Using the online PDF editor by FormsPal, you'll be able to fill in or edit fillable form 540 here. Our team is focused on providing you the perfect experience with our tool by constantly introducing new functions and enhancements. With all of these improvements, working with our tool gets better than ever before! To begin your journey, consider these simple steps:

Step 1: Hit the "Get Form" button in the top part of this page to get into our PDF editor.

Step 2: The editor provides you with the opportunity to change your PDF file in a range of ways. Improve it with your own text, correct existing content, and place in a signature - all readily available!

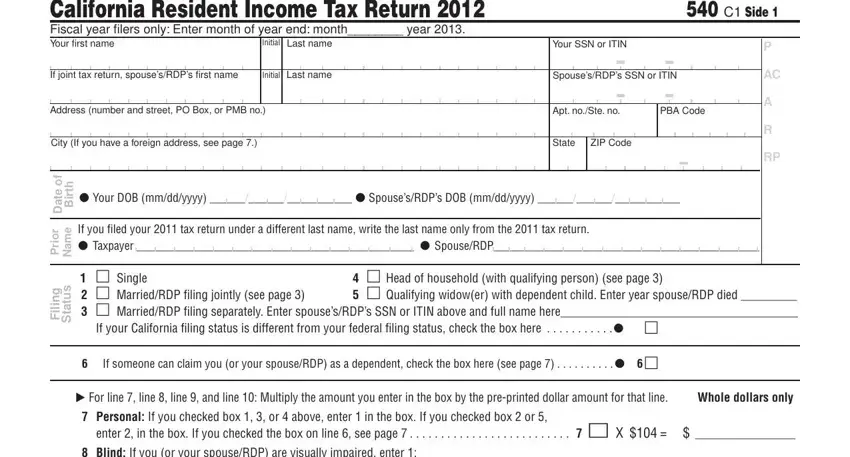

This PDF form will need specific details; in order to ensure accuracy and reliability, please make sure to heed the next guidelines:

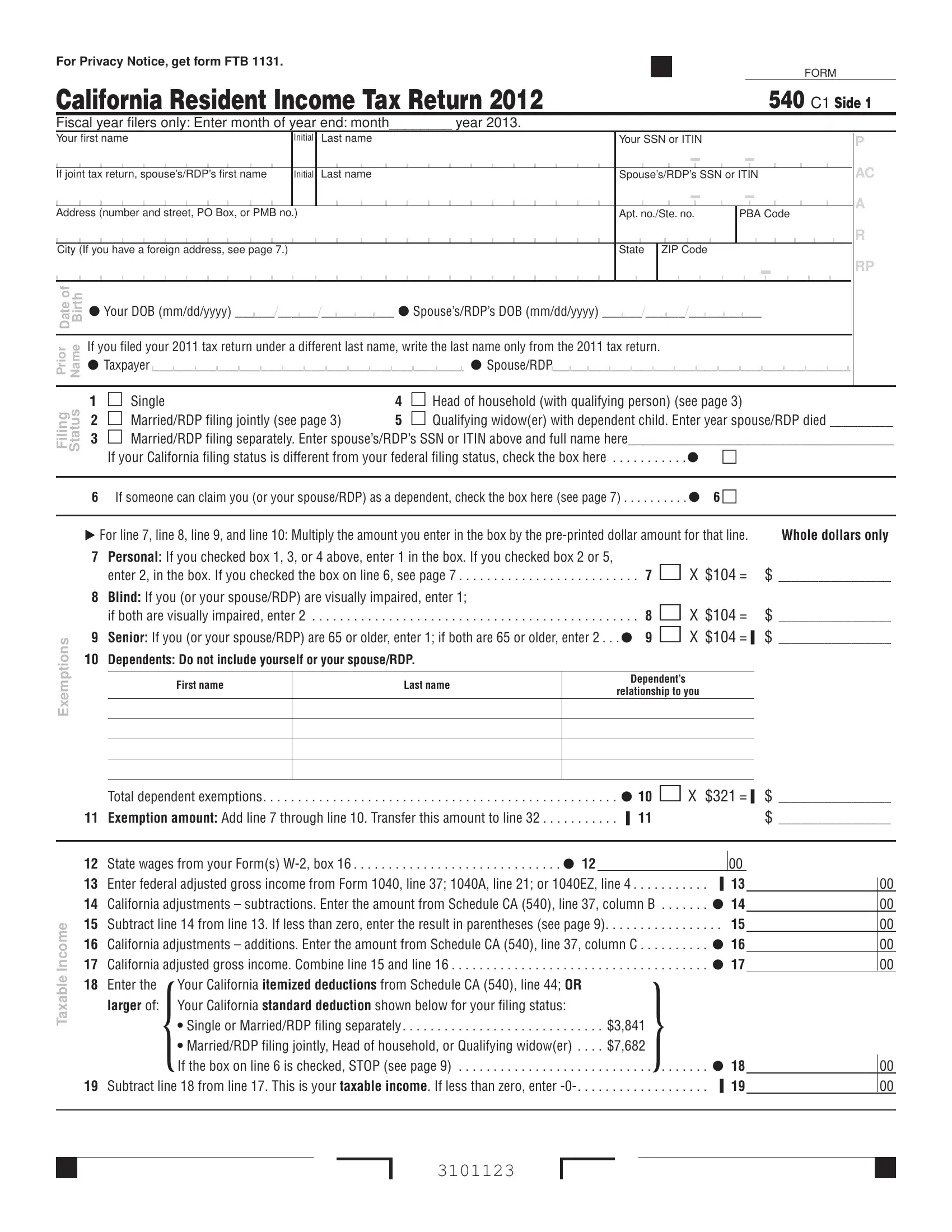

1. Fill out the fillable form 540 with a group of major blanks. Consider all of the necessary information and make sure absolutely nothing is overlooked!

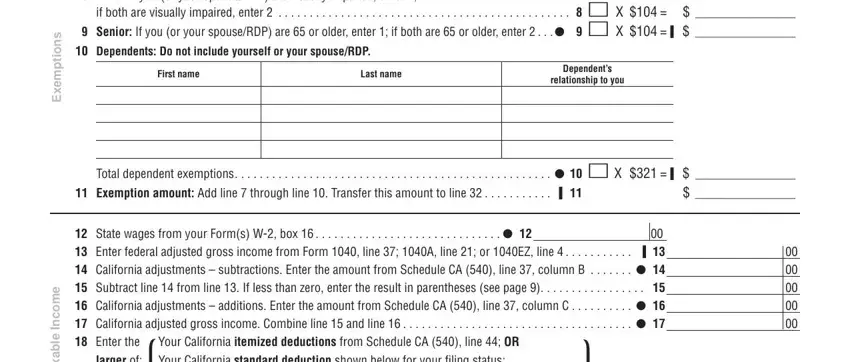

2. The next stage is usually to complete all of the following blank fields: s n o i t p m e x E, e m o c n, I e l b a x a T, if both are visually impaired, First name, Last name, Dependents, relationship to you, Exemption amount Add line , Total dependent exemptions , State wages from your Forms W box, larger of Your California standard, and Your California itemized.

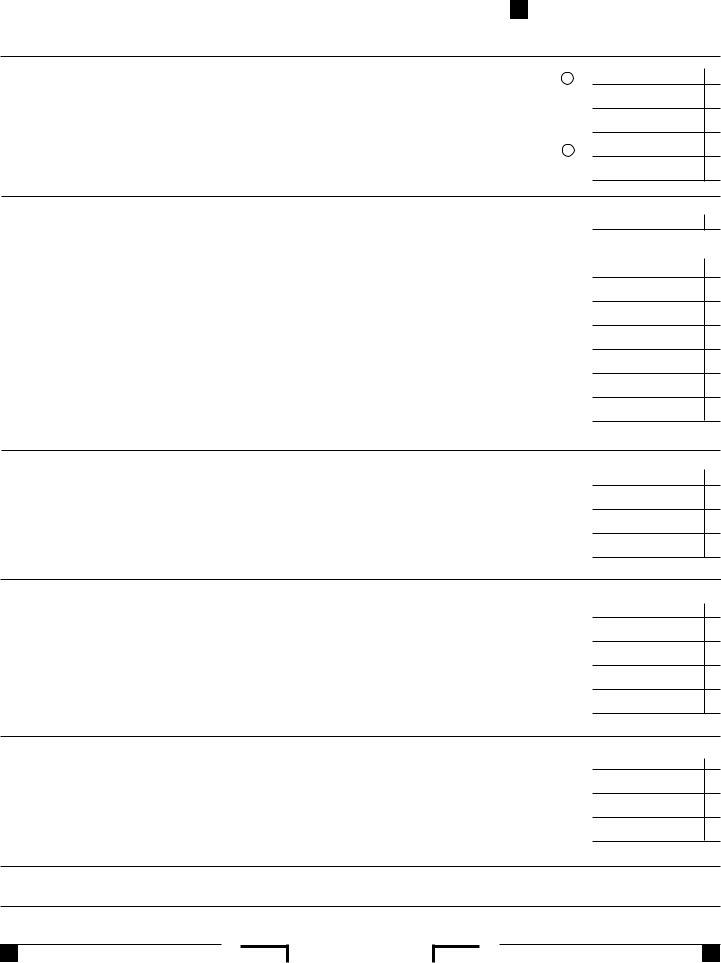

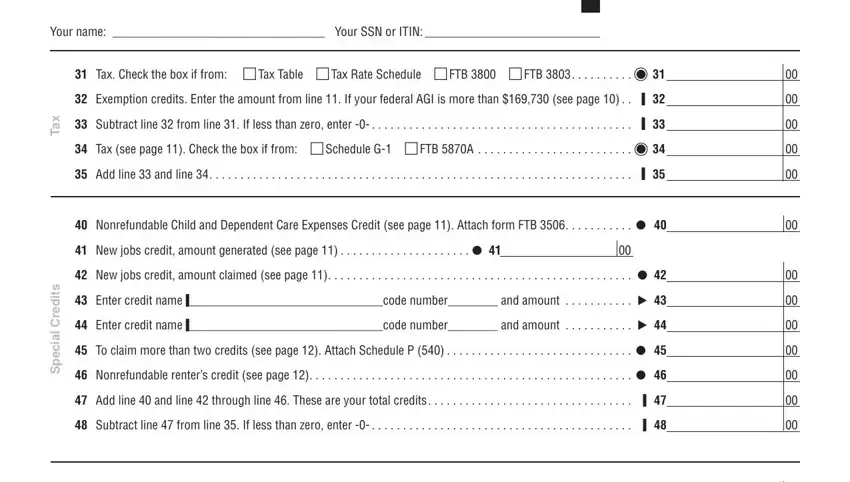

3. Throughout this step, take a look at Your name Your SSN or ITIN , Tax Check the box if from Tax, x a T, Exemption credits Enter the, Add line and line , s t i d e r C, a c e p S, Nonrefundable Child and Dependent, Enter credit namecode number and, Add line and line through line , and s Alternative minimum tax Attach. Each of these should be taken care of with greatest focus on detail.

Be very attentive while filling in Nonrefundable Child and Dependent and Enter credit namecode number and, because this is the part in which many people make mistakes.

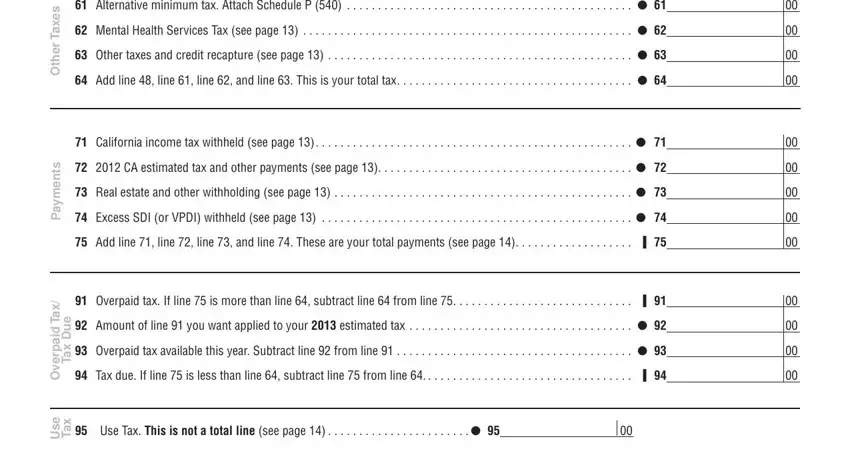

4. All set to proceed to this fourth segment! In this case you've got these s Alternative minimum tax Attach, e x a T r e h t O, California income tax withheld, s t n e m y a P, Add line line line and line , x a T d i a p r e v O, e u D x a T, Overpaid tax If line is more, Tax due If line is less than, e s U, x a T, and Use Tax This is not a total line blank fields to complete.

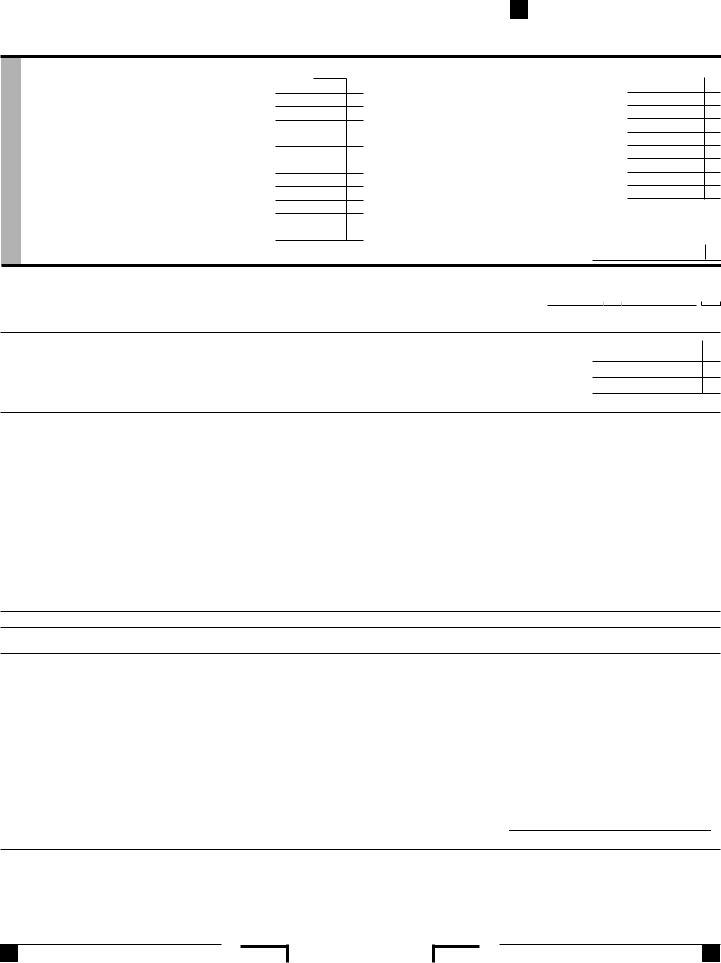

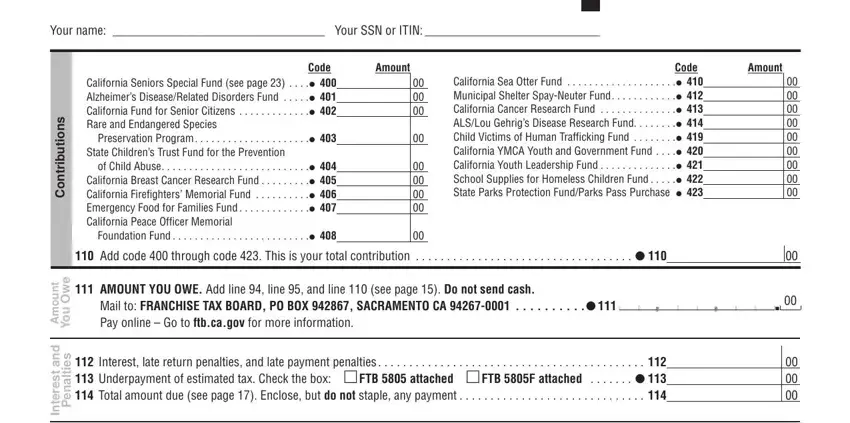

5. Lastly, this final section is precisely what you need to finish prior to submitting the PDF. The blanks you're looking at include the next: Your name Your SSN or ITIN , Code California Seniors Special, s n o i t u b i r t n o C, Amount, Code California Sea Otter Fund , Add code through code This is, Amount, t n u o m A, e w O u o Y, d n a, t s e r e t n, s e i t l, a n e P, AMOUNT YOU OWE Add line line , and Mail to FRANCHISE TAX BOARD PO BOX.

Step 3: Prior to finishing this document, make certain that blanks are filled in the proper way. As soon as you verify that it's fine, click “Done." Make a 7-day free trial account at FormsPal and get instant access to fillable form 540 - readily available in your personal cabinet. With FormsPal, it is simple to complete documents without needing to get worried about personal information leaks or records getting shared. Our secure system makes sure that your private details are stored safe.