It really is very easy to fill out the de 1. Our PDF editor was built to be allow you to fill out any form fast. These are the basic steps to take:

Step 1: At first, select the orange "Get form now" button.

Step 2: The document editing page is right now available. It's possible to add text or change current data.

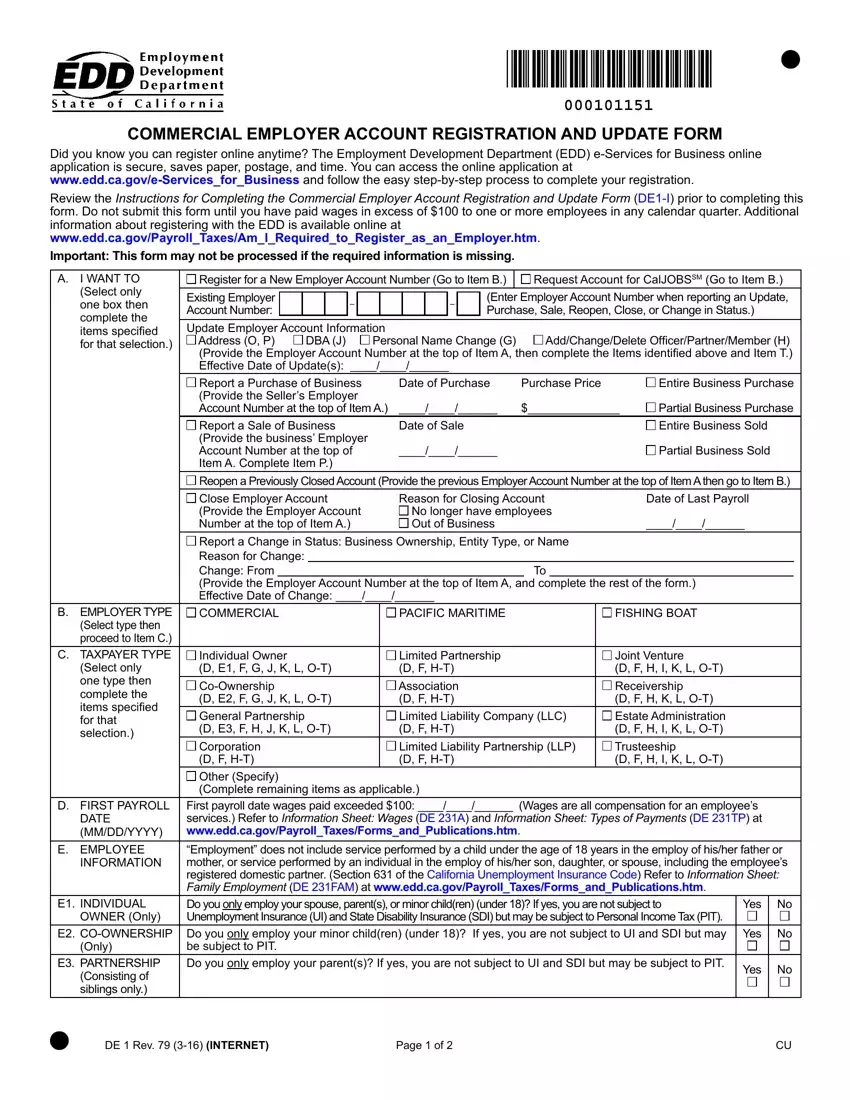

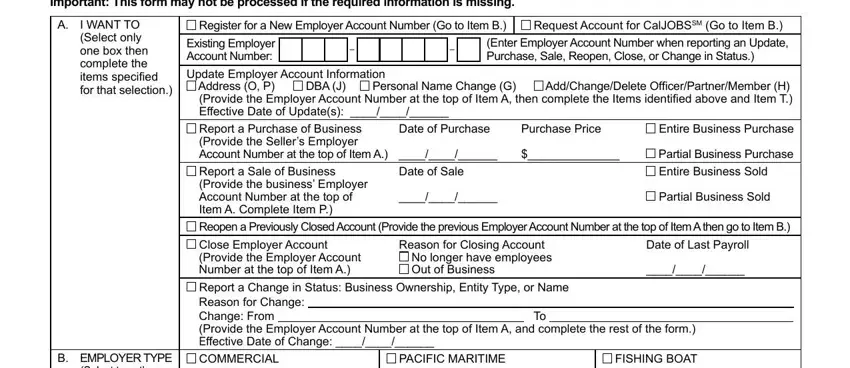

Create the following segments to prepare the template:

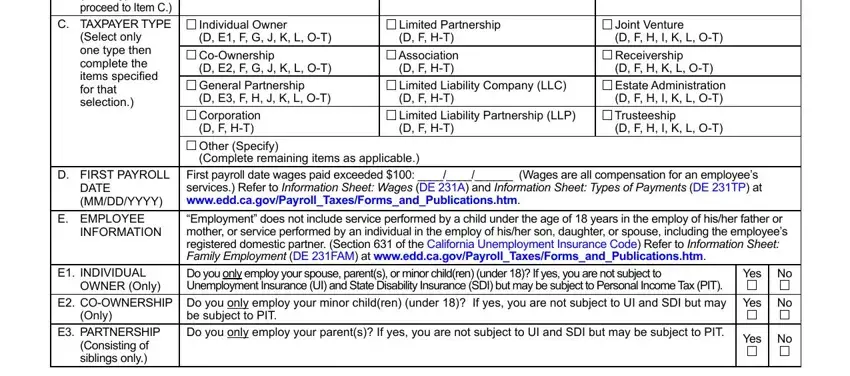

Provide the essential particulars in the B EMPLOYER TYPE Select type then, D FIRST PAYROLL, DATE MMDDYYYY, E EMPLOYEE, INFORMATION, E INDIVIDUAL, OWNER Only, E COOWNERSHIP, Only, E PARTNERSHIP Consisting of, Individual Owner D E F G J K L OT, Limited Partnership D F HT, Joint Venture D F H I K L OT, First payroll date wages paid, and Employment does not include box.

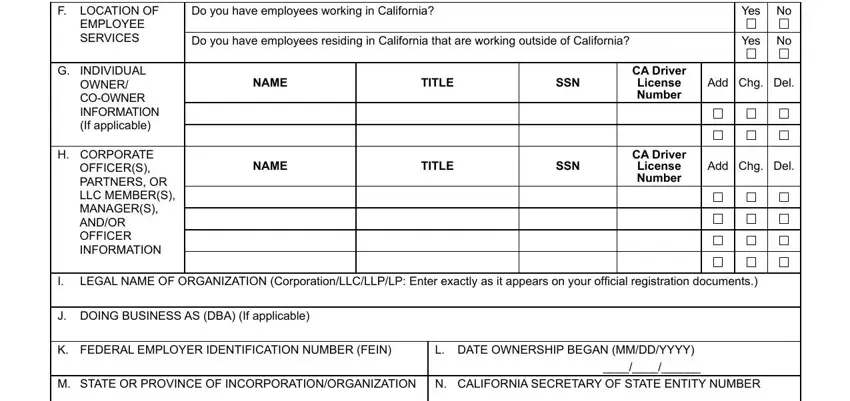

Inside the field dealing with Do you have employees working in, Do you have employees residing in, NAME, TITLE, SSN, NAME, TITLE, SSN, Yes No, Yes No, CA Driver License Number, Add Chg Del, CA Driver License Number, Add Chg Del, and F LOCATION OF EMPLOYEE SERVICES, you need to put down some appropriate data.

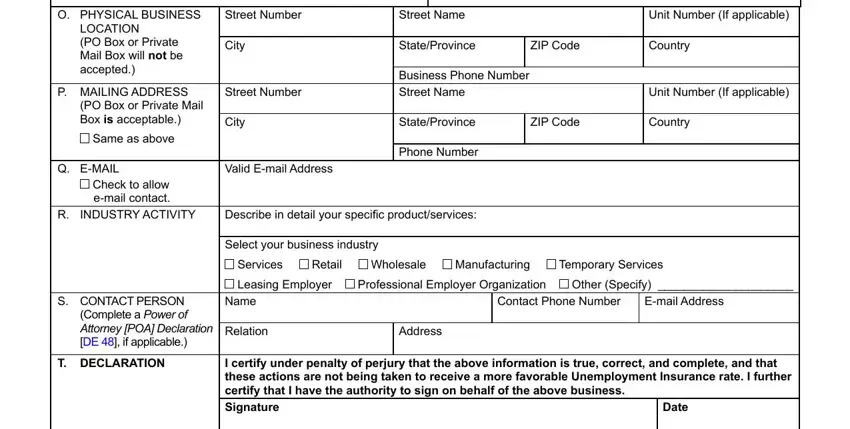

In field O PHYSICAL BUSINESS, Street Number, Street Name, Unit Number If applicable, City, StateProvince, ZIP Code, Country, LOCATION PO Box or Private Mail, P MAILING ADDRESS, Street Number, PO Box or Private Mail Box is, City, Same as above, and Q EMAIL, indicate the rights and responsibilities.

Finalize the form by analyzing these particular fields: Name, Title, Phone Number, MAIL TO EDD Account Services Group, DE Rev INTERNET, and Page of.

Step 3: Choose the "Done" button. You can now export your PDF form to your electronic device. In addition, you may forward it through email.

Step 4: Be certain to stay clear of future problems by producing no less than a pair of copies of the document.