ca form 587 fillable can be filled out online very easily. Just make use of FormsPal PDF editing tool to accomplish the job in a timely fashion. FormsPal team is aimed at making sure you have the ideal experience with our tool by constantly presenting new capabilities and enhancements. Our tool has become a lot more useful thanks to the latest updates! Now, filling out PDF documents is a lot easier and faster than ever before. With just a few easy steps, it is possible to start your PDF journey:

Step 1: First, access the pdf editor by pressing the "Get Form Button" at the top of this site.

Step 2: After you access the editor, you will get the form ready to be filled in. In addition to filling in different fields, you may as well do many other actions with the file, such as writing your own text, changing the original textual content, adding illustrations or photos, signing the form, and a lot more.

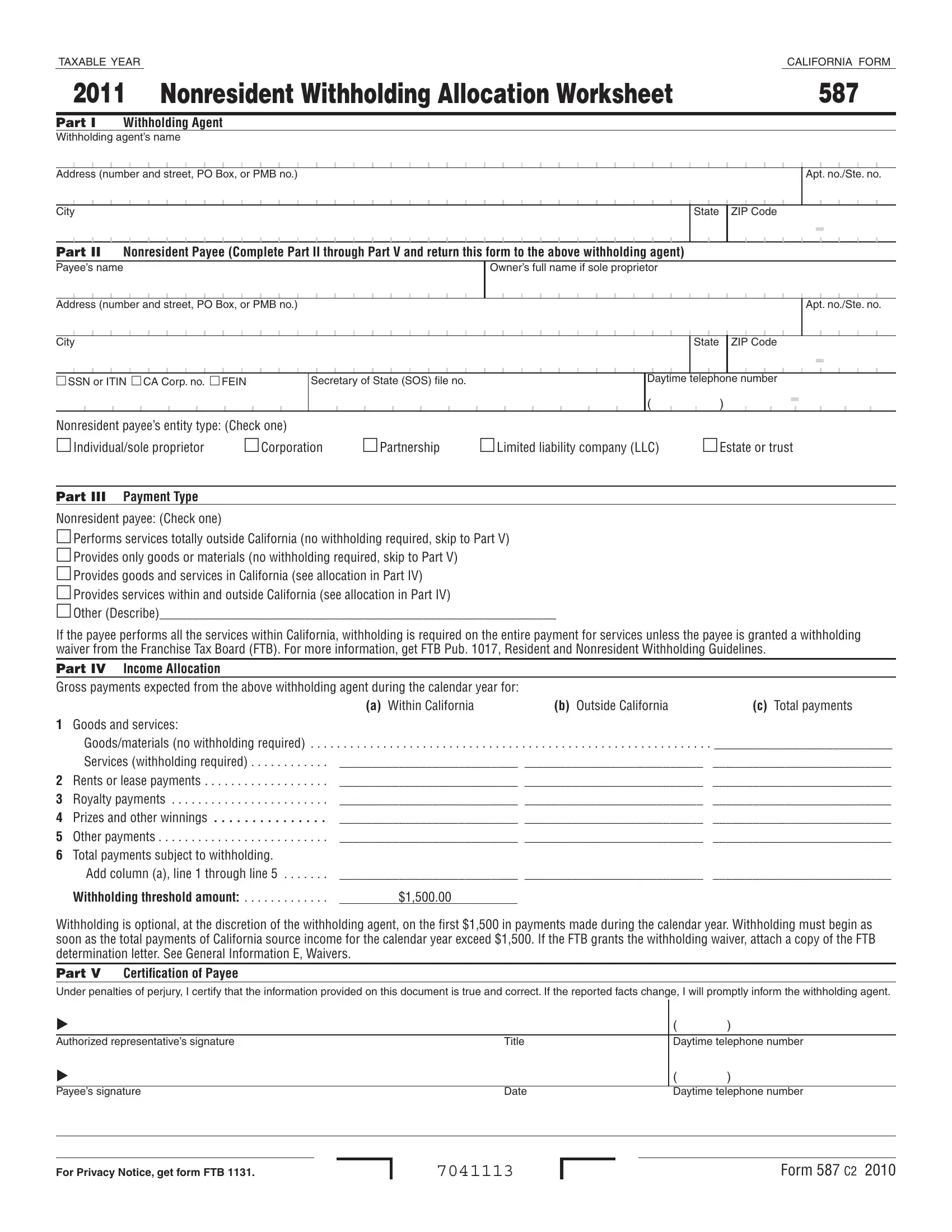

This document needs some specific details; in order to ensure accuracy and reliability, remember to take note of the guidelines down below:

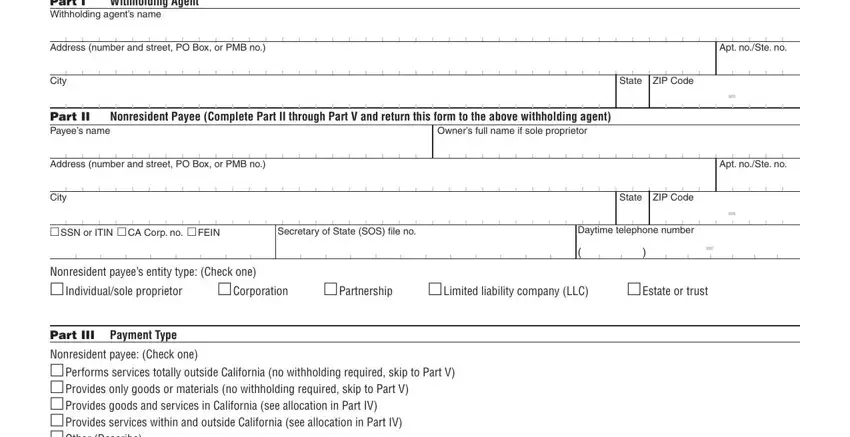

1. It is crucial to complete the ca form 587 fillable accurately, hence be careful when filling out the parts that contain these blank fields:

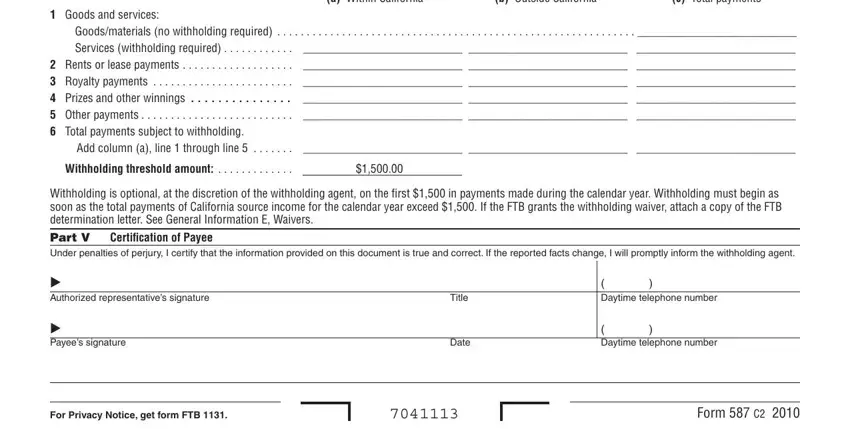

2. Once your current task is complete, take the next step – fill out all of these fields - Nonresident payee Check one , Services withholding required , Goodsmaterials no withholding, Add column a line through line , b Outside California, a Within California, c Total payments, Withholding threshold amount , Withholding is optional at the, Certiication of Payee, Authorized representatives, Payees signature, Title, Date, and Daytime telephone number with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

You can potentially make errors when filling out your Authorized representatives, so make sure to reread it before you finalize the form.

Step 3: You should make sure your details are correct and then press "Done" to finish the process. Join FormsPal today and instantly access ca form 587 fillable, prepared for download. All alterations made by you are kept , allowing you to modify the document at a later point when required. FormsPal offers risk-free document editing devoid of personal data recording or distributing. Rest assured that your data is safe here!