Any time you want to fill out California Form 540 Schedule P, there's no need to download any applications - simply try our online PDF editor. Our tool is consistently evolving to provide the best user experience possible, and that is thanks to our dedication to continuous improvement and listening closely to customer feedback. With just a couple of simple steps, you'll be able to start your PDF journey:

Step 1: First of all, open the tool by pressing the "Get Form Button" at the top of this site.

Step 2: When you access the tool, you will find the document made ready to be completed. Other than filling out different fields, you might also do some other things with the PDF, including writing custom textual content, changing the original text, adding images, placing your signature to the form, and much more.

It is actually easy to fill out the document with this practical guide! This is what you want to do:

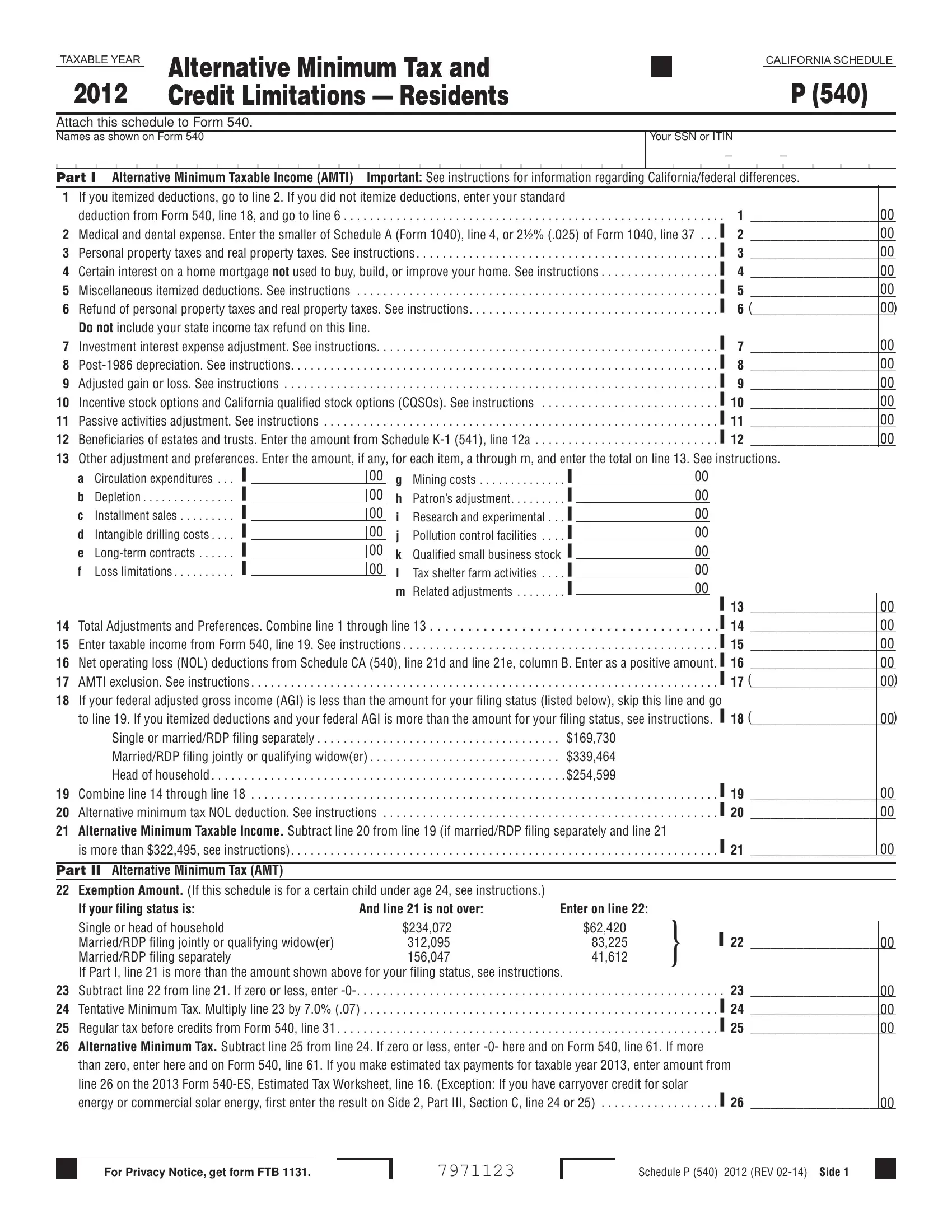

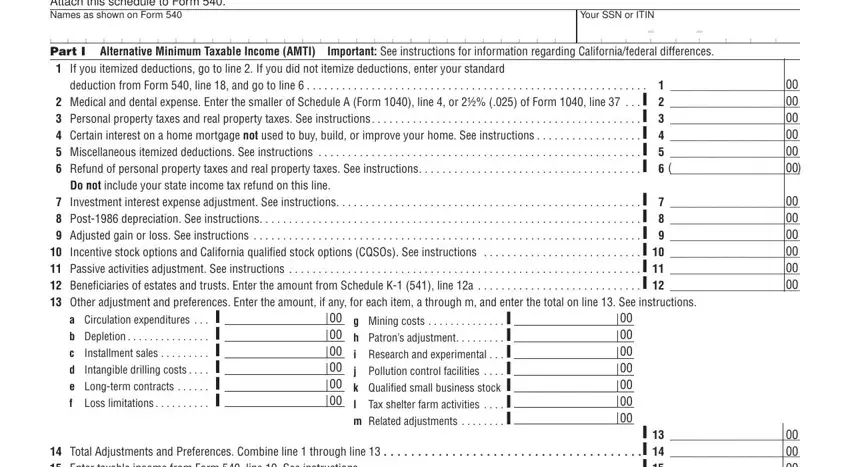

1. The California Form 540 Schedule P necessitates certain information to be entered. Be sure the next blank fields are filled out:

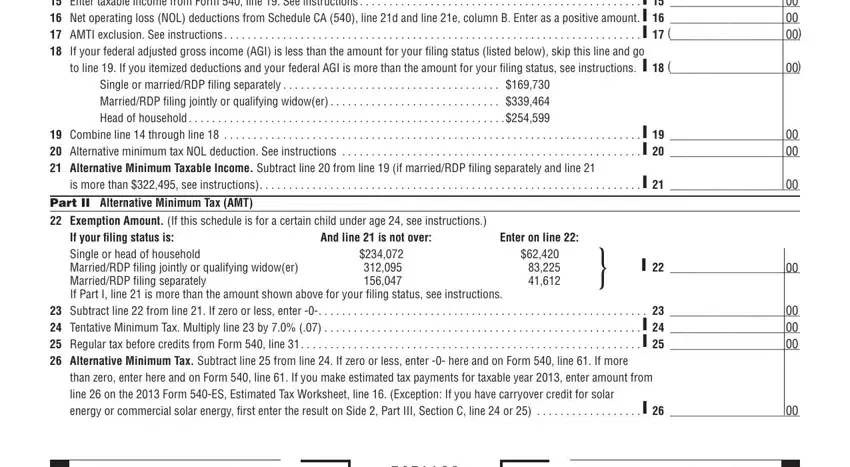

2. Your next step is to fill out these blank fields: to line If you itemized, Single or marriedRDP filing, Total Adjustments and, is more than see instructions , If Part I line is more than the, If your filing status is Single or, Subtract line from line If, than zero enter here and on Form , And line is not over, and Enter on line .

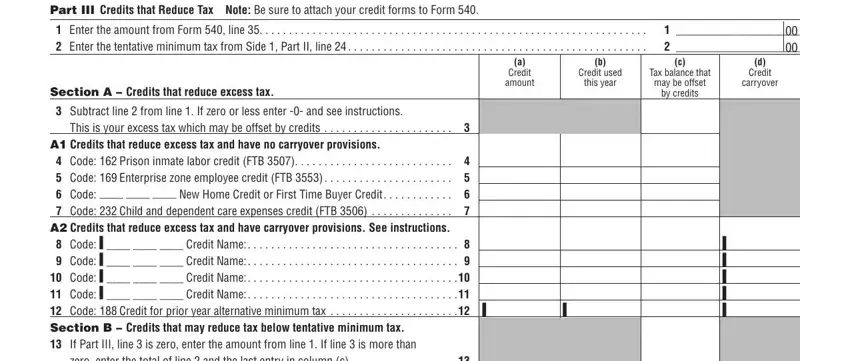

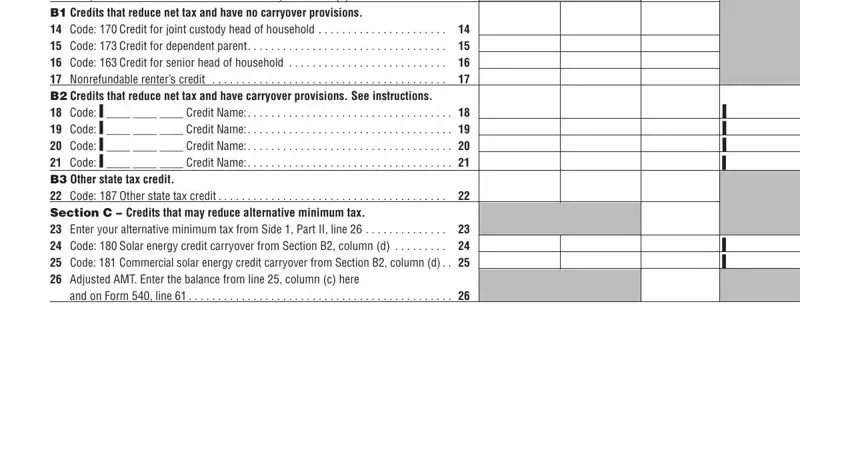

3. Your next step is normally simple - fill in every one of the blanks in Part III Credits that Reduce Tax, Enter the amount from Form line , Section A Credits that reduce, Credit amount, Credit used, this year, Tax balance that may be offset, by credits, Credit carryover, zero enter the total of line and, This is your excess tax which may, and Subtract line from line If zero to finish this part.

4. This particular subsection arrives with the next few empty form fields to type in your information in: zero enter the total of line and, Subtract line from line If zero, and and on Form line .

Be extremely careful when completing Subtract line from line If zero and and on Form line , because this is where a lot of people make errors.

Step 3: Immediately after taking one more look at your form fields you've filled out, click "Done" and you're good to go! After getting afree trial account with us, it will be possible to download California Form 540 Schedule P or email it at once. The document will also be readily accessible in your personal account page with your adjustments. FormsPal ensures your information confidentiality by using a protected method that in no way saves or distributes any sort of private data involved. You can relax knowing your docs are kept safe each time you work with our service!