The California Form De 305 filling in procedure is hassle-free. Our editor allows you to work with any PDF file.

Step 1: Click the button "Get Form Here".

Step 2: You'll find all of the options you can use on your template as soon as you've accessed the California Form De 305 editing page.

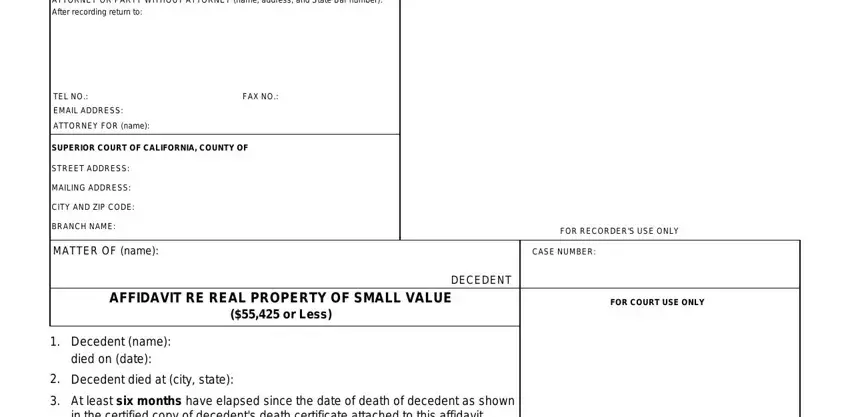

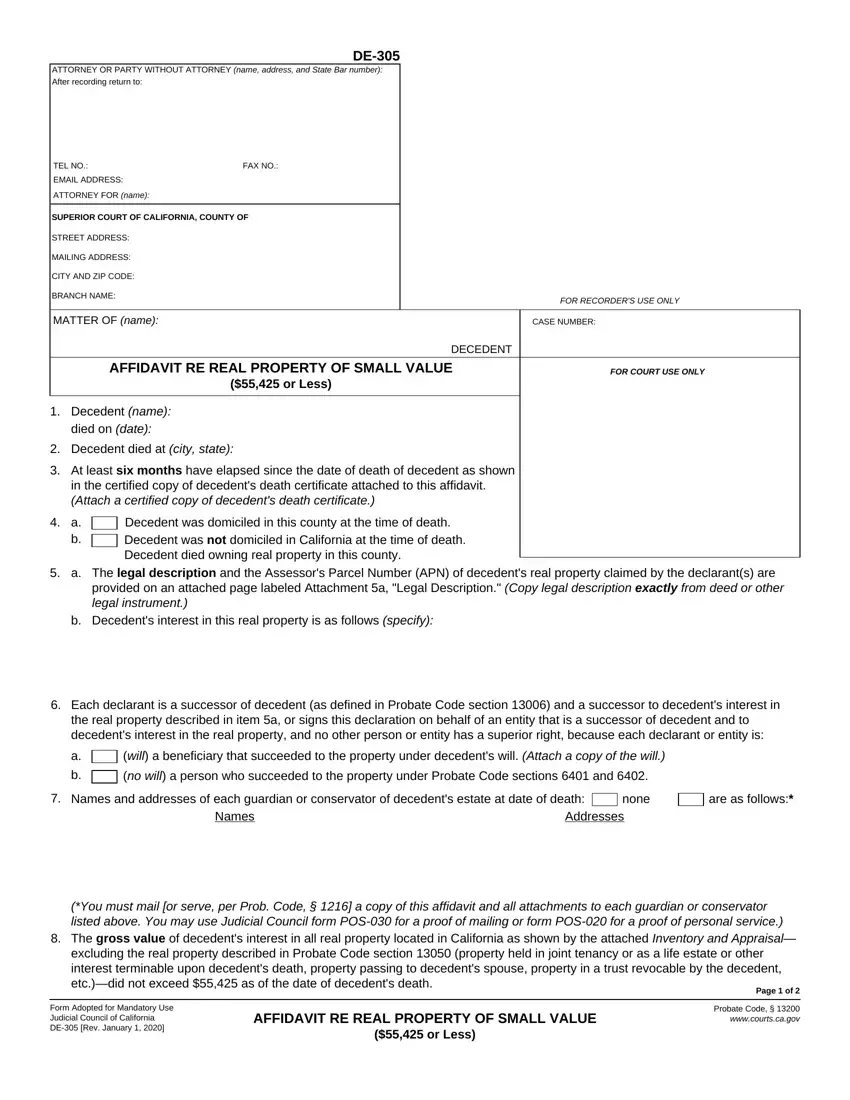

These parts are contained in the PDF file you will be filling out.

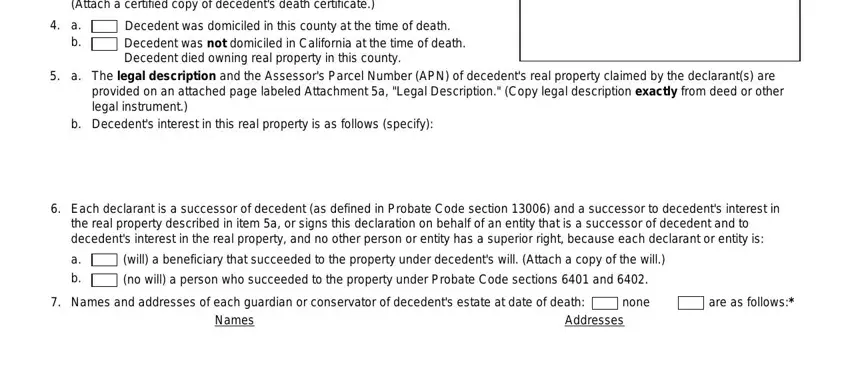

You have to enter the essential information in the At least six months have elapsed, a b, Decedent was domiciled in this, The legal description and the, Each declarant is a successor of, will a beneficiary that succeeded, no will a person who succeeded to, Names and addresses of each, none, are as follows, Names, and Addresses area.

You may be asked to enter the information to let the platform complete the section You must mail or serve per Prob, Page of, Form Adopted for Mandatory Use, AFFIDAVIT RE REAL PROPERTY OF, and Probate Code wwwcourtscagov.

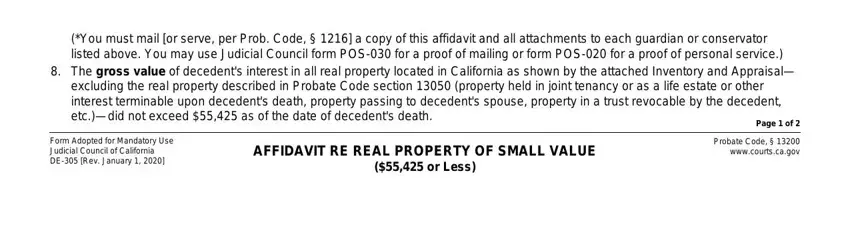

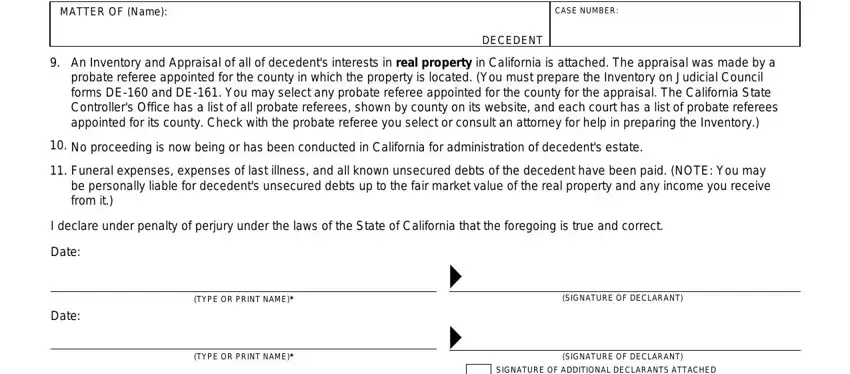

In the part MATTER OF Name, CASE NUMBER, DECEDENT, An Inventory and Appraisal of all, No proceeding is now being or has, Funeral expenses expenses of last, I declare under penalty of perjury, Date, Date, TYPE OR PRINT NAME, SIGNATURE OF DECLARANT, TYPE OR PRINT NAME, SIGNATURE OF DECLARANT, and SIGNATURE OF ADDITIONAL DECLARANTS, list the rights and responsibilities of the parties.

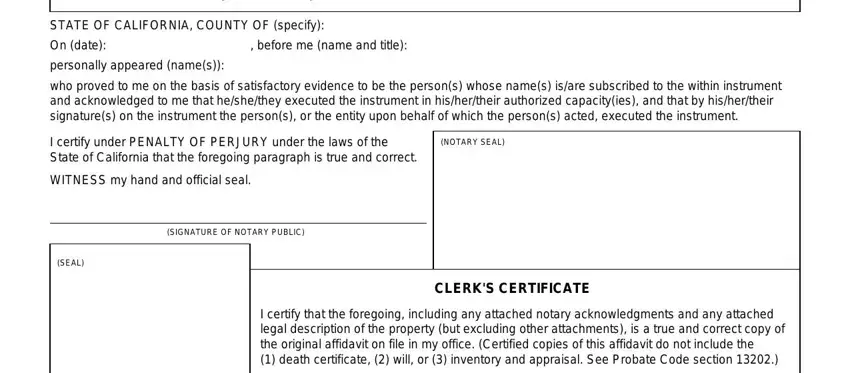

Finish by reviewing these fields and filling them out correspondingly: A notary public or other officer, STATE OF CALIFORNIA COUNTY OF, On date, before me name and title, personally appeared names, who proved to me on the basis of, I certify under PENALTY OF PERJURY, NOTARY SEAL, WITNESS my hand and official seal, SIGNATURE OF NOTARY PUBLIC, SEAL, CLERKS CERTIFICATE, and I certify that the foregoing.

Step 3: Select the Done button to save your file. So now it is obtainable for upload to your device.

Step 4: It will be easier to prepare copies of your form. You can rest easy that we are not going to distribute or view your information.

Decedent was domiciled in this county at the time of death.

Decedent was domiciled in this county at the time of death. Decedent was

Decedent was  (

( (

(