B Common Errors/Helpful Hints

•Get taxpayer identification numbers (TINs) from all payees.

•Complete all fields.

•Complete all forms timely to avoid penalties.

C Who Must Complete

Form 592-B must be completed by any person who:

•Has withheld on payments to residents or nonresidents.

•Has withheld backup withholding on payments to residents or nonresidents.

•Is a pass-through entity that was withheld upon and must flow-through the withholding credit.

Record Keeping

The withholding agent retains the proof of withholding for a minimum of four years and must provide it to the FTB upon request. Form 592-B is provided to the recipient to file with their state tax return. This form can be provided to the payee electronically. A broker can provide Form 592-B as a composite statement. For more information go to ftb.ca.gov and search for electronic 592-B requirements.

D When To Complete

Form 592-B must be provided to:

•Each resident or nonresident by January 31 following the close of the calendar year, except for brokers as stated in Internal Revenue Code (IRC) Section 6045.

•A recipient before February 15 following the close of the calendar year for brokers.

•Foreign partners in a partnership or members in a limited liability company (LLC) on

or before the 15th day of the 4th month following the close of the taxable year.

If all the partners in the partnership or members in the LLC are foreign, Form(s) 592-B must be provided on or before the 15th day of the 6th month after the close of the taxable year.

When making a payment of withholding tax to the IRS under IRC Section 1446, a partnership must notify all foreign partners of their allocable shares of any IRC Section 1446 tax paid to the IRS by the partnership. The partners use this information to adjust the amount of estimated tax that they must otherwise pay to the IRS. The notification to the foreign partners must be provided within 10 days of the installment due date, or, if paid later, the date the installment payment is made. See Treas. Regs. Section 1.1446-3(d)(1)(i) for information that must be included in

the notification and for exceptions to the notification requirement. For California withholding purposes, withholding agents should make a similar notification. No particular form is required for this notification, and it is commonly done on the statement

accompanying the distribution or payment. However, the withholding agent may choose to report the tax withheld to the payee on a Form 592-B.

E Penalties

The withholding agent must furnish complete and correct copies of Form(s) 592-B to the recipient (payee) by the due date.

If the withholding agent fails to provide complete, correct, and timely Form(s) 592-B to the recipient (payee), the penalty per Form 592-B is:

•$50 for each payee statement not provided by the due date.

•$100 or 10 percent of the amount required to be reported (whichever is greater), if the failure is due to intentional disregard of the requirement.

Specific Instructions

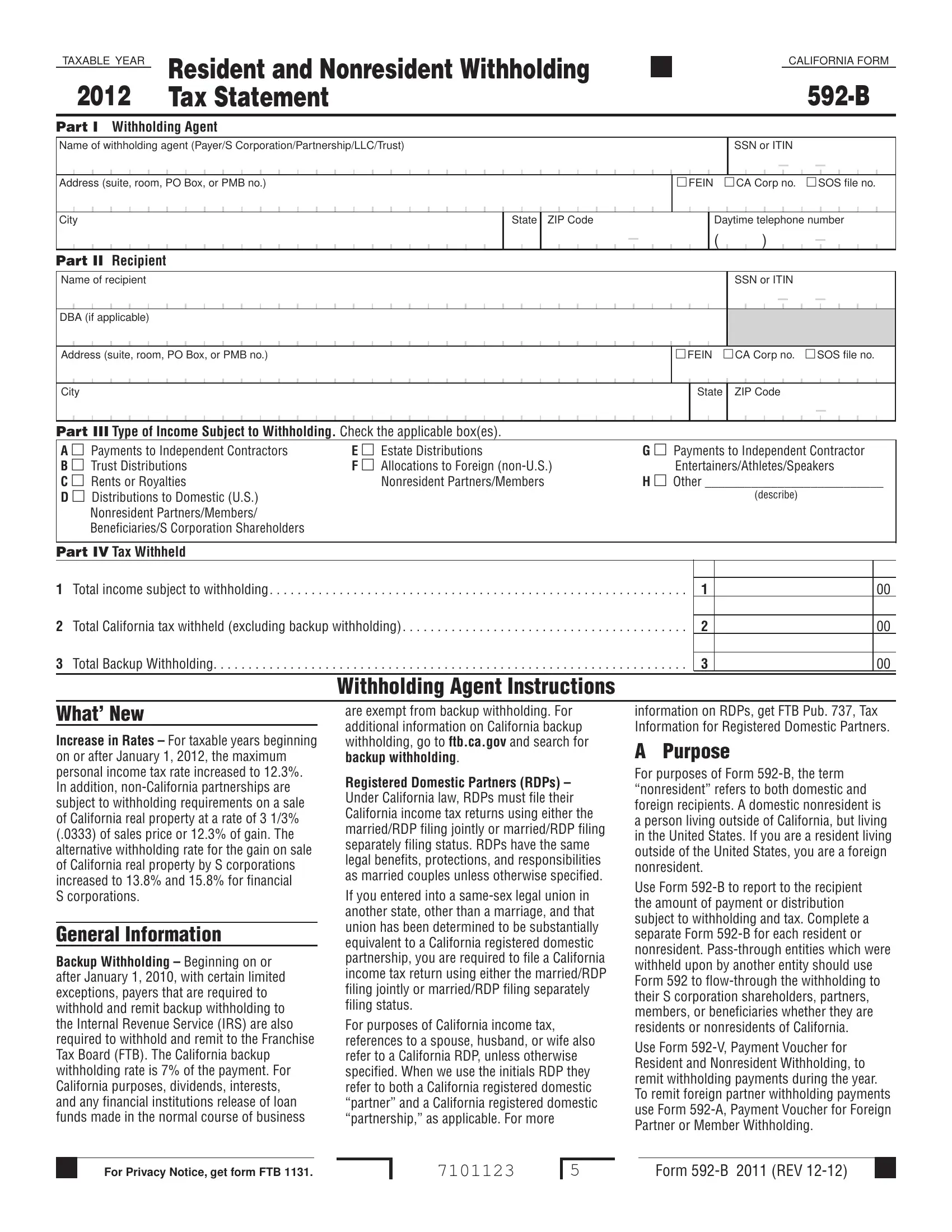

Year – Make sure the year in the upper left corner of Form 592-B represents the calendar year in which the withholding took place. If an S corporation’s, partnership’s, LLC’s, or trust’s current distribution represents a prior taxable year of California source income, the taxable year on Form 592-B must represent the year the income was earned. (Except for foreign partners, withholding of tax by withholding agents must be on a calendar-year basis, regardless of the accounting period adopted by the payee or withholding agent.)

For foreign partners in a partnership, or foreign members in an LLC, make sure the year in the upper left corner of Form 592-B is the year that the partnership’s or LLC’s taxable year ended. For example, if the partnership’s or LLC’s taxable year ended 12/31/09, use the 2009 Form 592-B.

Private Mail Box (PMB) – Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Enter the information in the following order: City, Country, Province/ Region, and Postal Code. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

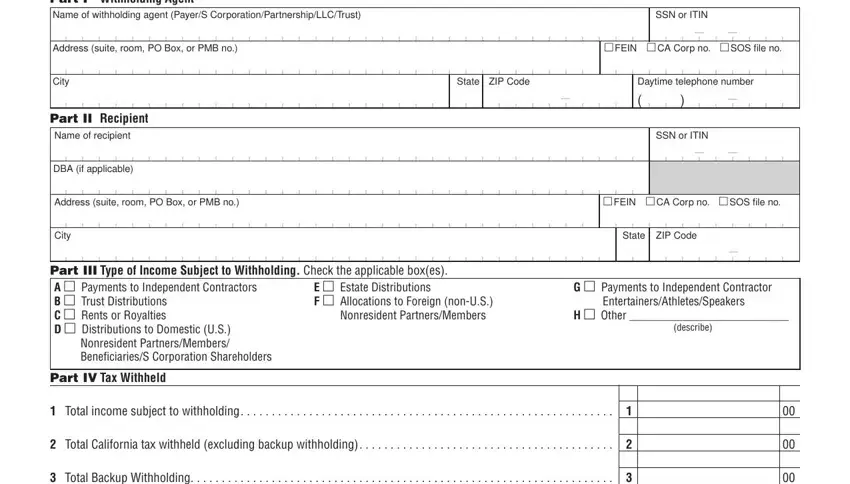

Part I – Withholding Agent

Enter the withholding agent’s name, tax identification number, address, and telephone number.

Part II – Recipient

Enter the name of recipient, DBA (if applicable), tax identification number, and address for the recipient (payee).

If the recipient is a grantor trust, enter the grantor’s individual name and social security number (SSN) or individual taxpayer identification number (ITIN). Do not enter the name of the trust or trustee information. (For

tax purposes, grantor trusts are transparent. The individual grantor must report the income and claim the withholding on the individual’s California tax return.)

If the recipient is a non-grantor trust, enter the name of the trust and the trust’s federal employer identification number (FEIN). Do not

enter trustee information.

If the trust has applied for a FEIN, but it has not been received, zero fill the space for the trust’s FEIN and attach a copy of the federal application behind Form 592-B. After the FEIN is received, amend Form 592-B to submit the assigned FEIN.

Only withholding agents can complete an amended Form 592-B. Upon completion, the withholding agent should provide a copy of the amended Form 592-B to the recipient. If a recipient notices an error, the recipient should contact the withholding agent.

If the recipients are married/RDP, enter only the name and SSN or ITIN of the primary spouse/RDP. However, if the recipients intend to file separate California tax returns, the withholding agent should split the withholding and complete a separate Form 592-B for each spouse/RDP.

Part III – Type of Income Subject to Withholding

Check the box(es) for the type of income subject to withholding.

Part IV – Tax Withheld

Line 1

Enter the total income subject to withholding.

Line 2

Enter the total California tax withheld (excluding backup withholding). The amount of tax to be withheld is computed by applying a rate of 7% on items of income subject to withholding, i.e. interest, dividends, rents and royalties, prizes and winnings, premiums, annuities, emoluments, compensation

for personal services, and other fixed or determinable annual or periodical gains, profits and income. For foreign partners, the rate is 8.84% for corporations, 10.84% for banks and financial institutions, and 12.3% for all others. For pass through entities, the amount withheld is allocated to partners, members,

S corporation shareholders, or beneficiaries, whether they are residents or nonresidents of California, in proportion to their ownership or beneficial interest.

Line 3

Enter the total backup withholding. Compute backup withholding by applying a 7% rate to all reportable payments subject to IRS backup withholding with a few exceptions. For California purposes dividends, interests, and any financial institutions release of loan funds made in the normal course of business are exempt from backup withholding.