the necessary information in every single area:

1. While filling out the s-edge, ensure to complete all of the necessary blanks in their associated section. This will help to hasten the process, allowing your information to be processed efficiently and appropriately.

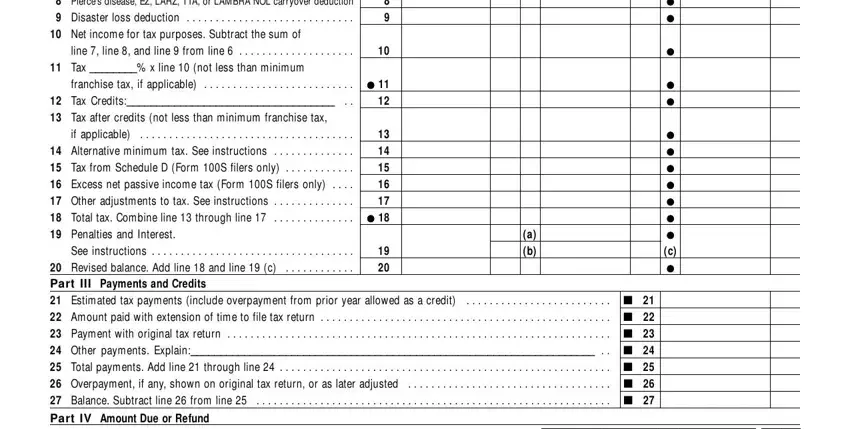

2. Immediately after this selection of blank fields is completed, go on to enter the relevant information in all these - Net operating loss NOL carryover, line line and line from line , Tax x line not less than minimum, franchise tax if applicable , Tax Credits Tax after credits, if applicable, , a b, See instructions , Revised balance Add line and, and Part IV Amount Due or Refund .

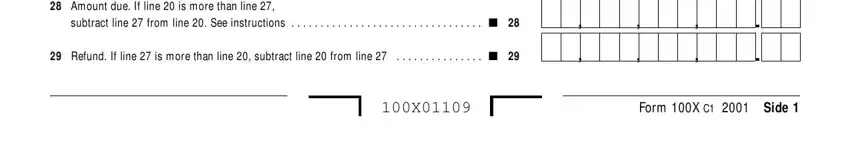

3. This next step should also be relatively simple, Part IV Amount Due or Refund , subtract line from line See, Refund If line is more than line, and Form X C Side - all these fields will need to be filled out here.

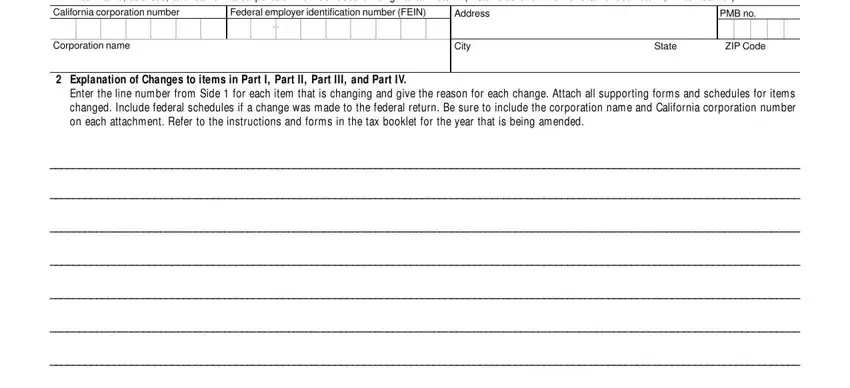

4. To go onward, the following part requires filling out several blanks. Included in these are Enter name address and California, Federal employer identification, Address, PMB no, Corporation name, City, State, ZIP Code, Explanation of Changes to items, and Enter the line number from Side , which are integral to moving forward with this process.

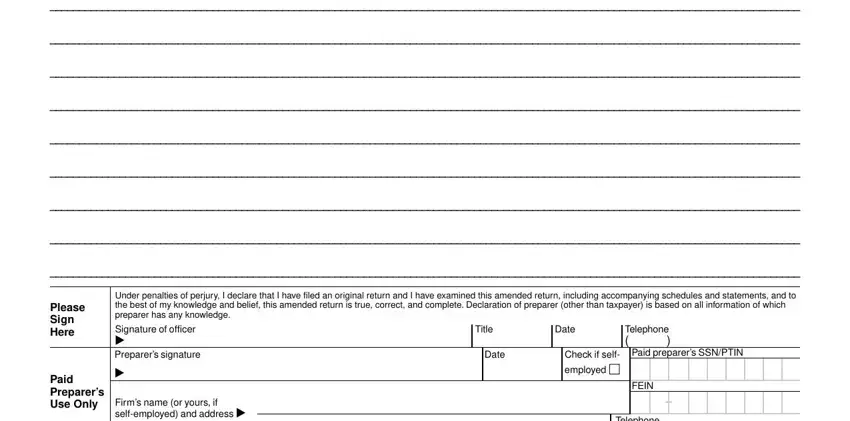

5. While you approach the finalization of your form, you'll notice several extra points to undertake. Particularly, Please Sign Here, Paid Preparers Use Only, Under penalties of perjury I, Signature of officer , Preparers signature, Firms name or yours if, Title, Date, Date, Check if self employed , Telephone , Paid preparers SSNPTIN, FEIN, and Telephone must all be filled out.

It's easy to get it wrong when filling out your Under penalties of perjury I, consequently be sure to go through it again prior to deciding to submit it.

Step 3: Before obtaining the next stage, make certain that blank fields are filled out right. Once you determine that it's good, press “Done." Go for a free trial option at FormsPal and gain direct access to s-edge - download or edit from your personal account. FormsPal ensures your information confidentiality by using a protected method that in no way saves or distributes any private information involved. Rest assured knowing your files are kept confidential each time you use our service!