Code 171 – Ridesharing Credit Carryover (Pre-1989)

You may claim a credit carryover for the cost of sponsoring a ridesharing program for your employees, or for operating a private, third-party ridesharing program under former R&TC Sections 17053, and 23605, only if a carryover is available from taxable years 1981 through 1986.

Use Code 171 only for employer ridesharing credit carryovers from pre-1989 taxable years. If you are claiming a credit carryover from the employer ridesharing vehicle credit available in taxable years 1989 through 1995, see codes 191 through 193 to determine which code to use.

Code 200 – Salmon and Steelhead Trout Habitat Restoration

You may claim a credit carryover for the cost associated with salmon and steelhead trout habitat restoration and improvement projects under former R&TC Sections 17053.66 and 23666, only if a carryover is available from taxable years 1995 through 1999.

The credit amount is the lesser of 10% of qualified costs, or other amounts determined by the California Department of Fish and Game.

Code 180 – Solar Energy Credit Carryover

You may claim a credit carryover for the costs of installing solar energy systems under former R&TC Sections 17052.5 and 23601, only if a carryover is available from taxable years 1985 through 1988.

Code 179 – Solar Pump Credit Carryover

You may claim a credit carryover for the cost of installing a solar pump system under former R&TC Sections 17052.1, 17052.4, 17052.8,

and 23607, only if a carryover is available from taxable years 1981 through 1983.

Code 217 – Solar or Wind Energy System Credit Carryover

You may claim a credit carryover for the purchase and installation costs of a solar energy or wind energy system installed on California property under former R&TC Sections 17053.84 and 23684, from taxable years 2001 through 2005.

Limitation: The credit may be carried forward for up to eight years from the year in which the credit was incurred, or until exhausted, whichever occurs first.

Code 201 – Technological Property Contribution Credit

Carryover (Corporations only)

You may claim a credit carryover if you contributed technological property under former R&TC Section 23606, only if a carryover is available from taxable years 1983 through 1984.

Code 178 – Water Conservation Credit Carryover

(Individuals, Estates, and Trusts only)

You may claim a credit carryover for the costs of installing water conservation measures under former R&TC Section 17052.8, only if a carryover is available from taxable years 1980 through 1982.

Code 161 – Young Infant Credit Carryover (Individuals Only)

You may claim a credit carryover for a dependent under 13 months of age under former R&TC Section 17052.20, only if a carryover is available from taxable years 1991 through 1993.

D Limitations

In general, a credit carryover cannot reduce the minimum franchise tax (corporations and S corporations) and the annual tax (limited partnerships, limited liability companies (LLCs) classified as partnerships, limited liability partnerships), the alternative minimum tax (corporations, exempt organizations, individuals, and fiduciaries), the built-in gains tax (S corporations), or the excess net passive income tax (S corporations).

Alternative Minimum Tax (AMT) may be reduced by the following credit carryovers: solar energy credit, commercial solar energy credit and the manufacturing investment credit (MIC). However, the MIC carryover may only reduce the alternative minimum tax (AMT) for corporations. Get Schedule P (100, 100W, 540, 540NR, or 541).

If the available credit carryover for the current taxable year exceeds the current year tax, any unused amount may be carried over to succeeding years unless the credit carryover period has expired. Apply the carryover to the earliest taxable year(s) possible.

In no event can a credit carryover be carried back and applied against a prior year’s tax.

Single Member LLCs (SMLLC)

If a taxpayer owns an interest in a disregarded business entity [a single member limited liability company (SMLLC) not recognized by California, and for tax purposes treated as a sole proprietorship owned by an individual or a branch owned by a corporation], the credit amount received from the disregarded entity that can be utilized is limited to the difference between the taxpayer’s regular tax figured with the income of the disregarded entity, and the taxpayer’s regular tax figured without the income of the disregarded entity.

An SMLLC may be disregarded as an entity separate from its owner, and is subject to statutory provisions that recognize otherwise disregarded entities for certain tax purposes. Get Form 568, Limited Liability Company Income Tax Booklet.

If the disregarded entity reports a loss, the taxpayer may not claim the credit this year, but can carry over the credit amount received from the disregarded entity.

Specific Column Instructions

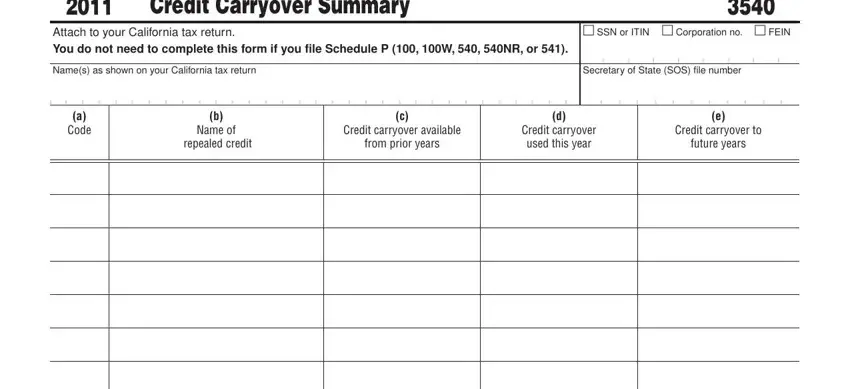

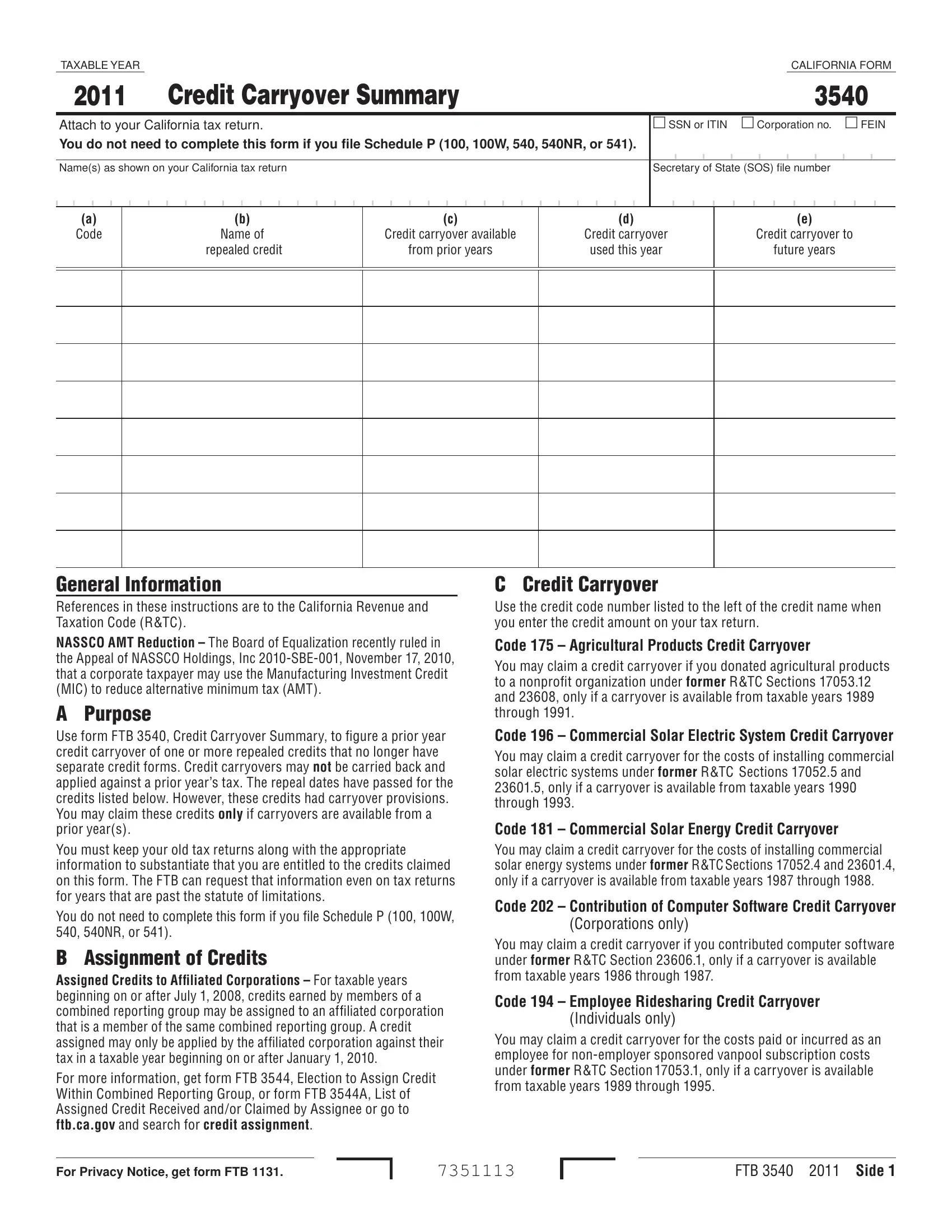

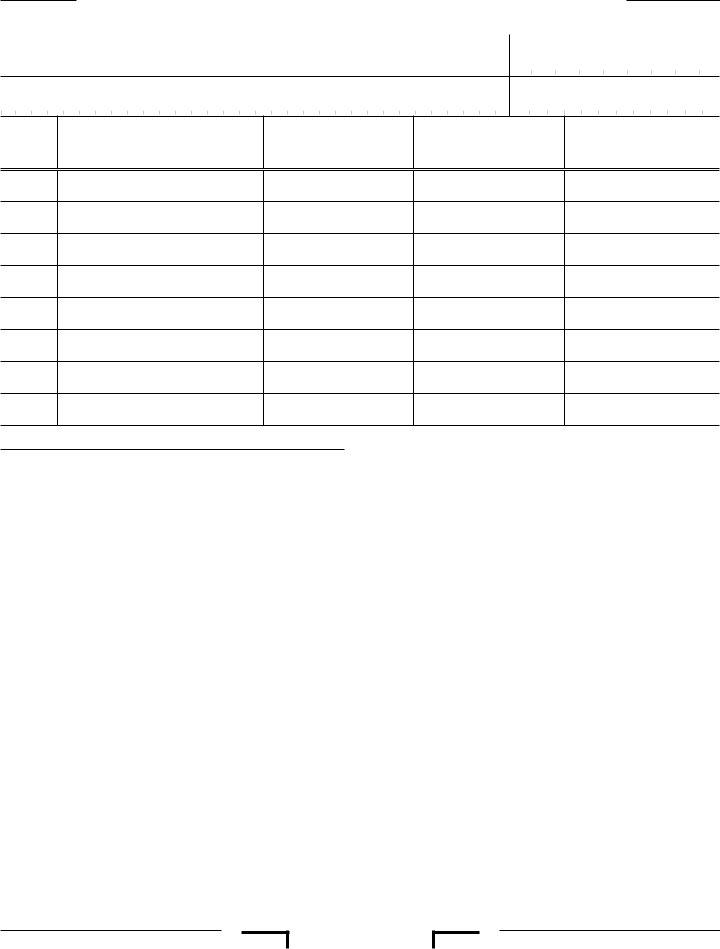

Column (a) – Enter the code number from the instructions for the carryover credit(s) you are eligible to claim.

Column (b) – Enter the name of repealed credit from the instructions for the carryover credit(s) you are eligible to claim.

Column (c) – Enter the amount of credit carryover available from prior years. This amount is on the prior year credit form or statement that you attached to your previous year’s tax return. This amount may also be on the prior year Schedule P (100, 100W, 540, 540NR, or 541), under Credit Carryover, column (d).

Column (d) – Enter the amount of credit carryover claimed on your current year tax return. The credit carryover amount you can claim on your tax return may be limited by tentative minimum tax or your tax liability. Refer to the credit instructions in your tax booklet to determine the amount of credit carryover you can claim and for information on claiming the credit carryover on your tax return. Also see General Information D, Limitations.

Column (e) – Subtract the amount in column (d) from the amount in column (c). Enter the result in column (e). This is the amount of credit that can be carried over to future years. To see if the credit is limited, see General Information D, Limitations.