Managing forms together with our PDF editor is more straightforward as compared to anything else. To enhance form ftb 3500 the file, you'll find nothing you should do - simply keep to the actions below:

Step 1: To begin, click the orange button "Get Form Now".

Step 2: Once you have accessed your form ftb 3500 edit page, you will notice all actions you can undertake concerning your document within the upper menu.

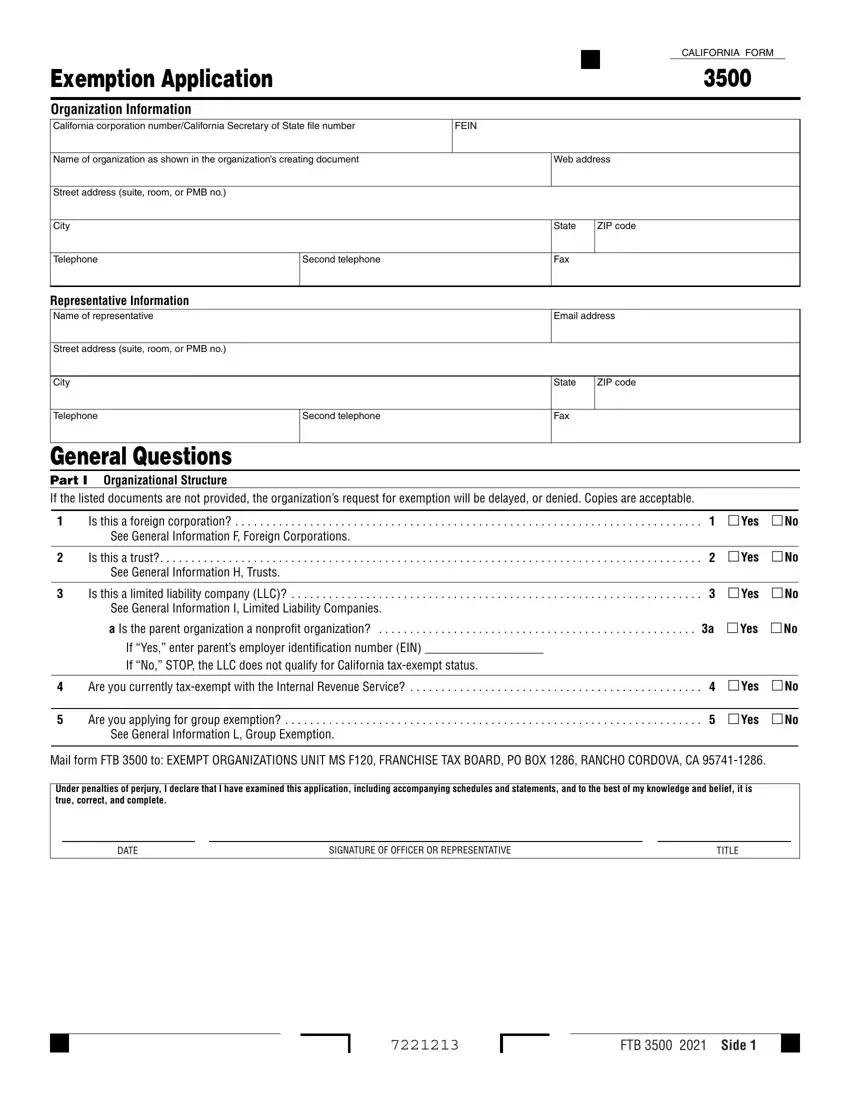

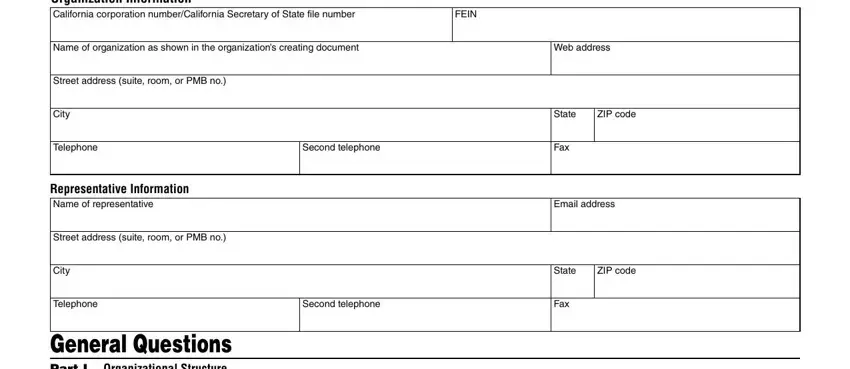

Get the form ftb 3500 PDF and type in the information for every area:

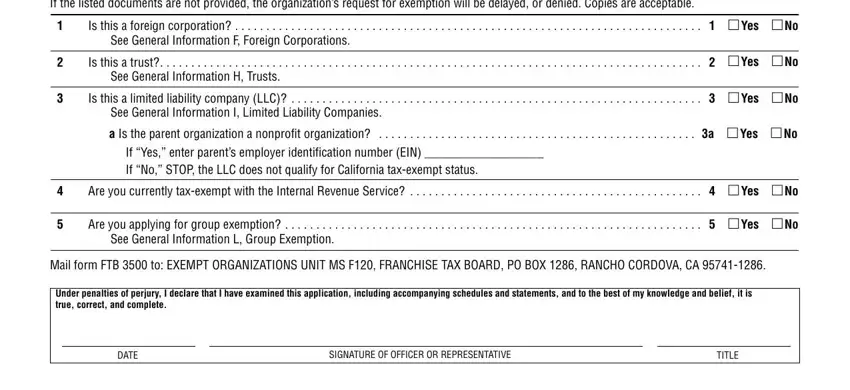

Type in the appropriate information in the field General Questions Part I, Is this a foreign corporation, See General Information F Foreign, Is this a trust, Yes, See General Information H Trusts, Is this a limited liability, Yes, See General Information I Limited, a Is the parent organization a, Yes, If Yes enter parents employer, Are you currently taxexempt with, Yes, and Are you applying for group.

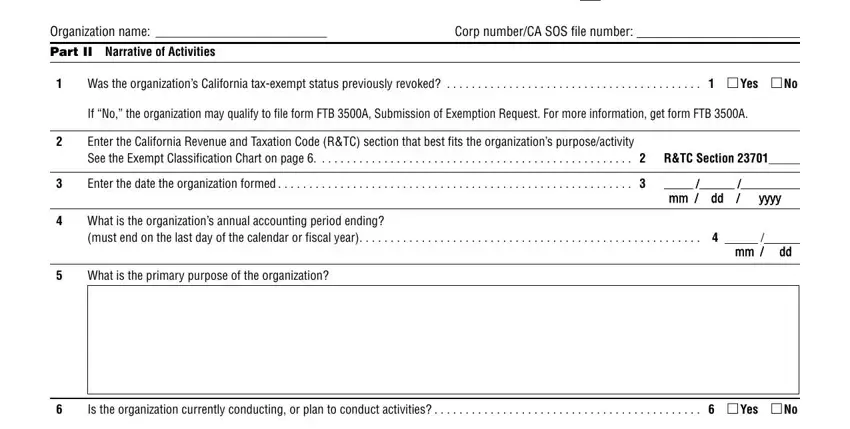

Note any data you are required within the section Organization name, Corp numberCA SOS file number, Part II Narrative of Activities, Was the organizations California, Yes, If No the organization may qualify, Enter the California Revenue and, Enter the date the organization, yyyy, What is the organizations annual, What is the primary purpose of the, Is the organization currently, and Yes.

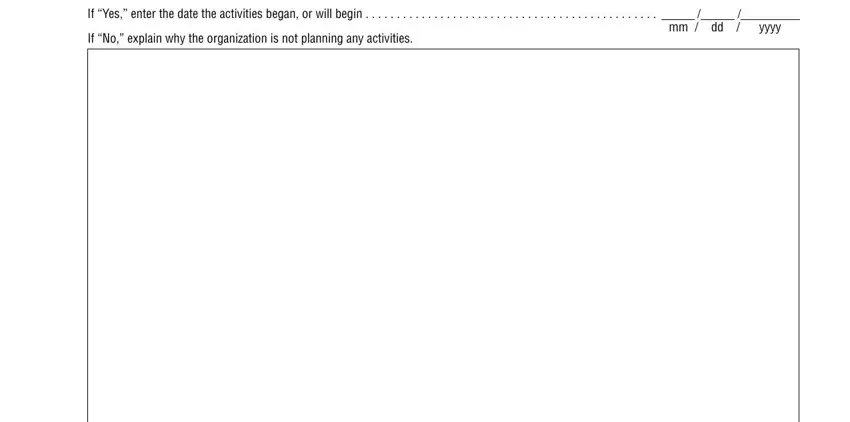

Through field If Yes enter the date the, If No explain why the organization, mm dd, and yyyy, state the rights and obligations.

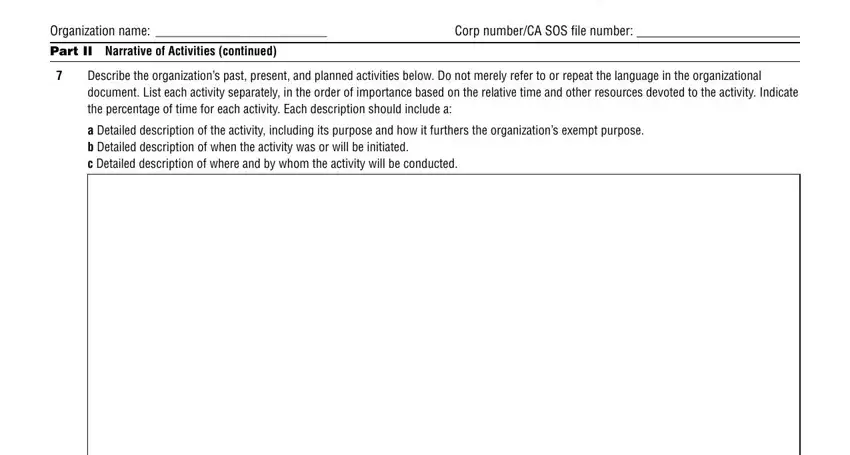

Look at the fields Organization name, Corp numberCA SOS file number, Part II Narrative of Activities, Describe the organizations past, and a Detailed description of the and then complete them.

Step 3: Press the "Done" button. Then, you can transfer your PDF document - upload it to your device or forward it by means of email.

Step 4: Ensure that you remain away from potential worries by preparing a minimum of a couple of copies of the form.